Summary:

- Pfizer’s share price has been declining since December with two failed rally attempts.

- Discontinuation of the development of lotiglipron and the Q2 revenue miss were the two recent disappointments, but the stock has stopped declining, which is a good sign.

- Recently acquired products like Nurtec and Oxbryta have not done well either while Vyndamax/Vindaqel continues to perform really well.

- Stabilization of the COVID-19 business and multiple expected product launches should improve the growth outlook in 2024 and beyond.

- Danuglipron data in the fourth quarter should shed light on how competitive this oral candidate is against the powerful injectables such as Ozempic/Wegovy and Mounjaro.

JHVEPhoto

Shares of Pfizer (NYSE:PFE) have been declining since last December. There were two minor rally attempts since then that were met with renewed selling and there is now a third attempt. It is quite remarkable that the stock is down to pre-COVID-19 highs from late 2018 despite the significant cash windfall that resulted from COVID-19 vaccine sales and the sales of Paxlovid and the company significantly expanding its non-COVID product portfolio and pipeline through M&A. But the old saying that stocks bottom on bad news could prove correct here.

The stock plunged in late June when Pfizer announced the discontinuation of the development of lotiglipron, a once-daily oral pill for the treatment of type 2 diabetes and obesity, due to elevated liver enzyme levels. I imagined the success of Pfizer in these markets was not priced in at all, but the market said otherwise.

This left the twice-daily danuglipron which is also a more advanced candidate and Pfizer is working on an extended-release version that could reduce the dosing requirement to once a day. No liver safety signal was seen to date in danuglipron’s trials that enrolled over 1,400 subjects to date. Results from the phase 2b trial in obese subjects are expected later this year and should show how competitive danuglipron can be versus the powerful injectables such as Novo Nordisk’s (NVO) Ozempic/Wegovy and Eli Lilly’s (LLY) Mounjaro.

Another disappointment came when Pfizer reported second-quarter results in early August. Total revenues declined 54% Y/Y in the second quarter due to the significant decline in Paxlovid and Comirnaty revenues, and the company missed the analyst revenue consensus by $700 million. After the Q2 miss, the company narrowed the full-year revenue guidance range from $67-71 billion to $67-70 billion.

This is supposed to be a trough year for Pfizer’s COVID business with an expected stabilization and potentially some growth going forward. Excluding COVID-19 revenues, we saw a 5% Y/Y increase in revenues in the second quarter.

On the Q2 earnings call, management acknowledged the uncertainties related to the COVID business but said that these uncertainties should be largely eliminated by the end of the year, informed by the vaccination rates during the fall and winter seasons and the planned transition to a commercial model. In the medium and long run, the company sees upside from the flu/COVID vaccine combo.

There are also contingency plans if revenues come below expectations and the company has identified areas within the COVID business where costs can be reduced if needed.

There were also some disappointments from recently acquired products. Nurtec’s net sales recovered sequentially, from $167 million in Q1 to $247 million in Q2, but this represents a modest improvement compared to the $211 million it generated in Q4 2022 and $194 million in Q2 2022. I expected more from this previously rapidly growing migraine drug and it seems that the integration has so far failed to produce better results. With this kind of growth, it seems unlikely peak sales will come close to $6 billion, but let’s give it a few more quarters.

The sickle cell disease drug Oxbryta has barely grown since the Global Blood Therapeutics acquisition last year. Net sales rose from $72 million in Q2 2022 in the hands of Global Blood Therapeutics to only $77 million in the second quarter of this year. Last year’s label expansion to include younger SCD patients produced a brief jump in sales and what followed was a few flattish quarters. And Oxbryta seems too small a product to be mentioned by management on earnings calls and we are left to wonder what they think about the medium to long-term outlook. However, as I covered in last year’s article, the second-generation candidate is what this acquisition should be all about as it is more potent than Oxbryta and has the potential to produce much better outcomes for SCD patients.

But it is safe to say that these two acquisitions are so far not living up to expectations.

On the positive side:

- Vyndamax/Vyndaqel continues to perform very well with $782 million in global net sales in Q2. Full-year net sales will likely come close to or exceed $3 billion.

- The company secured approvals for Litfulo (ritlecitinib) for the treatment of alopecia areata, for the RSV vaccine Abrysvo, and for Elrexfio (elranatamab) for the treatment of relapsed/refractory multiple myeloma.

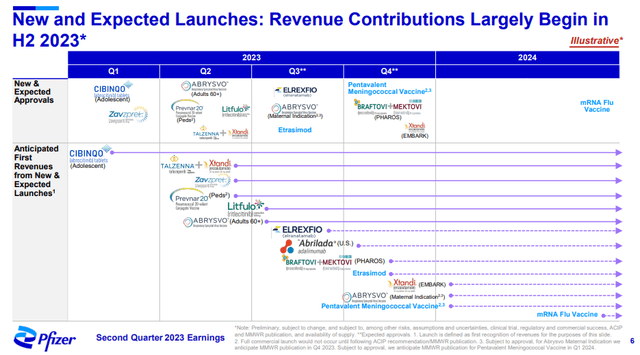

The presentation slide below shows that the contribution of recently acquired, approved, and soon-to-be-approved products is expected to significantly increase in the following quarters.

Last, but not least, Seagen (SGEN) continues to perform well and should become a significant revenue contributor when the deal closes and this is still expected to happen in late 2023 or early 2024. Last week, Seagen announced positive results from the phase 3 trial of Tukysa in combination with Kadcyla in patients with unresectable locally advanced or metastatic HER2-positive breast cancer, and prior to that, it reported strong second-quarter results.

Seagen is expected to generate $2.39 billion in revenues this year and $3.19 billion in 2024 and these estimates have slightly increased since the acquisition announcement. Pfizer continues to expect Seagen’s contribution in excess of $10 billion in risk-adjusted revenues from this acquisition in 2030.

The outlook

Pfizer is in the low growth/value category and as such, not a candidate for our Growth Stock Forum model portfolio, but I see it as one of the better-positioned big pharma companies to deliver shareholder value in the following years. Back in my December 2022 article, I noted the stock has the potential to deliver annual compounded gains in the 7% to 10% range and while I think the outlook has only slightly worsened since then, the stock is down nearly 30% since the publication of the article, and as such, I see the potential annual compounded returns of at 10% to 12% from current levels, driven by a combination of a return to topline growth following the stabilization of the COVID business, and resulting multiple expansion.

One wild card that could significantly and positively impact the long-term outlook is the obesity/type 2 diabetes pipeline. The drop in late June after lotiglipron’s discontinuation shows how sensitive the stock is to setbacks in this area, and the success of Eli Lilly and Novo Nordisk in the obesity market shows how big this market could be by the end of this decade. At current levels, the market is assigning a very low probability of Pfizer being a significant player, but there are ways to catch up beyond danuglipron and we could see the company take shortcuts through business development in the following quarters and years.

And regarding the near and medium-term outlook, I believe the stock has either bottomed or is very close to doing so as the market has done well to absorb the lotiglipron’s discontinuation and the Q2 revenue miss. One of the reasons to be optimistic aside from the largely unchanged long-term outlook and an attractive valuation, is that the stock has stopped falling on bad news.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article reflects the author's opinion and should not be regarded as a buy or sell recommendation or investment advice in any way.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.