Summary:

- Comcast offers a 2.5% yield, strong dividend growth, low payout ratio, and solid balance sheet. However, it faces challenges like rising rates, slow growth, and competition, which are all impacting its valuation.

- Comcast operates across Cable Communications, Media, Sky, Studios, and Theme Parks. It embraces Connectivity & Platforms, driving growth through domestic broadband, wireless, and international connectivity.

- Comcast shares underperformed due to rate concerns and slower growth. With potential undervaluation, it remains a hold with prospects for a rally on lower rates and improved growth.

Cindy Ord

Introduction

It’s time to talk about Comcast Corporation (NASDAQ:CMCSA), a stock I’ve had on my radar for years. However, I’ve never covered it or bothered to look into its numbers, which was a mistake, as CMCSA has done quite well in the past.

Now, I’m finally diving into the company, as there’s a lot to discuss.

On the one hand, Comcast yields 2.5%, it has double-digit long-term dividend growth, a very low payout ratio, a healthy balance sheet, and an attractive valuation.

On the other hand, the company is dealing with a rising rate environment, which isn’t doing it any favors, as it has more than $90 billion in net debt. This is leading investors to apply a much lower multiple to its valuation.

Additionally, the company is seeing slow growth. While this is taken into account in its valuation, all eyes are on its progress in a highly competitive communications/media environment.

In this article, we’ll look at the pros and cons of owning Comcast and the related risk/reward for long-term dividend growth investors like myself.

So, let’s dive in!

Comcast’s Business Model & Dividend

With a market cap of $190 billion, Comcast is the third largest company in the communication services sector, a sector that’s also home to Alphabet (GOOGL) and Meta Platforms (META).

However, instead of engaging in social media and related activities, Comcast is a giant operating five business segments:

| USD in Million | 2022 | Weight |

|---|---|---|

|

Cable Communications |

66,318 | 54.6 % |

|

Media |

23,406 | 19.3 % |

|

Sky |

17,946 | 14.8 % |

|

Studios |

11,622 | 9.6 % |

|

Theme Parks |

7,541 | 6.2 % |

|

Eliminations |

-6,345 | -5.2 % |

|

Corporate and Other |

863 | 0.7 % |

- Cable Communications: Under the Xfinity brand, Comcast Cable dominates as a premier provider of broadband, video, voice, wireless, and additional services for residential and business customers across the U.S.

- Media: NBCUniversal’s portfolio covers various television and streaming platforms, including national, regional, and international cable networks, as well as broadcast networks like NBC and Telemundo, further supported by Peacock, its direct-to-consumer streaming platform.

- Studios: NBCUniversal’s film and television studio production and distribution ventures are included in this segment.

- Theme Parks: This segment includes Universal theme parks located in key global destinations such as Orlando, Hollywood, Osaka, and Beijing.

- Sky: This is one of Europe’s leading entertainment companies, which engages in direct-to-consumer and content businesses, providing video, broadband, voice, and wireless services, along with entertainment and news networks.

These segments are now put into two main baskets:

- Connectivity & Platforms

- Content & Experiences

During the company’s presentation at the 51st Annual J.P. Morgan Global Technology, Media, and Communications Conference earlier this year, Comcast focused on the aforementioned Connectivity & Platforms group.

Comcast Corp.

This group covers the U.S. Cable business, the direct-to-the-consumer international business, and leverages the best practices across the enterprise.

The group holds 52.5 million customer relationships with an average monthly spend of roughly $100 per customer.

Within the Connectivity & Platforms group, there are four main growth-oriented businesses: domestic broadband, domestic wireless, international connectivity, and business services. These businesses collectively contribute to a $40 billion run rate, a high-margin collection of growth-oriented ventures, growing in the high single digits.

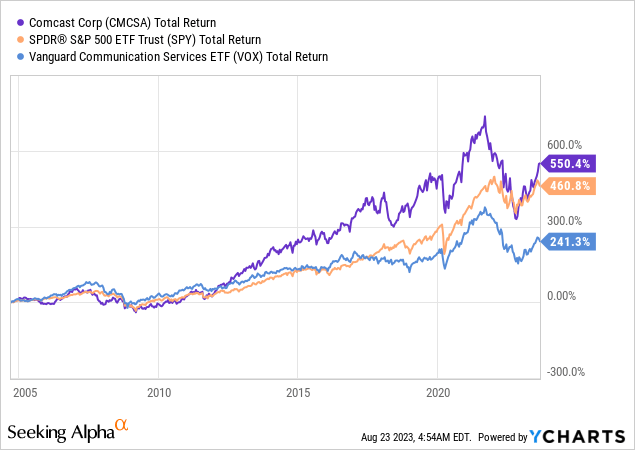

Looking at the total return picture, we see that shares of this Philadelphia-based giant have returned 550% since 2005, beating the S&P 500 by roughly 90 points. It beat its communication service peers by an even wider margin.

It has also been a source of steadily rising income for its investors.

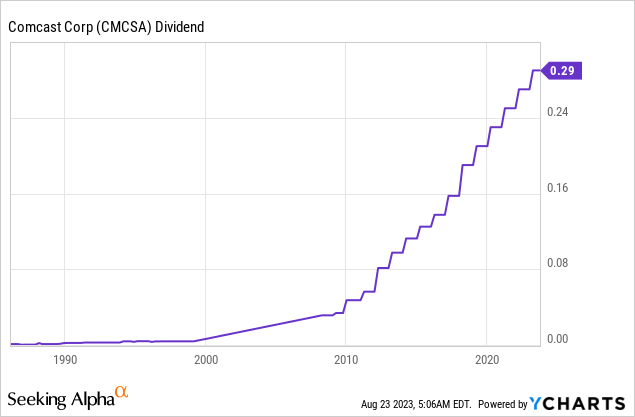

Currently, CMCSA shares yield 2.5%, which comes with a 10.0% average annual dividend growth rate over the past five years. Over the past ten years, investors have enjoyed 12.1% average annual dividend growth.

The company has hiked its dividend for 15 consecutive years.

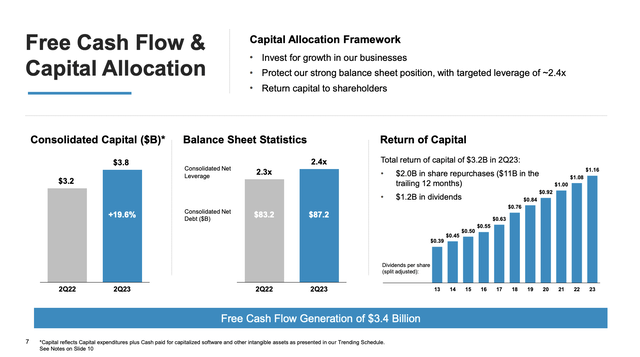

On top of that, the dividend is protected with a sub-30% payout ratio and a lot of free cash flow.

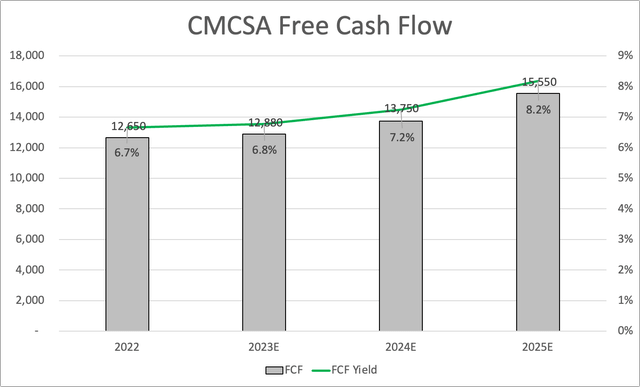

This year, the company is expected to generate $12.9 billion in free cash flow, potentially boosting the FCF yield to 6.8%. This indicates a 37% cash dividend payout ratio.

Leo Nelissen (Based on analyst estimates)

After 2023, free cash flow is expected to accelerate with double-digit (on average) annual growth rates to $15.6 billion in 2025.

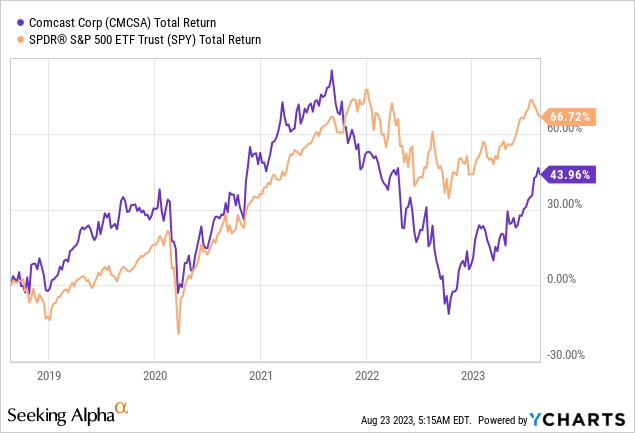

Yet, despite all of the good news so far, CMCSA shares have not outperformed the market in a while.

Over the past five (displayed below) and ten years, CMCSA shares have failed to outperform the market. Since mid-2018, CMCSA shares have risen 44%, including dividends. The S&P 500 is up 67%.

This brings me to the next part of the article, the valuation.

How Cheap Is Comcast?

CMCSA shares have risen 61% from their 52-week lows. Shares are up 30% year-to-date. However, shares are still 25% below their all-time high.

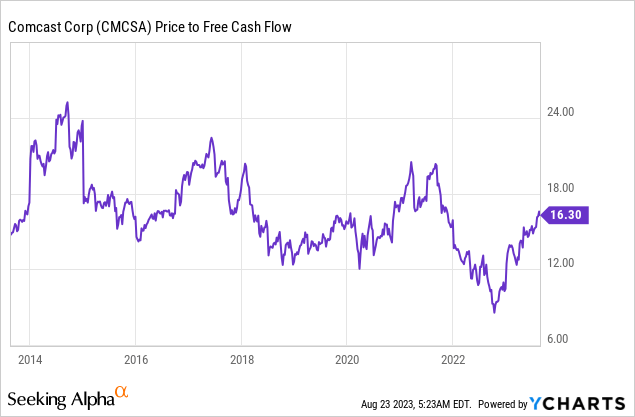

With that in mind, CMCSA shares appear cheap. Using next year’s free cash flow numbers, the company is trading at less than 14x free cash flow. Looking at the historical valuation range, the median is close to 16x.

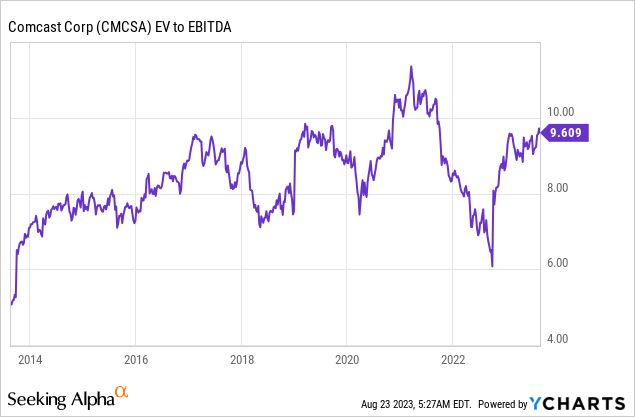

The same appears to be the case when using its enterprise value and EBITDA (this includes net debt).

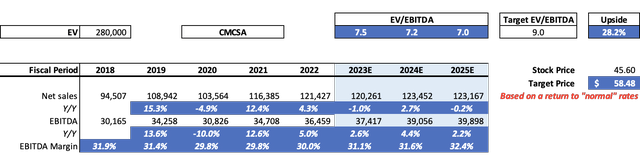

When including $91 billion in net debt and minority interest, we get an enterprise value of roughly $280 billion. Using analyst EBITDA estimates, we get a 2023E EBITDA multiple of 7.5x. Based on subdued EBITDA growth expectations, that number would fall to 7.0x EBITDA in 2025.

Leo Nelissen (Based on analyst estimates)

If we assume that the company used to trade close to 8-9x EBITDA quite consistently over the past ten years, one can make the case that the company is roughly 30% undervalued.

However, analysts do not seem to agree with this quick and dirty valuation – and rightfully so.

The current consensus price target is $49. That’s 7% above the current price.

I agree with this target for two reasons:

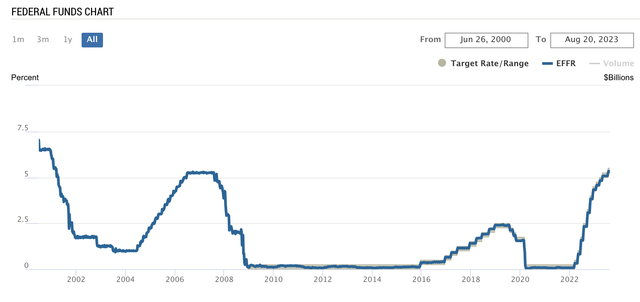

- Rates are elevated.

- Growth is declining.

For starters, Comcast does not have a risky balance sheet. While it has close to $90 billion in net debt, it’s just 2.4x EBITDA. It has an A- credit rating, which is fantastic.

Comcast Corp.

On top of that, it has steadily rising free cash flow with a very low dividend payout ratio.

Nonetheless, because of the high-rate environment, investors aren’t willing to give companies with high (gross) debt loads the valuation they had when the Fed was still dovish.

Federal Reserve Bank of New York

This makes sense, as higher debt comes with higher interest costs, which hurts net income.

Sectors with high debt include utilities, real estate, communications, consumer staples, and related.

While high-quality companies like CMCSA won’t go bust because of higher rates (junk-rated companies might), investors are adjusting their valuations.

In this environment, I agree with analysts. The stock is roughly 5-10% below its fair value.

Having said that, point two is slower growth.

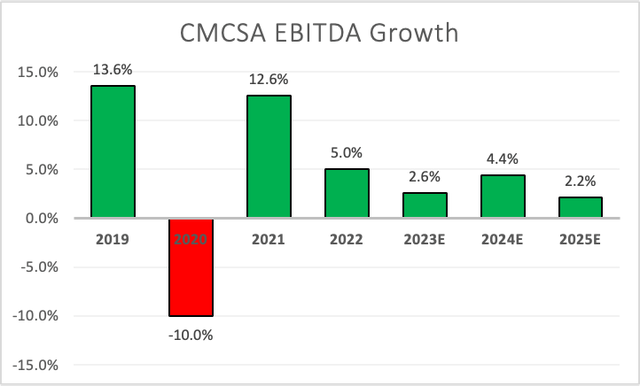

Over the past ten years, EBITDA has grown by 6.5% per year, which is impressive. It also includes a 10% contraction during the pandemic.

However, growth has come down significantly. This year, EBITDA growth is expected to be 2.6%, followed by 4.4% expected growth in 2024 and 2.2% growth in 2025.

Leo Nelissen (Based on analyst estimates)

In the second quarter of this year, the company’s consolidated revenue increased by 2% to reach $30.5 billion. This growth was driven by strong operating leverage in the high-margin Connectivity & Platforms division, as well as significant expansion in Studios and Theme Parks.

Adjusted EBITDA saw a 4% rise to a record level of $10.2 billion. Adjusted earnings per share also grew by 12% to $1.13.

- Core connectivity businesses, including Domestic Broadband, Domestic Wireless, International Connectivity, and Business Services Connectivity, saw strong growth with a 7% increase in revenue, reaching over $10 billion.

- In contrast, revenue from Video, Advertising, and other sources declined by 7% to $9.8 billion.

Furthermore, analysts expected more weakness in broadband.

The Philadelphia-based company, which owns NBCUniversal, the Sky TV business and Xfinity-branded cable services, said it lost 19,000 domestic broadband subscribers. Those losses were less severe than some analysts forecast, and broadband revenue still increased. – Wall Street Journal

The company’s strategy is now mainly focused on investing in high-margin businesses while efficiently managing costs in sectors facing challenges.

This focus includes its streaming service Peacock.

According to the same WSJ article I quoted above:

NBCUniversal’s streaming service added two million paid subscribers during the second quarter, boosting its base of customers to 24 million, nearly double its total a year earlier.

Some of Peacock’s subscriber growth came from a policy shift—Comcast cut off free Peacock subscriptions for Xfinity subscribers a few days before the quarter’s end and now requires them to agree to pay for a plan.

Despite these benefits, there is no doubt that risks are mounting.

During its 2Q23 earnings call, Comcast acknowledged rising risks that I expect will only get worse.

Without a doubt, consumer trends such as cord-cutting and new competitors, particularly from the technology sector present challenges for us. And we are facing an uncertain macro environment which continues to pressure linear advertising.

Having said all of this, I believe CMCSA is somewhere between dead money and significantly undervalued.

The company’s business is too strong to be considered dead money. It has room for growth to offset weakness in areas like cable. It also has strong free cash flow to increase investments in growth areas and cover (and raise) its dividend on a long-term basis.

It also has a healthy balance sheet.

I believe that CMCSA will continue its rally once investors start to bet on a return to lower rates and inflation. At that point, valuing the company at 9x EBITDA becomes much more likely.

For now, I do not believe that CMCSA is a buy. It is much more attractive to buy companies with similar slow growth rates and higher yields or companies with more secular growth. The area in between isn’t attractive.

I will give the company a Hold rating. Investors looking to buy CMSA may be better off waiting for a correction. Given my view on the company and its valuation, I do not believe that the stock will take off anytime soon.

Takeaway

With a long history of steady dividend growth, a robust balance sheet, and a diverse range of business segments, Comcast has held its ground in a competitive market.

However, the rising interest rate environment and substantial net debt weigh on its valuation, causing a reevaluation by investors.

Although Comcast’s growth trajectory has slowed down recently, it still remains a resilient contender.

While not a definitive Buy at the moment, it’s positioned somewhere between a promising undervalued opportunity and the realm of cautious optimism.

Its solid fundamentals, growth prospects in key areas, and the potential for a market shift make a return to better valuations foreseeable.

For now, I’d rate it a Hold, suggesting that while immediate takeoff might not be in the cards, the groundwork for future gains is being laid.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.