Summary:

- We remain concerned over the adverse impact higher interest rates will have on demand for its iPhone, iPads and MacBooks in the US.

- We do not anticipate significant earnings growth for Apple for the remaining 2023 calendar year and we remain on the sideline.

- From a technical perspective, Apple’s long-term chart was at a significant resistance level. Apple giving us a 5-wave drop from the recent high is a big warning to the bulls.

Wirestock

As inflation continues to fade in the US economy, along with a higher stock market, many are now celebrating a successful soft-landing maneuvered by the FED.

What these investors fail to realize in my view is: 1) the speed at which the FED raised rates in 2022 was one of the steepest rate hiking cycles in modern market history. This means that we haven’t had enough time to feel the effects of these hikes, which can give a false sense of security. 2) The lag time between a rate hike and the effects felt on the economy have a 9-12 month lag, while some estimate a 18-24 month lag. Assuming the best-case scenario, this would have us just now starting to experience the first rounds of the sequential 75 bps hikes from mid-2022.

As these rate hikes continue to filter into the economy, we will only see the consumer get weaker as a result. Therefore, entering this current earnings season, we were closely monitoring the impact of higher interest rates on consumer demand. In particular, segments where consumers rely on financing to make purchases and make monthly payments toward them. Higher interest rates are effectively price hikes above the purchase price and result in higher monthly payments.

For example, we recently exited Enphase around the $180 region over these concerns. Enphase sells solar inverters to installers who then sell them to consumers for home installation. Typically, installers rely on banks to provide financing to consumers for these purchases, who then pay monthly. Higher interest rates are making the economics of solar installation less attractive. Consumer demand has declined and inventory has accumulated in the channel. Enphase expects it will take at least a quarter for it to be cleared.

We also closed most of our TSLA position for a +60% profit over similar concerns. In the article “Tesla Q2 Earnings – It’s About Margins” we stated: “While some will talk about recurring software revenue from robotaxis as the most important catalyst, the harsh reality is that the FED lowering rates is the most important catalyst for Tesla today.” For consumers who chose to finance their electric vehicles, Tesla has reduced prices of its cars in part to reduce the monthly costs consumers have to pay due to higher interest rates. As a result, Tesla’s group operating margins have declined from 16% at the end of 2022 to 9.6% in Q223. Tesla signaled it will continue to lower prices to offset the “price increase” from higher rates.

Interest rates are taking a bite out of Apple

We had previously written about Apple (NASDAQ:AAPL) with a Hold rating in January this year and the solace in the near term is that the stock benefits from China’s reopening trade. “The divergence between Apple Inc. and the Dow Jones Industrial Average Index is alarming. More times than not, when important stocks/markets start moving in opposite directions, it’s a warning sign that one market needs to catch up with the other.”

We do not believe Apple is immune to the interest rate dynamics, considering their exposure to the consumer. We remain concerned over the adverse impact higher interest rates will have on demand for its iPhone, iPads and MacBooks in the US. In Apple’s most recent Q3FY23 call, they stated the following:

The majority of iPhones, at this point, are sold using some kind of a program, trade-ins, installments, some kind of financing. And that percentage, which again, it’s well over 50%, is very similar across developed and emerging markets.”

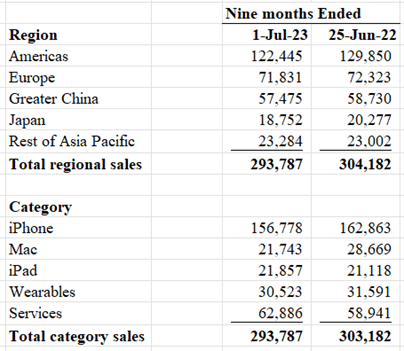

In its recent Q3FY23 earnings release, the Americas region which is primarily the US market declined by 6% while ROW showed moderate declines over the most recent 9 months. China and Emerging Markets have been a relative bright spot although the stronger USD continues to be a headwind. On the product side, iPhone sales were down 4% and Mac sales down 24%. Services are an important segment that has been growing, which has helped both from a sales and margin perspective.

Tech Insider Network

This is how Apple described the US market.

… the Americas is still declining somewhat year-over-year, as you can see on the data sheet. The primary reason for that is that it’s a challenging smartphone market in the U.S. currently.”

The uncertain macro, cell phone penetration maturation, and people holding off on upgrading to a new phone are all likely contributing factors to the current challenges in the US market. Meanwhile, the average price of an iPhone is approaching $1,000. We believe that given that over 50% of iPhones (likely higher in the US) are purchased through financing, higher interest rates are having an impact much like we’ve seen across other consumer discretionary segments.

Another factor we’re monitoring is the promotional activity by the major US carriers – ATT, Verizon and T-Mobile – who have become more focused on cashflow. Historically, this has been a very large market for iPhones. For example, the carriers may have promotional programs to help consumers upgrade by giving a cash rebate if they bring in their old phone.

For example, in its recent Q223 earnings call, Verizon stated

Additionally, we expect less pressure from the amortization and promotional cost in the second half of the year, given the softer upgrade environment and our disciplined approach to promotional spending.”

Apple provided guidance for the September quarter.

We expect our September quarter year-over-year revenue performance to be similar to the June quarter, assuming that the macroeconomic outlook doesn’t worsen from what we are projecting today for the current quarter […]

“We expect iPhone and Services year-over-year performance to accelerate from the June quarter. Also, we expect the revenue for both Mac and iPad to decline by double digits year-over-year due to difficult compares, particularly on the Mac.”

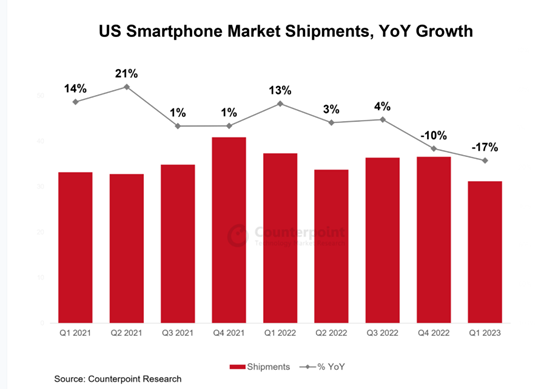

Given the factors described, we do not anticipate significant earnings growth for Apple for the remaining 2023 calendar year and we remain on the sidelines. While Apple’s US market share has increased, overall US Smartphone shipments continue to decline according to Counterpoint Research.

Counterpoint Research

Our fundamental view has been supported by our technical view

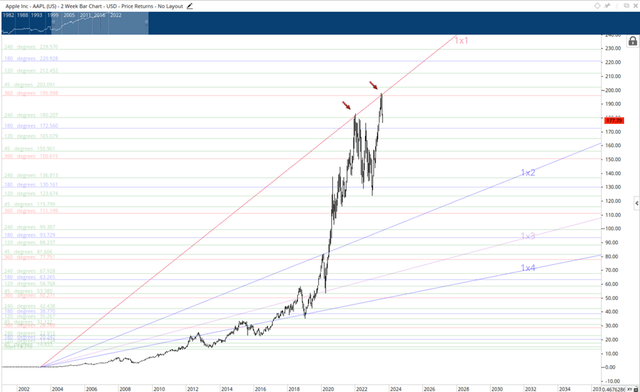

We were warning our members about Apple going into its recent earnings. From a technical perspective, Apple’s long-term chart was at a significant resistance level. If we place a Gann Fan at the 2003 low, which is just a sequence of significant angles that stock prices tend to respect, the red 1×1 line is the most important angle to monitor.

This angle is a true 45-degree angle, at which, big reactions tend to happen. Note the last time that Apple’s price touched this angle from the 2003 low. It marked the 2022 top. Interestingly, AAPL was testing this angle again going into earnings.

Tech Insider Network

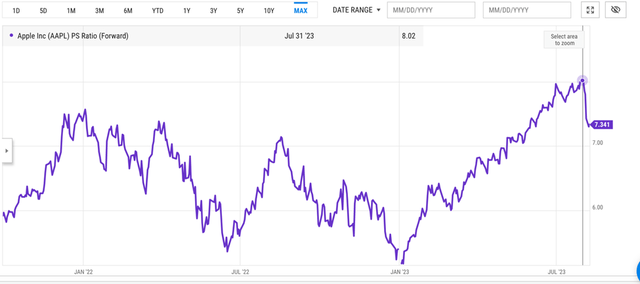

Further warning could be seen in AAPL’s forward valuations. Going into earnings, not only was Apple’s price at a significant angle, as shown above, but its forward Price to Sales was trading above the 2022 high.

Ycharts

It’s Do or Die for Apple Stock

Apple is the largest stock in both the NASDAQ and in the S&P 500. The direction it goes, so goes the market. For this reason, we put an outsized amount of analysis into this stock. We are not surprised by the market’s reaction to AAPL’s earnings. Now we’ll address the most important question – is this the start of a significant top, or is it a pitstop on its way to fresh highs?

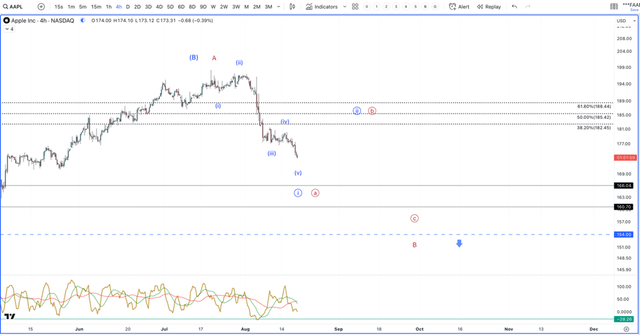

In the below chart, I have two general counts that we are tracking based on the current price information:

- Blue – This count suggests that we are ending a large rally in an ongoing bear market. Some would call this a cyclical bull market in a secular bear market. Regardless, the structure of the next leg lower would have to be a 5-wave pattern, and ultimately break below the $154 critical support. If this happens, we will retest the January lows, at minimum.

- Red – This count suggests that we are in a correction within a larger uptrend, which would ultimately take us to new highs. The key indicator of this scenario playing out would be a 3-wave drop that holds the $154 level. If this happens, Apple, and the market, would be providing an excellent buying opportunity.

Tech Insider Network

Also worth pointing out, note the gap down on heavy volume. Gaps are important markers in a trend. More times than not, they tend to start counter moves, which is why this needs to be watched so closely. Reclaiming this gap will be challenging, and supports the blue count while it remains open.

Now, if we zoom into the structure of this drop, it is very clear that we have a 5-wave pattern pointing down from the high. This is concerning. The next criteria will be a break below $154 to confirm a larger top is in. Both scenarios suggest a bounce soon, and then lower levels. So, the time to risk-manage will be on this next bounce.

However, Apple giving us a 5-wave drop from the recent high is a big warning to the bulls. From a risk management perspective, we believe the evidence is high enough to plan around the Blue count. If we are wrong, we will know at lower levels, and have ample time to reverse for the next swing to new highs. But, for now, we prefer to play it safe based on what the technical and Apple’s management are telling us.

Tech Insider Network

What’s next

In conclusion, it takes time for rate hikes to filter into the economy. Some businesses feel the effects sooner, like manufacturing; however, if a business has heavy exposure to the consumer, they tend to be more sensitive to economic slowdowns. We saw this with Enphase, then Tesla, and now Apple is forecasting a continued slowdown in their core business, while the technical are providing warning signs of a potential significant trend change. We are due for a bounce, but the odds favor lower levels after.

The Tech Insider Network Analyst Team contributed to this article.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Check out my premium service “Tech Insider Network”

We offer tech sector coverage that combines fundamentals and technicals. After recommending a stock, we provide entries and exits.

Our audited 3-year results of 47% prove we are a top-performing tech portfolio. This compares to popular tech ETFs at negative 46% and the Nasdaq at 19%.

We are the only retail team featured regularly in Tier 1 media, such as Fox, CNBC, TD Ameritrade and more.

Our services includes an automated hedge, portfolio of 10+ positions, broad market analysis, real-time trade alerts PLUS a weekly webinar every Thursday at 4:30 pm Eastern.