Summary:

- On August 1, Merck released its financial report for the second quarter of 2023, which showed excellent results.

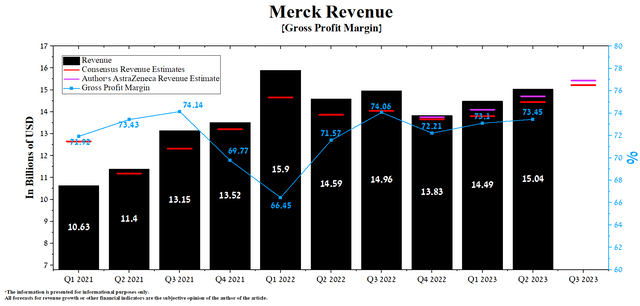

- Merck’s revenue for the second quarter of 2023 was $15.04 billion, up 3.8% from the previous quarter and up 3.1% from the second quarter of 2022.

- The active R&D policy, which is being implemented under the leadership of Robert Davis, is one of the main factors contributing to the increase in Merck’s revenue.

- The company’s operating income was negatively impacted by the ongoing decline of Lagevrio (molnupiravir), used to treat COVID-19.

- We continue our analytics coverage of Merck with an “outperform” rating for the next 12 months.

Parradee Kietsirikul

On August 1, Merck (NYSE:MRK) unveiled its Q2 2023 financial results, which not only beat analysts’ expectations but were able to demonstrate that demand for its innovative products, such as Vaxneuvance, Prevymis, and Gardasil, is growing faster than many on Wall Street expected. Furthermore, the sales of prominent medications such as Keytruda and Lynparza are experiencing a higher-than-anticipated growth rate, even in the face of heightened competition within the global cancer immunotherapy market.

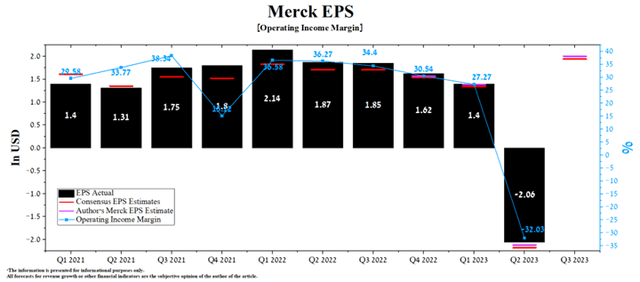

Merck’s revenue was about $15.04 billion, exceeding our expectations by $0.33 billion. This was mainly due to higher Keytruda (pembrolizumab) sales of $6.27 billion, up 19.4% year-over-year. In comparison, Q2 Non-GAAP EPS was -$2.06 per share, $0.06 more than we had previously forecast. The negative net income was driven by the completion of the acquisition of Prometheus Biosciences, which develops experimental medicines showing outstanding results in clinical trials, including for the treatment of immune-mediated inflammatory diseases such as ulcerative colitis and Crohn’s disease. As a result, Mr. Market favorably assessed the financial report of Merck, which was reflected in its price growth by 2.7%, pleasing investors a little more than the S&P 500 (SPY) over the past three weeks.

TradingView

The company does not stop at the progress made in the commercialization of medicines and vaccines, and the results of its numerous clinical studies continue to delight investors. On July 27, the company announced positive results from two Phase 3 clinical trials evaluating the efficacy and safety of V116 in adults. V116 is an experimental pneumococcal vaccine that demonstrated statistically significant immune responses compared to Pfizer’s Prevnar 20 (PCV20) for serotypes common to both vaccines one month after vaccination.

Sales of the Prevnar franchise were about $1.39 billion in Q2, 2023, down slightly from the previous year. Merck only announced in its press release that its experimental vaccine had reached its primary endpoints, without disclosing clinical trial results in more detail. However, we believe that V116, if approved by regulators, will be able to compete successfully with Pfizer’s vaccine (PFE) in the global pneumococcal vaccination market. According to the CDC, pneumococcal disease results in tens of thousands of hospitalizations each year. As a result, there is an urgent need for more funding to control better the Streptococcus pneumoniae bacteria that causes these symptomatic infections to save millions of lives around the world.

We continue our analytics coverage of Merck with an “outperform” rating for the next 12 months.

Merck’s Q2 2023 financial results and outlook for the second half of 2023

Merck’s revenue for the second quarter of 2023 was $15.04 billion, up 3.8% from the previous quarter and up 3.1% from the second quarter of 2022.

Author’s elaboration, based on Seeking Alpha

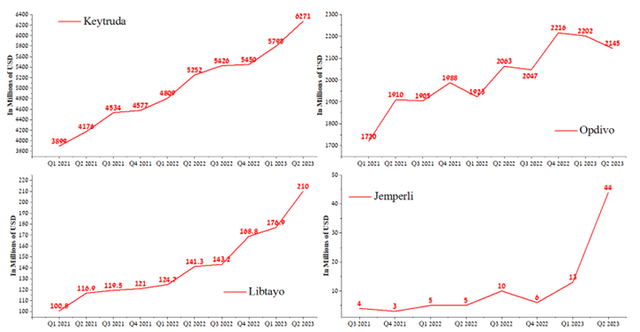

The company’s revenue growth was mainly driven by Keytruda, whose sales totaled $6,271 million in Q2 2023, up 8.2% QoQ. Merck’s key blockbuster continues to gain market share of immune checkpoint inhibitors, driven by competitive advantages and higher label expansion rates relative to competitors such as Regeneron’s Libtayo (REGN), Bristol-Myers Squibb’s Opdivo (BMY), and GSK’s Jemperli (GSK). So, in June 2023, Keytruda received approval for treating patients with relapsed or refractory PMBCL in Japan.

Author’s elaboration, based on quarterly securities reports

Moreover, demand for Merck’s medicine remains high, especially among patients battling serious illnesses such as triple-negative breast cancer, renal cell carcinoma, head and neck squamous cell carcinoma, and non-small cell lung cancer.

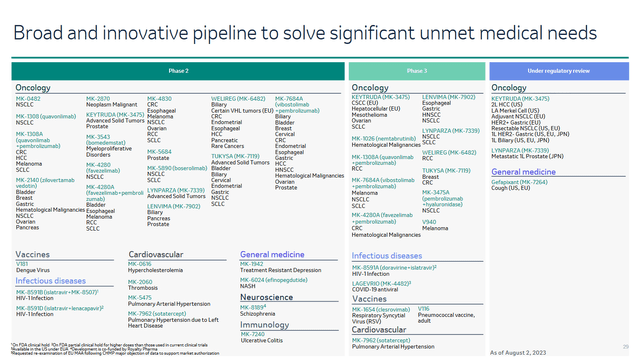

The active R&D policy, which is being implemented under the leadership of Robert Davis, is one of the main factors contributing to the increase in Merck’s revenue. It brings new generation vaccines and medicines to the market that can improve the quality of life for millions of patients worldwide.

One of the recent major successes in developing the Keytruda franchise was the achievement of one of the primary endpoints in a phase 3 clinical trial that evaluates its efficacy in treating patients with early-stage ER+/HER2- breast cancer. At the same time, the company, in its press release, announced that the study would continue to evaluate the second primary endpoint of event-free survival by the recommendations of the independent data monitoring committee.

2Q23 Merck Earnings Presentation

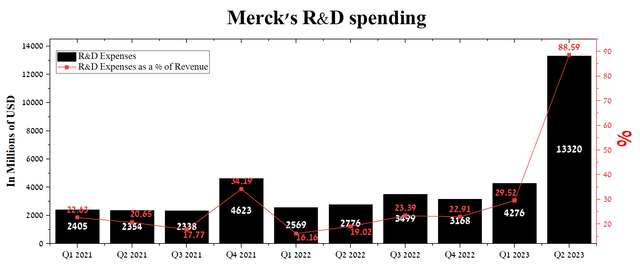

Merck’s R&D expenses were $13.32 billion in Q2 2023 or 88.59% of total revenue, up significantly QoQ due to the completion of the Prometheus acquisition. Furthermore, during the initial six months of 2023, the company is proactively establishing partnership agreements with pharmaceutical companies, even in light of the industry’s uncertain future due to the impending enforcement of some of the clauses of the Inflation Reduction Act.

Author’s elaboration, based on Seeking Alpha

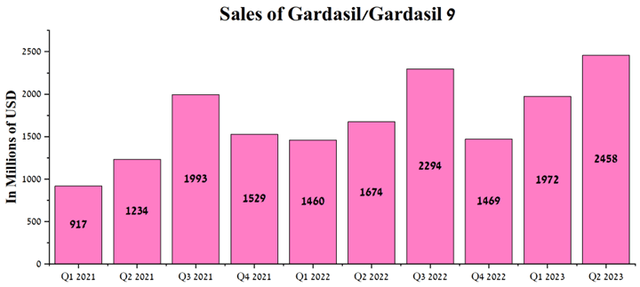

According to Seeking Alpha, Merck’s revenue for Q3 2023 is expected to be $14.62-$15.51 billion, up 5.3% from analysts’ expectations for Q2 2023. At the same time, under our model, the company’s total revenue will be slightly higher than the median value of this range and will amount to $15.42 billion. Primarily, this will be driven by increased sales of the Gardasil franchise driven by growing demand in China, as well as its rapidly increasing share of the global human papillomavirus (HPV) vaccine market. Overall, combined sales of Gardasil and Gardasil 9 vaccines were about $2.46 billion in Q2 2023, up 46.8% year-over-year.

Author’s elaboration, based on quarterly securities reports

Despite a one-off drop in Merck’s earnings per share (EPS) for the second quarter of 2023 due to a $10.2 billion charge to acquire Prometheus, company management has updated its guidance for 2023.

Taken together, we expect EPS of $2.95 to $3.05, which includes the one-time charge for Prometheus and a negative impact from foreign exchange of approximately 5 percentage points versus 2022, using mid-July rates.

Recall our prior guidance range was $6.88 to $7, which we noted at the time excluded Prometheus. Had we included the $4.02 one-time charge and an estimated $0.14 to advance the assets and financing costs, our prior guidance range would have been $2.72 to $2.84 with a midpoint of $2.78. Our current guidance midpoint of $3 represents an increase resulting from the strength in our business of approximately $0.24, partially offset by an incremental headwind from foreign exchange of approximately $0.02.

According to Seeking Alpha, Merck’s Q3 EPS is expected to be $1.79-$2.12, up 13.5% from the consensus estimate for the three months ended September 30, 2022. While we believe this is slightly underestimated, our model puts Merck’s EPS at $2.

Author’s elaboration, based on Seeking Alpha

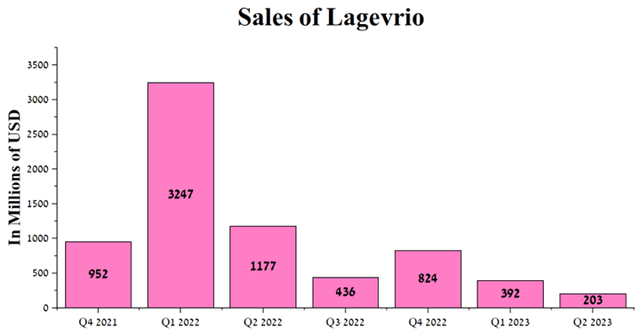

The company’s operating income was negatively impacted by the ongoing decline of Lagevrio (molnupiravir), used to treat COVID-19. Cumulative sales of this medicine were $203 million in Q2 2023, down 82.8% year-over-year due to a sharp drop in new cases.

Author’s elaboration, based on quarterly securities reports

Despite the rapid spread of a new variant of COVID-19 called EG.5, we believe that Lagevrio will not be a key contributor to the company’s cash flow growth due to Paxlovid’s continued dominance in the market.

Conclusion

In early August, Merck released its Q2 2023 financial results, which not only beat analysts’ expectations but demonstrated that demand for its innovative products, such as Vaxneuvance and Prevymis, is growing faster than many on Wall Street expected.

On the other hand, despite the decline in sales of antiviral medicines, the company increased its 2023 revenue guidance from $57.7-$59.6 billion to $58.6-$59.6 billion, also due to continued strong demand for Keytruda and Gardasil.

Driven by the company’s rapid expansion of its portfolio of experimental drugs targeting cancer and cardiovascular diseases, maintaining high margins of its two segments, and a $4.9 billion share repurchase authorization, we continue our analytics coverage of Merck with an “outperform” rating for the next 12 months.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, and does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.