Summary:

- Affirm is expected to report a non-GAAP EPS loss of 68 cents on revenue of $406 million for fiscal Q4 2023.

- The stock has outperformed the market 3:1 in the last 5 months, but its revenue growth has slowed down and the damage maybe too big to revert.

- Affirm’s reliance on interest-bearing transactions has increased, and its active users and transactions per active customer have declined.

Sviatlana Zyhmantovich

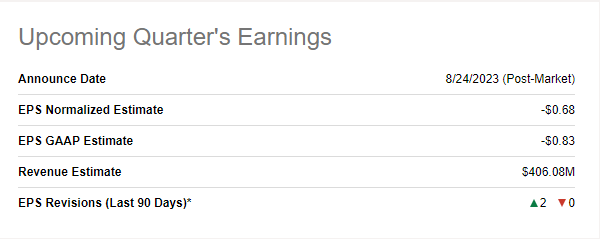

Affirm Holdings, Inc. (NASDAQ:AFRM) will report earnings fiscal Q4 that ended June 30th, 2023, post-market on Thursday, August 24th. Analysts expect Affirm to report a non-GAAP EPS loss 68 cents on revenue of $406 million. Should Affirm meet these numbers, it would represent a YoY decline in EPS (or increase in loss) by 6% and a revenue growth of 11.50% YoY.

AFRM Q4 Preview (Seekingalpha.com)

In my last coverage of Affirm, I called the company a “bottomless” but rated it a “Buy” on what I believed was favorable risk-reward. Since then, the stock has gone up 35% compared to the market’s 12%. In other words, Affirm has outperformed the market 3:1 in the last 5 months. Will this outperformance (on the back of terrible underperformance in 2022) continue?

With that background out of the way, let’s preview Affirm’s Q4 without any further ado.

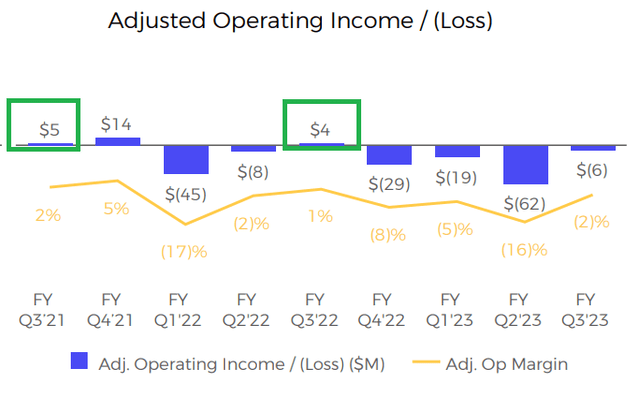

Still Expected To Lose Money, Adjusted Too

It was widely reported (example 1 and example 2) that Affirm was likely to be “adjusted operating income profitable” in FY 2023. In the three FY 2023 quarters reported so far, Affirm has reported an adjusted operating loss of $19 million, $62 million, and $6 million. It is worth noting that in the short-history that the company has as a public company, Q3 has been the most profitable quarter as shown below. The upcoming report is for Q4, which has seen one positive and one negative quarter in the last two years. But let’s not forget, we are talking about adjusted operating income.

AFRM Adj. Operating Income (investors.affirm.com)

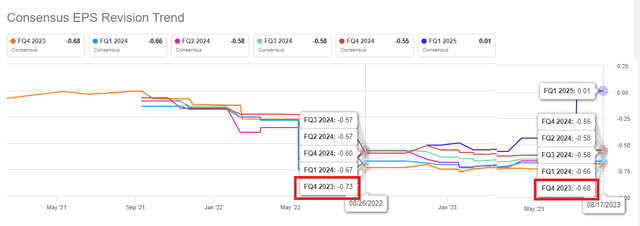

Once items like interest, taxes, and stock-based compensation are added to the equation, the numbers look far worse. Affirm was expected to make a loss of 73 cents/share in Q4 2023 a year ago. This expected loss has narrowed a little but is still significant at an expected loss of 68 cents per share.

AFRM Q4 Trend (Seekingalpha.com)

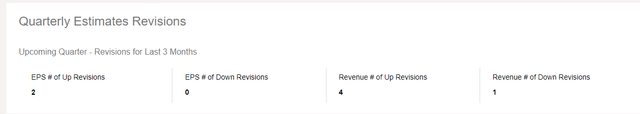

While most of the EPS and revenue revisions have been to the upside, the bigger news here is that with an EPS loss expected and a barely double-digit revenue growth, Affirm is neither in the “young and exciting” nor the “established but temporarily struggling” category.

AFRM Revisions Count (Seekingalpha.com)

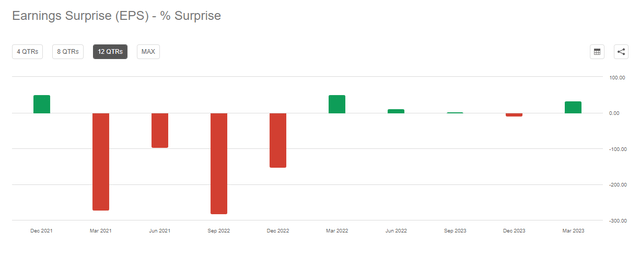

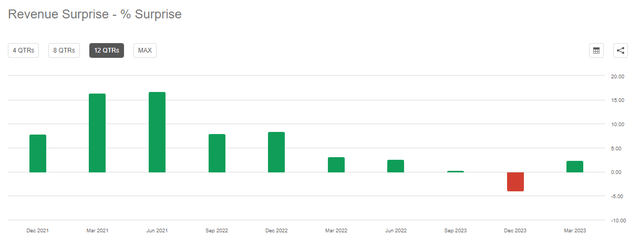

Beat or Miss? I Say A Small Beat on Both

Over the last 10 quarters, Affirm has beaten EPS estimates 5 times and revenue estimates 9 times. The EPS beats have been very small but the misses have been by a much wider margin. Revenue has come in more or less on expected lines over the last 5 quarters with the average being a beat by less than 1%. Going by that history, I am predicting in-line to minor beat on both EPS and revenue. But I don’t believe these beats will be enough to move the stock given the recent market weakness and general FinTech trend.

AFRM EPS Surprise (Seekingalpha.com) AFRM Revenue Surprise (Seekingalpha.com)

Main Stories – More Interest Rate Exposure Expected,

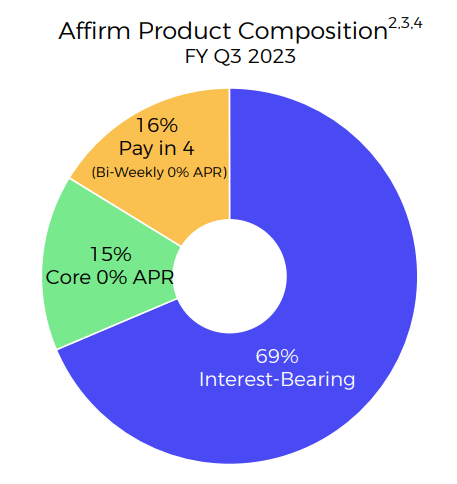

- In the last three quarters (Q1 2023 to Q3 2023), Affirm’s reliance on interest bearing transactions has gone up from 64% to 67% to 69%. This is not the direction the company would like to go in the present high-interest rate environment but that is where the company is likely to have gone in Q4 as well, as this is a structural issue. The whole idea behind Buy Now Pay Later [BNPL] firms is to allow consumers the flexibility to pay off things over time. And when the consumers are as hit as they are now, outright purchases are going to be harder to come by.

- When Affirm stock was going ballistic in 2021, the primary story was the expected revenue growth. This has died down rather quickly as the company reported YoY revenue growth of 34% in Q1 2023, 11% in Q2 2023, and just 7% in Q3 2023. Now, compare these numbers to the growth seen in the corresponding quarters in 2022: 55%, 77%, and 54%. While revenue is still an important metric given the age of the company (as a public entity), I don’t expect anything more than low double-digits in Q4.

- Finally, when a company is supposed to be in growth spurt, active users/consumers count is an important metric. It may not matter this early in the game how profitable the consumer is for the company or even the ARPU [Average Revenue Per User]. But it is extremely important to keep the active users engaged, which in Affirm’s world equates to transactions. Transactions per active customer has also fallen in each of the three quarters in FY 2023 so far with the rate going from 39% to 38% to 34%. It will be interesting to see if the company is able to reverse this or if the downtrend continues.

Valuation – Not Too Bad, But FinTech Is Hated Right Now

Affirm’s fall from $170s in 2021 to about $14 right now has been nothing short of stunning. In fact, the stock went as low as $8.62 in the last 52 weeks and even now, it is possible to make a case for the stock’s over-valuation. For example, the company is still losing money (even by Non-GAAP metrics). However, the company is trading at just 3.3 times sales based on 2022’s revenue of $1.3 billion. However, when you consider that much larger, established, and profitable FinTechs like PayPal Holdings, Inc. (PYPL) are trading at just 2.3 times 2022’s revenue, Affirm’s valuation still seems excessive.

Technical Strength

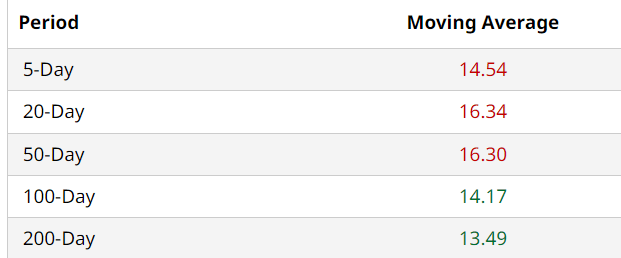

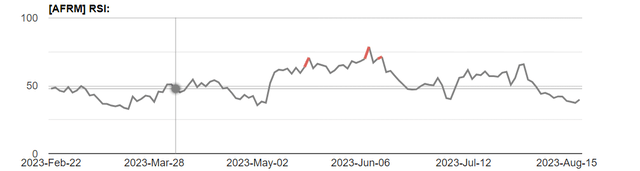

In one of the few bright spots for the stock, AFRM recently moved above both the 100-Day and 200-Day moving averages after struggling to find a strong bottom, making the trip all the way down to $8. That the stock has not become overbought consistently while clearing these two moving averages is worth noting. This makes me believe the stock should have no technical problems soaring higher should Q4 results and/or Q1 guidance surprise the market.

AFRM Moving Avg (Barchart.com) AFRM RSI (aiolux.com)

Conclusion

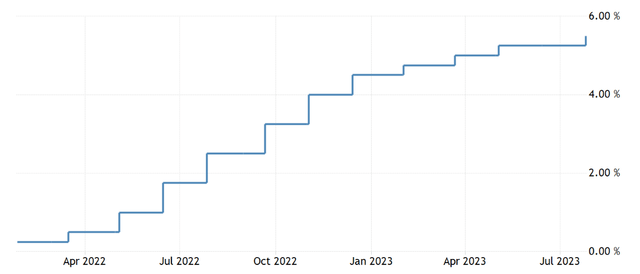

The only solace for Affirm and its investors is the fact that FinTech, in general, has been a no-go sector/industry since the Federal Reserve stopped pumping money into the economy. While this generally makes sense, it especially applies to BNPL firms like Affirm that are extremely susceptible to the consumer’s borrowing (and hopefully one day, repaying) strengths. However, as shown in what looks like a well-constructed set of stairs, interest rate has been on a steady upward climb with some Fed officials still calling for more increases. I don’t expect the rates to take the elevator down once they stop climbing the stairs.

US Fed Funds Rate (tradingeconomics.com)

Much larger and established FinTech companies like PayPal have their stock in the dog-house making multi-year lows almost each month. So, I expect it to take a while before these stocks get out of their time-out boxes and not many will have the resources to survive until then. I do expect PayPal to survive but I am not quite sure about Affirm surviving a high-rate environment for too long, primarily considering the company’s product composition with 70% of its transactions incurring interest expenses to the consumer. Over the short-to-medium term, I expect the stock to be wild with many opportunities to trade profitably, but I suggest the average investor to not get into the stock now, especially with earnings approaching. Stay away.

AFRM Transaction Makeup (investors.affirm.com)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.