Summary:

- Broadcom has underperformed its technology sector peers recently as the market reallocated away from semiconductor stocks.

- Broadcom remains well-positioned to capitalize on the surge in hyperscale spending in 2025.

- Custom AI chips are expected to be increasingly pivotal as hyperscalers seek to lower their AI scaling costs.

- The need to justify increasingly expensive AI clusters could spur a growth inflection for custom AI chips, which would benefit AVGO.

- I argue why I’m grateful for the market’s near-term myopia in AVGO, allowing high-conviction investors another solid opportunity to buy more shares.

Sundry Photography

Broadcom: AI Takes Centerstage. Is There A Catch?

Broadcom Inc. (NASDAQ:AVGO) investors have underperformed their technology sector peers (XLK) since October 2024, as investors reallocated from semiconductor (SMH) (SOXX) stocks. While Nvidia stock’s (NVDA) performance has remained resilient, peers with higher exposure to non-AI revenue (such as Broadcom) have faced more questions about their recovery prospects.

In my previous Broadcom article, I urged investors to ignore the pessimism observed as the market was concerned with its forward guidance. Despite that, AVGO’s performance has kept up with the S&P 500 (SPX) (SPY), highlighting its still solid “B-” momentum grade. Therefore, I’ve not assessed the need for investors to turn bearish on the stock, notwithstanding its recent relative weakness.

Broadcom will report its Q4 results on December 12. I expect investors to scrutinize the semiconductor leader’s AI revenue outlook, given the palpable disappointment in the previous quarter. Broadcom CEO Hock Tan expressed his optimism in a September 2024 conference, underscoring the surge in AI infrastructure CapEx undertaken by the leading hyperscalers (Microsoft (MSFT), AWS (AMZN), Google (GOOGL) (GOOG)). The momentum has carried on, as we observed in the recent Q3 earnings reporting season. Accordingly, hyperscalers have stepped up their confidence in investing aggressively to maintain their competitive edge in the rapidly evolving AI race. Morgan Stanley (MS) telegraphed its confidence that hyperscaler AI CapEx could surge to $300B in 2025. Nvidia’s recent earnings commentary underscored the “insane” demand underlying the transition from Hopper architecture to Blackwell AI chips.

Broadcom: Market Looking For Stronger AI Guidance

Hence, can Broadcom guide much better than its $12B AI FY2024 revenue outlook for next year? I assess there are sufficient reasons to give Tan and his team the benefit of the doubt. As massive AI clusters (>100K GPUs) take centerstage, they are increasingly becoming “table stakes” in the race for AI supremacy. Hence, it wouldn’t be misleading to assess that we could see AI clusters in the hundreds of thousands of GPUs being built. However, AI companies and hyperscalers are increasingly under pressure to solve the AI power and scaling costs challenges. With AI scaling reportedly decelerating even as AI companies rush to improve their cutting-edge LLMs, there could be an increased focus on moving into custom AI chips.

Broadcom’s expertise in custom AI chips is expected to lead the next phase of growth as AI companies and hyperscalers reassess their financial capabilities to invest in burgeoning AI clusters. Given the required scale to make designing and producing custom AI chips cost-effective, Broadcom’s expertise and experience are expected to be pivotal as the demand for custom chips is expected to increase significantly.

Tan shared in September that custom chips account for two-thirds of its AI revenue. In addition, Broadcom already has robust partnerships with three hyperscalers. ByteDance’s geopolitical headwinds are expected to spur the world’s most valuable startup toward custom chips with Broadcom as gaining access to Nvidia’s leading AI chips gets increasingly more complex. In addition, OpenAI’s increased scale makes developing custom chips with Broadcom a viable business, potentially improving its cost efficiencies. Hence, I assess that Broadcom’s assessment that custom chips could feature more prominently within hyperscaler workloads over the next five isn’t unreasonable. AWS’s experience with its customers using its custom AI chips demonstrates the viability and sustainability of the custom chips business as hyperscalers vie for opportunities to improve their cost competitiveness.

Despite that, Nvidia’s ability to scale its networking business that’s aligned with its merchant AI chips business is notable. As noted by Nvidia CEO Jensen Huang, the company’s earnings conference, xAI (led by Elon Musk), utilized NVDA’s Spectrum-X networking technologies for xAI’s Colossus 100K Hopper Supercomputer. Huang also highlighted Spectrum-X’s increasing competitiveness against more “traditional” Ethernet technologies.

While the market leader in Ethernet, Broadcom could face more intensified challenges as Nvidia seeks to develop more cost-effective “bundles” to bolster the adoption of its networking products. Despite that, AVGO maintains its confidence that it can remain the “industry standard” as it demonstrates its scalability and power efficiency. Hence, the competition between Nvidia and Broadcom is expected to remain incredibly intense, although Broadcom’s well-diversified revenue segments should mitigate unanticipated weakness from its nascent but growing AI business.

AVGO: Stock Priced For Growth

AVGO Quant Grades (Seeking Alpha)

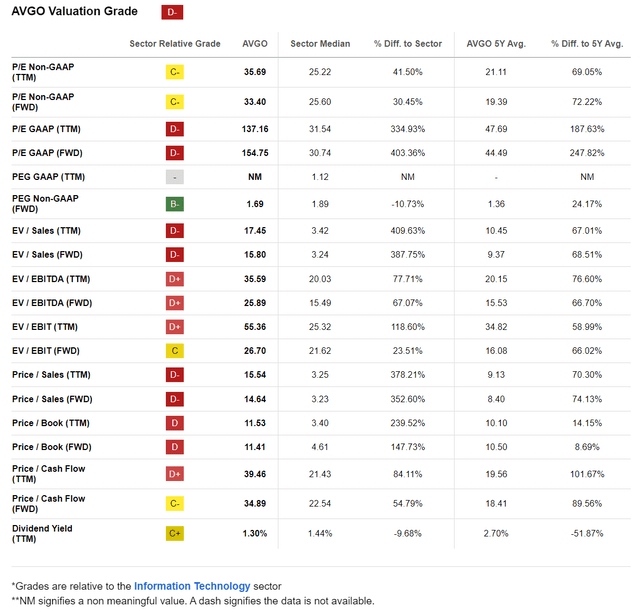

AVGO isn’t priced at a discount (“D-” valuation grade) relative to its tech sector median. Therefore, it’s clear that Broadcom is anticipated to continue performing well, given its “B-” growth grade, underscoring the market’s elevated expectations. In other words, less robust guidance moving ahead could temper buying sentiments on the stock, impacting its dip-buying momentum.

Therefore, Broadcom must continue to execute well on its AI thesis, even as there is growing caution on whether the surge in AI infrastructure investments is sustainable. Moreover, the recent weakness assessed in non-AI revenue segments for the semiconductor industry could weaken the bullish thesis in AVGO.

Wall Street’s estimates on AVGO have remained constructive, underpinning its bullish bias. However, the $12B in AI revenue for 2024 is anticipated to account for less than 25% of its total revenue base for the year. Therefore, investors must be cautious in overstating Broadcom’s AI growth thesis as the company navigates the near-term headwinds in the other business segments.

Despite that, I’m confident that AVGO’s forward adjusted PEG ratio of 1.69 seems relatively attractive compared to its tech sector median of 1.89. Therefore, it’s arguable that the market has considered execution risks for the semiconductor leader through 2025, notwithstanding the significant CapEx anticipated from the hyperscalers. Hence, I assess that a bullish thesis on AVGO remains appropriate, suggesting investors should consider capitalizing on its recent pullback to add more shares.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO, SMH, NVDA, MSFT, AMZN, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!