Summary:

- Meta Platforms stock is well-supported after its recent pullback. Buyers are getting pumped up to help push META toward its all-time highs.

- The advertising industry is recovering, in line with the resilience of the economy. META’s metaverse discount suggests room for further expansion in its valuation multiples.

- Meta’s open-source AI models could disrupt the dominance of Google and Microsoft’s closed ecosystem. AI monetization could underpin another growth optionality in Meta’s business model.

- I make the case for why META’s recovery still has further room for growth. Investors on the sidelines shouldn’t wait until META has scaled its all-time highs.

Araya Doheny/Getty Images Entertainment

Meta Platforms’ (NASDAQ:META) stock recovery into its long-term uptrend is nearly complete if META can survive the recent pullback, with buyers supporting it robustly at the $290 zone.

Based on Meta’s forward revenue and earnings estimates, it’s hard to envisage why its stock cannot continue riding its recovery to chart a new all-time high. Meta’s second-quarter or FQ2 earnings release in late July demonstrated that dip buyers in November 2022 were correct. As such, the market rewarded these investors with significant market outperformance with a surge that rivaled the extent of its previous collapse.

The recovery of the advertising industry has also underpinned bullish sentiment in digital ad leaders such as Meta and Google (GOOGL). Disney’s (DIS) recent earnings commentary corroborated the ongoing advertising recovery, as the economy is not expected to fall into a debilitating recession.

Despite that, META’s forward earnings multiples remain well discounted from its all-time averages, suggesting investors are likely still discounting execution risks from its long-term metaverse project. While the discount makes sense to reflect high CapEx needs and Reality Labs’ mounting losses, the valuation discount could underpin a further recovery in META despite the outperformance from last year’s lows.

Accordingly, META last traded at a forward EBITDA multiple of 9.6x, well below its all-time average of 15.1x. However, it’s also essential to consider its free cash flow or FCF multiples, considering the CapEx needed to fulfill its metaverse ambitions, including its AI investments.

Meta’s CapEx is expected to reach $29.8B this year, a marked reduction from last year’s $31.2B. However, investors should anticipate accelerating CapEx through FY25, reaching nearly $36B. The good news is that Meta’s highly profitable ad-based business model is still expected to generate significant operating leverage, sustaining its CapEx needs. Accordingly, FCF conversion is expected to remain robust, with Meta’s FCF margins projected to reach 26.1% in FY25, up markedly from FY22’s 15.8%.

However, the market is right in applying an appropriate discount on META’s valuation multiple (relative to its historical average). Meta’s average FCF margin from FY16-21 was 33.9%, well above its forward estimates. As such, investors must be circumspect about expecting market operators to re-rate META substantially upward in the near term.

Despite that, I believe Meta Platforms is well-positioned to continue riding on its open-source investments against the closed ecosystem of Google, Microsoft (MSFT), and OpenAI. The company has been making solid progress in the AI sphere following the launch of its Llama 2 LLM. It is reportedly close to launching its AI code generator, Code Llama, based on its open-source model. As such, it could disrupt Microsoft’s work on GitHub, attracting developers and enterprise customers toward Meta’s open ecosystem.

While external monetization of its AI models is likely not expected in the near term, Meta’s progress in generative AI indicates that the company is not far off from Microsoft and OpenAI. Hence, we shouldn’t rule out the opportunities for high-margin monetization opportunities that have not been baked into META’s current valuation compared to MSFT.

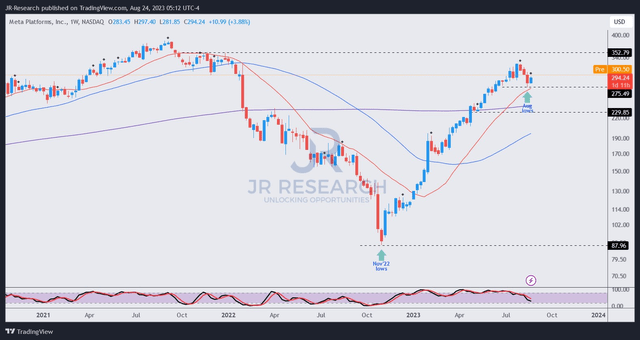

META price chart (weekly) (TradingView)

META found support at the $290 level as buyers absorbed further selling toward the $270 zone. If the $290 level could hold, META looks well-primed to resume its medium-term uptrend, with the 20-week moving average or MA (red line) underpinning it as its dynamic support zone.

I see more robust support potentially at the $230 level, which coincides with META’s long-term support levels. However, with META’s attractive valuation and improving earnings potential, falling back toward those levels doesn’t seem likely.

CEO Mark Zuckerberg has likely understood that the market is “enthralled” with its “year of efficiency,” helping drive an unprecedented recovery of its stock from its 2022 lows. With that experience under his belt, I don’t expect Zuckerberg to make another similar mistake of forging ahead with overly aggressive growth strategies. As such, Meta is expected to leverage its investments in AI to deliver more efficient earnings growth as its topline growth should normalize after this year’s tremendous recovery (given a lower 2022 base).

With that in mind, META looks ready to continue its recovery. I urge investors to consider adding more exposure and not wait until it surges above its all-time highs.

Rating: Maintain Buy. Please note that a Buy rating is equivalent to a Bullish or Market Outperform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, MSFT, GOOGL, DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!