Summary:

- McDonald’s maintains its leading position in the fast food market through a global franchise model and has seen strong revenue and earnings growth.

- The business posted strong top-line revenue growth (+14% YoY in 2Q23) and outpacing earnings growth (+23% YoY in 2Q23), despite slowing global economic growth and weak.

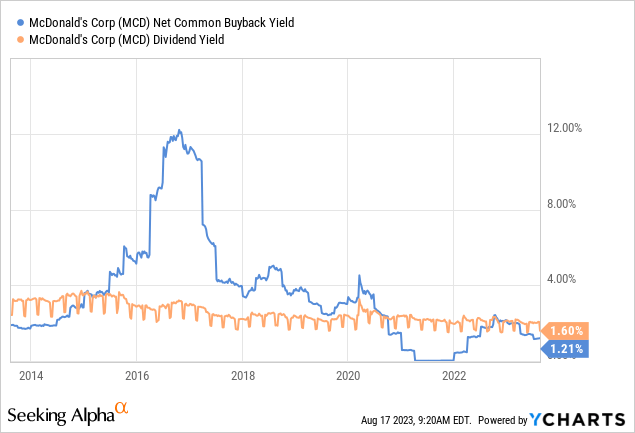

- Shareholders get a relatively good dividend and buyback yield but there likely won’t be any increase in buyback volume anytime soon.

- MCD’s faces valuation and non-valuation risks, which don’t make it a Buy.

RiverNorthPhotography

Main thesis

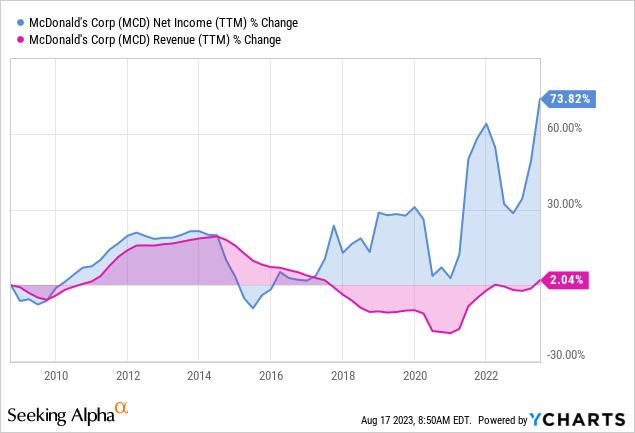

McDonald’s Corporation (NYSE:MCD) maintains its leading position in the fast food market through a global franchise model. The company has survived many large-scale crises, while for 46 years it has been increasing dividends. The business posted strong top-line revenue growth (+14% YoY in 2Q23) and outpacing earnings growth (+23% YoY in 2Q23), despite slowing global economic growth and weak consumer demand in many parts of the world. At the same time, I think that current levels are not attractive as McDonald’s trades for 23x forward P/E and faces other non-valuation risks.

Branding & global presence

McDonald’s is a world famous brand serving over 69 million people daily. As one of the world’s most recognized brands, it has a strong market position that translates into strong demand and revenue for both franchisees and the company itself. McDonald’s revenue drivers are the attraction of new partners and the opening of new restaurants, as well as the operating performance of franchisees, which affect the amount of royalties (average check and number of guests).

The company’s revenue is significantly higher than the main competitor, Burger King (QSR) ($12.9 billion vs. $1.01 billion for H1’23), and the brand value ($196.5 billion) is significantly higher than that of the second most popular company in the industry, Starbucks (SBUX), and the closest direct competitor, KFC (YUM).

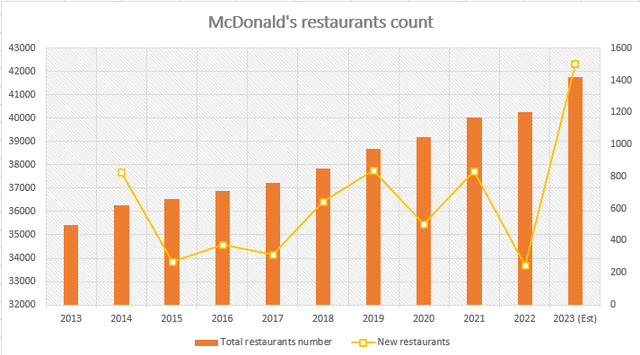

In 2023, McDonald’s plans to expand the network by 1,500 restaurants, which is significantly ahead of the pace of development over the past 8 years. According to management forecasts, due to network expansion in 2022 and 2023, the chain’s global turnover will grow by 1.5%.

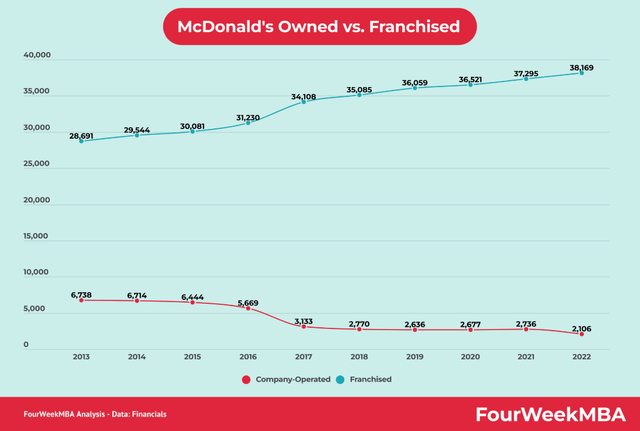

A significant share of the company’s assets is occupied by real estate. This is due to the specifics of the franchise model.

On standard terms, the agreement provides that McDonald’s acts as the owner or lessor of the land and real estate on the territory of which it is planned to open a chain restaurant, and the franchisee pays for the equipment and decoration of the premises. Franchisees also have to reinvest part of the income, and the company itself can invest in terms of co-financing for the further improvement of the restaurant. This both strengthens profitability and motivates franchisees to comply with the standards, norms, and values of the company (otherwise they may lose their land and the right to operate).

McDonald’s owned Vs franchised restaurants (FourWeekMBA)

Real estate is an asset with a high degree of reliability. It is not only capable of generating income (in the form of rent) but also increasing in value over time. Franchisees are bound by a long-term contract, thus, the company provides itself with a stable cash flow in the form of rent on real estate. This agreement also provides for a minimum amount of rental payments, which ensures McDonald’s income regardless of the restaurant’s performance, which partially saved the network during times of crisis.

Financials

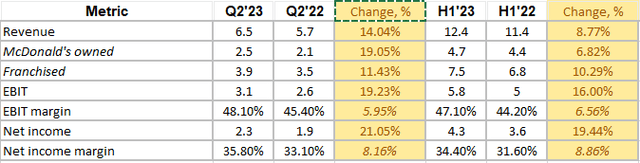

The franchising model allows the company to receive a stable income from license fees and a portion of the proceeds from franchisees. While McDonald’s revenue has remained largely unchanged over the past 15 years ($23.2 billion in 2022 compared to $23.5 billion in 2008), net income has been growing at a CAGR of 2.5%. This is due to an increase in the share of income from franchising, the profitability of this segment is higher than that of its own restaurant business.

In 2Q23 revenue grew more than expected, by 14% YoY, to $6.5bn, vs. $6.27bn expected. Earnings per share rose 24% YoY to $3.17 while the consensus was $2.79.

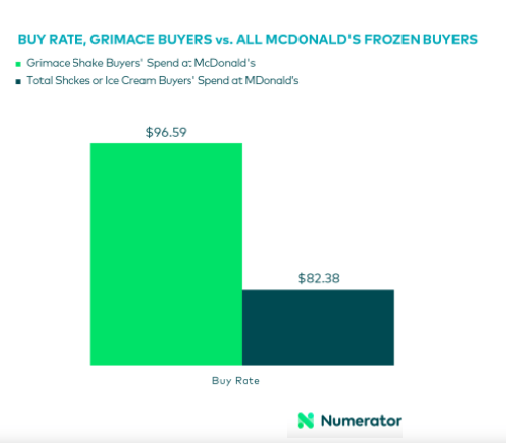

Revenue rose on the back of strong LFL sales growth (+11.7% YoY), driven by higher prices and traffic in the US, while restaurants in the UK, Germany and China improved. Management also noted the success of its marketing campaign. The recent viral campaign of Grimace Shake has indeed been incredibly popular and attracted a younger audience to the restaurants. Grimace buyers spent 17% more than other “shake&ice cream” customers.

Numerator

Shareholders’ benefits

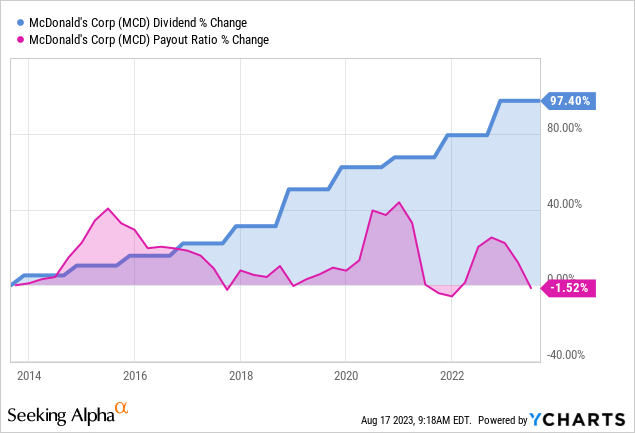

McDonald’s has paid regular quarterly dividends and raised them for 46 consecutive years. The average payout rate over the past five years is 61% and average dividend yield for the last 4 years has been 2.24%. The company is expected to raise its quarterly dividend by 6% in October 2023 to $1.61.

At the end of 2019, management approved a buyback program worth up to $15 billion (about half of that amount remains). Partly due to a very aggressive buyback in 2016, McDonald’s has had an equity deficit on its balance sheet since 2016. Funding the buyback with debt could have been appropriate in a low interest rate environment, but some slowdown in buybacks is likely to be behind the Fed’s rate hikes. On the other hand, future expansion of the network may become impractical due to the risks of cannibalizing the sales of existing restaurants, the company may optimize the current network and these funds may be partially used to pay shareholders.

Valuation & Other risks

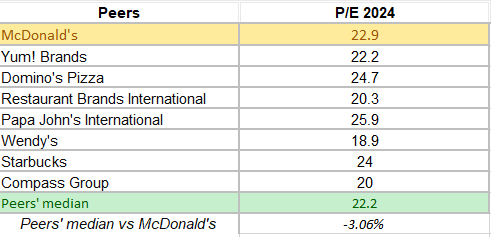

To estimate the target value of McDonald’s shares, I used a comparative approach, including valuation by multiples relative to peers.

Author

Therefore, MCD looks a bit overvalued for now and it would be better to buy on a relatively big dip when the market’s global trend changes.

At the same time, McDonald’s is also facing non-valuation risks.

Despite its wide popularity, the corporation has many critics. McDonald’s products are fast food that is harmful to human health. It contains a large amount of preservatives, fat, salt, sugar, other chemicals and few, if any vitamins and other useful elements. Among the negative factors are cardiovascular diseases and obesity. Frequent consumption of such foods increases the risk of diabetes, the 8th leading cause of death in the United States. After the pandemic, people are paying more and more attention to their own health. Apart from reputational risks, changing behavior and preferences of customers can negatively affect the sales potential of properties located, for example, in locations that have gone out of popularity or those that are not equipped for changing consumer needs (for example, drive-thru). Also, the results may be affected by changes in the value of real estate.

Conclusions

McDonald’s is the absolute leader among popular fast food chains in the world. Over the many years of its existence, the company has built a huge franchise network, on which its success now directly depends. The gap between MCD and competitors like Burger King and KFC is huge and continues to expand. At the same time, despite the scale and profitability, I see valuation and non-valuation risks, and I am waiting for a better price to increase my position.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.