Summary:

- Spinoffs have been a popular move on Wall Street, with GE and Johnson & Johnson recently debuting new spinoffs.

- 3M Company may be the next to spin off a division, despite concerns over litigations and liability issues.

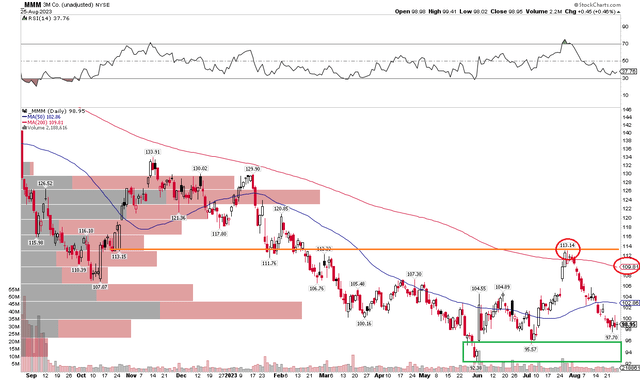

- The stock has a low valuation, high dividend yield, and potential upside factors, but technical risks are rising.

- I outline key price levels to monitor as we enter a bearish stretch on the calendar.

jetcityimage

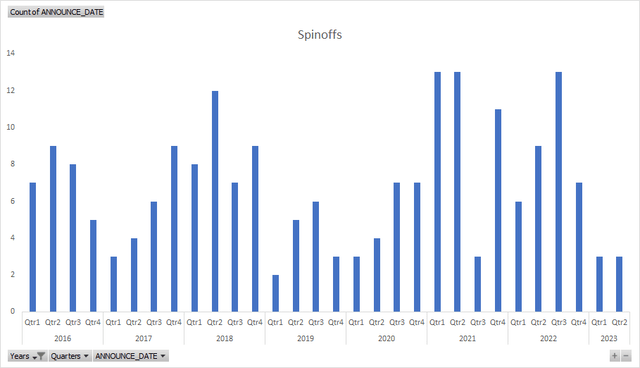

Spinoffs have been a popular value-accretive move by Wall Street executives over the past year. The major 2022 event was GE’s spinoff of its health care earlier in 2023. Johnson & Johnson (JNJ) then debuted Kenvue (KVUE) just two months ago amid a mini flurry of new issues hitting the tape at the close of the second quarter.

3M Company (NYSE:MMM) might be next on the docket. Amid concerning litigations and regarding its polyfluoroalkyl substances (PFAS) and combat arms liability, there are other positive factors to consider with MMM, such as the spinoff of 3M Health Care, which just recently appointed a CEO. That positive signal comes as the stock wavers following an earnings beat.

I reiterate my buy rating on 3M but acknowledge that technical risks are rising.

Global Quarterly Spinoff Count

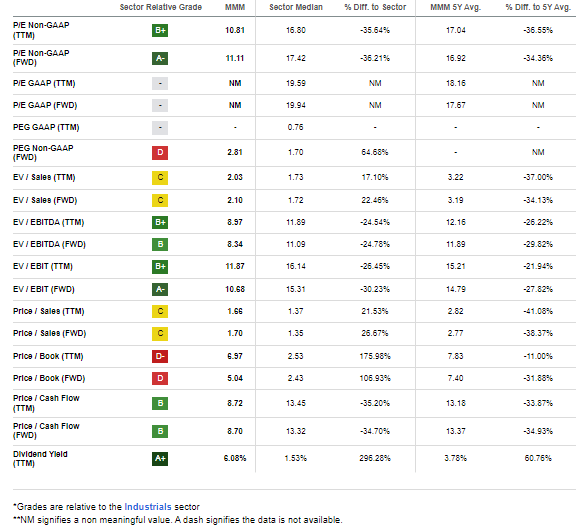

According to Bank of America Global Research, 3M Company was founded in 1902 as a mining concern. Today, the Minnesota-based company is a diversified, global manufacturer. Its businesses are technology-driven and organized under four segments: Consumer, Safety and Industrial, Transportation and Electronics, and Health Care. Its popular brands include Scotch, Post-It, 3M, and Thinsulate, and the firm holds over 500 US patents. The $54 billion market cap Industrial Conglomerates industry company within the Industrials sector trades at a low 11.2 trailing 12-month non-GAAP price-to-earnings ratio and pays a high 6.1% dividend yield.

Back in July, MMM reported a solid Q2 earnings beat. Per-share profits verified at $2.17 which was above the consensus estimate of $1.76 while revenue came in at $8.3 billion, a 4% annual decline, but better than the $7.9 billion forecast. Still, operating cash flow was up 34% from the same quarter a year ago with adjusted free cash flow jumping 44% to $1.5 billion. Assuaging investor concerns, the management team modestly raised its full-year adjusted EPS outlook for 2023 from $8.50 to $9.00 to $8.60 to $9.10.

Q2 performance was hallmarked by strong margins across its segments, driven by effective inventory management and cost control. Challenges remain, though, with weakness in China negatively impacting profitability. On the call, the management team indicated some disinflation trends, which impacted its logistics positively, but commodities and labor costs remained elevated. The company expressed confidence in its pricing strategy, mentioning pricing adjustments in the event of deflation.

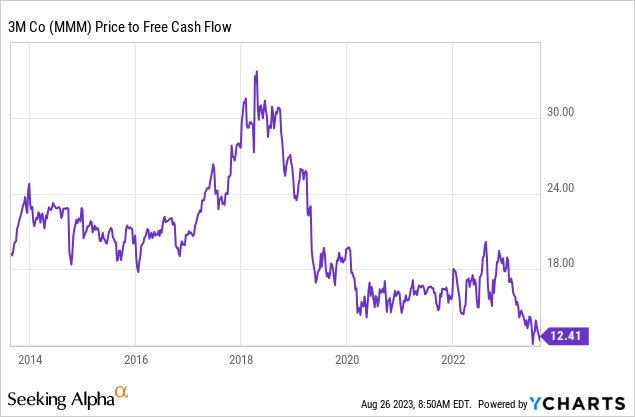

Very Cheap Price to Free Cash Flow Multiple

YCharts

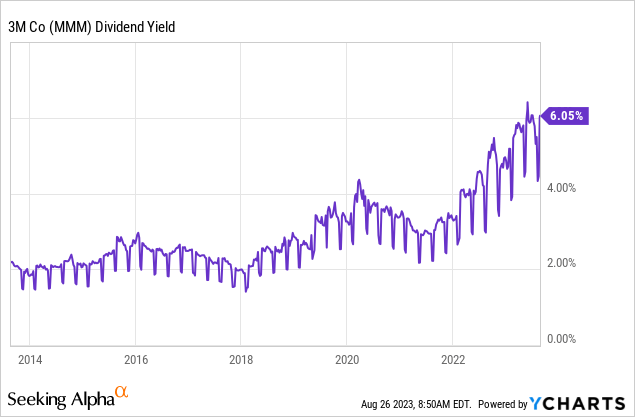

Historically High Dividend Yield

YCharts

Potential upside factors that could help the stock price include minimal market reaction to PFAS liability issues, perhaps caused by pessimism already being priced in, limited legislative action related to PFAS, and better-than-expected operational performance. Conversely, bearish factors that could pressure MMM include the need for increased investment impacting margins and a slower-than-expected recovery in the markets they operate. The firm could also cut its high dividend to help pay for legal settlements.

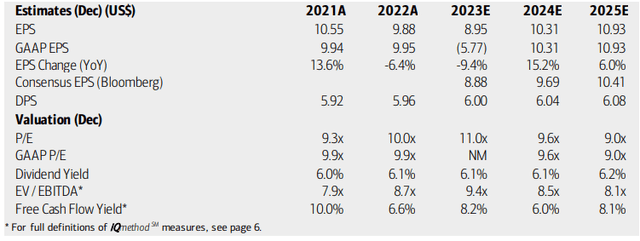

On valuation, analysts at BofA see earnings falling by more than 9% this year, but per-share profits are seen as snapping back 15% in the out year while 2025 EPS should approach $11. The Bloomberg consensus forecast is about on par with what BofA projects, though much depends on litigation outcomes over the coming months.

Dividends, meanwhile, are expected to rise modestly over the ensuing quarters while MMM’s earnings multiples are depressed, and its yield is historically high. Moreover, with an EV/EBITDA ratio that is significantly under the S&P 500’s average, the Industrials-sector giant appears attractive on valuation. Also consider that its free cash flow yield is more than 8% with current trailing 12-month free cash flow per share of $7.98.

3M: Earnings, Valuation, Dividend, Free Cash Flow Forecasts

Looking closer at the valuation, the 11 times forward operating P/E more than discounts the potential $30 billion of net present value after tax for all its legal settlements, in my view. If we assume normalized EPS of $10.50 and apply a 12 multiple, then the stock should trade near $126 today. That would still be a steep 29% discount to MMM’s 5-year average forward non-GAAP earnings multiple of 16.9.

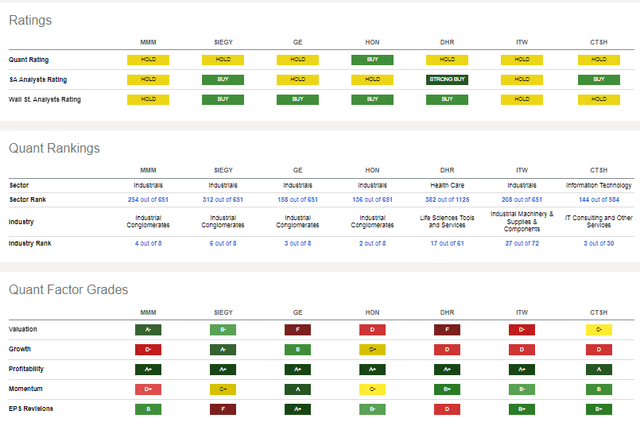

3M: Compelling Valuation Metrics

Seeking Alpha

Also consider that its Industrials sector peers trade, on average, with low 20s P/Es and while most of the industry is highly profitable, MMM has decent EPS revisions following its latest earnings report as the stock looks to find a floor. Still, I absolutely concede that a lack of clarity on what the legal payouts will be warrants a relative valuation discount to its competitors. Not shown, 3M’s consumer goods industry peers are likewise relatively pricey.

MMM: Peer Analysis

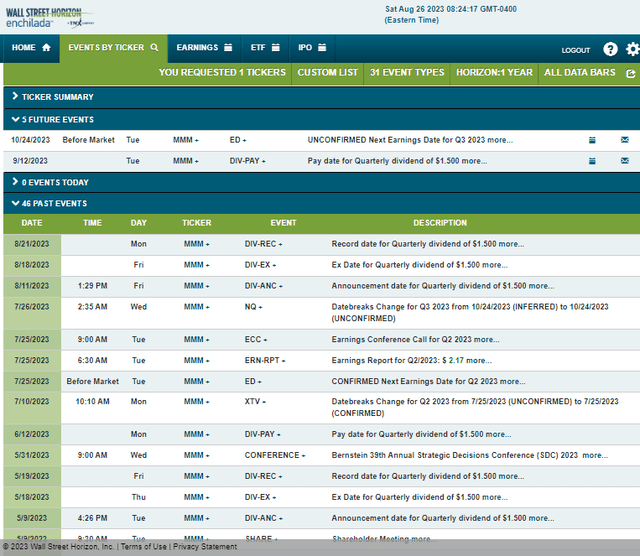

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q3 2023 earnings date of Tuesday, October 24 BMO. The calendar is light on volatility catalysts before then.

Corporate Event Calendar

The Technical Take

Back in the first half of the year, I initiated coverage of 3M with a buy rating, based mainly on its strong cash flow and profitability situation. I pointed out that the bears were in control of the technical chart, however. Notice in the graph below that not a whole lot has changed technically. The bears indeed took a swipe at the bulls by rejecting the stock as it attempted to rise above its long-term declining 200-day moving average in late July post-earnings.

With a current RSI momentum index reading back near a lackluster 40 level, shares cannot seem to sustain upward moves. While I see support in the low to mid $90s, I was really hoping to see firmer buying pressure step up to the plate under $100. We have not seen that. My concern is that the stock, continuing to probe its lows, might look to flush lower in a capitulation move.

While MMM has performed fine since my late May outlook, I assert that prospective buyers will have the chance to buy this one lower as we head into the dicey month of September. Finally, resistance is apparent at the 200-day and the $113 point. I noted longer-term resistance starting at $130 in May, so there’s considerable bearish overhead supply on rally attempts.

MMM: Shares Rejected At The 200dma

The Bottom Line

I reiterate my fundamental buy rating on MMM. The valuation remains decent in my opinion, but technical price action has not turned more favorable as I had initially hoped. Be ready to buy on a move into the $80s if we get it as that may offer a better risk/reward opportunity on this high free cash flow Industrials sector stock while long-term investors should own 3M for its high yield, free cash flow, and depressed valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.