Summary:

- Amazon’s stock has surged by 63% since its low in early 2023, and it remains one of my largest portfolio holdings.

- Upward earnings revisions are likely, and Amazon’s stock price could benefit from higher estimates and multiple expansion.

- Amazon’s revenue growth, profitability potential, better than expected EPS, and AI potential could drive its stock price substantially higher in the coming years.

4kodiak/iStock Unreleased via Getty Images

Amazon (NASDAQ:AMZN) is having a fantastic year, skyrocketing by 63% since its capitulation-style multi-year low in early 2023. While I’ve owned some Amazon stock over the years, I accumulated a significant traunch in my latest buy-in, around $89-$99 in late 2022 (average purchase price about $92). The stock has surged, achieving 60% gains since the year started. Additionally, due to the significant accumulation around the lows, Amazon is one of my most extensive portfolio holdings, accounting for 4.5% of the AWP’s total weight.

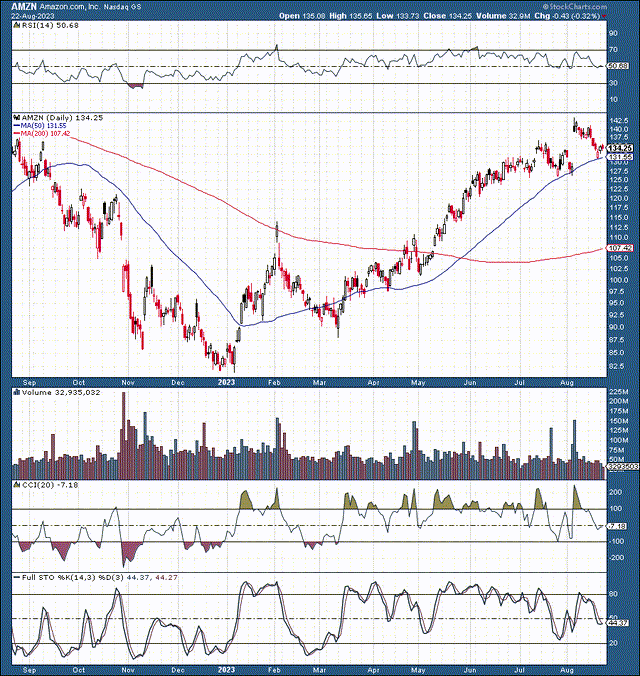

Amazon: 1-Year Highly Bullish

However, despite this stellar performance, I have yet to sell a single Amazon share and don’t plan to anytime soon. Amazon is a long-term investment. The company got sold off to incredibly cheap levels during the tech panic. Yet, Amazon has many things investors should be excited about. Additionally, Amazon could be the primary beneficiary of AI in the e-commerce segment.

Technically – The chart is highly bullish, with a likely long-term bottom formed around the $80-$90 range. Then we see a bullish inverse head and shoulders, followed by a golden cross as the 50-day MA moves above the 200-day MA. The stock is also trading nicely alongside the 50-day MA, and the overall technical image is very constructive, with substantial long-term momentum on Amazon’s side.

Fundamentally – Amazon’s revenue growth could expand more substantially than anticipated, and Amazon can deliver considerably higher profitability as we advance. Its latest earnings announcement illustrated high-level performance with top and bottom line beats, suggesting Amazon’s recovery may be taking off faster than expected. Despite Amazon’s seemingly high P/E ratio, the company can provide significant EPS growth in future years. Therefore, Amazon deserves its premium multiple, and its stock price should move much higher in the coming years.

Amazon – Significant AI Potential

Amazon offers various AI-related opportunities, including solutions through its AWS unit, the largest cloud service globally. Machine learning on AWS enables users to get deeper insight from their data while lowering costs. Moreover, Amazon provides the most comprehensive set of AI and ML services, infrastructure, and implementation resources.

AWS has more than 100,000 customers with more than 20 years of proven experience. Many existing customers will likely choose to build with a proven leader they have had a trusted relationship with for a long time. Therefore, many AWS users should get funneled into Amazon’s AI ecosystem, and we see many other promising AI initiatives. Amazon is a technology leader with bottomless pockets, still focused on innovation and growth. AI should incorporate very nicely with Amazon’s businesses, and the company should benefit considerably from AI.

Recent Earnings – Out of the Park

Amazon hit a home run in its latest earnings report, emphasizing that the recent slowdown was transitory. As we move forward, Amazon should return to more significant revenue growth and better-than-anticipated profitability, leading to higher EPS growth and a much higher stock price.

Amazon’s Q2 EPS reached $0.65, crushing the $0.34 consensus estimate. Revenue came in at $134.3B, beating the consensus estimate by roughly $3B, illustrating a much stronger-than-expected 11% YoY gain. Given the much stronger-than-expected revenues in a challenging economic phase, Amazon’s growth should remain robust and may accelerate. AWS segment sales showed a positive 12% YoY increase, illustrating the significant growth potential in Amazon’s massive cloud space.

Furthermore, Amazon is no stranger to beating EPS and revenue estimates. Despite the challenging economic phase, Amazon has delivered substantial outperformance in many prior quarters, including EPS of $1.27 vs. the expected $0.94 TTM. This dynamic illustrates a 35% EPS beat rate in the last twelve months of operations.

Therefore, Amazon’s forward EPS and revenue estimates could get revised higher in the coming quarters, enabling the premium multiple to persist and leading to a much higher stock price in the long term.

Amazon’s EPS – Could Explode Higher Again

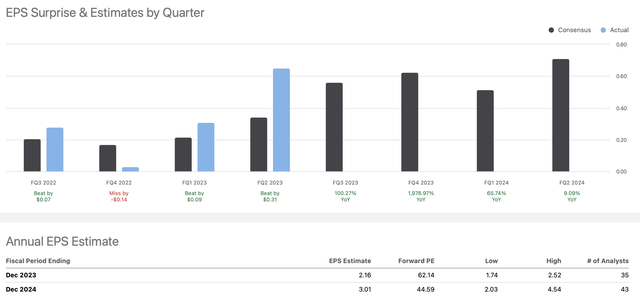

EPS estimates (SeekingAlpha.com )

Consensus estimates imply Amazon should earn about $2.40 in EPS in the next 12 months. However, Amazon’s EPS results could exceed downbeat consensus estimates due to the recent, intermediate, and long-term EPS trends. While we witnessed a 35% beat rate in the last twelve months, factoring in a beat rate of just 20% for the next year provides us an EPS of $2.88. Moreover, Amazon can achieve $3 in EPS in a slightly more bullish case scenario. Also, applying a similar 20-30% EPS beat rate to the depressed 2024 consensus estimate brings Amazon’s EPS closer to $4 (higher-end estimate range).

Bottom Line: Expectations Too Low For Amazon

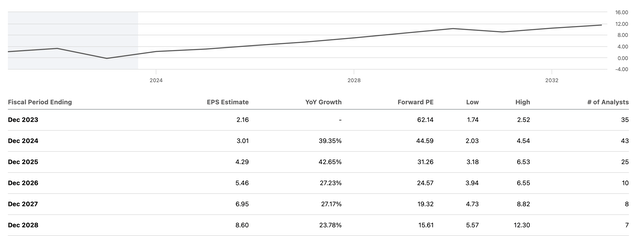

EPS estimates (SeekingAlpha.com )

While the consensus EPS estimate is only around $3 for next year, Amazon can do much better. If the company achieves a similar beat rate as recently, EPS should come in around $4 or higher in 2024 (toward the higher end of the estimate range). Therefore, Amazon could be trading at about a 30-forward P/E multiple, which is relatively inexpensive for Amazon’s shares.

Moreover, Amazon can beat the $4 EPS next year and may produce better-than-expected EPS growth in the years ahead. Instead of the consensus projected $4-$5 in EPS in 2025, Amazon could achieve $6-$7 due to its economies of scale capabilities, monopolistic-style advantages, AWS, and AI prospects. Moreover, Amazon and its diverse business segments should benefit significantly from the upcoming economic rebound, lower interest rates, increased consumer/enterprise spending, and other positive market elements.

Where the Stock Could Go in Future Years

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs |

$655 |

$755 | $853 | $964 | $1080 | $1198 | $1318 |

| Revenue growth | 15% | 15% | 13% | 13% | 12% | 11% | 10% |

| EPS | $4.25 | $6.50 | $8.25 | $10.32 | $12.70 | $15.50 | $18.60 |

| EPS growth | 80% | 53% | 27% | 25% | 23% | 22% | 20% |

| Forward P/E | 35 | 37 | 36 | 35 | 33 | 31 | 29 |

| Price | $228 | $305 | $372 | $444 | $512 | $577 | $650 |

Source: The Financial Prophet

I’ve been very bullish on Amazon since the lows and continue to see much more upside potential in the long run. While I had a $315 price target for 2026, we can achieve it sooner. Due to Amazon’s improving growth and earnings dynamic, I have a $300-$450 price target on its stock for the next 2-3 years.

Risks to Amazon

Despite my bullish outlook, Amazon faces some risks. The company often focuses most of its resources on growth. Thus its profitability growth may be slower than expected in a worst case scenario. Also, we could see lower growth than projected in my analysis as Amazon could run into regulatory issues, economic slowdown concerns, and other variables capable of impacting its business negatively in the long run. Please consider these and other risks before committing capital to an investment in Amazon stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

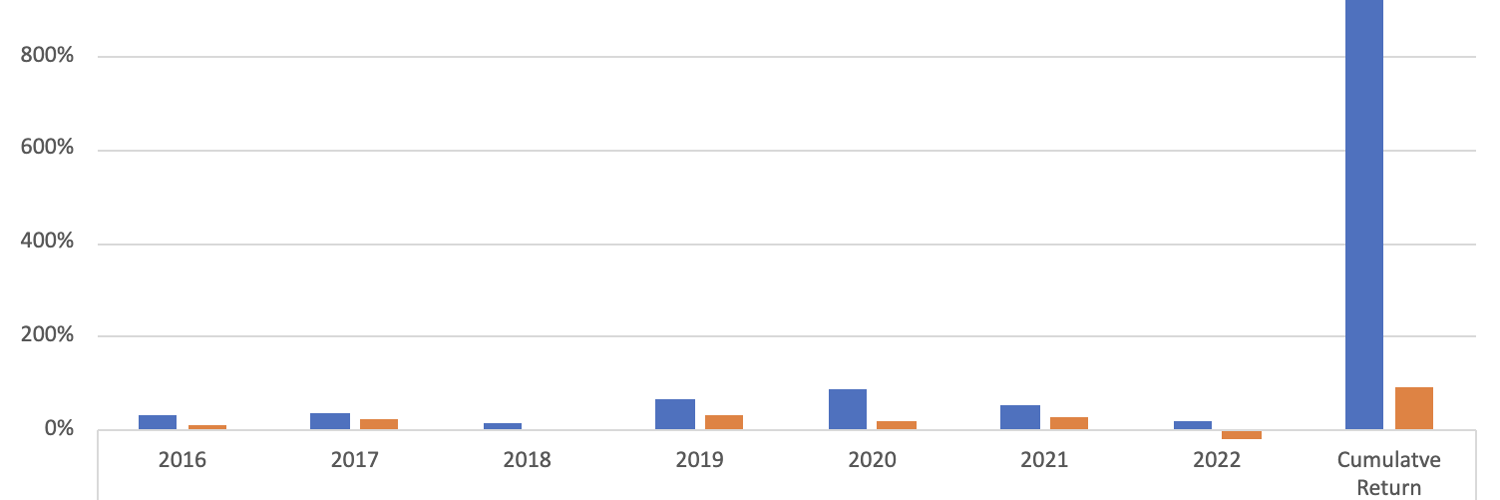

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!