Summary:

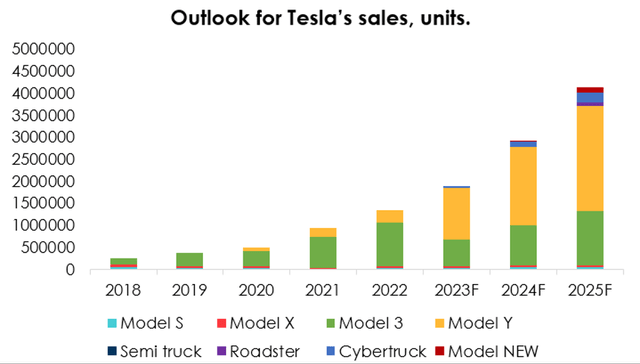

- Tesla’s shift in deliveries of Semi Truck and Roadster does not significantly impact future delivery forecasts, as the Model 3/Y remain the main drivers of the business.

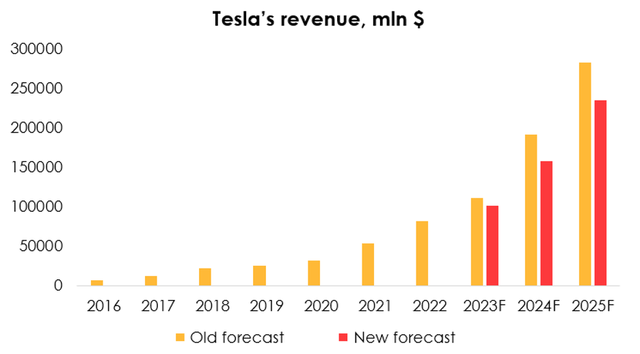

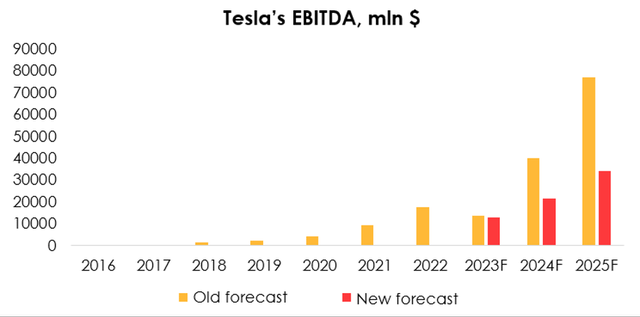

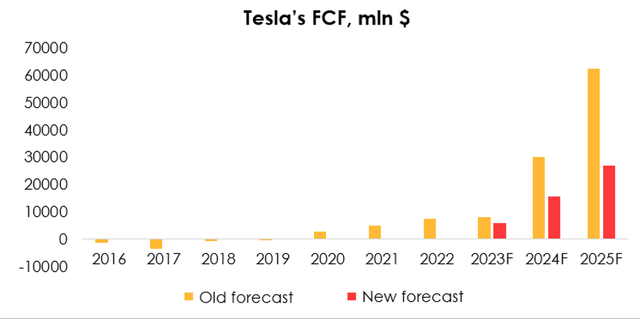

- The company’s price war and persistent price cuts have led to a decrease in revenue, EBITDA, and FCF forecasts.

- Tesla’s focus on sales volume over profits has resulted in increased discounts and subsidies, leading to record-breaking car sales in Q2 2023.

Scott Olson/Getty Images News

Investment thesis

The shift in deliveries of Semi Truck and Roadster, partially offset by an increase in Cybertruck deliveries forecast, does not affect our views on Tesla’s (NASDAQ:TSLA) future deliveries too much. The Model 3/Y are the main drivers of the business.

Having persistently cut prices on a number of Tesla models as part of the price war and due to the current prioritization of sales volume over profits, we are lowering the forecast for Tesla’s revenue, EBITDA and FCF. The prolonged price cuts for all models of electric vehicles could have had a more significant impact on the company’s key financial indicators, but they were mitigated by decreasing prices for all raw materials that Tesla uses in its lithium-ion batteries. Our rating is HOLD.

Price war

In January 2023, Tesla reduced the prices of its electric vehicles worldwide by 20%, which started a price war, particularly noticeable in China, where the company bet that its better profitability, compared to the rivals, would allow it to grapple with growing competition and win over buyers in a weak economy.

In April 2023, Tesla intensified the price war by stating that in the conditions of a weak economy and growing competition, the company would prioritize sales growth over profits. Since then, Tesla has increased discounts on all its models to clear out inventory, and from June 2023, federal subsidies of $7,500 are available in the US for the Model 3 and the Model Y.

Tesla CEO Elon Musk said at the conference call on the company’s 2Q 2023 financial results that prices for electric cars could be trimmed further, should the economy continue to weaken.

The pricing policy has proven successful and yielded noticeable results. In 2Q 2023, the company sold a record-breaking number of cars, or more than 466 thousand. Other manufacturers have followed Tesla’s suit by lowering their own prices they seek to maintain their market share in the electric vehicle industry. For example, Ford reduced prices for its F-150 Lightning trucks, including the base model, by 17% in early July.

The prolonged price cuts for all models of electric vehicles could have had a more significant impact on the company’s key financial indicators. However, they were mitigated by decreasing prices for all raw materials that Tesla uses in its lithium-ion batteries, such as lithium, nickel, cobalt, graphite, as well as metals needed for EV production, such as aluminum and steel.

The cost reductions are valued in the thousands of dollars per vehicle. Tesla took advantage of the low prices and extended some of the contracts for raw material supplies with fixed prices until the end of the decade.

The cost reductions of each model have been factored into the model, including the cost of the battery going down from an average of $13 thousand to $11 thousand.

In July 2023, Tesla’s electric car sales in China fell 31% from the previous month, prompting the company to move aggressively to revive sales. Since the beginning of August, Tesla has increased the availability of its vehicles in China in several iterations:

- lowered the prices of available inventory of the premium Model S (from RMB 808,900 previously to RMB 754,900) and Model X (from RMB 898,900 previously to RMB 836,900) in China by 6.7% and 6.9%, respectively;

- Tesla cuts prices in China for select Model Y versions prices of the Model Y Long Range by 4.5% to RMB 299,900 and Model Y Performance by 3.8% to RMB 349,900;

- provided insurance subsidies of 8,000 yuan to buyers of entry-level, rear-wheel-drive inventory versions of the Model 3 between Aug. 14 and Sept. 30 in China;

- offered $420 in Shanghai vouchers to 3,000 customers who order and register one of its Model 3 or Model Y electric vehicles produced locally in August 2023.

As for the U.S., unlike the Model 3 and Model Y, which are eligible for $7,500 tax credits, the Model S and Model X don’t receive any rebates, reducing their appeal. To maintain their sales in the face of increased competition, Tesla has launched two cheaper versions of its flagship Model S and Model X in the U.S. and Canada, reducing the price by $10,000.

The company’s actions have greatly accelerated the process of making EVs cheaper for the end consumer, cementing Tesla’s leadership position while other major automakers have not only failed to reach the same volume of EV sales, but are also unable to offer a competitive EV in the same price range.

Outlook for EV production

On July 15, Tesla made the long-awaited announcement about production of the Cybertruck, reiterating at the 2Q 2023 financial results conference call the plans to start deliveries this year and ramp up output next year. In light of this news, we are pushing back the start of production of the Cybertruck from 3Q to 4Q 2023, and boosting the sales forecast for this model for 2024-2025. We are moving back the start of production of other previously announced models, such as the Semi Truck and Roadster, from 3Q 2023 to 4Q 2024.

Tesla remains committed to producing 1.8 mln electric vehicles in 2023, despite a possible slight decrease in production volumes in 3Q 2023 due to factory upgrades.

The Tesla Model Y was the best-selling car in the world in 1Q 2023, surpassing Toyota Corolla and other cars, including those sold at much lower prices. We expect the Model Y to continue to be Tesla’s flagship model in terms of sales.

The shift in deliveries of new EVs (Semi Truck, Roadster and the Model NEW) does not affect our views on Tesla’s future deliveries too much. The Model 3/Y are the main drivers of the business. We expect Tesla to sell 2.7 mln Model 3/Y EVs in 2024 and 3.6 mln EVs in 2025.

Energy segment outlook

The energy industry may not be directly related to the development and production of automotive batteries, but it uses many of the same technologies for energy storage that are used in the automotive industry. For example, Tesla charging stations may eventually be fully fed by solar power systems that the company is developing in its energy segment. Tesla car owners can now install renewable energy generation and storage systems in their homes to power their cars.

The rate of deployment of solar batteries slumped by 38% (from 106 MW to 66 MW) in the second quarter of 2023, while the deployment rate of energy storage systems surged by 222% (from 1133 MWH to 3653 MWH). The company reported that revenue from storage and generation totaled $1509 mln (+74% y/y). We estimate revenue will reach $6336 mln (+62% y/y) in 2023, and $7594 (+20% y/y) in 2024.

Tesla’s battery business is set to continue developing as the company is expanding its first Megapack factory in California, which will produce 40 GWh of stationary batteries for energy systems every year once construction is completed. The company has also announced plans to start building a new Megapack factory in Shanghai in the third quarter of 2023 and start production there in the second quarter of 2024. The plant will potentially increase the company’s production capacity by another 40 GWh.

The decline of Tesla’s solar battery installations may be a sign that the market for household solar batteries is in the doldrums. The company said slower sales of solar batteries are largely due to high interest rates, which push customers to delay purchases across the entire industry. So far this year, the pace of deployment of solar systems hasn’t changed from quarter to quarter.

Tesla collaborates with several battery suppliers, including Japan’s Panasonic, South Korea’s LG Energy Solutions and China’s CATL, which since 2020 has been supplying LFP batteries for Tesla vehicles produced at its Shanghai factory. It has also been reported that BYD supplies Tesla with the Blade battery, a less cumbersome LFP battery that the carmaker uses in some of its models in Europe.

But, in addition, the company independently develops and manufactures its own batteries in order to control and minimize the cost of production of electric vehicles and to be less dependent on suppliers’ prices.

At Battery Day in 2020, Tesla announced the 4680 battery cell, which promised a potential cost reduction of up to 50% compared with the current 2170 cell format. The larger size of the 4680 cell provides a more rigid structure suitable for battery pack integration, which has been utilized in some Model Y vehicles and may be part of the upcoming Cybertruck. Since the announcement three years ago, Tesla has been persistently working to increase production volumes of this new type of battery cell.

Tesla does not have sufficient capacity to fully supply itself with 4680 cells at the moment, so it is also collaborating with the company’s current battery suppliers to deploy its own production at their plants. It was reported in 2022 that Tesla received 4680 battery cell samples from Panasonic and planned to start volume production in 2023. However, Panasonic has now announced that it is delaying volume production of 4680 cells until the first half of 2025 to introduce performance improvement measures that will make them more competitive.

In the second quarter of 2023, production of 4680 battery cells at Tesla’s Gigafactory in Texas surged by 80% compared with the first quarter, with the team surpassing the mark of 10 million manufactured cells. However, this is still not enough for mass deployment in both the Model Y and Cybertruck, so further increases in production should be expected.

Lithium iron phosphate, or LFP, batteries are becoming increasingly popular in the electric vehicle market, despite some drawbacks. Tesla’s recent announcement that it will create a “light” version of its upcoming heavy-duty Semi truck using LFP batteries instead of lithium batteries with nickel and cobalt cathodes has much significance. LFP batteries are lithium-ion batteries that use iron phosphate as cathode material.

Tesla, Ford (F), and other major automakers are switching to LFP batteries in some of their EV models due to their long life, safety, and affordability. Tesla uses LFP batteries in its Model 3 Standard Range Plus and Model Y Standard Range models. Ford has announced plans to use LFP batteries in its Mustang Mach-E later this year, and the F-150 Lightning electric pickup truck model will get them as an option next year. Other automakers using LFP batteries include BYD, CATL and Nio.

The drawbacks associated with the shorter range of LFP batteries may not be a problem, given that the average daily round-trip commute in the US is less than 45 miles, and the development of advanced charging infrastructure can make long-distance travel possible even if EVs equipped with LFP batteries have a slightly shorter range.

The decision by Tesla to use LFP batteries in its Semi Light means that the range on a single charge will be 300 miles, compared with the 500-mile range of the Tesla Semi that uses nickel-based lithium batteries. However, the longer lifespan of LFP cells will allow trucks to operate significantly longer compared with trucks running on nickel cathode batteries. The ability to withstand heavy loads should make LFP-equipped trucks safer for short-haul delivery in challenging conditions.

Plans for the Optimus robot

At a recent conference Elon Musk presented the latest updates on the Tesla Bot, also known as Optimus. Tesla has faced challenges in finding suppliers for actuators capable of efficiently powering the humanoid robot, particularly due to their limited availability. As a result, Tesla has been developing its own actuators that combine motors or power electronics, controllers, and sensors. The first Tesla-designed actuators are expected to be integrated into Optimus around November 2023, and upon successful implementation, the company plans to scale up production. Tesla will deploy the resulting robots at its own factories to monitor their effectiveness and usefulness, with the timing tentatively set for the following year.

Besides, Tesla is considering collaborating with Neuralink to develop a cyborg body, particularly for creating robotic limbs for amputees.

Tesla’s financial results

In 2Q 2023, Tesla sold a record number of electric cars: 466 thousand versus our forecast of 418 thousand, but the average selling price of the Model Y was lower than expected. We had expected the average price of the Model Y to be $47 thousand, while the actual price was in the neighborhood of $40 thousand. But at the same time, the company incurred lower losses related to the cost of production of electric vehicles as prices for all commodities declined.

We are lowering our forecast for EV sales in 3Q 2023 due to plant upgrades in 3Q, while raising the forecast for 4Q 2023 due to additional market stimulus measures in China. Compared with our previous forecast, we are slightly lowering total sales for the year due to a delay in the start of sales of such models as Cybertruck, Semi Truck and Roadster. We expect total sales for 2023 to be 1,857 thousand EVs (+39% y/y), compared with our old forecast of 1,882 thousand EVs (+40.4% y/y). EV sales forecasts for 2024-2025 are down slightly due to a delay in the start of sales of some models, which is poised to be mitigated by an increase in the Cybertruck sales forecast.

As revenue is down following the price cuts for the Model Y and sales are delayed for the Cybertruck, Semi Truck and Roadster models, we are lowering the forecast for Tesla’s revenue from $111 bln (+36.4% y/y) to $101 bln (+23.5% y/y) for 2023, and from $282.3 bln (+47.7% y/y) to $234.4 bln (+49.3% y/y) for 2025.

As we have taken the knife to Tesla’s revenue forecast, while Tesla’s price war with other EV makers is being extended, now involving more than a quarter of all market players, we are lowering the forecast for Tesla’s EBITDA from $13.6 bln (-21.8% y/y) to $12.9 bln (-25.8% y/y) for 2023, and from $76.8 bln (+92.3% y/y) to $34.1 bln (+60.2% y/y) for 2025.

Cuts have also been made to the free cash flow forecast, which went down from $8 bln (+5.2% y/y) to $6 bln (-20.7% y/y) for 2023 and was more significantly reduced from $62.6 bln (+107% y/y) to $26.9 bln (+73.9% y/y) for 2025. That’s a result of a delay with the start of sales of the previously announced Semi Truck and Roadster models from 3Q 2023 to 4Q 2024 and our lower expectations for Tesla’s gross EBITDA margin in 2025 (we earlier expected Tesla’s gross margin to reach 32%, while now we expect it to reach 19% as prices continue to slide and due to the high proportion of battery cost in the total cost of producing an EV).

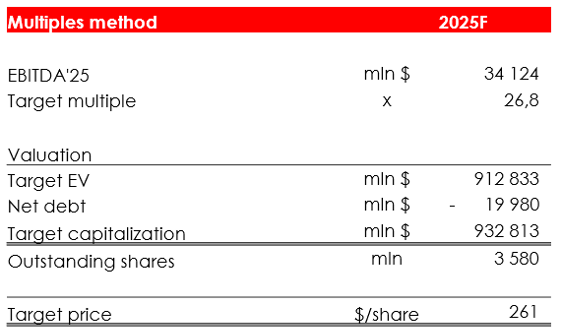

Valuation

Our fair value price for the shares is $217.

The share price estimate of $217 has been achieved by computing the company’s estimated valuation in 2025 based on the EV/EBITDA multiples method, and discounting it to FTM period at the rate of 13% per annum from a share price estimate of $261. Previously, we estimated the company’s value using not only the multiples method, but also FCF yield. We decided to abandon the latter, as due to the large delay with the start of sales of the previously announced models, the FCF yield method significantly underestimates TSLA and differs from the multiples method several times over.

Invest Heroes

Conclusion

Tesla has huge potential by ramping up deliveries of its EVs despite the possible loss of margins, because surely more cars on the road will help Tesla maintain its dominant U.S. market share in “turbulent times” and gain valuable vehicle usage data needed to train the artificial intelligence models that underpin the autonomous driving technology on which the company is betting heavily.

Tesla says that its full self-driving technology could one day account for much of Tesla’s value and give it the cushion of safety that it lacks for competitors struggling to make their electric car operations profitable.

Declining margins due to the price war are very likely to negatively impact the company’s stock, which has more than doubled since the start of 2023, but Tesla’s reliance on the FSD driver makes the company interesting over the long term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.