Summary:

- Tech stocks have experienced a recent pullback, but leaders like Meta should resume their uptrends shortly.

- The valuation has moved much lower during this pullback, which should drive fundamental buying.

- Fundamentally, Meta is focused on improving its profit margins through reduced spending, and revenue growth is expected to drive further upside.

panida wijitpanya

Tech stocks have been battered for the past few weeks, and several key technical levels have been lost in the process. However, I remain bullish, as I have been all year, and maintain that this is nothing more than a pause that refreshes rather than a new bear market.

One of the leaders of this epic tech rally has certainly been Meta (NASDAQ:META), which has led not only from a percentage gain basis but also in terms of market cap added. It’s been a beast this year, and I believe it’s set up for more gains in the coming months, if perhaps not right away.

Below, I’ll detail why I think Meta deserves a place in your portfolio, both from a technical and fundamental perspective. Let’s dig in.

A chart that is far from perfect, but good enough

I always start with the technicals, and with Meta, there is certainly cause for concern short term. However, I still think there’s plenty of evidence this is a pullback, not a new bear market.

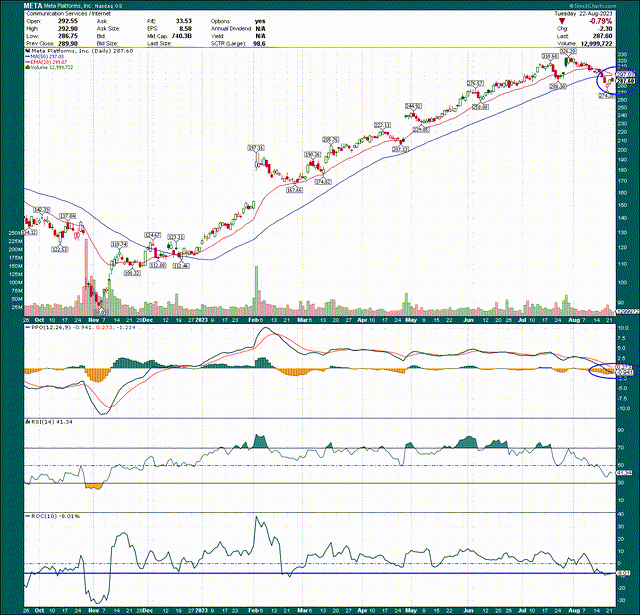

On the daily chart, we can see there’s been a significant break in the dominant uptrend we saw from November of last year until July 2023. That move was absolutely huge and has broken. That is not something we can sugarcoat or ignore. However, I do not believe we’ve seen Meta top.

The first key test is for the stock to crest the now-declining 20-day exponential moving average, and we’re almost certain to see that line make a bearish crossover of the 50-day simple moving average. Again, this chart is far from perfect. However, momentum suggests we’re about to see a bounce, and depending upon the velocity of that bounce, we could easily see these headwinds abate.

The PPO is bouncing higher right at the centerline after a big reset, which is a positive development for the bulls. In addition, the 10-day rate of change is at -8%, which is as low as it’s been since February of this year, and before that, November 2022. None of that guarantees a bounce, but it does certainly make it more likely.

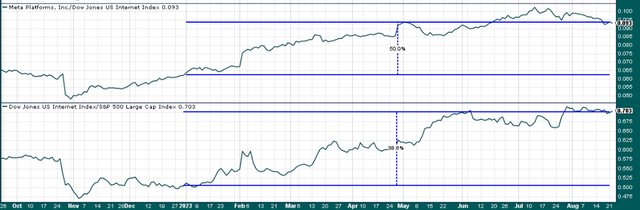

In addition, given that I’m on the lookout for outperforming stocks in outperforming sectors, it doesn’t get much better than Meta.

It has beaten its peer group by 50% this year, and the group itself has beaten the S&P 500 by a further 39%. You want relative strength? Look no further.

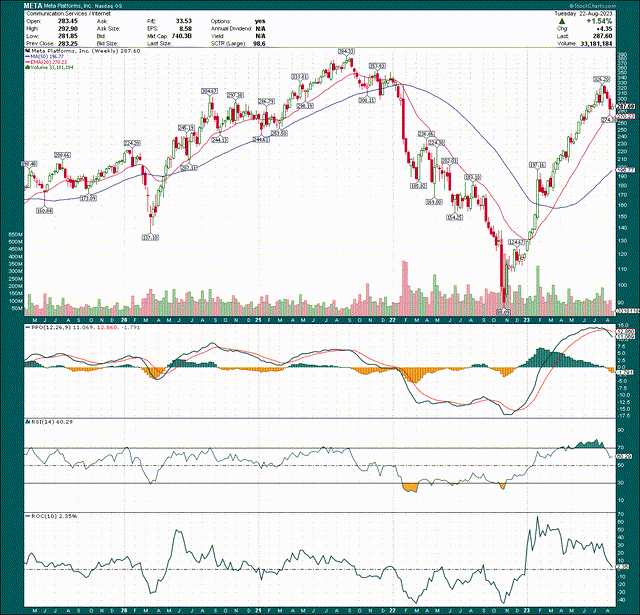

Now, I think the technical outlook improves materially when we zoom out to the weekly chart, which we can see below.

The stock bounced right off of the rising 20-week exponential moving average last week and has moved higher. The 14-week RSI was extremely overbought but is now at just 60. The PPO was also extremely overbought and still is to an extent, but that’s what happens during strong uptrends. Finally, the 10-week rate of change is now flat. In other words, the stock is right where it was 10 weeks ago; I can’t be bearish when a strong leader like Meta is trading where it was 10 weeks ago during a bull market.

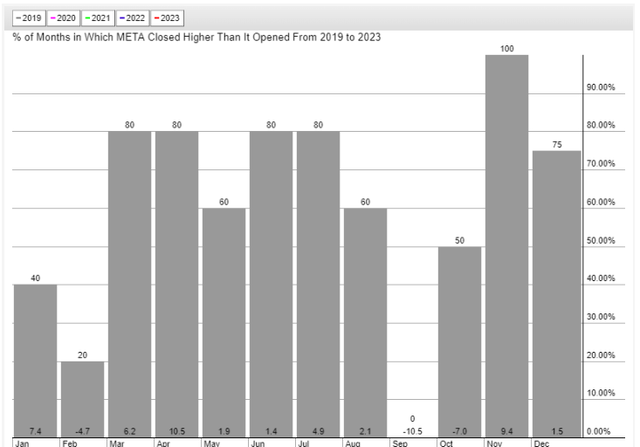

One caveat to all of this is that September is a pretty awful month for Meta historically. Below we have five years of seasonality data, and we can see September is far from kind.

It has closed higher at the end of September than at the start of September zero times out of five, with average annualized returns of -10.5%. That’s pretty rough and it’s a potential headwind. However, August is generally a good month for Meta, and obviously, this August has not been. Does that mean we’ll see the rally we typically see in August pushed to September this year? That’s possible, but my point in showing this is that we’re likely to get a big rally given the strong seasonality in Q4, but that it may be delayed by a few weeks from now.

Now, let’s take a look at some fundamental drivers that support the bull case longer term.

Focusing on margins to drive further upside

Meta was caught up in pandemic-driven demand for all things digital, as were many other tech companies of all shapes and sizes. That meant profligate spending with a devil-may-care attitude. The problem is that revenue growth essentially stopped, so the company’s profit margins had to shrink. What do you get with a tech company that has flat revenue and falling margins? You get a much lower share price, and that’s what Meta saw in 2022.

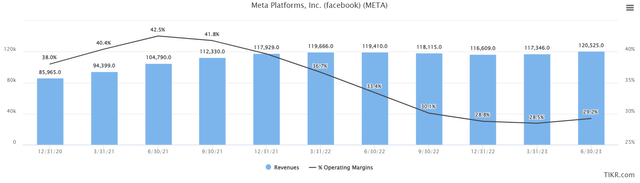

However, the company is back to revenue growth and critically has been on a very public campaign to boost margins through reduced spending. Below we have some data that shows Meta’s plan is working, and Wall Street is cheering.

This is trailing-twelve-month data for the past few years showing revenue and operating margins. Revenue is starting to tick higher, but we’re seeing much faster movement in operating margins. The primary reason for margin growth at the moment is reduced spending, but as revenue goes higher, we’ll continue to see building operating leverage that will send operating margins back towards former highs in the area of 40%+. That will be a huge positive for the stock if achieved, and all indications at the moment look pretty good for that being the outcome.

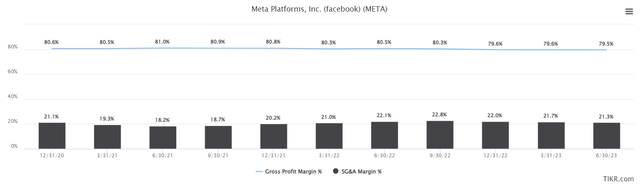

Here’s a focused look at gross margins and SG&A costs, which are the two primary components of operating profits. Gross margins have ticked lower, but only fractionally. The meat and potatoes here is SG&A spending, which we can see is moving fairly rapidly off of its former highs. I fully expect we’ll see SG&A costs back around 18% of revenue in fairly short order given reduced spending, but also rising revenue.

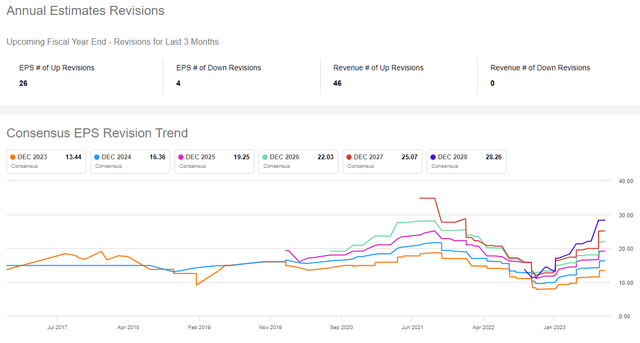

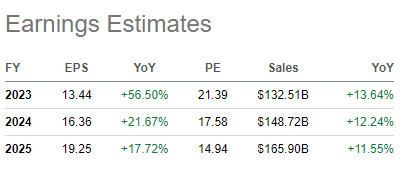

Speaking of those, we can see estimates for Meta on both fronts are showing outstanding growth potential from here.

Seeking Alpha

Revenue is expected to rise steadily in the coming years in the area of 11% to 13%, but EPS is set to rise much more quickly. The reason is operating leverage, and that is what is leading to outsized earnings growth estimates. Operating leverage works both ways and it crushed Meta’s earnings a year or two back, but we’re seeing margin reflation due to spending discipline, and it’s just what the doctor ordered.

Twenty-six of the past 30 EPS revisions have been higher, and all 46 of the most recent revenue estimates were higher. We can see the EPS lines above are flying higher; these are not incremental moves. As Meta continues to see revenue move higher, boosting its operating leverage, I can’t think of anything more bullish than this chart.

What it means is that the share price can ramp higher while the valuation remains the same. This is the opposite of what happened in 2022 as the company saw a lower share price on lower earnings. Now, we’re seeing the bullish flip side of that.

A valuation check and a ‘strong buy’ rating

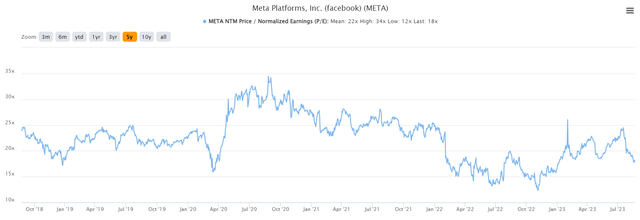

Meta has been on a legendary run this year, so it wouldn’t be weird to see its valuation stretched. However, because of the EPS revisions we’ve just looked at, the stock is actually pretty cheap, amazingly enough.

This chart shows forward P/Es for the past five years, which encompasses pre-COVID, COVID, and now post-COVID to get a good look at what the valuation “should” be. You can decide for yourself what fair value is, but when I look at this data, this stock just looks cheap.

We can see the recent pullback has taken the valuation from 25X forward earnings to 18X, which is a massive reduction, and just what I think was needed for a renewed push from the bulls. Eighteen times forward earnings were good enough for the last two pushes in the 2023 uptrend, and I don’t have reason to believe this time is any different. Even if you’re investing rather than trading a short-term move, 18X forward earnings for a dominant, fast grower like Meta is highly attractive.

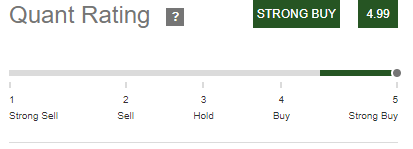

I’m a believer in the Quant system Seeking Alpha has put together because it matches my desire to take the emotions out of investing and focus on facts. And in terms of Quant Ratings, you literally cannot do better than this.

Seeking Alpha

Meta gets essentially a perfect score, and while I would have preferred to see the daily moving averages hold during this pullback, I’m also placing a strong buy on Meta. The stock is cheap, it has terrific growth ahead, and the weekly chart shows this pullback is likely done or close to done. September’s weak seasonality is a potential headwind, but Meta is likely to end this year much higher than it is today.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in META over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.