Beyond Meat has a vibrant protein drink lineup

Beyond Meat (BYND) continues to expand its product lineup into beverages. The company announced the launch of four new...

News / Analytics / Reviews

Beyond Meat (BYND) continues to expand its product lineup into beverages. The company announced the launch of four new...

Beyond Meat, Inc. (NASDAQ:BYND) has characteristics which have been historically associated with poor future stock...

Beyond Meat (BYND) has filed with the SEC for a mixed shelf offering, though the total size of the offering has not been...

Beyond Meat, Inc. (BYND) Q3 2025 Earnings Call Transcript Beyond Meat: High Cash Burn, Extreme Dilution, And Negative...

Earnings Call Insights: Beyond Meat (BYND) Q3 2025 Ethan Brown, Founder, President & CEO, stated that the company's...

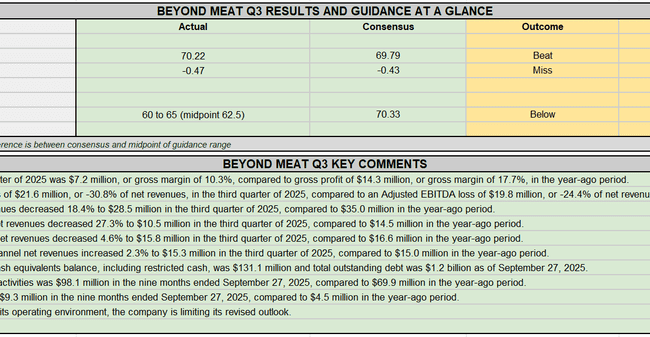

Beyond Meat (BYND) reported revenue fell 13.3% year-over-year to $70.2 million in Q3. The decrease in revenue was primarily...

Beyond Meat press release (BYND): Q3 Non-GAAP EPS of -$0.47 misses by $0.04. Revenue of $70.22M (-13.3% Y/Y) beats by...

Beyond Meat (BYND) is scheduled to announce Q3 earnings results on Tuesday, November 4th, after market close. The consensus...

Shares of Beyond Meat (BYND) are underwater in Monday’s premarket trading after the company said it would delay the...

Stock futures edged up in the premarket session on Monday, the first trading day of November, as investors started the month...