Summary:

- Management has now said that the convertible bondholders have asked about exercising their options, implying up to 20% dilution is on the table.

- I am not as concerned about it; a lot of it should already be priced in.

- Even focusing on the intrinsic value of the shares, the effect appears small relative to the uncertainty over the fundamental value of the company’s drillships a few years out.

- The big winner from the conversion will be the junior debt which can still be purchased at double-digit yields.

designer491

Investment thesis

I recently wrote about the improvement in Transocean’s (NYSE:RIG) credit prospects and what it could mean for the equity:

Transocean Stock’s Credit Spreads Have Significantly Narrowed.

One “watch area” that I identified were Transocean’s convertible bonds:

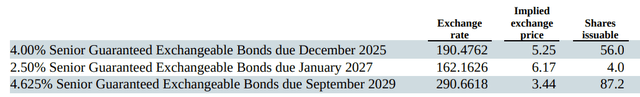

As I pointed out, all convertibles are now in the money and this may imply up to 20% dilution for the equity holders. Interestingly, during the subsequent Q2 earnings call, RIG’s management also emphasized this point:

With respect to ongoing balance sheet activities, our recent share price performance has resulted in all of our [exchangeable] bonds being deepened consistently in the money. As such, we expect [that] these bondholders may be inclined to convert their position to shares. And in fact, we have received numerous inquiries regarding early conversion.

Given we may now theoretically exit Q3 at north of 900 million shares, I wanted to explore this topic a bit further.

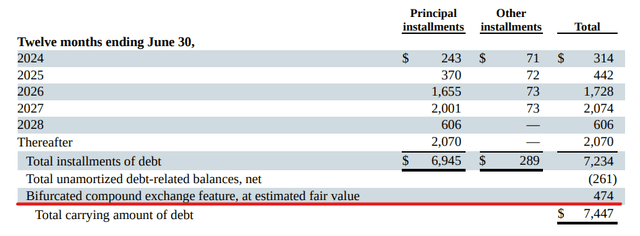

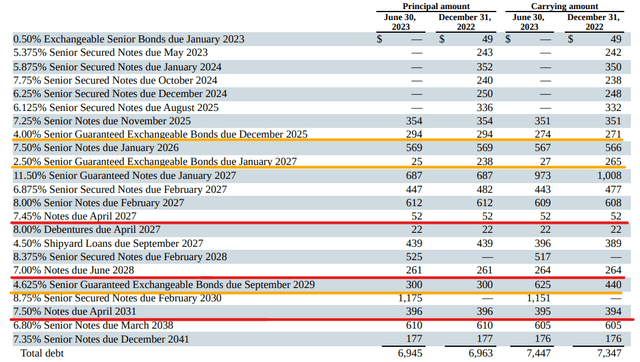

One view is that everything is already priced in; clearly, the potential dilutive effect has been known since last September when these bonds were issued. From accounting perspective, Transocean even records a liability associated with the “moneyness” of the exchange feature:

However, what I want to show is that, abstracting oneself away from what is or isn’t priced in and just looking at the intrinsic value of the shares, the exercise of the conversion options would potentially reduce this intrinsic value by 5 to 10% in most scenarios. While not immaterial, I think that 5 to 10% is small compared to the fundamental uncertainty over how much Transocean’s underlying assets would be worth in, say, 2025.

In other words, the conversion by itself shouldn’t really change your bullish or bearish stance on the stock although short-term buying opportunities could arise if the bondholders who avail themselves of the conversion option also seek to divest their newly minted shares. Interestingly, a corollary of the balance sheet mechanics is that if you are very bearish on Transocean, the conversion should make you relatively more bullish.

Finally, while in the long term the conversion could be a wash for the equity, what is undisputable in my view is that it will be very bullish for the non-convertible debt, especially for the junior bonds which currently rank below the convertibles. Despite the spread compression I described in my prior article, these junior notes still offer an attractive yield for what at this point isn’t that much risk.

The convertible bondholders want to cash out

A convertible bond can be seen as a combination of a straight bond and a call option on the equity. We know from the theory that the early exercise of an option is never optimal, but it’s not unusual that institutional factors may dictate otherwise. For example, distressed debt investors may rather get their money out and put it into another investment consistent with their mandate than retain long-term exposure to Transocean’s equity. As the conversion options are now deep in the money, the primary driver for future bond gains would be the equity itself.

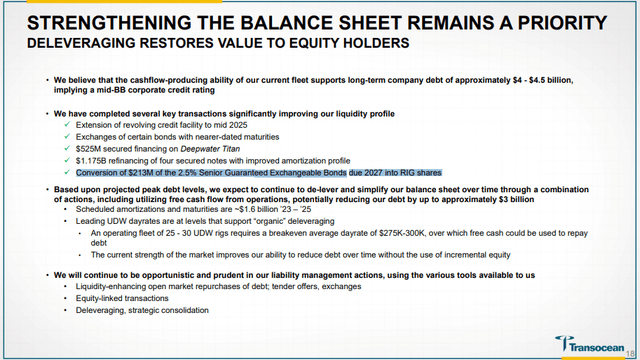

Insider Perestroika already converted a lot of its debt in Q2 and this was already noted in a Transocean presentation from June:

Transocean Investor Presentation

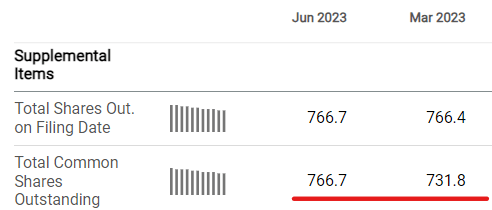

Now that the 10-Q is out, we can also see the corresponding growth in the share count:

Seeking Alpha

If the remaining options get exercised this quarter, going into the next quarter we are looking at a little more than 900 million outstanding shares.

What does it mean for the balance sheet?

As the conversion substitutes debt for equity, the expected 20% dilution doesn’t mean that the intrinsic value of the shares will drop by 20% too. To quantify the effect, we need to have a view on the fair value of the asset side of the balance sheet.

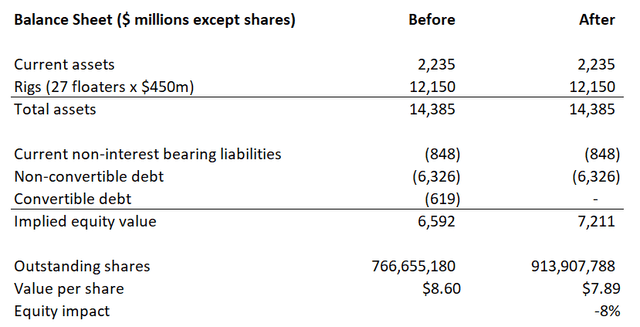

To make things easy, I am going to assume an average value of $450 million for the 27 active floaters. As it’s an “average”, you’ll have units such as the Titan and Atlas well above and older units below that mark. I will assume zero value for the 12 stacked units. If these assumptions don’t seem reasonable to you, don’t worry; I also ran a sensitivity analysis that shows how the impact of the conversion changes with the asset values.

Given various estimates from offshore drilling earnings calls that suggest up to $1 billion cost for a newbuild, I don’t think $450 million is aggressive, especially as I don’t include any contracted backlog either. In total, my assumptions suggest fixed assets value of $12.15 billion, which is still below the latest net book value of $16.92 billion. Perhaps as additional reference point, Deep Value Driller AS, a company listed in Norway that owns a single stacked 7G ship, currently being reactivated, is trading at an enterprise value equivalent to about $250 million.

So let’s first compare the “before” and “after” conversion balance sheet for my $450 million per active rig scenario:

So here the intrinsic value drops by 8%. Again, remember these are intrinsic values. If you subscribe to the efficient markets hypothesis, you could argue that the price you observe in the market already corresponds to the post-conversion $7.89 value from the example (which, if you reverse my process, should tell you what the market thinks about the average rig values).

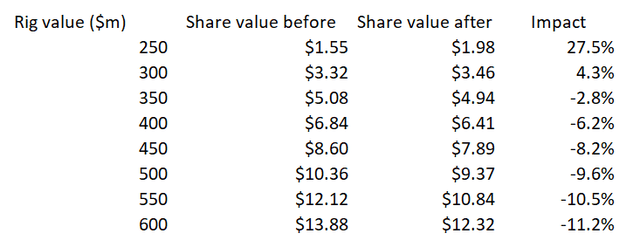

Now, as promised, let’s see what happens as we vary the average rig value from $250 million all the way to $600 million:

For the scenarios that I see as plausible, we are looking at a 5 to 10% effect. If you are very bearish on Transocean (which means you think its rigs are worth very little), the conversion should even make you slightly more bullish.

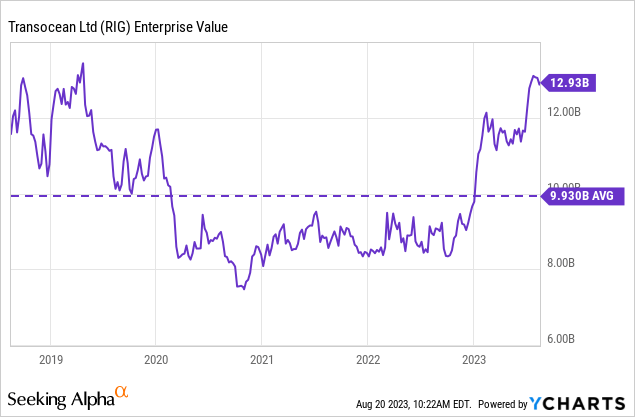

At first glance, the conversion option’s effect on the equity is quite significant. However, I would argue that we are still facing much uncertainty about what Transocean’s drillships would be worth a few years out:

Over the last 5 years, Transocean’s enterprise value has moved within a +/- 30% band from its average, and the equity range is even wider due to the leverage effect. Comparatively, a 5 to 10% one-time move shouldn’t reverse your bullish (or bearish) thesis.

One can also run this exercise from an earnings per share perspective. Exchanging the convertible bonds will reduce the interest expense, but increase the number of shares over which the earnings are spread. However, the convertible bonds carry lower interest rates and Transocean still reports a net loss, so this calculation would be less informative.

Is there any change in liquidity?

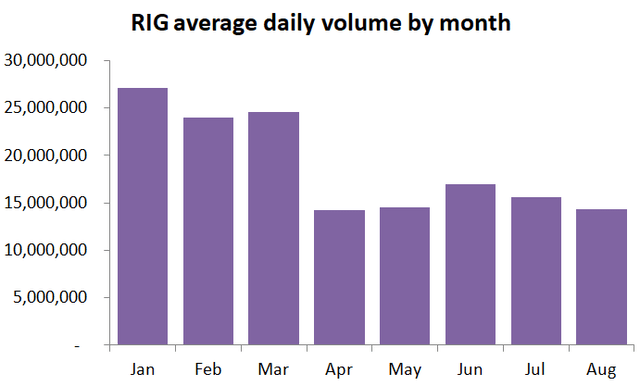

I would think that if we go from 766 to 913 million shares, the average daily volume should also increase, all else equal. However, so far I am not seeing that:

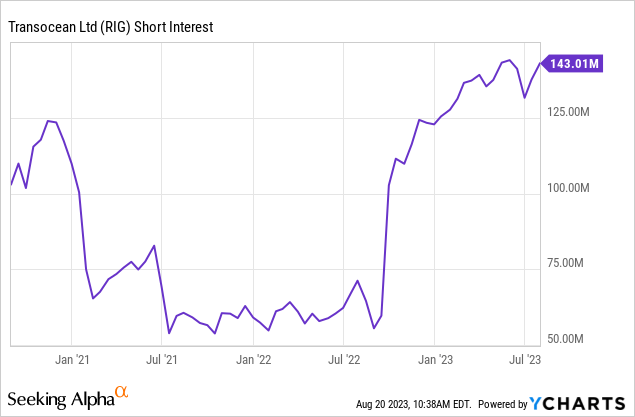

In fact, the daily volumes have fallen from Q1. The short interest has been relatively static since last September, when the convertibles were issued:

If some of the short interest was meant to hedge the convertibles, the effect of the debt conversion may be even more muddled.

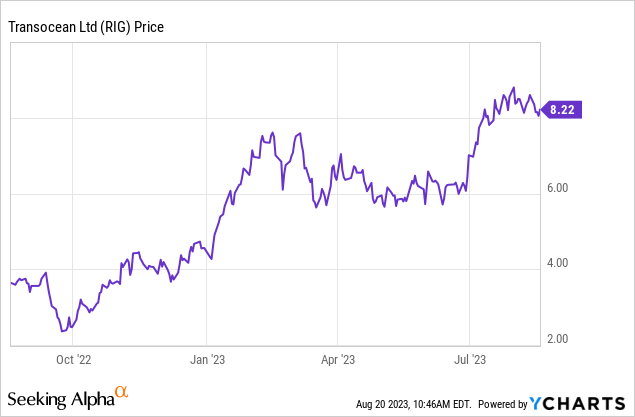

With all this said, I am not hugely concerned about the remaining convertible notes getting exchanged. In fact, bondholders exchanging and cashing out could even create some buying opportunities. For me personally, my average cost basis in Transocean’s equity is $3.44, and I would consider adding more if we get down to $6 again:

I won’t engage in any sophisticated technical analysis, but I think the $6 level has been good support for the stock so far this year.

The junior bonds are the big winner

While the impact on the equity depends on what you think of the market value of the drillships and what is already priced into the stock, there should be little doubt that the non-convertible debt is the big winner. This is especially true of the junior bonds because the convertibles have senior guaranteed status:

From the junior bondholders’ perspective, the conversion is removing a layer of higher priority debt above and replacing it with lower ranked equity. That must be credit positive and we are talking 10% of the overall debt. I would contend that is less likely to be priced in because the demand for debt is strongly influenced by its credit rating due to institutional mandates. I don’t think the credit rating agencies would make any move before the conversion is actually effected.

I myself maintain a long position in the April 2027 notes. As I write this, the ask yield on these notes is 11.615 although it was north of 13% when I purchased them. I intend to hold these notes until maturity or until they are called.

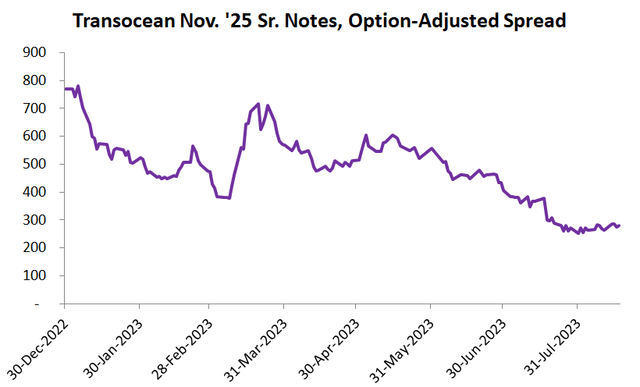

Generally, as I pointed out in my prior article, spreads on all of Transocean’s traded debt are narrowing, implying a reduced likelihood of financial distress. Here is, for example, the chart for the November 2025 senior notes:

Does 279 bps (latest data point) look to you like distressed debt? I don’t think so. Check out Carvana (CVNA) if you don’t believe me. For me, the upgrade from the unflattering “CCC” rating is no longer a question of “if” but of “when.”

Bottom line

Transocean’s management has now said that the convertible bondholders are looking into exercising their options. This means we may exit Q3 with a little more than 900 million outstanding shares, up from the current 766 million.

I think the long-term effect on the equity may end being a wash. First, some of this should already be priced in. Second, we are talking about 5 to 10% changes in the intrinsic value of the shares which is much less than the fundamental uncertainty over what RIG’s drillships will be worth a few years out.

What should be clear, though, is that if the conversion happens, the non-convertible debt will be further de-risked, especially the junior notes that currently rank lower than the convertibles.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

My articles, blog posts, and comments on this platform do not constitute investment recommendations, but rather express my personal opinions and are for informational purposes only. I am not a registered investment advisor and none of my writings should be considered as investment advice. While I do my best to ensure I present correct factual information, I cannot guarantee that my articles or posts are error-free. You should perform your own due diligence before acting upon any information contained therein.

I am also long RIG's April 2027 bonds.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.