Summary:

- Amidst a sharp rise in long-duration treasury yields, Amazon’s stock has declined by ~7% from its post-earnings high of ~$144.

- Amazon’s Q2 2023 earnings report showed solid revenue and EPS beats, with growth stabilization at AWS and improved profitability in the retail business serving as highlights for the quarter.

- Amazon’s technical chart and quant factor grades remain supportive, but there is a potential for a near-term correction in the stock.

- In my view, any significant dip in Amazon should be viewed as a buying opportunity, as AMZN stock remains significantly undervalued.

- At ~$135 per share, I continue to rate AMZN stock a “Buy”, with a strong preference for slow, staggered accumulation.

4kodiak/iStock Unreleased via Getty Images

Introduction

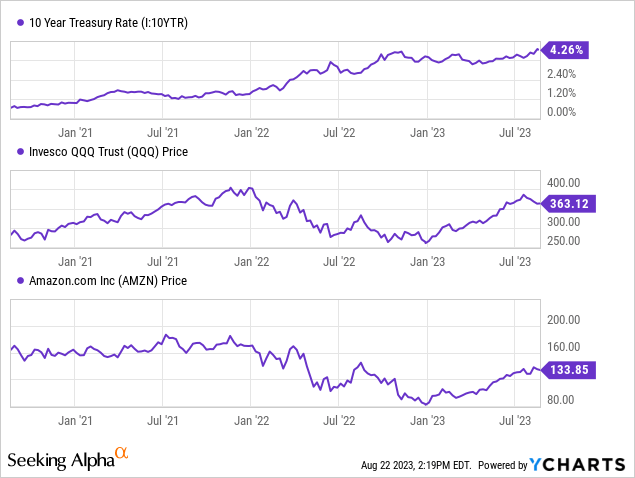

With long-duration treasury yields climbing above March 2023 highs, the tech-led equity market rally has been losing steam since the start of August. While Amazon’s (NASDAQ:AMZN) stock is still in the green for this month, AMZN has declined by ~7% from its post-ER highs of $143.93 per share.

In my previous article on Amazon [Can Amazon Stock Reach $150 In 2023?], I laid out the path for Amazon’s stock to reach $150 by the end of 2023 whilst rating it a “Buy” at $130 in early July. With the rise in long-duration treasury yields, equity risk premiums are getting narrower, and stocks are becoming less attractive relative to bonds. Today, we will briefly review Amazon’s Q2 2023 earnings report, and then analyze its technical chart, quant factor grades, and valuations to make an informed investment decision.

Brief Overview of Amazon’s Q2 2023 Results

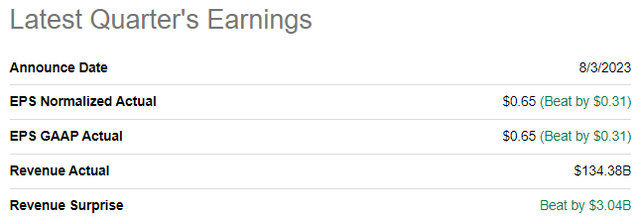

For Q2 2023, Amazon reported revenues of $134.38B (up +11% y/y), beating street estimates of $131.34B by ~2.31% (or $3.04B), on the back of growth stabilization at AWS and stronger-than-expected performance in Amazon’s retail ecosystem. While Amazon’s top line beat was solid, the tech conglomerate absolutely annihilated consensus expectations on earnings, with a normalized EPS of $0.65 (vs. est. $0.34).

SeekingAlpha Amazon Q2 2023 Earnings Release

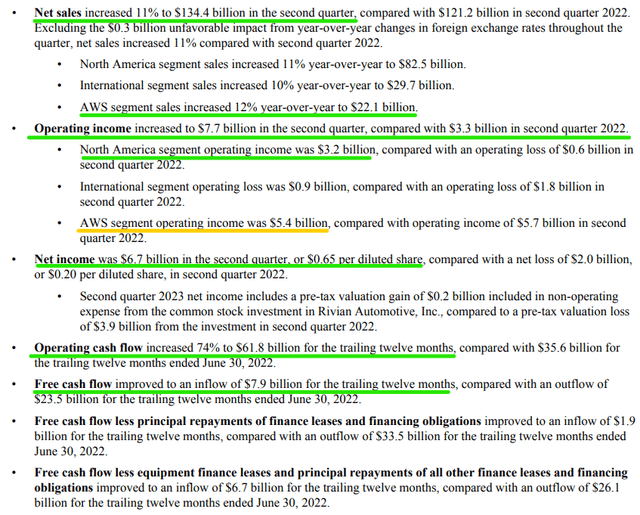

During Q2 2023, Amazon’s operating income increased to +$7.7B, driving TTM operating cash flow higher to $61.8B (up +74% y/y). More importantly, Amazon is firmly back to positive free cash flow generation as of the end of Q2 2023, with TTM FCF reaching +$7.9B this quarter.

While AWS continues to serve as Amazon’s primary profit center (contributing nearly 70% of AMZN’s total profits), the earnings surprise came from Amazon’s retail business turning profitable. After going through an intense CAPEX-spending cycle that saw Amazon’s retail business doubling its footprint since the start of the COVID-19 pandemic, Amazon is now starting to reap the benefits of economies of scale as capacity utilization and rationalization get better with a new regional distribution network.

Amazon Q2 2023 Earnings Release

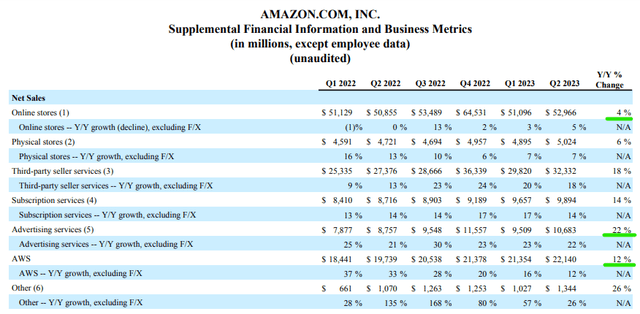

In addition to strength in its retail ecosystem, Amazon’s digital advertising business showed continued momentum, with y/y growth of ~22% in Q2 2023. Lastly, Amazon’s cloud business [AWS] outperformed growth expectations during Q2 (y/y growth of 12% vs 11%), with management commentary pointing toward a trough for AWS’ growth rates.

As I see it, Amazon is re-accelerating top-line growth whilst improving profitability. There’s a lot of room for margin optimization at Amazon, but the company is clearly headed in the right direction. Here’s what Amazon’s CEO, Andy Jassy, had to say about this quarter:

We continued lowering our cost to serve in our fulfillment network, while also providing Prime customers with the fastest delivery speeds we’ve ever recorded. Our AWS growth stabilized as customers started shifting from cost optimization to new workload deployment, and AWS has continued to add to its meaningful leadership position in the cloud with a slew of generative AI releases that make it much easier and more cost-effective for companies to train and run models (Trainium and Inferentia chips), customize Large Language Models to build generative AI applications and agents (Bedrock), and write code much more efficiently with CodeWhisperer. We’re also continuing to see strong demand for our advertising services as the team keeps innovating for brands, including the ramp up for Thursday Night Football with the ability for advertisers to tailor their spots by audience and create interactive experiences for consumers. We remain excited about what lies ahead for customers and the company.

Source: Amazon Q2 2023 Earnings Release

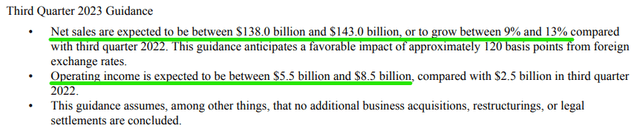

After a horror show in 2022, Amazon has relatively easy comps for the rest of this year; however, re-accelerating growth back up to low-teens in this macroeconomic environment is no mean feat. For Q3 2023, Amazon is projected to record net sales of $138-143B (up 9-13% y/y), and given recent quarterly beats, I wouldn’t be surprised if this guide was conservative.

Amazon Q2 2023 Earnings Release

As you may know, my investment thesis for Amazon is centered around its twin growth engine of AWS and Ads. In the Q2 report, I see signs of stabilization at AWS and continued strong growth in Ads. And Amazon’s retail business turning profitable at scale is like free icing on top of an already incredible cake. Overall, I am pleased with Amazon’s Q2 results. Barring a significant deterioration in macro, I would expect Amazon’s financial performance to remain robust over upcoming quarters.

Amazon’s Technical Chart and Quant Factor Grades

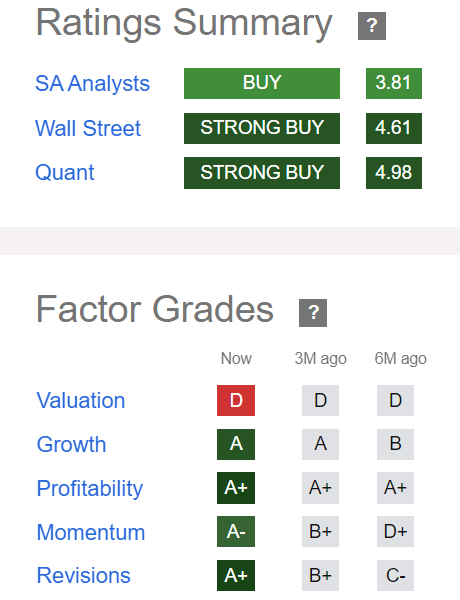

According to Seeking Alpha’s Quant Rating system, Amazon is rated a “Strong Buy” with a score of 4.98/5. As we have remarked in the past, Amazon’s quant factor grades have been trending in the right direction in recent months.

Amazon’s Quant Rating (Seeking Alpha)

With Amazon back to reporting strong operational cash flow generation (and positive net income) in H1 2023, AMZN’s “Profitability” grade of “A+” is now beyond the scope of any doubts. As Amazon re-accelerates growth and improves its margin profile, “Growth” and “Revisions” of “A” and “A+” are looking a fair reflection of strong ongoing business momentum and near-term expectations.

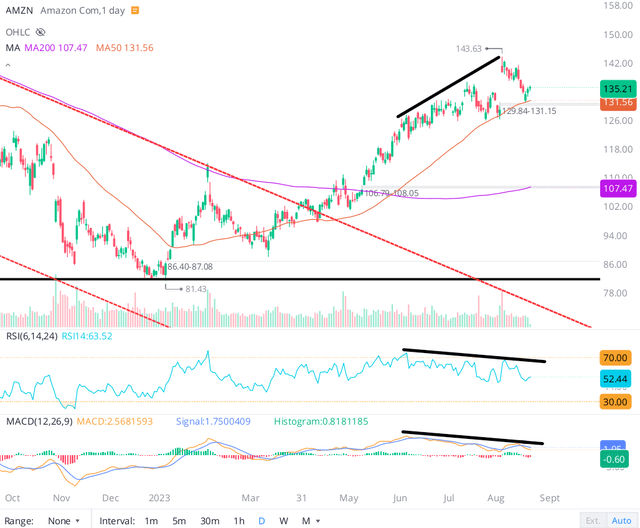

In 2023, Amazon’s stock has had an incredible run, and this strength is visible in its “Momentum” grade, which has improved from “D+” to “A-” over the last six months. While mega-cap tech names like Apple (AAPL) and Microsoft (MSFT) have lost a good bit of momentum in recent trading sessions, Amazon’s bullish momentum is still intact with AMZN stock trading above both 50-DMA and 200-DMA levels.

That said, I see a negative divergence between AMZN’s stock and key indicators such as RSI and MACD. Given this setup, Amazon may also join its peers in breaking below the 50-DMA level in the near future. And if AMZN breaks below the ~$130 (50-DMA) level, I can see the stock re-testing the $110-120 range.

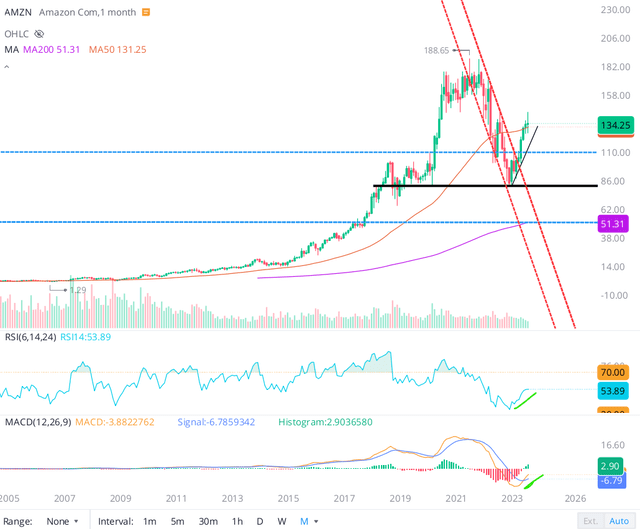

Now, a near-term correction in AMZN is possible (in fact it is quite likely); however, the longer-term setup for Amazon is looking bullish, with MACD on the monthly chart curling up and RSI (54) still far off overbought territory.

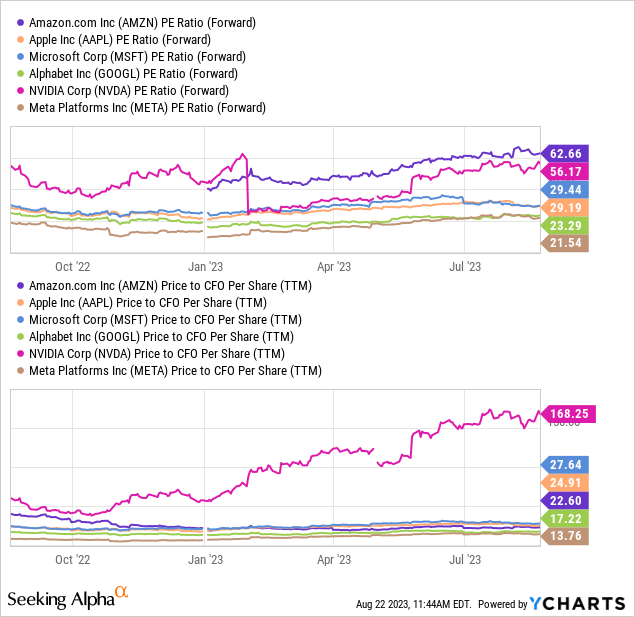

Lastly, AMZN’s “Valuation” factor grade continued to hold up at a lowly “D” rating. On a relative earnings basis, Amazon looks expensive compared to its industry peers, and that’s reflected in AMZN’s valuation factor grade.

However, as we know, Amazon’s earnings are masked by its intense CAPEX-spending cycle, which the company is slowly exiting. In my view, investors should look at operational cashflows to evaluate Amazon. And as you can see, on a Price-to-CFO basis, Amazon is one of the cheaper big tech names, along with Alphabet (GOOGL) and Meta (META).

Now, let’s determine Amazon’s intrinsic value and projected returns using TQI’s Valuation Model.

AMZN’s Fair Value and Expected Return

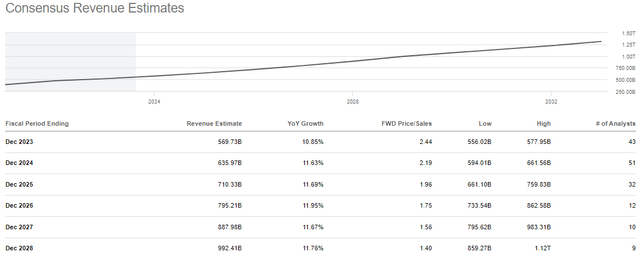

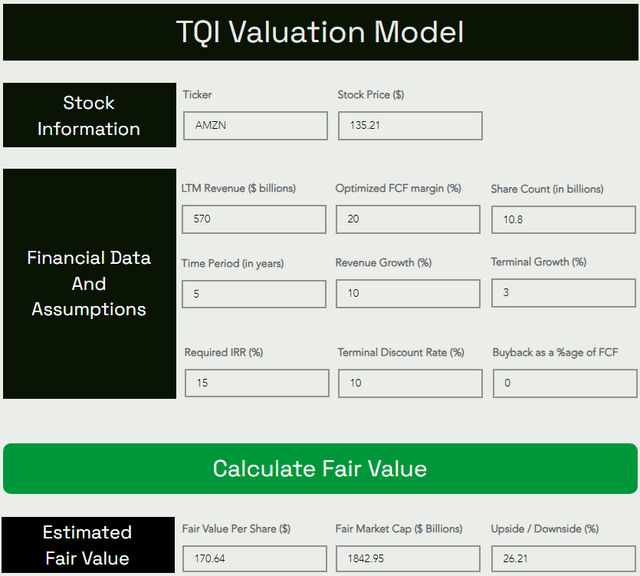

To build a margin of safety into our valuation model for Amazon, I have assumed a 5-yr CAGR sales growth rate of 10% (vs. current consensus analyst CAGR estimates of 11.5%).

While AMZN bears would disagree with an optimized FCF margin of 20%, I firmly believe that Amazon’s high-margin businesses, i.e., AWS and Ads, can lead FCF margins even higher than 20% over the long run. All other assumptions are relatively straightforward, but if you have any questions, please feel free to share them in the comments section.

Here’s my updated valuation model for Amazon (including 2023E revenue):

TQI Valuation Model (TQIG.org)

According to TQI’s Valuation Model, Amazon’s fair value is ~$171 per share (or $1.84T). With the stock trading at ~$135 per share, AMZN is trading at a sizeable discount to its intrinsic value.

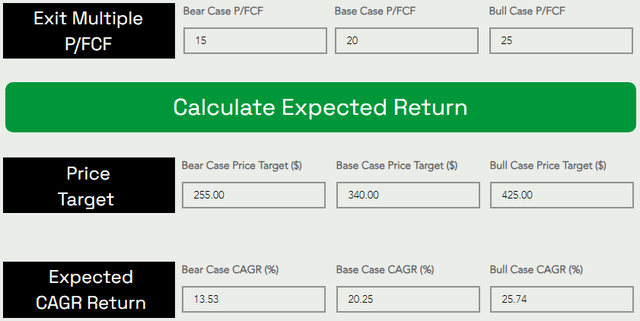

Predicting where a stock would trade in the short term is impossible; however, over the long run, a stock would track its business fundamentals and obey the immutable laws of money. If the interest rates were to stay depressed, higher equity multiples would be justifiable. However, I work with the assumption that interest rates will eventually track the historical long-term average of ~5%. Inverting this number, we get a trading multiple of ~20x.

TQI Valuation Model (TQIG.org)

Assuming an exit multiple of 20x P/FCF, I see Amazon’s stock price rising from $135 to $340 at a CAGR rate of ~20% over the next five years. With Amazon’s 5-yr expected CAGR return still exceeding my investment hurdle of 15%, AMZN stock remains a “Buy” under our valuation process.

Concluding Thoughts

From a long-term standpoint, improving business fundamentals, strong quant factor grades, and long-term risk/reward [based on absolute valuation] render Amazon stock a buy. In Q2, Amazon outperformed expectations, and displayed its potential as a massive cash cow. Despite continued macroeconomic uncertainty, Amazon remains a fundamentally sound business, with market-leading positions in humongous markets – e-commerce and cloud.

As we discussed in one of my previous notes, Amazon is likely to be a big beneficiary of the secular megatrend of artificial intelligence. And I continue to view Amazon as a reasonably-valued AI stock.

The near-term technical setup is looking somewhat dicey and elevated (+ rising) long-duration yields could pressure AMZN stock (along with the broader market) in upcoming weeks. Hence, I strongly suggest slow, staggered accumulation in AMZN over lump sum cash deployment.

Key Takeaway: I rate AMZN a “Buy” at $135, with a strong preference for staggered accumulation.

Thank you for reading, and happy investing! Please share any questions, thoughts, and/or concerns in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

At TQI, we are pursuing bold, active investing with proactive risk management to navigate this highly uncertain macroeconomic environment. Join our investing community and take control of your financial future today.