Summary:

- GameStop’s latest quarter showed a marginal improvement, with a smaller net loss and reduced costs.

- The company’s high selling, general, and administrative costs make it uncompetitive compared to other retailers.

- GameStop’s declining revenue and lack of a clear strategic vision indicate that it is rudderless and in need of a turnaround.

Spencer Platt

The GameStop (NYSE:GME) rally driven by the Reddit crowd has been one of the most exciting market events in recent times. I’m sure everyone who watches the stock market knows the story by now. However now that GME stock has somewhat fallen back to earth, has this meme-rally saved the business? Taking a step back from all the drama, is GME stock worth a buy?

GameStop’s Latest Quarter A Marginal Improvement

GameStop’s latest Q1 result wasn’t so bad. If looking at it from the lens of “working with what they have”. The company reported a much smaller Net loss in Q1 2023 of $50.5 million. This is roughly a third of the Net loss reported in Q1 last year.

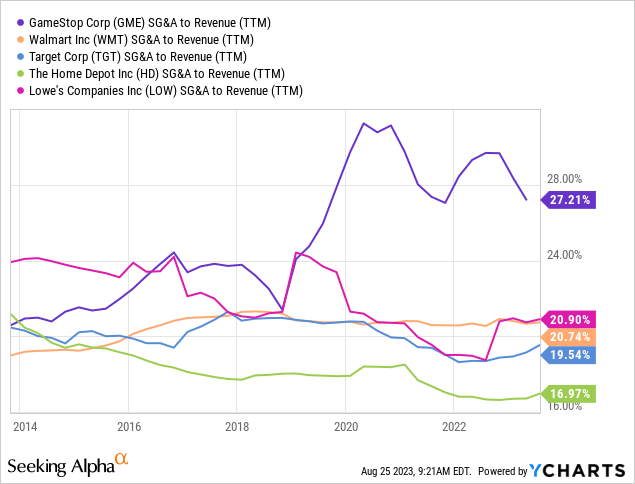

A lot of the loss mitigation was driven by slashing costs. Selling, general, and administrative (“SG&A”) costs dropped from $452.2 million in Q1 2022 to $345.7 million in Q1 2023. SG&A costs represented 27.9% of sales in 2023 which is an improvement from the 32.8% in the previous quarter. I wouldn’t exactly call this result “good” though as SG&A is still much higher than it needs to be for the company to be competitive. If we look at GameStop’s historical SG&A to revenue over the past 10 years we can see prior to 2019 it has been hovering in the 20% to 25% range.

Furthermore, it’s pretty obvious that these levels of SG&A costs make GameStop uncompetitive when compared to the retail industry. Looking at other “big box” retailers like Walmart (WMT), Target (TGT), Home Depot (HD) or Lowe’s (LOW), we can see that their SG&A costs are much lower at below 20% of revenue.

This is especially bad news for GameStop as the company primarily sells an undifferentiated and easy-to-carry product (videogames and peripherals). In other words, there really is no difference between buying a videogame at GameStop as opposed to getting it from your local Target or Walmart. Therefore, retail competition within this niche can be intense. This isn’t even mentioning simply getting games online which has the option of both a physical copy or a digital one.

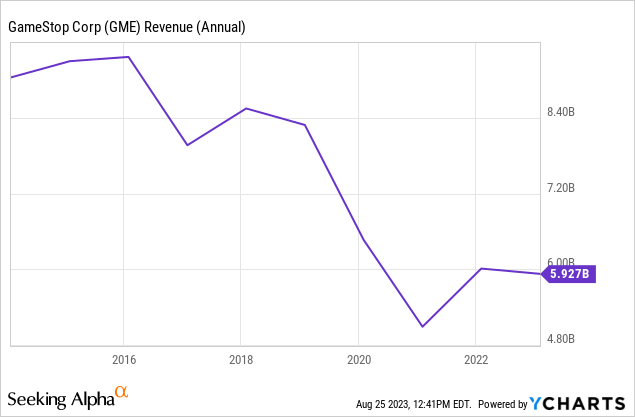

Another worrying factor is the steady decline in GameStop’s top-line revenue. In Q1 2023 Net Sales were $1.24 billion which was a decrease of 10.2% when compared to the $1.38 in the same time the previous year. The company’s trailing twelve-month revenue is $5.79 billion which is a far cry from the $8 to $9 billion the company earned 10 years ago. The company’s business model is indeed “dying”. While I won’t bore you with another article bemoaning the “death” of physical retail, this decline can clearly be seen just by looking at GameStop’s financials.

GameStop Is A Little Rudderless

One thing that stands out to me is that a lot of the results are in veins of trying to “stop the bleeding” and not really “turning this ship around”. It hasn’t been from a lack of trying, though. GameStop has had multiple nixed “turn-around” plans. Ranging from the realistic pivots to e-commerce to pie-in-the-sky ideas like NFTs and Crypto. The company’s executive leadership team has been a revolving door, with five CEOs leaving in five years.

The latest CEO departure was Matthew Furlong who had stayed in the company for two years. A former Amazon (AMZN) executive, Furlong presided over an attempt to shift to e-commerce and NFTs. Both of which were “too little, too late”. With no new CEO currently, GameStop is pretty rudderless. Jefferies analyst Andrew Uerkwitz said it best;

“the revolving door of top execs at GameStop (GME) represents more of the same for the company. “It’s hard to have an opinion with no earnings call, little-to-no investor communication, and lack of consistent strategic vision,”

So how exactly do we value GameStop? We can make a current assumption that the re-pivoting to a “brick and mortar” business is where the company intends to go moving forward. The current game plan seems simple enough. Cut costs until its brick-and-mortar business becomes profitable.

As shown earlier GameStop has a lot of room for improvements on that front. Let’s make the assumption that the company can bring down its SG&A to 20% of Revenue (in line with the company’s retail peers).

These cost-cutting measures efforts include ditching its e-commerce pivot plan. GameStop has decided to close down its e-commerce customer service center and warehouse expansion plans. The company hasn’t disclosed any plans for any sort of massive store improvements. Because of this, I can make the assumption that in the best-case scenario, Revenue remains steady or slightly growing.

Therefore using TTM Gross Profit of $1.4 billion less 20% of TTM Revenue of $5.8 billion gives me a Net Income of roughly $203.8 million (or approximately $50 million per quarter). Multiply this by an earnings multiple of 10x to 15x, a rough valuation of GameStop should be in the $2 billion to $3 billion range. This is pretty far out from the company’s current Market cap of $4.98 billion.

Conclusion

In my view, in the best-case scenario of GameStop making a retail turn-around the stock should be trading between $7 to $10. Any premium above this price is due to the hope that the company could make some sort of fantastic turn-around. Maybe the company could still do this. After-all it is sitting on a large stockpile of cash to the tune of $1.3 billion. However, any attempts into new business lines have failed so far.

It’s been interesting to watch the GameStop drama unfold from afar. I wouldn’t exactly advise shorting GME stock due to the 19% short interest, but I find no compelling reason to buy at these prices.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in WMT, HD, LOW over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.