Summary:

- Amazon’s long-awaited turnaround in Retail margins has kicked in.

- AWS growth seems to be finding a bottom.

- AMZN’s Valuation still seems conservative.

- I believe the above points equal a Strong Buy.

thitimon toyai/iStock via Getty Images

Introduction and investment thesis

The show must go on! Like I pointed out several times since the beginning of the year (1,2,3) there has been significant potential for Amazon’s (NASDAQ:AMZN) margin profile to improve in the shorter run. In the Q2 quarter the company continued to walk down this path with its operating margin rising to 5.7%, the highest reading since 2021 Q2. What’s more, this time it hasn’t been accompanied by cloudy news on the AWS front.

Based on this, I believe that after Q2 results no doubts have been left that the long-awaited fundamental turnaround has set in. Most recent SA articles on the company represent a unanimous Buy rating as well, supporting this thesis. The question is should investors fear this unusually strong Buy consensus?

I strongly believe they shouldn’t, and in the following easy-to-digest analysis I also want to show why.

Cost savings kicked in, more to come

Let’s begin with the most important driver of recent margin expansion, which is cost savings in the fulfillment network. Amazon conducted a 6-9 month long deep dive into the Retail segment’s cost structure last year. Based on these findings a series of changes have been implemented, which are set to continue in the upcoming quarters.

The most important one has been the redesign of the national fulfillment and transportation network. The formerly centralized North American network has been separated into eight smaller independent ones, enabling faster, less-expensive deliveries. This process has been aided by the increasing number of same-day fulfillment facilities as well.

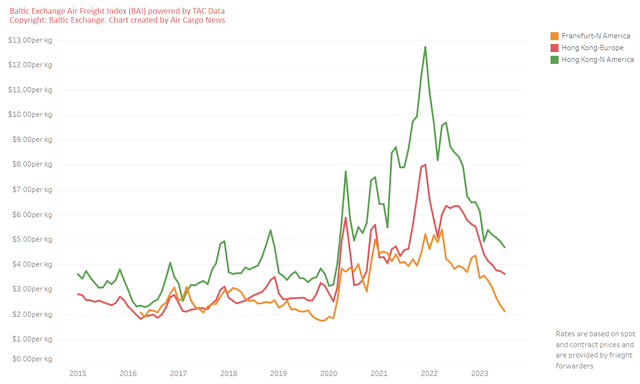

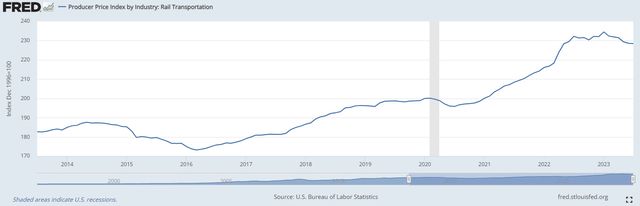

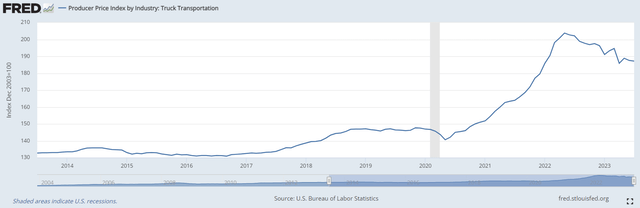

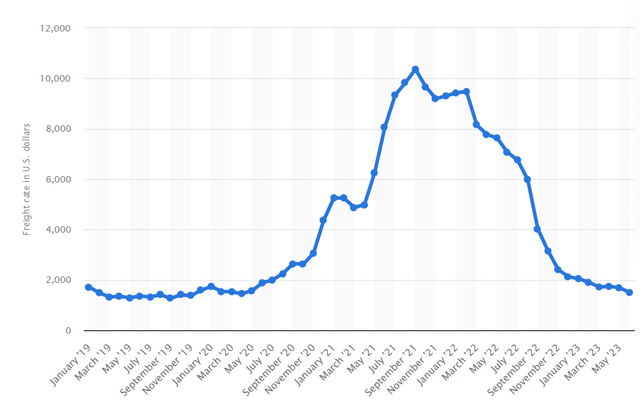

On top of that, inflation-related fulfillment and transportation costs continued to ease over Q2 showing signs of a turnaround. Here are a few examples:

- Air freight rates.

- Rail transportation prices.

- Truck transportation prices.

- Container shipping costs.

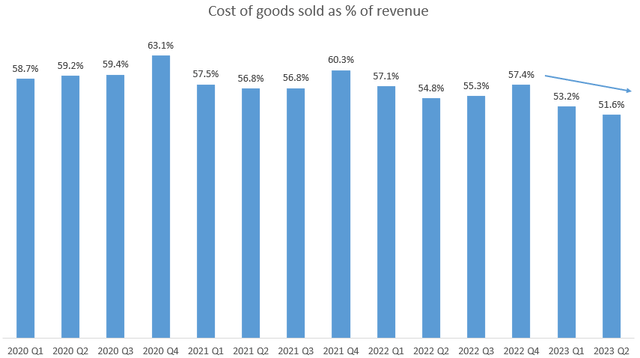

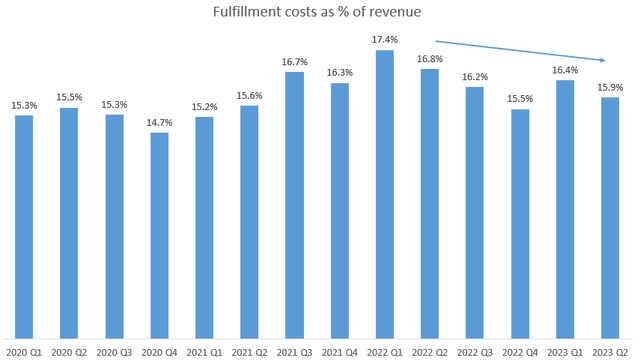

Thanks to these developments cost of goods sold (COGS) and fulfillment costs as a % of revenue began to moderate over the previous quarters:

Created by author based on company fundamentals Created by author based on company fundamentals

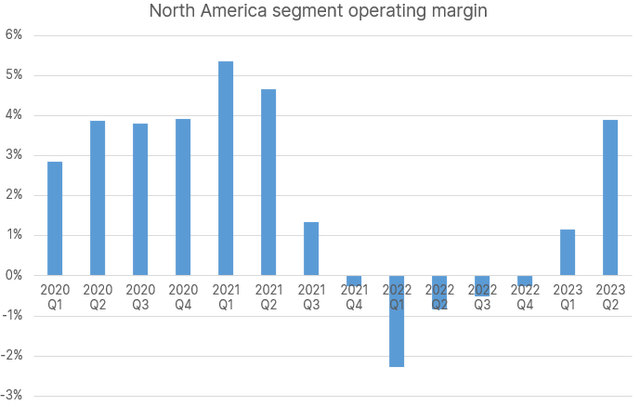

This has formed the base for the recent significant increase in operating income and the accompanied rise in North America margins:

Created by author based on company fundamentals

While there is no guarantee that inflation-related costs will continue to moderate in the upcoming quarters company specific fulfillment and transportation costs have further room to decrease according to Brian Olsavsky, SVP and CFO: “And while we are pleased with the progress we have made, we see more opportunity to drive improved cost efficiencies going forward.” – Q2 earnings call.

Following Amazon closely for the past few years management has been transparent and consistent, following up on promises. Based on this, I believe that investors can give them credit this time as well. For someone who is looking for hard evidence it’s enough to look at expected Capex spending of ~$50 billion for 2023, which will be significantly less than the $59 billion for 2022. This will result in proportionally decreasing depreciation expense contributing positively to margins. Much of this decrease will be related to fulfillment and transportation aiding North America margins further.

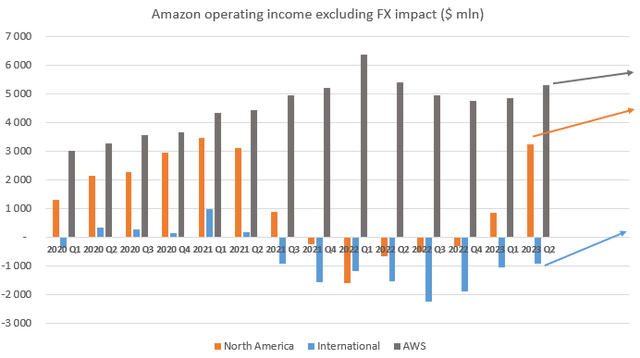

I believe cost optimization efforts described above have at least a few more quarters to run making the Retail segment an increasingly significant pillar of operating profitability:

Created by author based on company fundamentals and author’s estimates

In my opinion this should continue to be the main story of 2023 supporting the share price throughout the year.

AWS bottom powered by AI

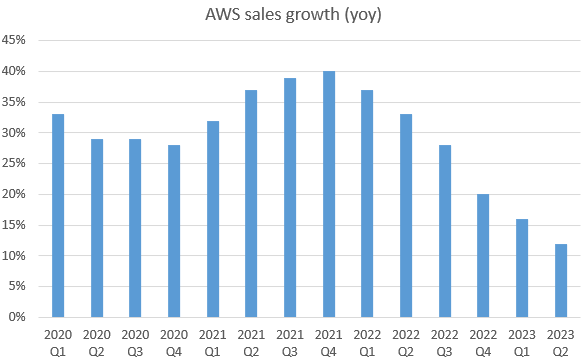

The other critical aspect of the Amazon story in 2023 should be the turnaround in AWS revenue growth, which has been dampened by cloud cost optimization efforts from customers for several quarters:

Created by author based on company fundamentals

YOY sales growth reached a new bottom with 12% in Q2, a little better than projected by management after the close of the Q1 quarter.

However, the tide seems to be finally turning. Looking at main rivals, Microsoft (MSFT) Cloud revenues have grown 23% YOY in constant currency in the most recent quarter, only a slight slowdown from 25% in the previous quarter. Meanwhile, Google (GOOG) (GOOGL) Cloud revenues increased 28% YOY in Q2 at the same growth rate they did a quarter before. I believe Amazon won’t be an exception from this trend, which will be evident already in the upcoming Q3 quarter. Based on management comments in the Q2 earnings call this should be the case indeed:

“What we’re seeing in the quarter is that those cost optimizations, while still going on, are moderating and many maybe behind us in some of our large customers. And now we’re seeing more progression into new workloads, new business. So those balanced out in Q2. We’re not going to give segment guidance for Q3. But what I would add is that we saw Q2 trends continue into July. So generally feel the business has stabilized,…”. – Brian Olsavsky, SVP and CFO

Besides the short-term impact of diminishing cloud optimizations, new AI workloads should aid AWS topline growth over the medium/long run as well. Looking again at the competition, in case of Microsoft Azure management expects 2 points of the expected 25-26% YOY revenue growth rate in the current quarter coming from AI services, which is already a meaningful contribution in my opinion. I believe AWS should walk down a similar path.

An important competitive advantage of Amazon in AI compared to the other hyperscalers is its chip expertise. Amazon already launched its ML inference chip, Inferentia back in 2018, and its custom ML training chip, Trainium back in 2020. As these chips provide strong performance for a competitive price in LLM training and inference they should be a meaningful contributor to AWS revenues soon.

Another key building block, which distinguishes Amazon in the AI race is its recently introduced Bedrock service, which lets companies create personalized applications based on Foundation AI models from other companies. This is a very important step in democratizing AI, and already thousands of Amazon customers have tried the service. According to Swami Sivasubramanian, VP of Database, Analytics, and Machine Learning at Amazon Bedrock will be generally available to customers soon, implying that it should meaningfully contribute to revenue growth as soon as 2024.

Finally, there are the self-developed AI applications, where Amazon has gained significantly less attention than rivals like Microsoft Bing with its ChatGPT integration or Google with Bard. Recently, the company announced its Amazon CodeWhisperer service, which helps developers in code generation based on their comments in natural language. I believe it’s a good start, but the main mission and focus of Amazon in AI and LLM will be the democratization of these technologies, just like they did it with the cloud. I think there is lot of potential in this aspect of the space, where Amazon has established itself as a leader in my opinion.

To sum it up, the continued proliferation of AI and LLM-based technologies combined with the decay of the cloud cost optimization cycle should lead to a visible turnaround in AWS growth in the upcoming quarters. The first signs of this are already visible, but I think this process is only in its early innings.

This makes Amazon shares still an attractive investment at current levels, especially if we take the further upside in Retail margins into consideration. Looking at the valuation of shares confirms this thesis, which I want to present in the following.

Valuation: Potential fundamental turnaround far from priced in

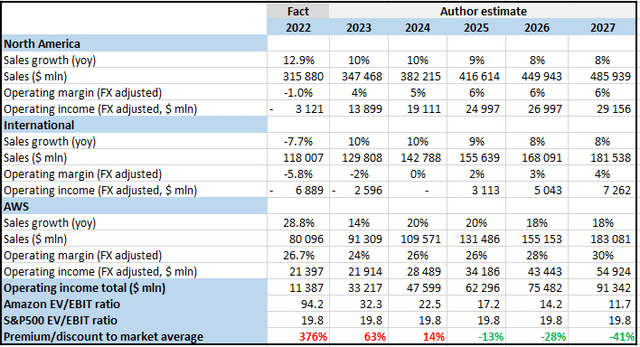

Based on recent developments I have updated my EV/EBIT-based valuation framework for Amazon. The most important changes have been the following: I increased AWS YOY revenue growth rate by 2%-points from 2024 to 2027 to cautiously reflect AI/LLM-related upside. For 2023 I increased the growth rate by 1%-point to reflect recent slight optimism around the decay of the cloud optimization cycle.

In the case of Retail, I increased the YOY revenue growth rate for 2023 to 10% both for the North America and the International segment to reflect the better-than-expected resilience in consumer spending. In addition, I have increased North America operating margin by 1%-point for 2023, 2024 and 2025 to reflect the quicker than expected progress in fulfillment cost savings.

Finally, I have updated the EV/EBIT ratio for the S&P500, which tracks currently at ~20. After accounting for these changes my relative valuation framework looks as follows:

Created by author based on company fundamentals and author’s estimates

Based on the comparison to the S&P500 shares trade at a ~60% premium with 2023 expected EBIT of $33.3 billion. At first glance this could seem aggressive, but if we take further margin improvement and the turnaround in AWS sales growth into account the valuation premium diminishes already for 2025 turning into a discount of 13%. I would be surprised if 2 years from now Amazon shares would trade at a 13% discount compared to the S&P500, which means that shares must outperform the index over this horizon to reflect their relative appeal to investors.

I believe that over the forecast horizon Amazon shares will continue to trade at a premium compared to the S&P500 (reflecting better long-term growth prospects), which means they should at least outperform the S&P500 by 41% until 2027. However, if we also factor in that some premium persists, this outperformance could be significantly more, possibly by 20-30% percentage points more.

Based on this, I believe the market hasn’t priced in the potential significant improvement in fundamentals, which could characterize the upcoming quarters. So, I believe it’s still a good time to invest in the company’s shares for the longer run.

Risk factors

Finally, it’s important not to look at just one side of the coin. There are some important risk factors, which are worth considering before investing in the shares based on the information presented above.

An important one that could hinder the continued uptick in Retail margins is the development of inflation, especially when looking at transportation costs and raw materials. As I have shown above the worst on that front is probably behind us, but it’s important to keep a close eye on those indicators and watch out for possible turnarounds.

A possible uptick in inflation could also negatively influence the valuation of tech shares as we had experienced through 2022, so it’s important monitor it through this lens as well.

Considering AWS, an important risk factor in my opinion is whether the recently experienced cloud cost optimization cycle is not more permanent in its nature than many investors have hoped for. Although based on recent earnings releases of hyperscalers there have been some positive news on this front, but it would be too early to call an end to this era yet.

Finally, there is fierce competition on the AI/LLM front as there are many unique companies in the space beyond hyperscalers. This, and the rapidly changing customer needs make it impossible to predict what exact impact this new trend could have on Amazon’s top and bottom lines. Although current trends seem promising, investors can only guess at this point.

Conclusion

With the Q2 earnings release of Amazon it became obvious for most market participants that a significant fundamental turnaround is on its way. Despite the fact that this seems to be treated as common knowledge, the valuation of shares is far from reflecting this turnaround in my view. I believe it’s absolutely not too late to get on board and invest in the shares for the long run at current levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.