Summary:

- AT&T’s stock has been underperforming for years and is heavily indebted, making it an unattractive long-term investment.

- There may be a near-term rebound in AT&T’s stock, but the upside is minimal and the company’s growth prospects are lacking.

- AT&T’s acquisition of Time Warner was a disaster, and its outdated and inefficient managerial approach is unlikely to change.

jetcityimage

I’ve lived in beautiful and sunny Greece for the last year and a half, and my favorite thing about Greece is the people here. The Greeks have a rich and proud history, and one of my favorite national holidays here is “Oxi-Day.”

On October 28th, 1940, Italy and the Axis powers demanded access through Greek territories or else (war). The Greek prime minister Metaxas, proud as ever, answered the ultimatum with a simple one-word reply, “Oxi,” or No. Then thousands of Greeks hit the streets shouting Oxi, and the rest, as they say, is history.

I was an AT&T (NYSE:T) investor for several years until recently. After years of underperformance, I finally said Oxi to AT&T and dumped its stock to explore better investment opportunities. Despite a probability for a near-term rebound in its stock, I don’t consider AT&T a viable long-term investment. AT&T is one of the worst-managed companies I’ve come across, and it seems like wishful thinking to expect management to change anytime soon. Moreover, due to years of poor decision-making, AT&T is heavily indebted and may need to cut its dividend again.

Therefore, AT&T deserves its rock bottom multiple, as the company has little (if any) growth prospects and could continue being a value trap as we advance. Thus, I’m changing my buy rating to a sell, and I will look for better long-term opportunities, as we’re not likely going to see anything more than a dead-cat-bounce from poorly-run AT&T.

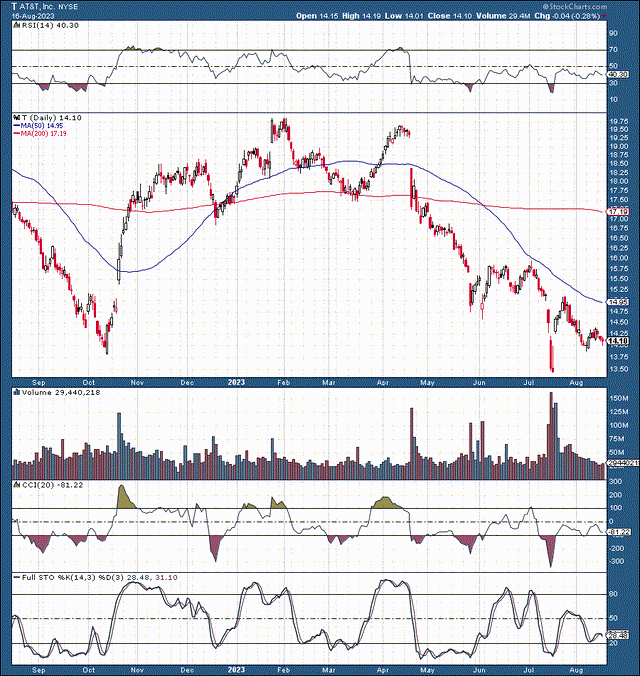

Technical Blueprint – May See A Near-Term Rebound

AT&T’s stock price has been all over the place in the last year, but ultimately, it’s down by 24%. Moreover, if we look further back, AT&T’s stock price is down by about 44% over the last five years and 45% in the previous ten. Therefore, we see continuous underperformance in AT&T’s stock over the years. Poor past performance is not a constructive indicator of positive future results, especially in AT&T’s case. Justifying an AT&T position because the stock price had been down for so long may be a recipe for poor returns in the long run.

AT&T’s stock is bouncing around multi-year lows here, and it could catch a rebound soon. Nevertheless, longer term, the upside is minimal. Moreover, if AT&T fails to progress quickly, we could see the stock breakdown and move to new lows.

Let’s talk about the short-term prospects – Theoretically, we could see a transitory move higher in AT&T’s stock. However, I would use the opportunity to reduce exposure due to ongoing uncertainties, growth and innovation concerns, and other harmful factors. Nevertheless, a temporary move higher is probable if the $13.50-$14 support level holds.

AT&T’s Blown Golden Opportunity

Acquiring Time Warner was a big deal for AT&T. First, the price tag was massive, a whopping $85B, and AT&T took on a significant debt load to finance the transaction. Perhaps most importantly, AT&T had a golden opportunity to incorporate Time Warner’s streaming assets into its business strategy, providing internet access, streaming, and content all under the same umbrella. Unfortunately, AT&T failed, and what a disaster the Time Warner acquisition came to be.

AT&T acquired one of the most outstanding media companies ever, and instead of building something unique, it destroyed massive shareholder value because AT&T’s management team was arrogant, reportedly only listening to themselves. Furthermore, they degenerated Time Warner’s assets, spinning off the company at about half the value they acquired it for. The Time Warner debacle is one of the worst-managed mergers ever and speaks volumes about AT&T’s outdated and inefficient managerial approach. However, the most troubling element is that nothing constructive at AT&T will likely transpire or change.

AT&T’s Growth Catalysts – None To Speak Of

I fail to see significant catalysts capable of pushing AT&T’s stock price considerably higher in the long run. A low multiple is not a suitable catalyst for a higher stock price if no growth prospects are ahead. Much of the growth potential was due to the content/streaming opportunity, which went away as soon as AT&T spun off Time Warner. I question the narrative that AT&T will unlock growth while concentrating on its core operations now. Even if AT&T archives its minimal revenue growth targets, its margins could get cannibalized by its bureaucratic inefficiencies and high costs.

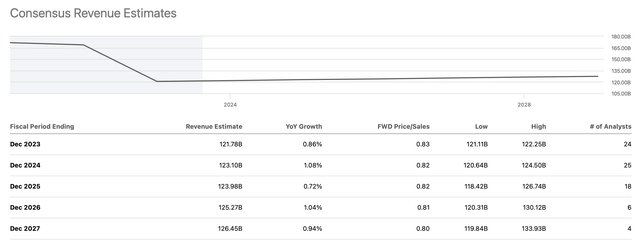

Revenue Growth Likely to Stagnate

AT&T revenues (SeekingAlpha.com )

Consensus estimates suggest AT&T’s sales growth should be minimal (1% or worse) as we advance. Moreover, we could see lower revenues in future years, as some estimates imply that AT&T’s revenues could contract in the coming years. Therefore, I see little hope for improving revenue growth in future years, suggesting AT&T’s valuation could remain around the depressed 5-7 P/E multiple range.

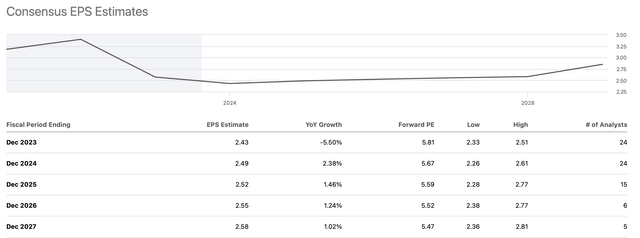

Little or No Prospects for Significant EPS Growth

EPS estimates (SeekingAlpha.com)

Why own a company with no future growth prospects, regardless of how cheap it may seem? Analysts expect AT&T’s P/E ratio to remain in the 5-6 range in the coming years, and I don’t see a catalyst for that to change. While AT&T’s multiple could expand when the Fed begins easing again, it may be a temporary phenomenon and does not justify owning AT&T’s stock. Should I hold AT&T’s stock exclusively for its dividend? Perhaps, but not if that dividend gets cut again or disappears.

AT&T – The Dividend Could Evaporate

Many poorly managed companies forego their dividends for various reasons. A couple of the brightest gems include General Electric (GE) and Disney (DIS). Who’d ever thought that an industrial giant like GE would cut its dividend to essentially zero? Nevertheless, here we are, and GE pays a dividend of 0.28% now.

After decades of dividend growth, AT&T finally cut its dividend last year, which is not a good signal as we advance. AT&T’s current 7.87% dividend costs around $8 billion to maintain. Unfortunately, AT&T’s TTM net income is about negative $8 billion.

Due to its enormous debt load, AT&T’s annual interest expense is more than $6B. It would be constructive if AT&T had growth-oriented assets to compensate for its massive debt. However, AT&T has nothing worthy that can produce growth, making its stock a poor long-term investment. Furthermore, AT&T’s continuous underperformance and high debt obligations could soon lead to another dividend cut, likely causing its share price to decrease in the long run.

The Bottom Line: AT&T – A Value Trap

Despite AT&T’s “cheap” valuation, the stock likely has limited upside potential. AT&T has limited growth prospects while plagued with managerial problems and high debt. Moreover, AT&T blew its golden growth opportunity with Time Warner, losing its chance to expand into streaming. Instead, AT&T has a massive debt load that costs more than $6 billion to service annually.

Perhaps most importantly, AT&T has the stamp of poor management branded all over it, and there is no indication that things will change for the better any time soon. Additionally, AT&T may need to decrease or suspend its dividend due to high debt and higher costs. Despite transient upside prospects due to temporary oversold technical conditions, AT&T’s stock has minimal upside potential in the long run. Therefore, I’m saying “no thank you,” Oxi, and I will look for better investments elsewhere.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!