Exact Sciences ticks higher amid reports HSR for Abbott deal expired

Exact Sciences (EXAS) edged higher by 0.5% amid reports the HSR waiting period for its planned sale to Abbott Laboratories...

News / Analytics / Reviews

Exact Sciences (EXAS) edged higher by 0.5% amid reports the HSR waiting period for its planned sale to Abbott Laboratories...

The U.S. Food and Drug Administration (FDA) on Wednesday categorized a product recall initiated by Abbott Laboratories (ABT)...

Abbott Laboratories (ABT) shares snapped six straight sessions of losses, as the stock closed 1.2% higher at $108.77 on...

Abbott Laboratories (ABT) Chairman and CEO Robert Ford purchased 18.8K of company stock recently with a value of just over...

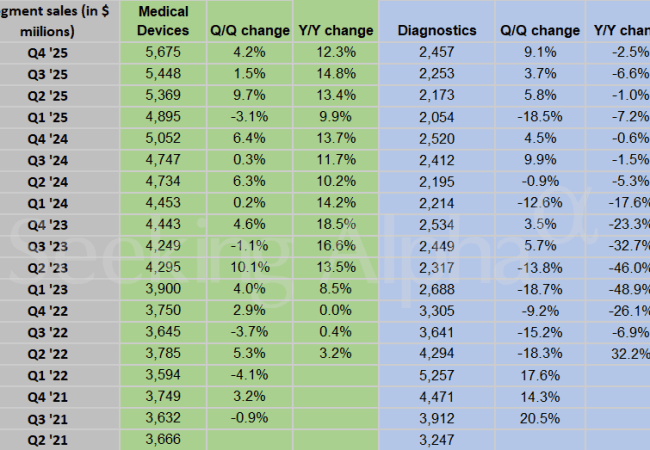

Earnings Call Insights: Abbott Laboratories (ABT) Q4 2025 CEO Robert Ford highlighted that 2025 showcased "Abbott's...

Abbott Laboratories (ABT) lost ~5% in the premarket on Thursday after the MedTech giant reported lower-than-expected revenue...

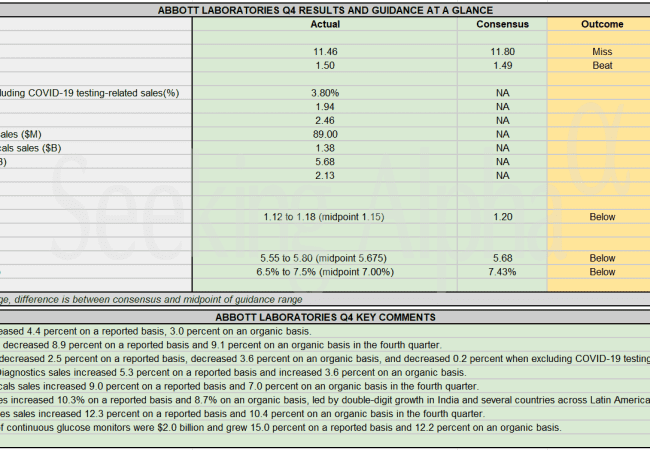

*Other Operating Data Consensus Source: Bloomberg Abbott Laboratories: Q4 Earnings On The Horizon Abbott: Not Cheap, But...

Abbott Laboratories press release (ABT): Q4 Non-GAAP EPS of $1.50 beats by $0.01. Revenue of $11.46B (+4.5% Y/Y) misses by...

Abbott Laboratories (ABT) is scheduled to announce Q4 earnings results on Thursday, January 22nd, before market open. The...