Summary:

- Teva Pharmaceutical Industries Limited, valued at $9.2bn, is a leading player in the global generic drug industry, but its growth is not impressive and it is valued at a significant discount to the rest of the sector.

- The company’s long-term debt increased after acquiring Allergan for $40.5bn in 2015, and most of its free capital has gone towards paying this down, leaving little for investment in new technologies and revenue streams.

- Despite a decent margin profile, a struggling bottom line makes it difficult to suggest even a hold.

Solskin

Investment Outline

Teva Pharmaceutical Industries Limited (NYSE:TEVA) has made a name for itself in the global generic drug industry. They boast a leading position and the market cap currently sits at $9.2 billion, but it is valued at a significant discount to the rest of the sector. An FWD p/e of just 3.4 as a result of growth perhaps not being that impressive.

Without a dividend being distributed either, there isn’t anything significant that investors can get from the company right now. The company has over the last 10 years posted a very disappointing share price growth, down 80%. It all seems to be traced back to 2015 when TEVA acquired the Dublin-based company Allergan for $40.5 billion. This drastically increased the long-term debt for TEVA and all of the free capital seemingly has to go towards paying this down instead of distributing to shareholders. They also lack significant capabilities to invest in the technologies and revenue streams with so much debt hanging over them. Rating TEVA a sell here as no catalyst seems to be in sight.

Recent Developments

In recent news TEVA together with Alvotech (ALVO) has reached an agreement with Johnson & Johnson (JNJ) for the licensing of one of their products, the AVTO4, the Alvotech proposed biosimilar to Stelara. The new settlement between the parties included grants a license with an entry date for AVTO4 in the United States no later than February 21, 2025.

Besides this, the company posted back in May its earnings report, Q1 FY2023. The revenues came in at $3.7 billion and the non-GAAP EPS at $0.4. The CEO Mr. Richard Francis seemed happy with the results, stating the following, “I am pleased to report that our revenues for the first quarter reached $3.7 billion, marking a 4% increase in local currency terms, compared to the first quarter of 2022: We have seen growth across all regions – Europe is experiencing a solid 9% increase, International Markets an 8% increase, and North America is up 2%”.

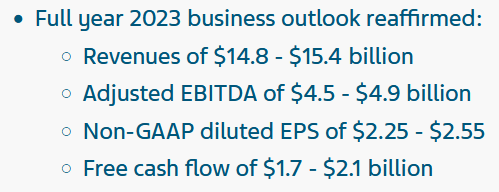

2023 Outlook (Earnings Presentation)

The company also maintained its outlook for 2023 with FCF coming in at $1.7 – $2.1 billion in total. It seems highly likely that TEVA will continue to pay down debt though. In 2022 for example, debt repaid reached $7.1 billion. This seems to have been partly helped by diluting shares. R&D expenses have over the last few years decreased quite heavily and I think this showcases why the only thing investors will get with TEVA is a slow and steady deterioration of an investment position. The lack of incentive and possibility to invest aggressively and gain new revenue streams result in a low valuation such as this.

Margins

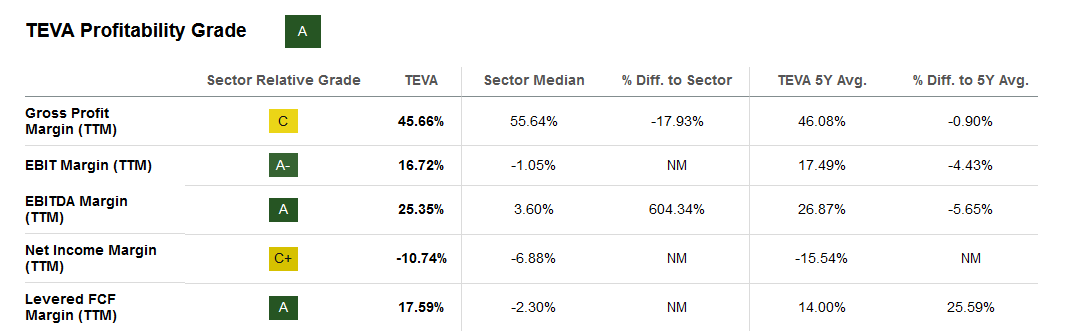

Margin Profile (Seeking Alpha)

As far as the margin profile goes for TEVA it’s quite decent. The company does, however, struggle with its bottom line, seeing it negative 10% in the last 12 months presents investors with a lot of risk here though. The first quarter to 2023 also included a net loss for GAAP EPS of $0.18.

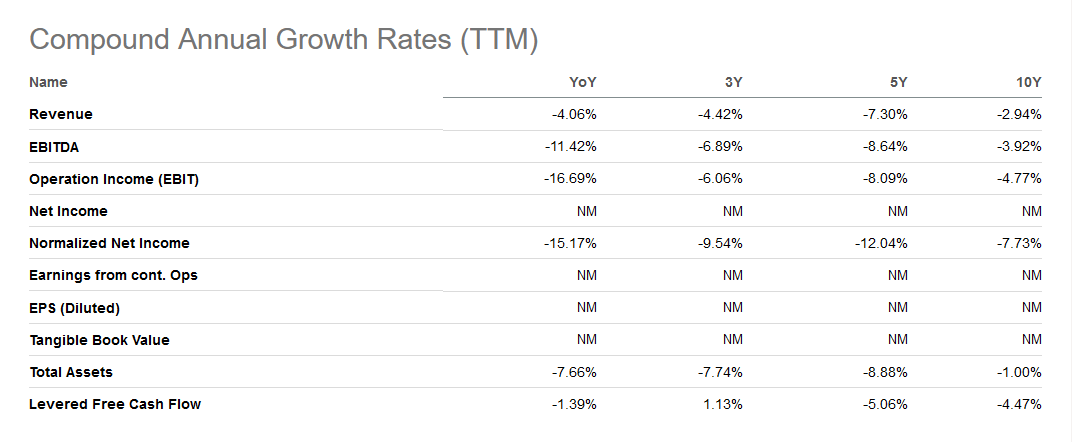

Historical Growth (Seeking Alpha)

It seems to have been very difficult for TEVA to have a positive bottom line over the years and the normalized net income has on average decreased by 7.73% yearly over the last 10 years. Even though previous results don’t always paint the picture of what the future might hold, I think in this case it does. TEVA made a very expensive acquisition that put them in a very leveraged position where they lacked the capital to invest in new projects and revenue streams. That ultimately resulted in disappointing growth and is the reason for the low multiple it receives.

Valuation

The valuation of TEVA is very low when compared to the rest of the sector, but as we have outlined, there seem to be some very strong reasons for this being.

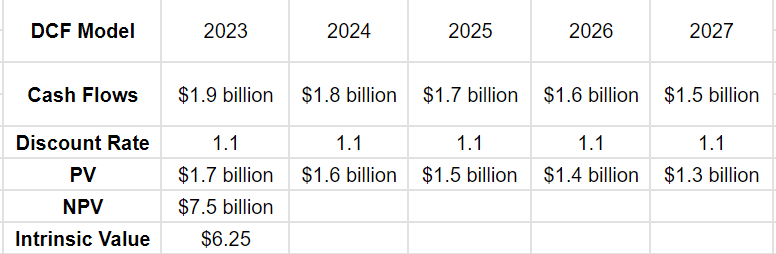

DCF Model (Author)

The DCF model above here shows that even though TEVA is generating strong FCF it doesn’t make an appealing buy. I have expected them to see a YoY decrease of around 5% for the FCF going forward until 2027. This is in line with their historical performance. I am also not accounting for the long-term debt that still sits at $19 billion. That would reduce the intrinsic value to $0 per share, as the debt position trumps the FCF. But even with the intrinsic value I have above, TEVA is today trading about 30% higher. TEVA has a long way to grow still and give investors confidence that it can grow efficiently. I think that investors’ capital is better deployed elsewhere. With a rich premium still to what my model produced a sell rating continues to make sense here.

Risks

TEVA is strategically rebalancing its portfolio and product mix to emphasize higher-margin innovative medicines while still maintaining its presence in the generics market. While the focus on innovative medicines presents growth opportunities, the company must remain vigilant about the potential impact of the generics business slowdown.

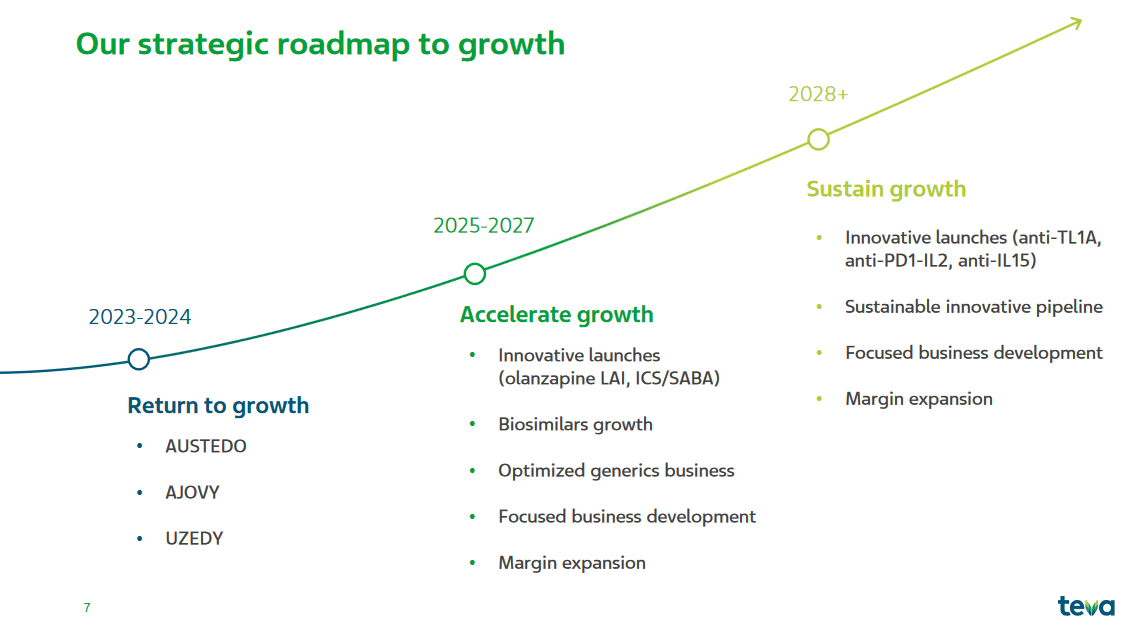

Strategic Roadmap (Earnings Presentation)

If the generics business continues to decline rapidly, it may hinder TEVA’s growth plans, potentially offsetting gains from its innovative medicine portfolio, including products like Austedo. Moreover, a faster-than-anticipated slowdown in generics could affect the company’s cash generation, making it more challenging to repay debts. As TEVA navigates this transition, striking the right balance between generics and innovative medicines will be crucial for sustained growth and financial stability.

Investor Takeaway

TEVA might look like a steal when just looking at the low multiples. But the poor history of growth seems to be a very good reason for this discounted price. It looks more and more like a value trap the deeper you dig. With still a large amount of debt, 2x the market cap the FCF is going to be needed towards paying it down. It will take a long time until it’s reduced enough that TEVA could establish a dividend or be buying back shares rather the diluting them. I don’t see an investment case and holding a position lacks upside potential. As a result, I view TEVA stock as a sell right now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.