Summary:

- Airbnb’s recent financial performance remains strong, with growing bookings, resilient ADRs, and solid profit margins.

- While demand is currently solid, a number of large economies globally look extremely vulnerable, and the US will soon face the impact of student loan repayments restarting.

- Elevated construction activity in the US could eventually lead to an increased supply of short-term rentals, pressuring pricing and margins.

Sean Anthony Eddy/E+ via Getty Images

Airbnb’s (NASDAQ:ABNB) growth is moderating as the economy and consumers continue to adjust to the post-pandemic environment. Despite this, the company’s recent financial performance has still been strong, with bookings continuing to grow, resilient Average Daily Rates (ADRs) and solid profit margins.

There are reasons to be concerned about Airbnb’s outlook though. As demand growth continues to wane, questions about future sources of growth are likely to mount. In addition, a large oversupply is building in the US housing market, creating a risk of downward pressure on ADRs. These factors could cause Airbnb’s earnings to decline and its earnings multiple to compress.

Demand

Demand for Airbnb’s services appears to be fairly resilient, with increased bookings and stable ADRs resulting in solid revenue growth in the second quarter of 2023.

Nights and experiences booked increased 11% YoY in the second quarter. Active bookers also grew in every region and growth in the number of nights booked in North America accelerated in Q2. Cross-border nights booked increased 16% YoY, although the mix of international travel hasn’t returned to pre-pandemic levels yet. High-density urban nights booked was another area of strength, increasing by 35% YoY in Q2. Long-term stays are also supporting Airbnb’s business, with bookings growth increasing in every month during the quarter. Long-term stays currently contribute 18% of total gross nights booked.

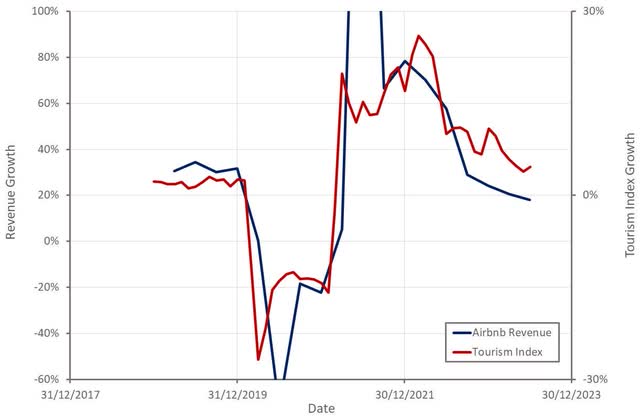

While Airbnb’s growth continues to be fairly strong, it has come in an extremely strong demand environment due to a resilient economy and pent-up demand for travel. Tourism demand is normalizing though and is likely to be less of a tailwind going forward. This isn’t necessarily that negative for Airbnb though, as the company still has the opportunity to increase market share and expand into adjacent verticals.

Figure 1: Airbnb Revenue Growth (source: Created by author using data from Airbnb)

On the demand side, the big unknowns going forward are the impact of student loan repayments restarting in the US and excess savings being depleted globally. Generally solid labor markets coupled with rapidly declining inflation are likely to help offset the negative impact of these somewhat though.

Supply

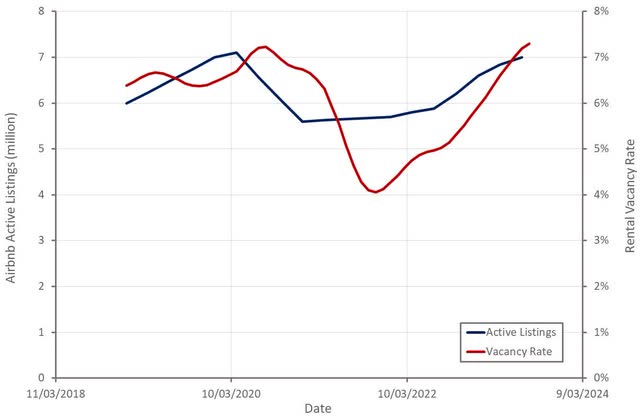

Airbnb is focused on making hosting mainstream, but at this point it is probably reasonable to question how much of a growth opportunity is left in Airbnb’s more mature markets from a supply perspective. Efforts to increase supply are based on raising awareness, making hosting easier and providing hosts with better tools. Active listings grew 19% YoY in Q2 and now exceed 7 million.

There is a growing housing oversupply issue in the US, which could negatively impact Airbnb, although the dynamics of this are unclear at the moment. While this is counter to the housing deficit consensus, I have previously written about this issue, and it is starting to become apparent in rent and vacancy data.

Figure 2: Airbnb Active Listings and Rental Vacancy Rate in the US (source: Created by author using data from Airbnb and Apartment List)

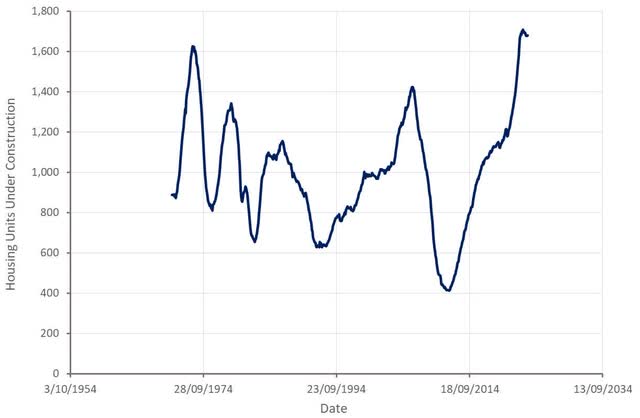

There is still an enormous backlog of housing under construction that will eventually end up as part of the housing stock as well. As a result, rental vacancy rates are likely to continue increasing rapidly until construction activity declines significantly. This situation could also be exacerbated by a weaker jobs market, as this would likely reduce housing demand.

How landlords will respond if they are forced to dramatically lower rents or if they are simply unable to find a tenant is unknown. There is a possibility that some landlords will turn to the short-term rental market for relief, and this could have a large impact if it comes at a time when demand is soft.

Figure 3: Housing Units Under Construction in the US (source: Created by author using data from The Federal Reserve)

Product Innovation

Airbnb has redesigned its pricing tools so that it is easier for hosts to add discounts and promotions. This has reportedly resulted in hosts lowering their prices, with more of them offering weekly and monthly discounts. For example, the percentage of new active listings offering monthly discounts has increased from 22% to 50%.

Airbnb appears to be a believer in the importance of long-term stays, with management stating that they expect the importance of the segment to increase over time. Some of the initiatives introduced to support long-term stays include:

- A reduced guest service fee after the third month

- Allowing guests to pay by bank in the US to save money on stays over one month

- Improved search for longer stays

These efforts appear to be having an impact, with nights booked for three months or longer growing to approximately 25% of total monthly stays in June, compared to 18% in April.

Airbnb also introduced Airbnb Rooms in May. This should help support supply growth but will also pressure ADRs as the average price in only 67 USD per night. Given the scale and maturity of Airbnb’s business, it seems likely that Airbnb Rooms will only have a marginal impact though.

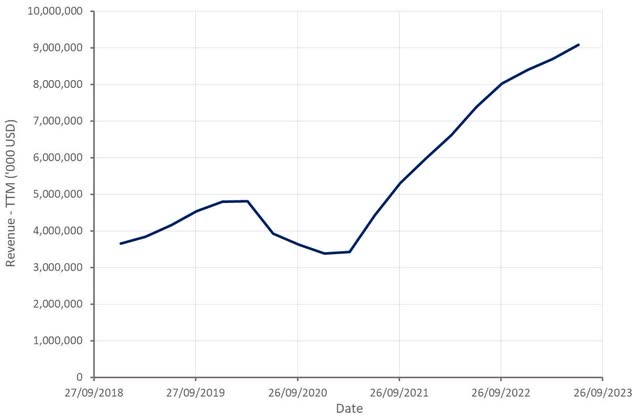

Financial Analysis

Airbnb’s revenue increased 18% YoY in the second quarter. This is a robust growth rate given the size of the company, and management appears confident that they are still a long way from saturating their market. For example, Airbnb believes that for every dollar spent on Airbnb, 10 dollars are spent on hotels. Airbnb will also likely make greater use of alternative revenue streams at some point in the future, like paid placement.

Airbnb is expecting 14-18% YoY revenue growth in the third quarter, based on assumptions of higher take rates, resilient ADRs and bookings growth. Growth at the lower end of this range likely wouldn’t be well received by the market, but there is also probably substantial conservatism in the guidance.

Figure 4: Airbnb Revenue (source: Created by author using data from The Federal Reserve)

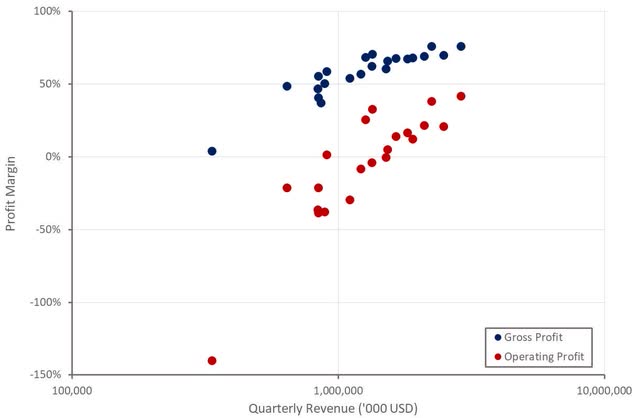

Airbnb’s margins are also still strong, which comes from consistent ADRs, revenue growth and the leverage in the business model. There is probably more downside than upside in margins at this point though. If growth continues to moderate, Airbnb will likely be forced to begin investing more in the business (R&D / marketing).

Figure 5: Airbnb Profit Margins (source: Created by author using data from Airbnb)

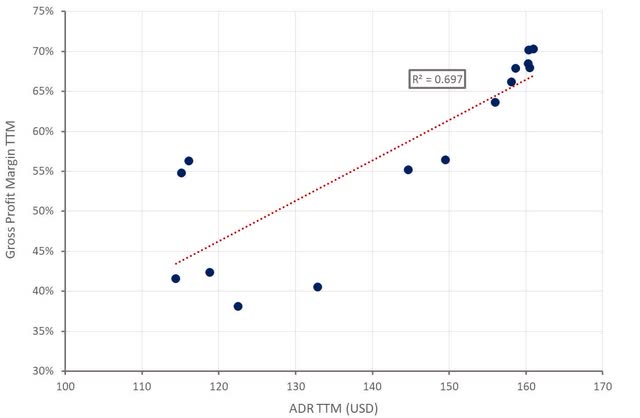

ADRs could also negatively impact margins if they decline significantly. Somewhat surprisingly, ADRs have remained consistently high post-pandemic. Airbnb has also suggested that an ongoing mix shift in its business is supporting ADRs. Prices were down 1% in North America in the second quarter though and accounting for mix shifts prices were actually down 4%.

If America’s rapidly growing housing stock begins to create vacancy issues, there is a risk that the number of active listings could increase and drive ADRs down, which would likely have a significant impact on Airbnb’s gross profit margins.

Figure 6: Airbnb ADRs and Gross Profit Margins (source: Created by author using data from Airbnb)

Conclusion

The merits of Airbnb as an investment at this point in time really depend on the company’s ability to maintain growth and current profit margins. While I believe the company has solid long-term growth prospects, there is a risk of a near-term slowdown, and margins in particular look vulnerable. If a drop in demand occurs at the same time as an increase in supply, Airbnb’s profits could fall rapidly. Given this risk, the stock still looks fairly expensive, despite the recent pullback.

Figure 7: Airbnb EV/S Multiple (source: Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.