Summary:

- Nvidia’s Q2 FY2024 results exceeded expectations, with revenues of $13.51B and non-GAAP EPS of $2.70.

- The strong performance was driven by growing demand for generative AI and large language models utilizing Nvidia’s Data Center AI chips.

- Nvidia’s Q3 sales guidance projects revenue of $16B, indicating a y/y growth of +171% and suggesting continued strong business momentum.

- Despite strong financial performance and optimistic near-term outlook, question marks remain around the sustainability of this demand spike.

- Given Nvidia’s premium valuation, I see little to no margin of safety in NVDA stock for long term investors. Hence, I choose not to chase NVDA at $500 per share.

Justin Sullivan

Introduction

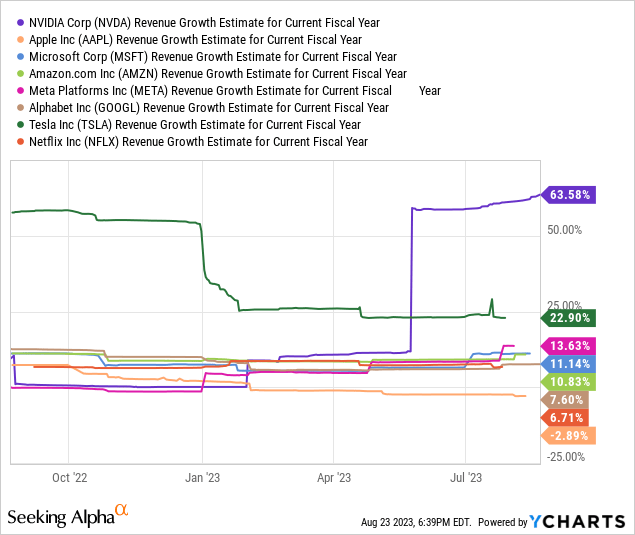

The generative AI boom has taken significant mindshare across the globe, with big tech stocks reaping the rewards since the turn of the year. While the year-to-date run-up in equity markets is largely attributable to the leadership of “Magnificent Seven”, Nvidia (NASDAQ:NVDA) is the only clear beneficiary of the AI boom in the early stages of this secular megatrend as evidenced by forward growth expectations:

In today’s note, we will analyze Nvidia’s blowout Q2 FY2024 results, and update its intrinsic value based on another quarterly set of numbers and optimistic forward guidance.

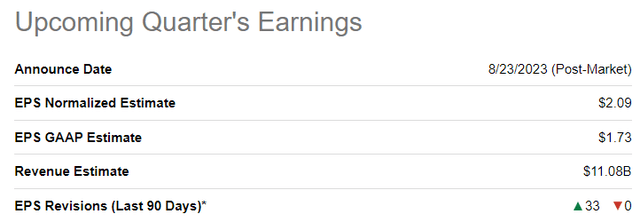

What Were Nvidia’s Expected Earnings?

Going into the Q2 FY2024 earnings report, Nvidia was projected to deliver revenues and Normalized EPS of $11.08B [up +65% y/y, estimate range: $10.59B to $12.00B] and $2.09 [up +309% y/y, estimate range: $1.76 to $2.49], respectively.

Did Nvidia Beat Earnings?

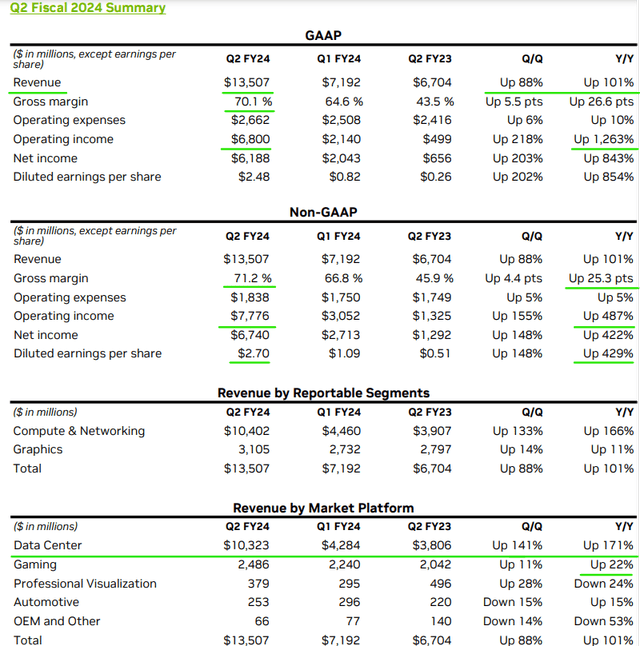

For Q2 FY2024, Nvidia absolutely blew past top and bottom lines expectations, with revenues and non-GAAP EPS coming in at $13.51B [up +101% y/y] (vs. est. $11.08B) and $2.70 [up +429% y/y] (vs. est. $2.09), respectively. As you can see below, the top-line outperformance was driven by insatiable generative AI-induced demand for Nvidia’s Data Center AI chips:

And as you may remember, Jensen Huang, Nvidia’s CEO, shared the following remarks last quarter:

The computer industry is going through two simultaneous transitions – accelerated computing and generative AI.

A trillion dollars of installed global data center infrastructure will transition from general purpose to accelerated computing as companies race to apply generative AI into every product, service and business process.

As of Q2 2023, it is clear that the generative AI boom is benefitting Nvidia. And here’s what Huang had to say about Nvidia’s Q2 FY2024 report in the earnings press release (emphasis added):

A new computing era has begun. Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI.

NVIDIA GPUs connected by our Mellanox networking and switch technologies and running our CUDA AI software stack make up the computing infrastructure of generative AI.

During the quarter, major cloud service providers announced massive NVIDIA H100 AI infrastructures. Leading enterprise IT system and software providers announced partnerships to bring NVIDIA AI to every industry. The race is on to adopt generative AI.

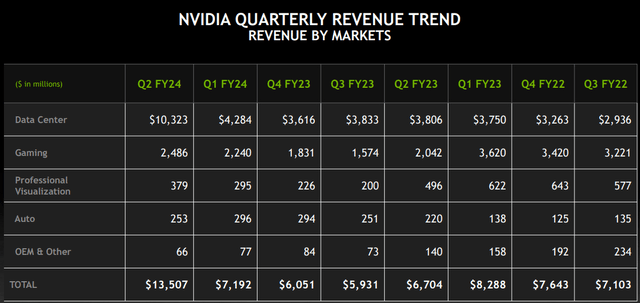

In Q2 FY2024, Nvidia’s Data Center revenue reached a record high of $10.32B (+171% y/y and +141% q/q) on the back of growing demand for generative AI and large language models [LLMs] utilizing GPUs based on NVIDIA’s Hopper and Ampere architectures. According to Nvidia’s leadership, the strong demand for NVDA’s data center AI chips is a result of their strong platform offering that includes Mellanox networking solutions and CUDA software. With major consumer internet companies, cloud service providers, and AI startups all looking to compete in the generative AI race, the picks and shovels (critical generative AI infrastructure) provider, i.e., Nvidia, is making some real dough in this AI boom.

While Nvidia is clearly a data-centric business now and going forward, strong performance in Gaming was an additional gift for shareholders in Q2 FY2024. Now, Nvidia’s Professional Visualization and Auto business segments are still down on a y/y basis; however, the long-term outlook for these businesses is also incredibly bright.

On the margin front, Nvidia’s non-GAAP gross margin expanded to 71.2%, up 440 bps over Q1 FY2024 and up 2,530 bps over Q2 FY2023. With its first-mover advantage in AI, Nvidia is enjoying tremendous pricing power, and in effect, getting a massive AI windfall.

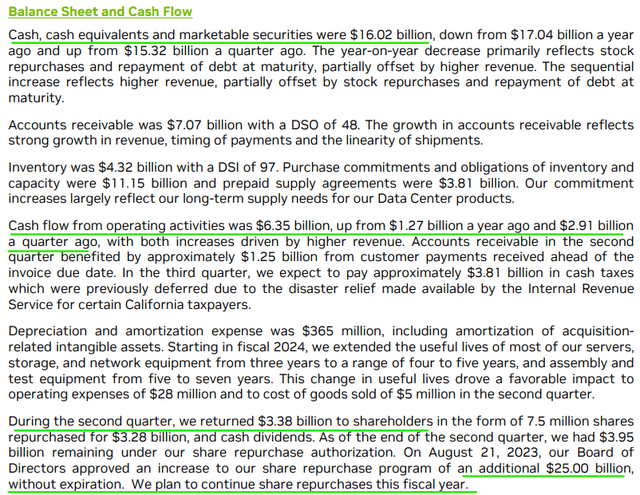

With a recovery in margins, Nvidia’s quarterly free cash flow increased from +$2.64B in Q1 2023 to +$6.05B (up +634% y/y) in Q2 2023. As you may know, the semiconductor giant boasts a sound balance sheet with ~$16B of cash and short-term investments, and now that the company is once again a free cash flow printing machine, I see no liquidity risks for Nvidia in the foreseeable future.

During Q2 2023, Nvidia bought back shares 7.5M shares for $3.28B at an average price of ~$437 per share. Furthermore, Nvidia’s management announced the authorization of an additional $25B for its share repurchase program and disclosed an intention to continue share repurchases in FY2024. Clearly, Nvidia’s leadership is bullish on their stock.

What Is The Outlook For NVDA Stock?

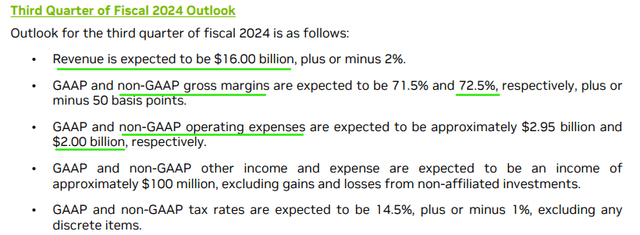

Investing is all about the future, and Nvidia’s Q3 sales guidance was yet another mind-blowing number, with next quarter’s revenue projected to come in at $16B compared to street estimates of ~$14.5B. This guided revenue figure implies y/y growth of +171%, and if we were to consider PEG ratios, Nvidia is looking a lot cheaper than it did before its Q2 release [despite a ~5%+ jump in its stock in the after-hours session].

In his closing remarks, Jensen Huang reiterated confidence in their ability to scale supply to satisfy rising demand for AI chips in the back half of 2023 and into next year. Also, management dismissed export regulation concerns for the near to medium term. Fundamentally, Nvidia looks like an absolute beast right now. And looking at Nvidia’s outlook, business momentum is set to remain strong for the foreseeable future.

Additionally, Nvidia’s non-GAAP gross margin is projected to rise to 72.5% in Q3 FY2024. With rapid revenue growth and improving gross margins, Nvidia is set to deliver tons of operating leverage in the upcoming quarters.

What Is Nvidia’s Fair Valuation In Light Of Q2 Blowout Earnings?

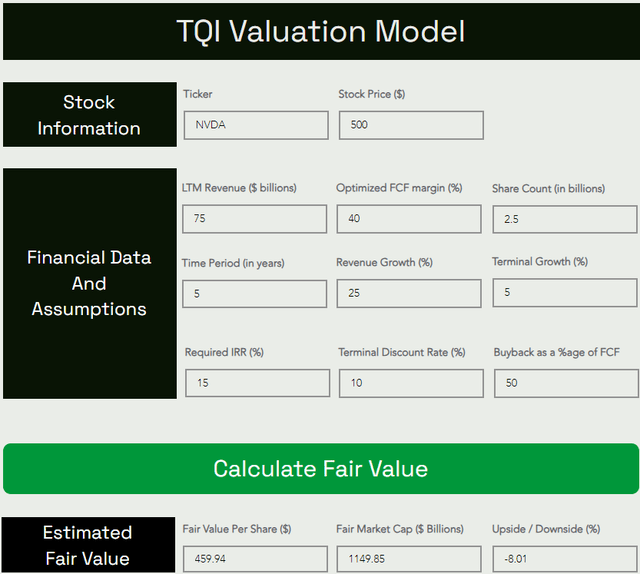

In light of Nvidia’s incredible Q3 guidance and positive management commentary for FY2025, I think Nvidia Corporation could clock $75-80B in revenue over the next twelve months. Given the seismic jump in near-term sales growth, we will be building the model based on this forward revenue estimate and then discounting the fair value output from the model to get a current fair value estimate.

Given Nvidia’s incredible pricing power and looming shift to a high-margin software business, I believe that steady-state free cash flow (“FCF”) margins for NVDA could be as high as 40-50%. And given the humongous total addressable market (“TAM”) opportunity being unlocked by AI, Nvidia could realistically drive 20-30% growth per year beyond 2023.

All other assumptions are relatively straightforward. Please let me know if you have any questions via the comments section.

Here’s my updated valuation model for Nvidia:

TQI Valuation Model (TQIG.org)

Applying a 15% discount to this 2024 fair value estimate, we get a current fair value estimate of ~$390 per share for NVDA stock. With Nvidia stock trading at ~$500 per share (at the time of writing), I continue to believe that the stock price is running way ahead of fundamentals at this moment in time. Last quarter, my fair value estimate was at $260 at a time when the stock was at $380. Hence, I could be wrong again. That said, I think our updated model for Nvidia is very generous, and lofty assumptions leave little margin of safety.

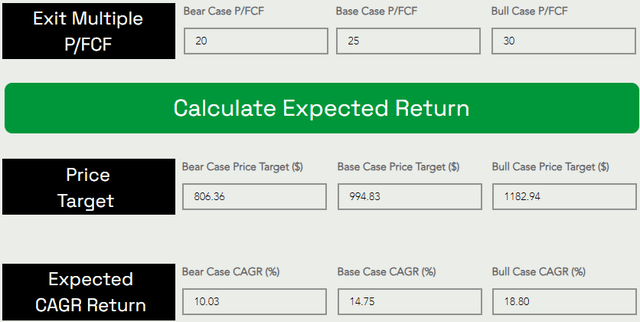

By 2028-29, I can see Nvidia rising to $995 per share at a CAGR rate of 14.75% based on an exit multiple of ~25x P/FCF.

TQI Valuation Model (TQIG.org)

Despite using generous assumptions, NVDA’s expected 5-year CAGR returns are in line or a little short of my investment hurdle rate of 15%. Nvidia is clearly winning big in the era of AI; however, this initial-stage demand growth jump could be temporary in nature. Given a genuine lack of a margin of safety here, I am still not a buyer of Nvidia stock.

Concluding Thoughts: Is NVDA Stock A Buy, Sell, Or Hold After Q2 Earnings?

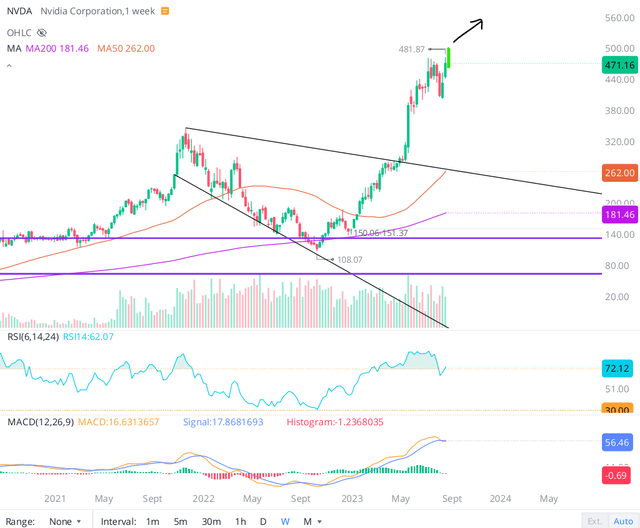

With Nvidia Corporation stock once again breaking out to new all-time highs in the after-hours session, I see no resistance for the stock, i.e., the sky is the limit for this AI leader. Investors and analysts have been chasing NVDA higher and higher in order to stake their claim in the “AI rush”, and as of now, Nvidia remains the most obvious “picks and shovels” play in the market.

Technically, Nvidia’s stock is significantly overbought; however, we know that it can stay in overbought territory for long periods of time, and momentum can carry NVDA stock to unimaginable levels. Given Nvidia’s robust financial performance and management’s optimistic outlook, I don’t think investors (institutional or retail) are going to be in any hurry to race toward the exit doors here.

I may sound like a broken record but I will say this again –

Nvidia Corporation is a great company with market-leading products and arguably the best CEO in the semiconductor industry. However, the price we’re being asked to pay for Nvidia (~$1.2T) is too steep, in my opinion. In a zero-interest rate world, investors can afford to be valuation agnostic; however, we are no longer operating in such an environment, with the FED still pulling liquidity out of financial markets and a bank credit tightening cycle in effect after multiple bank failures.

A valuation compression still looks inevitable for Nvidia, and while the long-term risk/reward on offer is looking decent after Q2 2023, the stock offers little to no margin of safety to long-term investors.

In the case of Nvidia, the AI hype is real, and I have been wrong on the stock in the past. That said, despite running the risk of missing out on further gains in NVDA stock, I choose to remain on the sidelines in this counter. While Nvidia is delivering exceptional financial performance right now, I continue to believe that the current price tag leaves little to no margin of safety for a long-term investor. Given the lack of revenue visibility going into a potential economic recession (hard landing), I am “Neutral” on Nvidia Corporation stock at these elevated levels.

Key Takeaway: I continue to rate Nvidia Corporation stock “Avoid/Neutral/Hold” at $500.

Thanks for reading, and happy investing! Clearly, I missed the boat on Nvidia Corporation in late 2022/early 2023 and post Q1 2023, but I’m cheering for NVDA bulls from the sidelines. Please share your thoughts, questions, or concerns in the comments section below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.