Summary:

- Nvidia is expected to report its Q2 earnings results on Wednesday, which could determine if its $1 trillion market cap is justified.

- Nvidia’s dominance in the generative AI industry, lack of competition, and high demand for its GPUs position it for continued aggressive returns if the guidance is met.

- As we all await the results, this article highlights why the Q2 report might become the most important earnings report that the company has released in years.

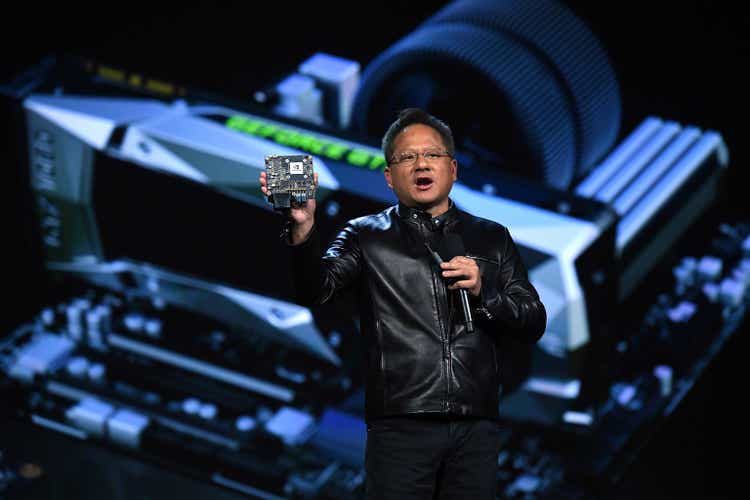

Ethan Miller

On Wednesday, Nvidia (NASDAQ:NVDA) is expected to report its Q2 earnings results which should make it clear to all of us whether the company’s market cap of over $1 trillion is justified. Considering that the demand for Nvidia’s GPUs skyrocketed in recent months thanks to the generative AI revolution, there are reasons to believe that the company has everything going for it to continue to generate aggressive returns in years to come. That’s why I think if Nvidia’s leadership manages to deliver on its promises and meets or even exceeds the updated guidance, then a further rally might ensue.

As we all await the results, this article highlights everything that investors need to know about what’s been happening with Nvidia in recent months and why the Q2 report might become the most important earnings report that it has released in years.

All Eyes On Q2 Results

The latest rally that helped Nvidia reach a $1 trillion market cap was possible thanks to the improvement of the company’s guidance for Q2, which the management released right after the Q1 earnings results a few months ago. While the consensus on the street was that Nvidia would likely generate $7.11 billion in revenues in Q2, the company’s management announced that they expect the business to generate around $11 billion in revenues in Q2 alone. This was above even the most optimistic expectations on the street and resulted in a major rally for the stock.

Once that guidance had been revealed, I published an article on Nvidia in May in which I stated that I was wrong about undermining the company’s growth potential. At the same time, all the other analysts who cover Nvidia have also made numerous upward revisions in recent months and the current consensus is that the company’s EPS and revenues could increase by ~145% Y/Y and ~64% Y/Y in FY24 to $8.19 per share and $44.19 billion, respectively.

The improvement of the guidance was possible thanks to the ongoing generative AI revolution, which could have a profound impact on our society and change the way we interact with this world. The latest reports suggest that generative AI could drive a 7% increase in global GDP in the following years, as the industry alone is expected to grow at a CAGR of over 40% and be worth over $1 trillion in the next decade.

Given such a growth potential, it’s no surprise that Nvidia has become one of the most important companies in the business as its GPUs power the ongoing generative AI revolution. There is already news that in recent months Nvidia began to make 1000% profit on its advanced H100 GPUs as their price now ranges from $30,000 to $70,000 per unit. Thanks to such returns, it’s possible that the company could indeed once again exceed the street expectations once the Q2 numbers come out.

What’s more, is that it seems that Nvidia will remain a dominant force that powers the generative AI revolution for years to come. The company’s competitor Intel (INTC) is expected to release its chip that’s made for AI only in 2025. At the same time, even though another competitor AMD (AMD) is expected to release its own MI300X GPU that’s comparable to Nvidia’s H100 GPU at the start of 2024, there are questions about whether it’ll be able to capture a significant portion of the market share. This is due to the fact that Nvidia itself earlier this month introduced a more powerful advanced platform called GH200 that will be available a year from now. The biggest advantage of GH200 is that it will have three times the memory capacity of the popular H100 GPU and it has the chance to undermine the importance of x86 chips in the data center industry.

In addition to all of this, thanks to its first-mover advantage and a lack of competition, major companies and states are buying Nvidia’s GPUs en masse in order not to miss the generative AI revolution. Earlier this month, reports came in which stated that Saudi Arabia along with the United Arab Emirates purchased and secured access to thousands of the company’s H100 GPUs. At the same time, major Chinese tech firms such as Alibaba (BABA), Baidu (BIDU), and others have also acquired up to $5 billion worth of Nvidia’s chips that are priced as high as $70,000 per unit in order to minimize the geopolitical risks. All of this shows that Nvidia has everything going for it to continue to generate aggressive returns as the demand for its GPUs is unlikely to decrease anytime soon.

Major Risks To Consider

Even if the growth of the global economy slows down or the gaming market doesn’t properly recover, there’s still a case to be made that Nvidia’s sales would continue to increase due to the importance of its GPUs to the generative AI industry. That’s why I believe the only major thing that can undermine Nvidia’s growth story is an outright ban on the sale of its chips to China by the United States.

Last year, the Biden administration has already prohibited Nvidia and others from selling directly their most advanced chips in the Chinese market, which prompted the chip maker to design specific weaker GPUs for China in order to not lose customers and to comply with the new rules at the same time. However, earlier this month the Biden administration announced new restrictions on investment into the Chinese tech sector, which prompted the Chinese industry executives to work on a plan to become more self-reliant. This is likely not the last time new restrictions are being placed as the ongoing Sino-American confrontation is unlikely to end anytime soon.

That’s why a potential disruption of Nvidia’s operations in China, which accounted for around 21% of total revenues last fiscal year, is the only major thing that can greatly undermine the company’s growth story and result in a permanent loss of opportunities for its business in my view.

Such a potential disruption is also the only thing, in my opinion, which could make the market question Nvidia’s current valuation. We shouldn’t forget that despite the forecasted growth of the generative AI industry that’s expected to be worth $1.3 trillion only a decade from now, Nvidia already has a similar market capitalization today and trades at ~26 times its forward sales. What’s more is that in Q1 the company’s revenues actually decreased by 13.3% Y/Y to $7.19 billion, which doesn’t bode well with the growth narrative.

However, despite those valuation concerns, there’s nevertheless a case to be made that if Nvidia’s business is not disrupted by geopolitics and the management delivers on its promises in Q2 and beyond, then the company’s shares could rally even further. This is due to the fact that the momentum is on the company’s side and considering the high demand for its chips, Nvidia is likely to continue to generate aggressive returns even in the current high interest rate environment.

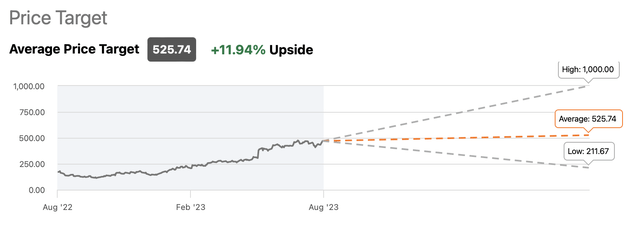

At a forward P/E of ~57x, Nvidia’s shares trade at lower multiples than Amazon (AMZN) today and at much lower multiples than Tesla (TSLA) at the high of the post-Covid bubble in 2021. That’s why it won’t be impossible for Nvidia’s shares to rally further. This is likely one of the main reasons why Wall Street seems excited about the company’s future, helps justify its current valuation, and gives it a consensus price target of $525.74 per share.

Nvidia’s Consensus Price Target (Seeking Alpha)

The Bottom Line

Considering all of this, there’s a decent chance that if Nvidia meets or even exceeds its updated guidance for Q2, then its stock could very well rally further and help the company reach a much greater market cap. Add to all of this the fact that the demand for its GPUs is not going anywhere and it becomes obvious to me that the only thing that could undermine Nvidia’s growth story is a further Sino-American confrontation, which would disrupt its operations. Other than that, as long as the guidance is met, Nvidia’s growth story would likely be far from over.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He's/It's/They're solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!