Amex, Wells Fargo in top losers; Circle Internet, PayPal among gainers – week’s financials wrap

Wall Street's major indexes closed the last week of February on a disappointing note, while monthly returns also turned...

News / Analytics / Reviews

Wall Street's major indexes closed the last week of February on a disappointing note, while monthly returns also turned...

ClearBridge International Growth ACWI Ex-US Strategy underperformed the MSCI All Country World Ex-US Index in Q4 2025, as...

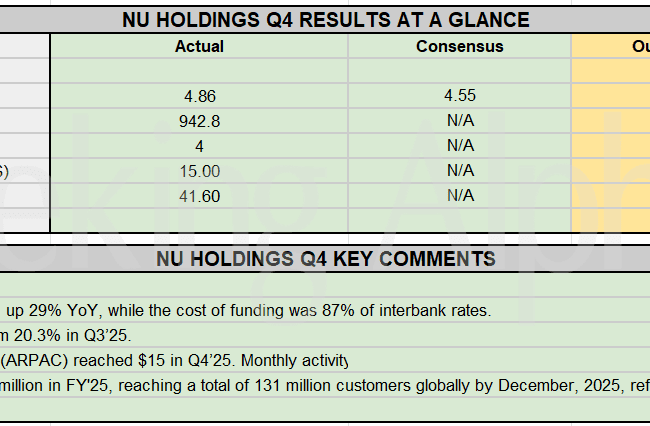

Earnings Call Insights: Nu Holdings Ltd. (NU) Q4 2025 David Velez-Osomo, Founder, Chairman & CEO, described 2025 as a...

Nu Holdings (NU) stock climbed after the fintech reported record Q4 revenue that exceeded Wall Street estimates, but...

Nu Holdings press release (NU): Q4 Revenue of $4.9B beats by $350M. Net income of $895 million and a ROE of 33%. Shares...

Nu Holdings (NU) is scheduled to announce Q4 earnings results on Wednesday, February 25th, after market close. The...

Brazilian digital bank Nubank (NU) has won approval from the Office of the Comptroller of the Currency to establish a de...

Nu Holdings (NU) announced a new multi-year global partnership with the Mercedes-AMG PETRONAS F1 Team starting ahead of the...

Nu Holdings (NU) announced on Wednesday that its digital banking unit Nubank intends to obtain a banking license in Brazil...