Summary:

- Amazon stock has returned a staggering 178,729% since its public listing in 1997.

- I believe that Amazon can continue to scale its earnings and generate historically comparable returns for investors in the next 10 years.

- This is due to the economic fundamentals of its business as well as projections for its future valuation.

- Establishing what I believe to be a relatively conservative model for its forward valuation, we see that Amazon stock can be worth significantly more by the end of this decade.

Sundry Photography

Overview

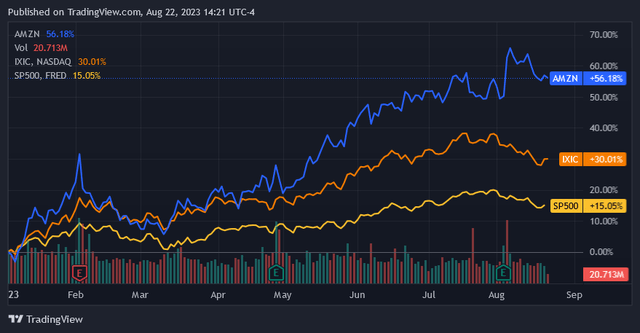

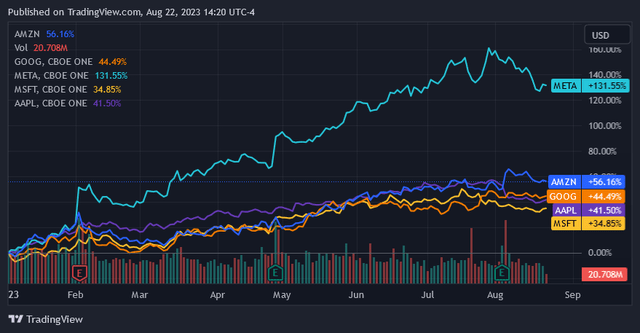

Amazon (NASDAQ:AMZN) has always been a good stock, and this year’s been no exception. AMZN shares returned 56% YTD as of this article, handily outpacing the NASDAQ Composite and S&P 500 this year. Of course, this was also the case for the other 4 big tech firms, amongst which Amazon has been the 2nd best performer YTD.

Seeking Alpha

Seeking Alpha

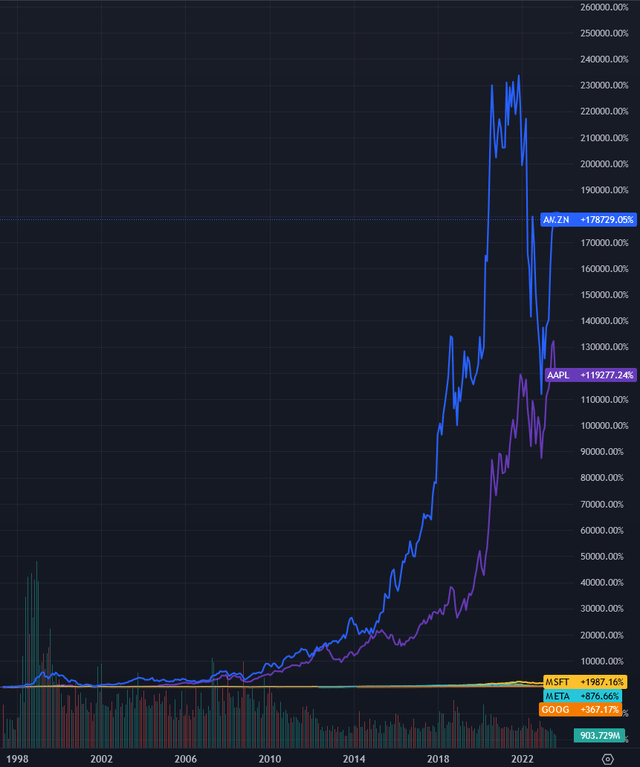

2023 is just one year among many, however. When we look at Amazon stock since its public listing in Q2 1997 we can see just how well it has performed over the years. Well outpacing all of the other largest technology companies on price return, Amazon stock has returned a staggering 178,729% since its public listing. An investment of $10,000 held to date (25 years) is now worth $17,872,900. For buy and hold investors that’s about as good as it gets.

Seeking Alpha

Of course, that was then – and this is now. Can Amazon stock generate similar (or even close) returns over the next 10 years?

I believe that the answer is yes. Fundamentally, I think Amazon can continue to scale its earnings and eventually acquire the kind of valuation that will generate historically comparable returns for its investors. I will outline why I believe this to be the case and comment on how I expect this to play out for buy and hold investors with a long-term investment horizon (10 years).

Growth Thesis

My belief that Amazon can again achieve its stellar return profile in the future is due to three things that I believe about its business:

- Ability to maintain double-digit (10% +) revenue growth until reaching at least $1T yearly revenue

- $514MM revenue in 2022

- Maintain current 40-45% operating margins

- Increase operating margins 50-55% over 10 years

- Maintain current 1-5% net margins

- Increase net margins to 5-10% over 10 years

I see Amazon as a very large business that has what it takes to continue getting larger while concurrently improving its unit economics over time. This is certainly one of the rarest combinations that you can find in the stock market as a whole. This is made possible by the company’s unique business, one which is well-positioned to continue growing in the largest markets while also being aligned to secular growth trends. Together these can allow for an earnings growth runway that can extend over 10 to 25 years while also being comparatively brisk.

1. Exposure to secular growth trends (E-Commerce, Artificial Intelligence)

2. Exposure to some of the largest markets (Global Retail, Cloud Computing, Digital Advertising)

3. Accrual of operating leverage and economies of scale

Secular Growth Trends

Amazon’s business participates in several markets that are growing particularly quickly and are set to continue doing so. For starters, global e-commerce continues to grow, with global sales going from $1.4T in 2014 to $5.2T in 2021. While this certainly isn’t slow, I actually think that this space has matured somewhat and isn’t going to be delivering particularly exciting growth in the future.

The actual highlight here is that Amazon is a credible player in artificial intelligence and is going to be one of the few companies earning money from this technology in the near to medium term (1-5 years). While the cloud services business will of course continue growing apace throughout this time, this subsector within it looks to be the most opportune one in the near-to-medium term.

Amazon has been working on AI for some time. It has products in the market already as well as the infrastructure to deliver them at scale. Considering the high barriers to entry for offering top-end AI capabilities such as large language models, Amazon’s early entrance into the market and robust cloud business should bode very well for it as the novel investment cycle in B2B AI computing capabilities plays out.

Exposure to Largest-Scale Markets

For Amazon to continue growing revenues in the double-digits even as it’s already doing over $500MM in yearly top line, it needs to operate in the largest markets. Thankfully this is the case. We can see in the table below that Amazon already operates within some of the largest markets that exist.

Market | Market Size (2022)

Retail $27.34 Trillion

Digital Ads $567.5 Billion

Cloud $445 Billion

It’s fair to surmise that this has been by design.

Operating Leverage and Economies of Scale

Operating Leverage refers to how well a company converts revenue into operating income. Without any operating leverage a firm couldn’t establish its first layer of margin at the operating level and pave the way for net income down the line. While this isn’t always the case for businesses, Amazon establishes its operating leverage through economies of scale. This is by design and intended to work in synergy with its operations across very large markets.

Economies of scale imply that Amazon can sell each thing more cheaply as it sells more of it. This applies in distinct ways across its retail business and its cloud business, but this declining cost curve applies in both cases. Scale allows for fixed costs per dollar of revenue to decrease. Through this, Amazon can then capture more of its long-term margins – ones which are intrinsically high to begin with.

Long-term margins for Amazon’s business are relatively high because of the digitized nature of its operations. Online retail has better variable margins than regular retail, albeit with more up-front costs from building out customer-facing software and fulfillment logistics infrastructure. Ultimately, a customer buying something from its website will end up costing much less than a customer going into a physical store to buy the same item. With its robust fulfillment network now in place, Amazon can start to capture more operating leverage in this area.

Amazon’s cloud business is also a scale business at its very core. The fixed costs of buying computing power and its delivery mechanisms are able to be converted into extremely high variable margins. Once the infrastructure is in place, it costs little to deliver it to customers. While Amazon is more likely to continue making capital investments in this area vis-à-vis its retail business, it is fundamentally a business that has excellent economies of scale. As the level of capital investments decreases, and fixed costs are allocated over more revenue, margins should continue to increase.

Considering all of this Amazon is well-positioned to improve its margins significantly over time.

Valuation and Conclusion

We can now establish a long-term valuation for Amazon along the lines of the assumptions that I outlined above. This will create a sensible fair value for its shares and subsequently establish an estimate for future returns.

We can establish forward revenue projections by using the consensus for the current year and growing revenues at a 10% compound rate thereafter. The margins, net income, and EPS numbers for 2022 are a 10-year average in order to more accurately reflect future growth.

I assume that operating margin will increase to 3.5% for this full year and net income margin will rise to 2.5%, continuing for a decade and accelerating after 2025. At the end of this decade, I assume that Amazon will have net margins of 6.5%.

|

2022 |

2023 |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

|

|

Revenue $B |

$514 |

$569.73 |

$626.70 |

$689.37 |

$758.31 |

$834.14 |

$917.56 |

$1,009.31 |

$1,110.24 |

|

Fwd. Revenue CAGR |

10.84% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

10% |

|

Operating Margin |

3.28% |

3.5% |

3.8% |

4.0% |

4.5% |

5.0% |

5.5% |

6.0% |

6.5% |

|

Net Margin |

2.23% |

2.5% |

2.8% |

3.0% |

3.5% |

4.0% |

4.5% |

5.0% |

5.5% |

|

Net Income $M |

$7,966.70 |

$10,563.64 |

$13,695.01 |

$17,529.61 |

$25,308.38 |

$35,351.39 |

$48,122.08 |

$64,162.77 |

$84,106.70 |

|

EPS |

$0.78 |

$1.03 |

$1.34 |

$1.72 |

$2.48 |

$3.46 |

$4.71 |

$6.28 |

$8.23 |

|

Current P/E |

106.5 |

106.5 |

106.5 |

106.5 |

106.5 |

106.5 |

106.5 |

106.5 |

106.5 |

|

Implied Share Price |

$133.90 |

$177.55 |

$230.18 |

$294.63 |

$425.37 |

$594.17 |

$808.81 |

$1,078.41 |

$1,413.62 |

|

Current IT P/E |

24.24 |

24.24 |

24.24 |

24.24 |

24.24 |

24.24 |

24.24 |

24.24 |

24.24 |

|

$30.48 |

$40.41 |

$52.39 |

$67.06 |

$96.82 |

$135.24 |

$184.09 |

$245.45 |

$321.75 |

Data Source: Seeking Alpha

At Amazon’s current TTM P/E ratio of 106.5, this will yield a staggering increase in its shares, with each share rising to $1413.62 by the end of 2030. This should serve as an upper-limit estimate. We can use the TTM P/E ratio for the IT sector as a whole we can arrive at a much more conservative valuation and also establish a lower bound. Here the implied share price is only $321.75 by the end of 2030.

This puts Amazon’s fair value at somewhere between $322 and $1414 by the end of 2030. With these estimates, which I consider to be reasonable, we see that Amazon stock’s value is going to appreciate well, with a relatively conservative case still yielding significant appreciation.

Downside Risks

The risk here is twofold: a slowdown in revenue growth or an inability to grow margins. Either, or both, could significantly deflate the company’s valuation in the future. This would then crimp the long-duration return that investors would be getting with Amazon stock. These two risks stem from different risk factors.

As for revenue growth, I see this as being less likely than pressure on margins. Ultimately the markets that Amazon is in are exceptionally large and tend to be growing at double-digit compound annual growth rates. This combination of open space and a ‘rising tide that lifts all boats’ acts as a natural hedge against revenue growth dipping below the double digit mark.

Margin pressure is more of a concern over the next decade, in my opinion. This is especially the case considering the broad-based inflation that we’ve seen over the last several years. Ongoing increases in labor costs can put significant pressure on margins and keep them closer to where they currently stand. Other cost inputs, such as energy, are also a factor; Amazon’s logistics network certainly uses quite a bit of it. Persistent competition from scale players within its core markets would also force Amazon to continue selling closer to cost for longer and keeping margins below 5%. It is critical to continue watching how these metrics evolve over the next several years in order to see if this trade truly has legs.

Conclusion

Overall I think Amazon is unique in that it is a large company that can keep growing briskly while also increasing its margins. Upon evaluating this I have further conviction that it is well-positioned to do so and can perform in line with the progression that I have established above. Even with moderate growth in its net margins, along with 10% y/y revenue growth, Amazon stock will be worth quite a bit more over the next 10 years. On this basis I am calling it a buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.