Summary:

- Despite solid demand for its AI chips, certain analysts and investors are preparing for an underwhelming earnings guidance from Nvidia Corporation following disappointing forecasts from its key suppliers.

- Supplier SMCI stock plummeted 23.4% following the disappointing earnings guidance numbers. Now, Nvidia’s investors fear that the stock could follow a similar fate if the chip giant offers disappointing earnings guidance.

- Investors need to understand that Nvidia was much better prepared for the AI revolution than any of its rivals and suppliers.

Justin Sullivan

Nvidia remains the undisputed front-runner in the artificial intelligence (“AI”) race. However, in order for it to sustain its incredible stock price rally this year, the tech giant will need to prove that the AI boom is indeed translating into material revenue and profit growth when it reports earnings in a few days. While demand for its AI chips will have undoubtedly been solid over the quarter, certain analysts and investors are preparing for an underwhelming earnings guidance from Nvidia following disappointing forecasts from its key suppliers. Nonetheless, Nvidia has been proactive in managing anticipated supply chain issues, which should subdue the impact of supply constraints on its earnings guidance to a certain extent. Nexus Research maintains a “buy” rating on the stock.

In the previous article, we discussed the powerful bull case for Nvidia stock. We covered how Nvidia’ AI advantage is not just based upon its industry-leading chips, A100 and H100, but also its broader suite of adjacent data center solutions, such as Data Processing Units (DPUs) and networking technologies, which create remarkable cross-selling opportunities to drive robust sales growth amid the AI revolution. Nvidia’s extensive set of data center solutions also create multiple network effects, resulting in an incredibly powerful moat to win in the era of AI.

Nvidia will be reporting its Q2 FY24 earnings in a few days (post-market Wednesday, August 23rd), and the market is watching closely to see whether it can live up to the expectations and once again offer jaw-dropping earnings forecasts, the way it did last time.

Most investors are aware by now that the demand for Nvidia’s AI chips has been solid over the quarter given numerous positive signs. The most promising signal came from the leading cloud providers, particularly Microsoft Azure (MSFT) and Google Cloud (GOOG) (GOOGL), as the executives of both these tech giants shared on their earnings calls that they are spending heavily on AI-related capex, which includes Nvidia’s GPUs.

For instance, on Microsoft’s last earnings call, the CFO offered insights into cloud capex in response to an analyst question:

“Mark Moerdler

… Amy, CapEx moved up significantly Q-over-Q and year-over-year and it’s increasing moving forward. Can you give us some color? Is it physical data centers? Is it predominantly servers? Is it predominantly AI-driven?

Amy Hood

… Mark, really, first of all, both in Q4 and then talking about Q1, the acceleration is really quite broad. It’s both on — both the data centers and a physical basis plus CPUs and GPUs and networking equipment, think of it in a broad sense as opposed to a narrow sense. So it’s overall increases of acceleration of overall capacity.”

Therefore, going into earnings, Nvidia investors can be confident that demand for its AI chips will be strong. However, the real concerns lie on the supply side.

Certain analysts and investors are preparing for an underwhelming earnings guidance from Nvidia following disappointing guidance numbers from its key suppliers, Taiwan Semiconductor Manufacturing Company (TSM) aka “TSMC,” and Super Micro Computer. On the TSM earnings call, CEO C. C. Wei shared:

“Moving into third quarter 2023. While we have recently observed an increase in AI-related demand, it is not enough to offset the overall cyclicality of our business. We expect our business in the third quarter to be supported by the strong ramp of our 3-nanometer technologies, partially offset by customers’ continued inventory adjustment.”

Note that AI-related demand is indeed strong, and the CEO added later in the call:

“For the AI, right now, we see a very strong demand, yes. … for the back end, the advanced packaging side, especially for the cohorts, we do have some very tight capacity to – very hard to fulfill 100% of what customer needed. So we are working with customers for the short term to help them to fulfill the demand, but we are increasing our capacity as quickly as possible. And we expect these tightening will be released in next year, probably towards the end of next year. But in between, we’re still working closely with our customers to support their growth.”

A few days later, this was followed by the announcement that the company “plans to invest nearly $90 billion New Taiwan dollars (about $2.87 billion) in an advanced chip packaging plant in Taiwan.”

Nonetheless, investors fear that the near-term supply constraints could weigh on Nvidia’s ability to offer strong earnings guidance numbers, as TSMC may potentially not be able to fulfil Nvidia’s demand.

Similarly, with regards to SMCI, on which Nvidia relies for server assembly, the company also offered underwhelming guidance due to supply constraints, as CEO Charles Liang shared on the earnings call:

“Due to the current key components supply shortages, we forecast revenue in the range of $1.9 billion to $2.2 billion for the September quarter. However, given the record high backlog, we see fiscal year 2024 revenue between $9.5 billion to $10.5 billion with room to deliver more depending on availability of supply.”

SMCI stock plummeted 23.4% following the disappointing earnings guidance numbers. Now, Nvidia’s investors fear that the stock could follow similar fate if the chip giant offers disappointing earnings guidance due its suppliers’ supply constraints.

Firstly, the inability to offer strong sales guidance numbers due to not being able to produce the AI chips fast enough to keep up with demand is a better problem to have than the other way around (demand being too low relative to high supply availability). In fact, the supply constraints should indeed translate to higher pricing power for its chips, which should bolster Nvidia’s top line revenue and bottom-line profitability prospects.

That being said, if Nvidia does end up offering poor earnings guidance numbers, it could indeed induce near-term selling pressure on the stock, as it becomes more difficult to justify the high valuation based on forward earnings estimates. Furthermore, the supply constraints also create another problem in the sense that any demand that Nvidia is not able to fulfil this year could create an entry-point for competitors like Advanced Micro Devices, Inc. (AMD), which will start producing its rival AI chip, MI300, in Q4 2023.

Though AMD will indeed be facing similar supply constraints as Nvidia. In fact, Nvidia was far ahead in anticipating demand for its AI chips, as no competitor was as ready for the AI revolution the way Nvidia was. Consequently, Nvidia has been proactive in securing supply for the production of its own chips to stay ahead of its competitors, as CFO Colette Kress mentioned on the last earnings call:

“This demand has extended our data center visibility out a few quarters and we have procured substantially higher supply for the second half of the year.”

Therefore, investors should not be too pessimistic regarding Nvidia’s ability to deliver on customers’ high demand for AI chips, as the executive team has been ahead of the curve in procuring supply. Hence, there is indeed a strong likelihood that despite suppliers’ current inability to fulfill high demand orders due to their own supply constraints, this plight may not be impacting Nvidia to the extent as its competitors that use the same suppliers, thanks to Nvidia’s proactive supply procurements ahead of rivals.

Remember, when the ChatGPT moment hit late last year, Nvidia was ready for the upcoming AI revolution with its A100 and H100 GPUs, while competitors were still trying to play catch up in terms of designing their own AI chips. Therefore, it would be unsurprising to find Nvidia better positioned than its competitors in terms of supply chain management.

Nonetheless, there is always the possibility that Nvidia may have underestimated future demand of its own products, which means Nvidia could still be impacted by supply constraints despite its proactiveness, potentially inhibiting it from optimally capitalizing on the AI opportunity.

Financials & Valuation

The sales of Nvidia’s AI chips and adjacent data center solutions contribute to its Data Center revenue segment. Given that the Data Center segment is by far Nvidia’s largest source of revenue, making up 60% of total revenue last quarter, it will undoubtedly also be the largest driver of profitability.

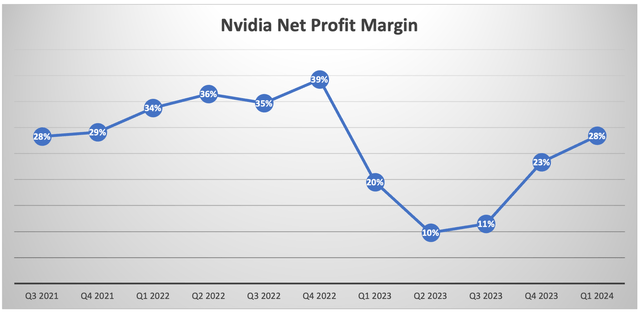

Nvidia’s net profit margin has been rebounding over the last few quarters. In the upcoming earnings report and earnings call, investors should pay close attention to how well the chip giant is managing supply chain issues, and how successfully the chip giant is able to pass on higher supply chain costs to its customers. This will be a key determinant of forward earnings prospects, and consequently its valuation multiple.

Given the ongoing supply constraints and the strong pricing power of key supplier TSMC, Nvidia could face cost pressures that undermine its profitability. On the other hand, Nvidia too enjoys strong pricing power thanks to its monopolistic position in the AI GPUs market, and this pricing power could be further amplified if its highly sought-after AI chips are indeed in short supply. This should allow Nvidia to sustain its profit margins, if not grow its profitability.

One of the biggest risk factors of Nvidia stock remains its valuation. The stock is currently trading at over 46x next year’s (FY2025) earnings estimates, though the multiple has actually contracted from around 65x amid the recent stock price correction. While the stock remains expensive, the contraction in the forward earnings multiple does create buying opportunities for investors that have been sitting on the sideline.

For investors that have been sitting on the sideline waiting for a buying opportunity, Nexus Research understands the inclination to wait and buy until after the earnings report on 23rd August for a clearer outlook, though note that the recent contraction in its valuation multiple is indeed an attractive opportunity to start buying to build a long-term position in the stock.

Nevertheless, given the signs of supply constraints, Nvidia is less likely to once again offer jaw-dropping earnings guidance numbers despite its proactive supply chain measures, which means the stock is unlikely to jump 30% again following its earnings release. Besides, even if Nvidia is able to offer blowout earnings guidance again that sends the stock rallying, the forward earnings multiple could still contract post-earnings just like last time, depending on the extent to which the forward earnings numbers outpace investors’ expectations. Either way, given just how close we are to the earnings report release, it is understandable for side-line investors to wait until after the report to start buying, but the 46x forward earnings multiple is certainly a better price to buy at than the 65x multiple it was trading at.

As for investors that already own the stock and are worried about underwhelming forward guidance numbers due to supply chain issues, which could send the stock price lower, Nexus Research recommends continuing to hold the stock.

Firstly, as mentioned earlier, Nvidia should be better prepared than its rivals to manage any anticipated supply constraints, which subdues the risk of forward guidance numbers being ultra-disappointing that send the stock price plummeting.

Nexus Research emphasizes considering Nvidia as a long-term investment, and discourages short-term trading in the stock.

Hence, even if Nvidia ends up offering underwhelming guidance that induces a stock price plunge, investors should consider this as an opportunity to buy more. As a long-term investor, one should be willing to endure short-term pain in the form of 20-30% unrealized losses, while using these corrections to deploy a dollar-cost-averaging strategy. Each investor’s strategy will ultimately depend on their current average buying price.

Nvidia’s long-term growth story remains solid amid the AI revolution. Therefore, not owning the stock while witnessing the stock rally higher would be more painful than owning the stock while witnessing short-term corrections, as investors can be confident Nvidia stock will continue growing over the long term.

Nexus Research maintains a ‘buy’ rating on Nvidia Corporation stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.