Summary:

- Nvidia reported strong Q2 revenue and EPS, with a whopping 101% YoY sales gain and a $16B revenue guidance for Q3.

- Nvidia remains the top AI stock globally, with remarkable data center growth and a dominant market-leading position.

- The estimates for Nvidia’s revenue and EPS could be too low, with the potential for even higher results in future quarters.

Justin Sullivan

Nvidia (NASDAQ:NVDA) reported another stellar earnings announcement, sending its share price skyrocketing above $500. If Nvidia’s previous quarter was a home run, this one is a grand slam. However, due to the early stages of the AI supercycle, I believe the best is still to come for Nvidia.

It’s good to be the King – No one beats Nvidia in AI

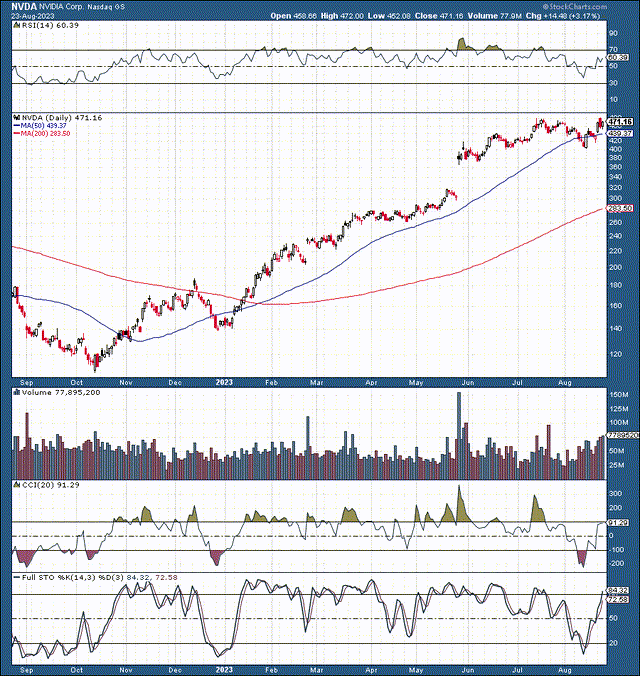

Nvidia: 1-Year Chart

I’ve been bullish on Nvidia since the $100-120 range. However, while maintaining my bullish perspective, I did not anticipate Nvidia to quintuple in about ten months. Unfortunately, I sold my Nvidia shares prematurely, after only about a 100-200% gain, and have been unable to find an appropriate pullback to get back in. Fortunately, I have substantial exposure to several high-quality AI stocks to compensate for not owning Nvidia. Nevertheless, I still want to own Nvidia, and here’s why:

Like in Q1, Nvidia smashed its Q2 revenue and EPS forecasts, recording a whopping 101% YoY sales gain. Moreover, Nvidia announced a $25B buyback program and declared a four-cent quarterly dividend. The $16B revenue guidance for Q3 is phenomenal, and Nvidia will likely announce another beat three months from now. Therefore, there is a high probability for Nvidia’s stock to go much higher in the intermediate and long run in my view.

Nvidia remains the top AI stock globally, as it will account for much of the heavy lifting required to provide the necessary power for supercomputers and high-powered AI networks to function at their optimal level of efficiency around the globe. Nvidia remains ahead of its competition and provides (arguably) the best “entire package” of AI-enterprise products, complete with the most capable hardware, software solutions, and a comprehensive suite of support and various services for enterprise needs. Due to its superior GPU-powered hardware, Nvidia’s data center growth is remarkable, surging to $10.32B last quarter, a 171% YoY gain.

Due to Nvidia’s dominant market-leading position, remarkably long growth runway, and significant sales growth potential, its profitability should increase considerably in future years. Additionally, Nvidia has a high-margin business, and due to economies of scale and its AI-related advantages, its operations should remain highly profitable, leading to better-than-anticipated EPS growth and higher-than-expected profitability. This uniquely long-term bullish dynamic should enable Nvidia’s stock to continue commanding a high multiple, leading to a considerably higher stock price in the coming years.

Nvidia’s Grand Slam Quarter – A Closer Look

Nvidia’s EPS came in at $2.70, beating by 61 cents, a whopping 29%. In last year’s quarter, Nvidia delivered 51 cents, illustrating a 429% YoY EPS increase. Also, $2.70 was very high in the EPS estimate range. The estimate range was $1.76-2.70 out of the 39 analysts covering the stock. This dynamic suggests we should see bullish upward revenue and EPS revisions in future quarters. Furthermore, Nvidia could continue surpassing consensus figures, enabling its stock price to continue increasing as we advance.

Revenue was $13.51B, way above Nvidia’s prior guidance of $11B. So, we see a staggering 23% revenue beat over the company’s guidance at the end of last quarter. I pretty much knew Nvidia would surpass its guidance, but I hadn’t considered a massive 23% revenue beat. Moving further, Nvidia’s most exciting and booming segment, the data center business, provided revenue of $10.32B, up 141% from Q1. Therefore, we see a sharp re-acceleration in enterprise-side revenues, where Nvidia is king.

Nvidia Is The AI King

Nvidia provides the best GPUs to power the growing super AI computing world demand. Moreover, Nvidia has been developing and improving its enterprise AI program for years. Nvidia has the most advanced AI ready for enterprises. Nvidia also has numerous other exciting AI-related opportunities I’ve outlined since over a year back.

It is an understatement to say that Nvidia is ahead of its top AI data center/server space rivals. Nvidia has the best infrastructure, ecosystem, the most powerful chips for advancing AI technologies, and a comprehensive strategy to continue gaining market share in the ultra-lucrative data center space.

AMD Inc. (AMD) has advanced processors capable of running supercomputing but lacks a complete AI hardware/software package that’s as seamless as Nvidia’s. Intel (INTC) lacks the high-end GPU technology capable of competing effectively on the higher-end level with Nvidia and AMD in this space.

However, Intel has a considerable data center market share due to its CPU use in this space’s mid and lower end. Nevertheless, if you’re considering top-of-the-line AI enterprise-level capabilities, Nvidia has a considerable advantage and should continue leading in this space. Moreover, Nvidia has immense potential to branch into numerous growth areas like AI-enhanced self-driving and other sectors.

Therefore – The Estimates Could Be Wrong

Revenues Could Go Much Higher Than Expected

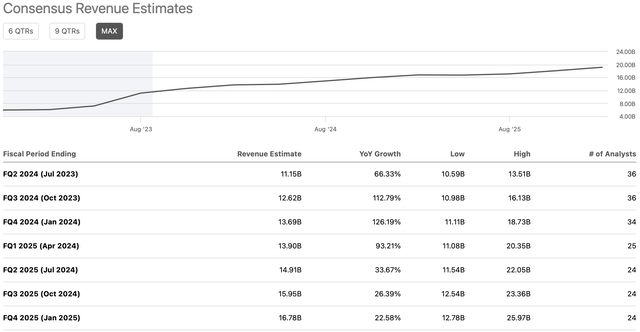

Revenue estimates (SeekingAlpha.com )

Nvidia reported $13.51B in revenues (highest-end estimates) and guided to $16B in Q3. Nvidia provided stellar guidance last quarter but still smashed the results by 23%. Now, Nvidia is guiding to $16B, but it’s doubtful it would guide to revenue numbers it couldn’t easily achieve. I believe we could see a similar scenario next quarter as Nvidia beats its guidance by 10-20% or more. Therefore, Nvidia’s Q3 revenues could be around $17-18B.

Remarkably, the current estimate is around $12.62B, likely because many analysts still need to adjust estimates higher, but soon will. Also, Nvidia’s revenues are growing remarkably, illustrating the enormous demand and growth potential-Nvidia recorded $5.93B in revenues in Q3 2022. If Nvidia delivers approximately $17.5B in revenues this quarter, it would be nearly a 200% YoY (remarkable) revenue gain.

EPS Estimates – Much Too Low

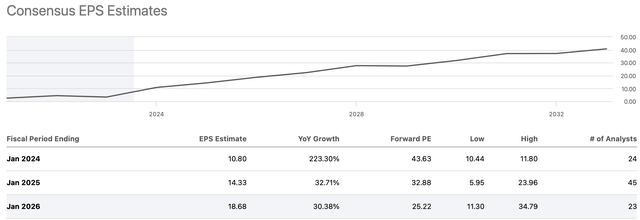

EPS estimates (SeekingAlpha.com )

We see a similar dynamic with EPS, as Nvidia delivers much better than expected results. Last quarter, Nvidia provided top-end estimates, and despite the possibility of upward EPS adjustments, Nvidia should continue showing higher-end results. Next quarter, consensus estimates imply Nvidia should achieve $3.34 in EPS. Yet, the higher-end estimate is around $3.70, and there is a strong possibility that Nvidia can achieve it.

The 2025 full fiscal year EPS ranges wildly, but it’s plausible that Nvidia can achieve earnings toward the higher end of the range. The $14.33 consensus estimate makes little sense, as Nvidia is already approaching $4 in quarterly EPS. Therefore, going by slightly higher-end estimates (that could get revised even higher), Nvidia could earn approximately $20 in EPS in fiscal 2025 in my view.

This dynamic implies that despite Nvidia’s $500 price tag, this king of AI may only be trading at around 25 times forward earnings here. Given Nvidia’s dominant market-leading position, explosive growth opportunities, and high profitability potential, next year’s EPS estimates are relatively modest. Nvidia should continue outperforming, and its stock price could increase considerably as we advance.

Where Nvidia’s Stock Could be Moving Forward

| Year (fiscal) | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $99 | $130 | $170 | $218 | $275 | $345 |

| Revenue growth | 73% | 31% | 30% | 28% | 27% | 25% |

| EPS | $20 | $30 | $43.5 | $53.5 | $70 | $88 |

| EPS growth | 90% | 50% | 45% | 35% | 30% | 25% |

| Forward P/E | 30 | 29 | 28 | 27 | 26 | 25 |

| Stock price | $900 | $1262 | $1498 | $1890 | $2288 | $2500 |

Source: The Financial Prophet

Risks to Nvidia

Despite my bullish outlook for Nvidia, there are several risks. Nvidia could run into supply or demand issues for various reasons moving forward. Moreover, Nvidia’s demand could suffer due to stringent China relations and other variables. Nvidia’s technology and AI solutions may prove less effective than anticipated, and there is increasing competition in the AI-related hardware, software, support, and solutions space. Also, Nvidia may not achieve the level of growth my projections envision, and its profitability could be less than expected as we advance. Investors should examine these and other risks before committing capital to an investment in Nvidia’s stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diverse portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!