Summary:

- RIVN has outperformed our expectations indeed, with expanded production/delivery numbers and improving contribution margins.

- With H2’23 expected to record narrowing losses, it appears that its FY2024 target of positive gross margins are not overly ambitious as well.

- Combined with the improved economy of scale, sustained operating efficiencies, and raised FY2023 production guidance, RIVN is surprisingly a viable EV play.

- However, investors may want to calibrate their expectations, since GAAP profitability may not occur over the next few years, with another capital raise likely by 2025.

- While RIVN may be a Buy, investors may want to wait for our previous May 2023 buy recommendation point of$15s for an improved margin of safety.

Doucefleur

The RIVN Investment Thesis Remains Viable, But With Some Patience

We previously covered Rivian Automotive (NASDAQ:RIVN) in July 2023, discussing its surprising FQ2’23 production and delivery report, well exceeding its FQ1’23 numbers. Despite our previous scepticism, it appeared that we had been proven wrong then.

For now, thanks to the delivery beats, RIVN has recorded a double beat FQ2’23 performance, with revenues of $1.12B (+69.5% QoQ/+207.9% YoY) and adj EPS of -$1.08 (+13.6% QoQ/+33.3% YoY).

It also appears that the automaker has been improving its economy of production scale, based on the improved gross margins of -36.8% in the latest quarter (+44.1 points QoQ/+156.6 YoY).

RIVN’s implied cost per vehicle has improved drastically to $109.3K (-14.1% QoQ/-54.9% YoY) as well, based on its COGS of $1.53B (+28.5% QoQ/+44.3% YoY) and production of 13.99K vehicles (+48.9% QoQ/+217.9% YoY).

This corroborates with the management’s commentary of improved gross profit per vehicle QoQ by about $35K in the recent earnings call, reducing the gap to its MSRPs of approximately $70K per vehicle.

With RIVN guiding a heavier production weightage of 70% for R1S moving forward, we expect a sustained bottom line expansion as well, since the management has hinted that “the R1S is more profitable than the R1T.”

These promising developments suggest that the management’s guidance of positive gross profits by 2024 is not overly ambitious indeed, thanks to the production ramp and the lifting of global supply chain issues.

Most importantly, its Electric Delivery Vans are already generating positive contribution margins (considering only variable cost of goods), with the R1s similarly expected to achieve the same milestone by the end of the year, thanks to the optimized supplier costs and higher MSRPs by H2’23.

Due to the decelerating quarterly cash burn of $1B (-10.3% QoQ/-31.1% YoY), we believe RIVN’s current balance sheet of $10.2B (-9.2% QoQ/-31.6% YoY) remains sufficient over the next few quarters, if not 2025, as previously projected by the management.

This will be aided by the management’s decision to push back its capital expenditure from the previous guidance of low $2B in 2023 to $1.7 instead, and low $2B from 2024 onwards.

We are also seeing great cost optimization efforts, with RIVN reporting $692M in adjusted operating expenses (-3.2% QoQ/-9.1% YoY), after deducting non-cash stock based compensation of $181M in FQ2’23 (-1% QoQ/-25.2% YoY).

It is likely that the management expects to generate another $100M in operating efficiencies in FY2023, as demonstrated by its narrowed adj EBITDA loss guidance of -$4.2B (-19.2% YoY), compared to the previous guidance of -$4.3B (-17.3% YoY).

Based on the improved FQ2’23 production/delivery numbers, it is unsurprising that the RIVN management felt confident enough to moderately raise its FY2023 production target to 52K (+113.6% YoY). This is against the previous guidance of 50K (+105.4% YoY).

Based on its H1’23 production of 23.38K (+236.4% YoY), the raised guidance is still achievable, since the automaker only needs to push out an average of 14.31K vehicles quarterly (+2.2% QoQ/+94.4% YoY) in H2’23.

Combined with the planned 2024 upgrade to boost its R1s annual capacity from the current 65K to 85K vehicles, we may see RIVN generate another year of exceptional growth ahead.

So, Is RIVN Stock A Buy, Sell, Or Hold?

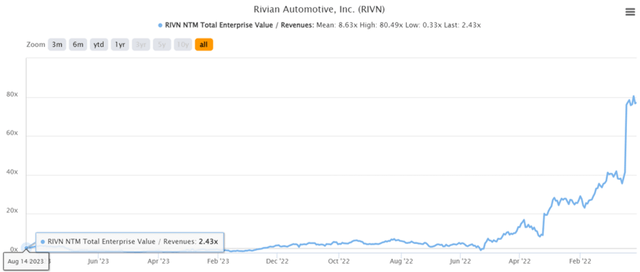

RIVN 2Y EV/Revenue Valuations

Due to its high growth cadence, it is unsurprising that RIVN’s valuation remains decent at NTM EV/Revenues of 2.43x, after the much needed moderation from the hyper-pandemic mean of 22x.

While this number may seem elevated compared to the automotive median of 0.94x, we believe this number is somewhat justified for now, due to the reasons discussed above.

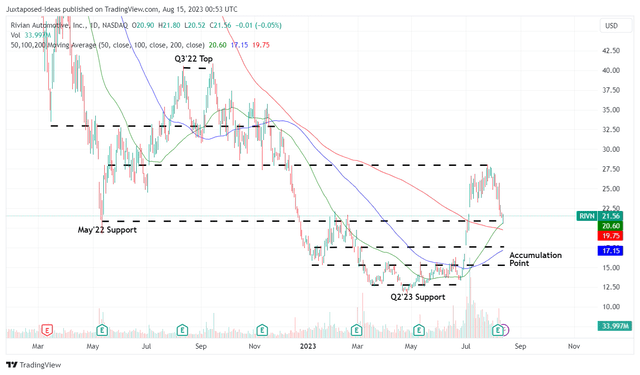

RIVN 1Y Stock Price

The RIVN stock has also moderated from its recent highs, nearing another retest point of $20.

However, we believe there may be more volatility in the intermediate term, since the automaker remains unprofitable for now, with the general US consumer appetite for EVs temporarily moderated by the elevated interest rate environment and higher borrowing costs.

For example, the average interest rate for auto loans on new cars has further risen to 7.18% in July 2023, compared to 2019 averages of 4.63%. While the EV market leader, Tesla (TSLA), may have reported record deliveries in FQ2’23, these are also mostly attributed to deep discounts, with General Motors (GM) and Ford (F) both reporting underwhelming EV sales.

As a result, we believe RIVN’s correction may not be over yet, with the stock likely to further retrace to its next support levels of $15s, especially due to the 13.50% of short interest at the time of writing.

Therefore, while we may rate the RIVN stock as a Buy, investors may want to stay at the sidelines for now, while waiting for our previous May 2023 accumulation point of between $15 and $17 for an improved margin of safety.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.