Summary:

- Chevron’s stock price has decreased due to impaired financial results in the past two quarters.

- The company is focusing on increasing production in the Permian Basin, but this may not significantly boost its financial results.

- Chevron’s profit margin and return on equity are lower than its peers, but its EV to free cash flow and EV/EBITDA ratios are higher.

- CVX is a Hold.

Mario Tama/Getty Images News

Investment thesis

Chevron Corporation’s (NYSE:CVX) stock price decreased from $188 per share at the end of January 2023 to $159 per share on 24 August 2023, as the company’s financial results were impaired in the past two quarters. CVX’s earnings per share dropped from $5.95 in 2Q 2022 to $3.46 in 1Q 2023, and decreased further to $3.20 in 2Q 2023 as the company’s liquids, and natural gas realized prices, and its refining margins dropped. It is important to know that despite lower realizations and lower margins, Chevron increased its domestic upstream and downstream production levels across all the segments, while its international upstream net production decreased driven by lower production levels in Canada and Nigeria.

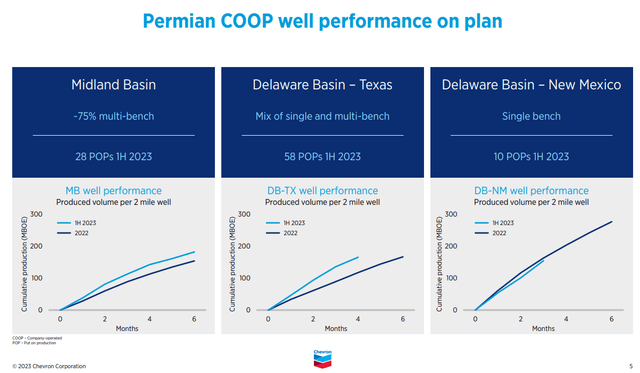

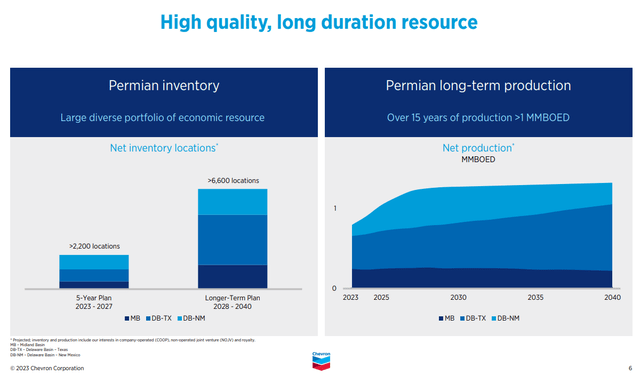

In its 2Q 2023 presentation, one of the most important things that Chevron anchored its future to, was its Permian development (see Figure 1). We can see that CVX’s cumulative production in the Midland Basin, and Delaware Basin (Texas) in the first half of 2023 was significantly higher than in the first half of 2022. CVX’s U.S. upstream net production (including liquids and natural gas) accounts for 63% of its total U.S. upstream net production. CVX has a large diverse portfolio of economic resources in the Permian Basin, and its 5-year and longer-term plan is to increase its net inventory locations in the Midland Basin, Delaware Basin (Texas), and Delaware Basin (New Mexico) at a fast pace, which means the company’s Permian long-term production in the following years is going to jump, driven by significantly higher production in Delaware Basin (New Mexico) in the first years (see Figure 2). At first glance, this might seem attractive, convincing investors that in the next few years, CVX’s financial results are going to be much stronger than they are now. However, it is not as simple as it seems.

CVX’s upstream earnings accounts for 82% of its total earnings, and the share of U.S. upstream earnings in the company’s total upstream earnings was only 33% in 2Q 2023. In 1H 2023, U.S. upstream earnings accounted for 34% of CVX’s total upstream earnings, and in the full year 2022, U.S. upstream earnings accounted for 42% of its total upstream earnings. However, in the full year 2021, U.S. upstream earnings accounted for 46% of its total upstream earnings, and in 2017, 2018, and 2019, the share of U.S. upstream earnings in the company’s total upstream earnings was more than 50%. What I’m trying to say is that in the current market condition, more Permian production levels may not be able to boost CVX’s financial results as the company’s international operation results are playing a more important role. It is worth noting that in the downstream segment, CVX’s domestic earnings are significantly higher than its international earnings (however, CVX’s downstream earnings accounts for only 25% of its total earnings).

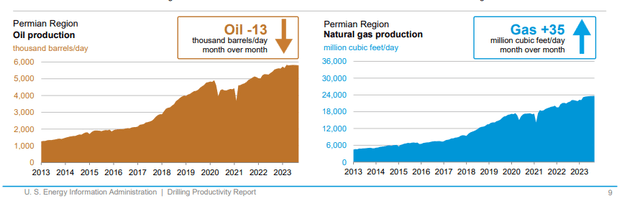

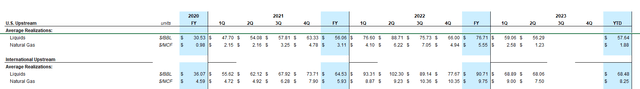

I’m not saying that CVX’s developments in the Permian Basin are negligible. As oil and natural gas production in the Permian Basin jumped in the past few years (see Figure 3), Chevron had to develop its footprint in the region to remain one of the biggest liquids and natural gas producers in the United States. However, as a great part of CVX’s financial earnings is linked to its operational results in other countries, you shouldn’t get too excited about its developments in the Permian Basin. Furthermore, it is important to know that in the past three years, CVX’s international liquids and natural gas average realizations were significantly higher than its U.S. liquids and natural gas average realizations (see Figure 4). According to EIA’s short-term energy outlook, crude oil prices in the second half of 2023 and the first half of 2024 are expected to be higher than in the first half of 2023. Also, Henry Hub natural gas prices in 2H 2023 and 1H 2024 are expected to be higher than in 1H 2023. As a result, overall, due to increasing production levels, and higher price realizations, Chevron’s financial results can improve in the next few quarters. However, as energy prices are not expected to reach their levels in 2022, I don’t expect CVX’s earnings to reach their levels in 2022. It’s simple math! A year ago, CVX’s stock price was trading at around $165 per share. In the third quarter of 2023, CVX had a net income per diluted share of $5.78, and in 2Q 2023, its net income per diluted share was $3.20.

Even with higher production and higher realizations in the third quarter of 2023, CVX’s net income per diluted share in 3Q 2023 is not expected to get close to its levels a year ago. Despite that, CVX’s stock price is now trading at around $160 per share. From my perspective, CVX’s current stock price is already representing the company’s developments in the Permian Basin, higher energy prices in 2H 2023 and 1H 2024, and its international developments by achieving first natural gas production from Gorgon Stage 2 development in Australia, reaching final investment decision to build a third gathering pipeline that is expected to increase production capacity from 1.2 to nearly 1.4 billion cubic feet per day in the Leviathan field in Israel, signing agreements to conduct pilot test on advanced loop geothermal technology in Japan.

Figure 1 – CVX’s Permian company-operated well performance on plan

Figure 2 – CVX’s Permian long-term production

Figure 3 – Oil and natural gas production in the Permian region

Figure 4 – CVX’s U.S. and international average realizations

Comparison with the peers

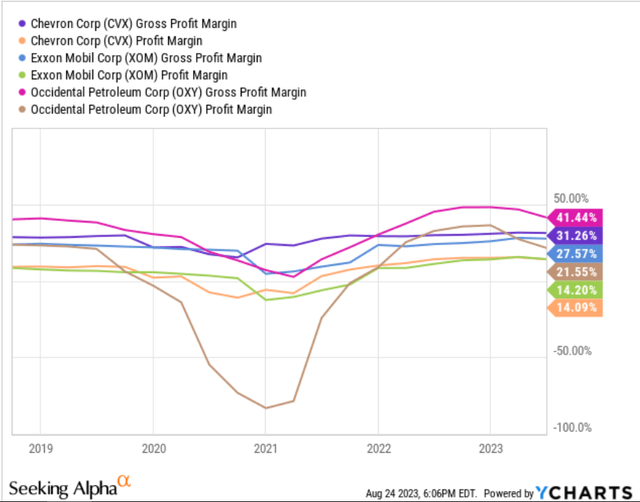

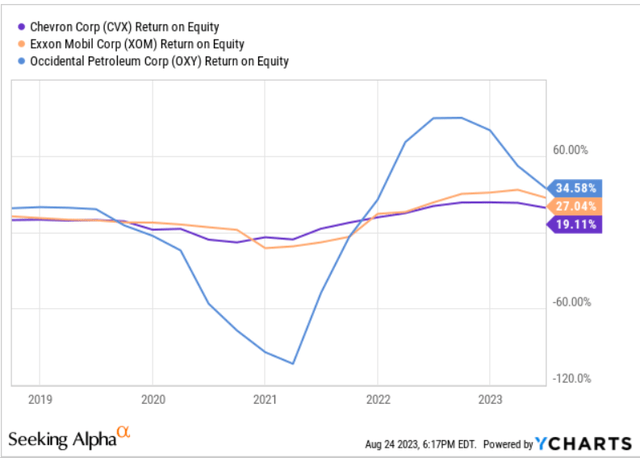

According to Figure 5, Chevron’s gross profit margin is higher than the gross profit margin of Exxon Mobil (XOM) and lower than Occidental Petroleum (OXY), which means that the company is in a normal position in turning every dollar it pays directly to make revenue to cash. However, CVX’s profit margin is lower than its peers, meaning that its ability to turn its revenues into net income is lower than its peers. Also, Chevron has a return on equity (ROE) of 19.11%, which is lower than the ROE of Exxon Mobil and Occidental Petroleum (see Figure 6).

Figure 5 – CVX’s gross profit margin and profit margin vs. peers

Figure 6 – CVX’s ROE vs. peers

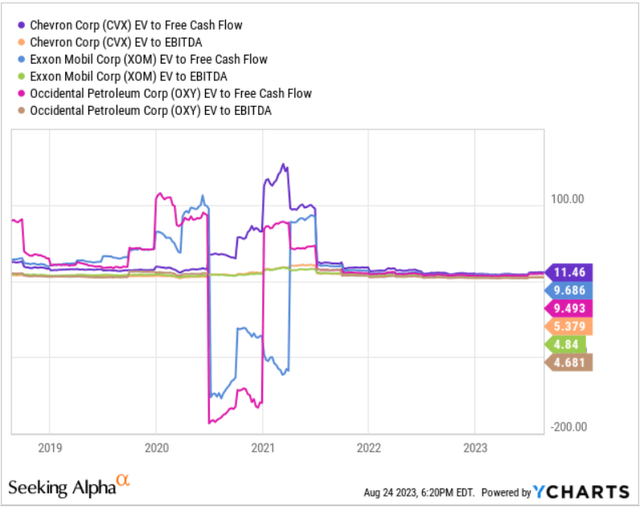

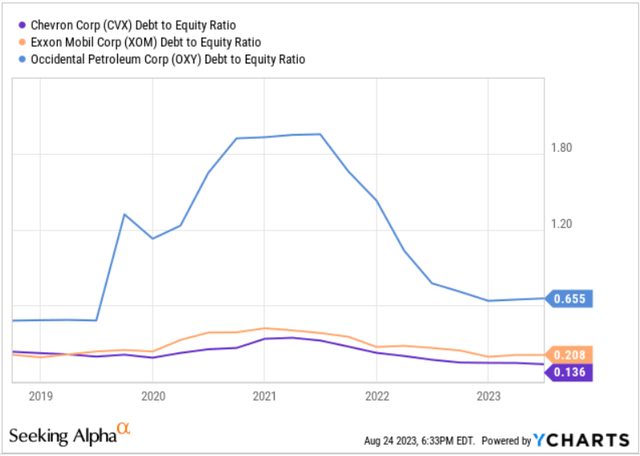

Thus, Chevron’s gross profit margin, profit margin, and return on equity, don’t suggest that the company is in a better financial position compared to its peers. Despite that, CVX’s EV to free cash flow and EV/EBITDA are higher than the EV to free cash flow and EV/EBITDA ratios of Exxon Mobil and Occidental Petroleum (see Figure 7). Chevron’s recent developments mean higher domestic and international production levels, and its recent acquisition of PDC Energy, which has high-quality assets in important U.S. Basins, (including 275000 net acres in the Denver-Julesburg Basin adjacent to Chevron’s existing operations, which add more than 1 billion barrels of oil equivalent proved reserves, and 25000 net acres in the Permian Basin), combined with its better leverage ratios (see Figure 8), may support its higher EV to free cash flow and higher EV/EBITDA compared to Exxon Mobil and Occidental Petroleum; however, cannot support higher prices in the current market condition.

Figure 7 – CVX’s EV to free cash flow and EV/EBITDA vs. peers

Figure 8 – CVX’s debt to equity ratio vs. peers

End note

Chevron’s 2Q 2023 financial results show that lower energy prices in the past two quarters hurt the company’s earnings and cash flow generation ability in a significant way. The company is increasing its domestic production by enhancing its footprint in the Permian Basin. Also, through its international developments in Australia, Japan, and Israel, tries to benefit more from the current market condition (in the past three years, CVX’s international liquids and natural gas realizations have been higher than its U.S. liquids and natural gas realizations). However, the current stock price is already representing its increasing production levels, and based on the current market outlook, energy prices are not going to jump shortly. Furthermore, compared to its peers, the stock is not overvalued or undervalued. CVX is a hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.