Summary:

- Teva Pharmaceutical operates globally, offering affordable health solutions through its portfolio of generic medicines, over-the-counter products, and innovative drugs.

- The company faces challenges such as patent expiration and competition but shows potential for growth with new drug prospects and a revenue boost from Anda.

- Financial performance presents a mixed picture, with concerns about earnings revisions, negative revenue growth, and high total debt.

- Recommendation: Hold, with careful monitoring of debt reduction and new product performance.

JHVEPhoto

Introduction

Teva Pharmaceutical (NYSE:TEVA), founded in Israel in 1944, provides affordable health solutions globally. With a presence in the United States, Europe, and more, its portfolio includes generic medicines, over-the-counter products, and innovative drugs. Teva operates in three segments: North America, Europe, and International Markets, and offers additional services like contract manufacturing.

In my analysis of Teva’s Q1 2023 earnings, I observed both its potential and its challenges in its broad portfolio. I noted that Anda’s revenue boost and new drug prospects could improve earnings and assist in debt relief. Teva’s growth in products like Ajovy and Austedo showed their R&D commitment, while the decrease in earnings from certain drugs highlighted patent expiration challenges. Despite its innovation and dedication, Teva’s substantial debt, competition, and lack of a game-changing drug led me to recommend a ‘Hold’ for investors, advising careful tracking of debt reduction, new product performance, and competition handling.

Recent developments: Today, Teva Pharmaceutical reported Q2 2023 revenue of $3.9B, a 2% YoY growth, with increased sales in North America and revised full-year revenue guidance. Net income fell ~17%, while cash flow more than doubled.

The following article provides an in-depth look and analysis of Teva’s Q2 earnings report and concludes with a “Hold” recommendation.

Financial Performance

In the second quarter of 2023, Teva reported revenues of $3.878 billion, a 2% increase from the previous year, driven mainly by higher sales in North America from Austedo and Anda, and generic products internationally. The revenue increase in local currencies was 4%. Exchange rate movements negatively impacted revenues and operating income by $51 million and $38 million, respectively.

Gross profit was flat at $1.796 billion, with a decrease in both gross profit margin and non-GAAP gross profit margin due to rising costs and changes in revenue streams. R&D expenses increased 5%, and S&M expenses rose 2%, while G&A expenses decreased 2%.

Operating loss was $646 million, improving from a $949 million loss in Q2 2022, and adjusted EBITDA remained flat at $1.125 billion. Financial expenses were $268 million, and a tax benefit of $16 million was recognized. Non-GAAP tax rate was 15.2%.

Net loss was $863 million, and loss per share was $0.77. Non-GAAP net income was $629 million with earnings per share at $0.56. Free cash flow was $632 million, an increase from Q2 2022.

As of June 2023, Teva’s debt stood at $20.678 billion, slightly reduced from December 2022, with recent repayments and new issuances taken into account. The average debt maturity extended to 6.2 years.

Taking a closer look at the North America segment for the three months ended June 30, 2023, the revenue summary is as follows:

- Generic products: Revenue decreased by 6% to $969 million, mainly due to increased competition.

- Ajovy: Revenue increased by 16% to $57 million, mainly due to growth in volume.

- Austedo: Revenue increased by 51% to $308 million, reflecting growth in volume and the launch of Austedo XR in May 2023.

- Bendeka and Treanda: Revenue decreased by 17% to $69 million, mainly due to the entry of a generic product into the market.

- Copaxone: Revenue decreased by 33% to $64 million, mainly due to generic competition and alternative therapies.

- Anda (third-party products): Revenue increased by 27% to $392 million, mainly due to higher demand.

Overall, the total revenue for major products and activities in the North America segment increased by 5% to $1.991 billion. The changes in revenue were driven by various factors, including increased competition, growth in volume, new product launches, and shifts in market share.

Now, turning to 2023 guidance: Revenue projections were revised to $15.0-$15.4 billion from $14.8-$15.4 billion with the company anticipating free cash flow between $1.7 and $2.1 billion.

Stock Evaluation

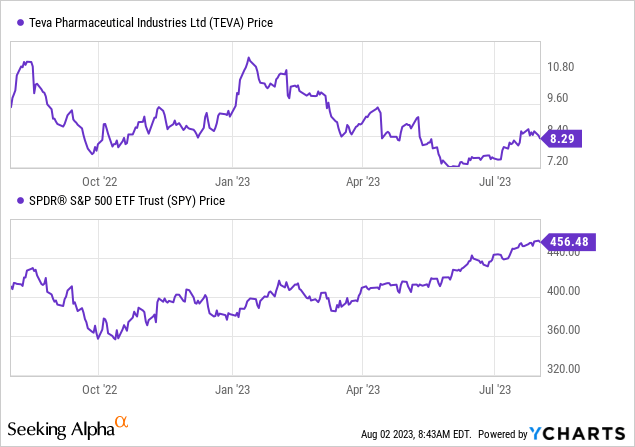

Taking a look at Seeking Alpha data: TEVA’s financial outlook presents a mixed picture. Earnings estimates show a recovery from a -9.29% YoY in 2023 to a growth of +4.80% in 2025, with sales slowly increasing. Earnings revisions are concerning with 9 down revisions. Valuation metrics like P/E Non-GAAP at 3.67 and EV/EBITDA at 7.68 appear attractive. Growth is rated poorly with negative revenue growth YoY and 3-year CAGR. Profitability is strong with 45.66% gross profit margin, but negative net income margin and ROE are red flags. Momentum is lagging with negative returns over various periods, and the company has high total debt of $20.67B relative to a $9.41B market cap.

My Analysis & Recommendation

After a detailed analysis of Teva Pharmaceutical’s Q2 2023 results, I must acknowledge that the performance presents an intriguing blend of opportunities and challenges that requires careful consideration.

Encouraging signs abound, especially in the North American segment. The revenue growth of 51% for Austedo and 27% for Anda is promising. These leaps showcase the strength of Teva’s R&D investment, reflecting successful product launches and strong demand. It’s an indication that Teva is on the right path, reinforcing its portfolio and adapting to market needs.

However, caution must be exercised. The operating loss, while improving, is still substantial at $646 million. Despite growth in specific products, overall revenue growth was a modest 2%, with net income falling by 17%. The continued decrease in certain products like Copaxone reveals underlying vulnerabilities. The high total debt, negative net income margin, and lukewarm growth projections further add to the cautionary tale.

So, is Teva on the right path? Partially, yes. The company appears to be making the right moves in areas like Anda and Austedo, and its ability to reduce debt even slightly is commendable. But it’s a complex picture, with some persistent issues that cannot be ignored.

As for investment recommendations, Teva does appear to be a potentially attractive investment, but mostly for a specific type of investor. If you are an investor with a higher risk tolerance, attracted to the potential in pharmaceutical growth, and patient enough to wait for the realization of R&D investments, Teva might suit your portfolio.

However, considering all factors, I find it necessary to maintain my prior “Hold” recommendation. While there’s clear growth in some areas, the lingering challenges and complex financial landscape do not yet inspire sufficient confidence to shift to a more aggressive stance. Close monitoring of Teva’s debt reduction, new product performance, and handling of competition is still warranted, with an eye on future quarters to reevaluate the investment stance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content only and should not be construed as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. Any predictions made in this article regarding clinical, regulatory, and market outcomes are the author's opinions and are based on probabilities, not certainties. While the information provided aims to be factual, errors may occur, and readers should verify the information for themselves. Investing in biotech is highly volatile, risky, and speculative, so readers should conduct their own research and consider their financial situation before making any investment decisions. The author cannot be held responsible for any financial losses resulting from reliance on the information presented in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.