SLB wins contracts for Tangkulo deepwater development in Indonesia

SLB (SLB) said Thursday it was awarded multiple offshore drilling services contracts by Mubadala Energy for the Tangkulo...

News / Analytics / Reviews

SLB (SLB) said Thursday it was awarded multiple offshore drilling services contracts by Mubadala Energy for the Tangkulo...

Oilfield services provider SLB (SLB) +1.4% in early trading Tuesday after saying it was awarded a five-year, $1.5B...

The Trump administration is in discussions with the world’s biggest oilfield service providers and major crude oil...

SLB (SLB) CEO Olivier Le Peuch said Friday the company is well-positioned to quickly expand its business in Venezuela, given...

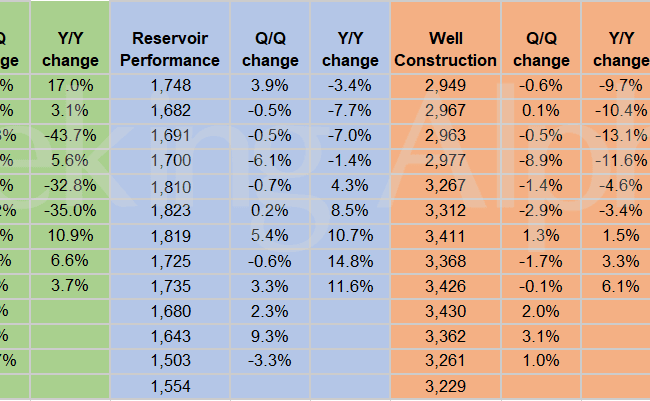

Earnings Call Insights: SLB N.V. (SLB) Q4 2025 CEO Olivier Le Peuch stated that SLB ended the year with "strong operational...

SLB (SLB) declared $0.295/share quarterly dividend, 3.5% increase from prior dividend of $0.285. Forward yield...

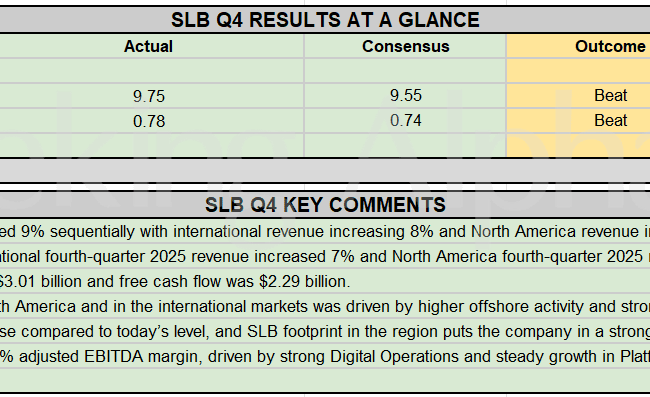

Schlumberger press release (SLB): Q4 Non-GAAP EPS of $0.78 beats by $0.04. Revenue of $9.75B (+5.1% Y/Y) beats by $200M....

SLB (SLB) is scheduled to announce Q4 earnings results on Friday, January 23rd, before market open. Wall Street, on...