Summary:

- Carnival Corporation is experiencing a strong recovery in passenger numbers and is seeing record bookings.

- The cruise line industry is benefiting from high demand for ocean-going cruises, leading to robust growth in passengers and pricing strength for cruises.

- CCL has raised its adjusted EBITDA outlook for FY 2023 due to booming demand.

- A high valuation based off of P/E, relative to rivals, and a high debt burden translate into a hold rating.

Joel Carillet

The cruise line sector experiences a strong recovery in passenger numbers which has translated to a revenue re-acceleration as well as record booking growth for Carnival Corporation (NYSE:CCL) and other cruise line companies. Carnival also raised its adjusted EBITDA outlook for FY 2023 and indicated that it is seeing strong booking demand for its North American and Australian cruises. Although the operating conditions in the cruise line segment have fundamentally improved after the pandemic and Carnival reported positive operating income in the second quarter, I believe the risk profile remains unattractive due to the company’s relatively high P/E valuation compared to other cruise line companies such as Norwegian Cruise Line Holdings (NCLH) and Royal Caribbean Cruises (RCL) and its high level of debt.

Previous rating

I rated Carnival a strong buy in 2021 as the CDC reopened the cruise market after the Covid-19 shutdown. The cruise line market has recovered much more slowly than initially expected and, given the reasons laid out in this article, I am currently rating Carnival as a hold.

Strong booking trends for Carnival and the broader industry

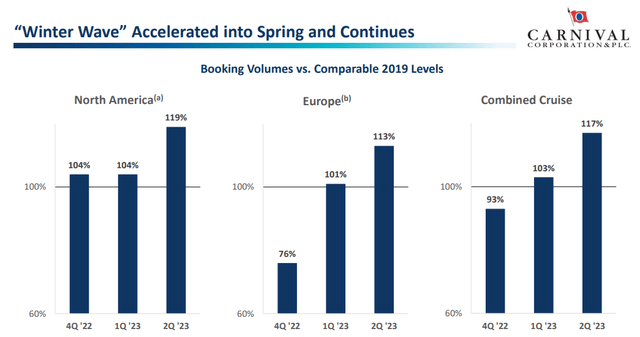

The cruise line industry is benefiting from enormous demand for ocean-going cruises at the moment and all three major cruise line companies are seeing robust growth in passenger numbers, revenue growth and pricing strength for their cruises. Carnival reported strong booking growth in FY 2023 that lifted its total bookings significantly above the 2019 level… which was previously the record year for Carnival as well as the broader cruise line industry.

Interestingly, momentum in booking volume growth is not constrained only to North America, but also affects Carnivals European and Australian cruises. According to the Cruise Line International Association, FY 2023 is set to be a record year for the cruise line industry which bodes well for continual revenue and operating income growth for the three major cruise line companies.

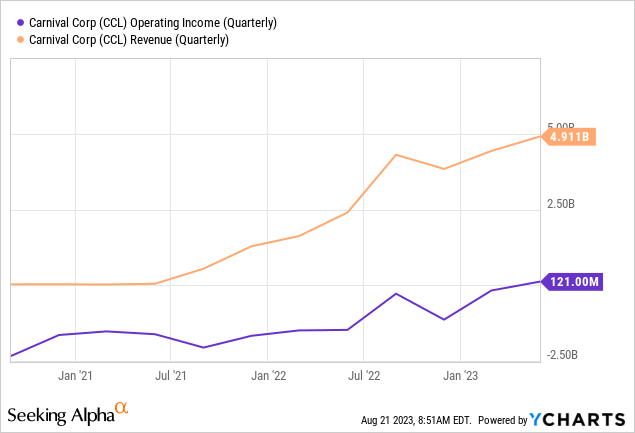

Due to the discussed post-pandemic recovery in the cruise line sector, Carnival has seen a re-acceleration of its top line as well. In the first six months of FY 2023, Carnival revenues soared 132% year over year to $9.3B. Carnival also reached positive operating income in the second-quarter and the trend in revenue and operating income growth is encouraging.

Guidance raise for FY 2023

Due to a fundamental improvement in operating conditions, Carnival raised its adjusted EBITDA outlook by $175M, compared to its previous guidance, and now expects to earn $4.10-4.25B in EBITDA in FY 2023.

Why I Rate Carnival As A Hold

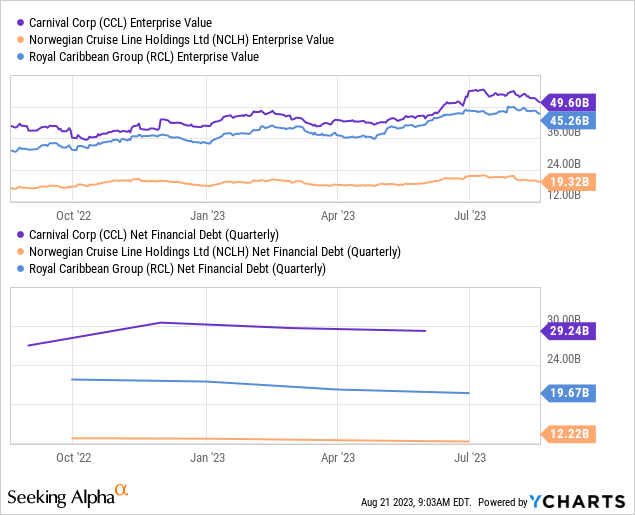

Carnival, Norwegian Cruise Line Holdings and Royal Caribbean Cruises dominate the cruise line market and Carnival is the largest company in terms of enterprise value. But while Carnival is the biggest fish in the pond, the firm also has by far the most debt to service… which is something that could hurt the cruise line company in the event of a down-turn in the economy. Cruise line companies are dependent on strong consumer spending, meaning slowing economic growth and cutbacks in spending are likely to hurt demand for cruise line operations.

Carnival had $29.4B in net financial debt at the end of the second-quarter, which was the most of any cruise line company. Carnival, however, has said that it wants to pay its debt down significantly in the next three years and targets to cut its net debt by $8B or more. The successful deleveraging of Carnival’s balance sheet could be a catalyst, eventually, for an upside revaluation of the cruise line company’s shares.

Don’t Buy The Drop

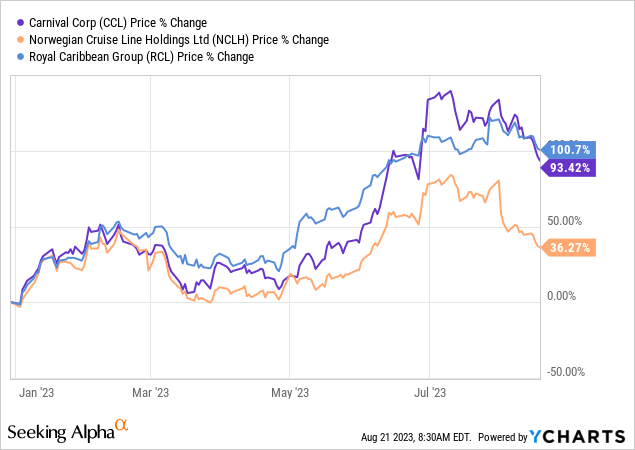

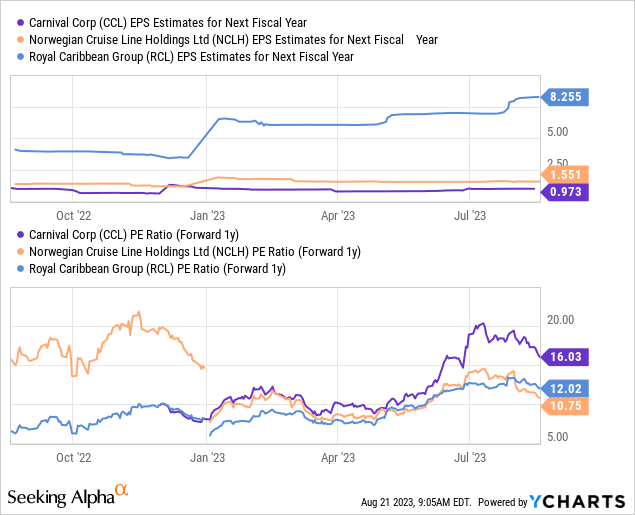

Cruise line companies have experienced a drop in valuations lately, in-line with the broader market, but I don’t recommend investors to buy the drop just yet. This is because Carnival is trading at the largest earnings multiplier factor in the industry group with a P/E ratio of 16X. Norwegian Cruise Line Holdings currently has the lowest P/E ratio in the industry and the company has seen a massive rebound in its operating income in the second-quarter. Considering that both Norwegian Cruise Line Holdings and Royal Caribbean Cruises have both less debt and lower earnings multiplier factors, I believe both cruise line companies also have more attractive risk profiles than Carnival.

Risks with Carnival

The biggest commercial risk for Carnival is a potential recession which could lead to declining passenger numbers, a weakening of booking trends and pricing power that could affect the company’s operating income prospects and lead to a deceleration of its top line growth. Carnival also has to deal with a lot more debt than its rivals in the industry which could weigh on the firm’s valuation factor going forward as well.

Final thoughts

Although valuations of cruise line companies have recently dropped, in-line with the broader market, I would not recommend to buy the drop for Carnival just yet. Carnival is trading at an expensive valuation relative to its rivals in the industry, and while booking and pricing trends are still favorable due to booming demand for cruises, I believe lower-priced cruise line companies offer investors more upside potential. Carnival also has a considerable amount of debt sitting on its balance sheet which, in my opinion, could limit the firm’s upside potential. Since both Norwegian Cruise Line Holdings and Royal Caribbean Cruises have much lower P/E ratios and have solid operating income, NCLH and RCL have much better risk profiles than Carnival, in my opinion.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.