Summary:

- Adobe has soared this year due to being perceived as a generative AI winner.

- Management is bullish for how generative AI can supplement their product portfolios and boost revenue growth.

- That said, generative AI may also help the competition to catch up.

- I discuss the valuation and what exactly is being priced into the stock.

wwing/iStock Unreleased via Getty Images

Adobe (NASDAQ:ADBE) is posting strong fundamental results and that ironically may be causing the somewhat bubbly valuations at which the stock trades at. The stock is now being seen as a beneficiary of generative AI, which at first makes sense given the company’s quick integration of generative AI in its products. While generative AI may help accelerate growth in the near term, I maintain concerns that it may also help competitors narrow the gap. In the meantime, ADBE is trading at very rich valuations which may make it difficult to provide strong returns relative to the broader market index. I reiterate my neutral rating for the stock.

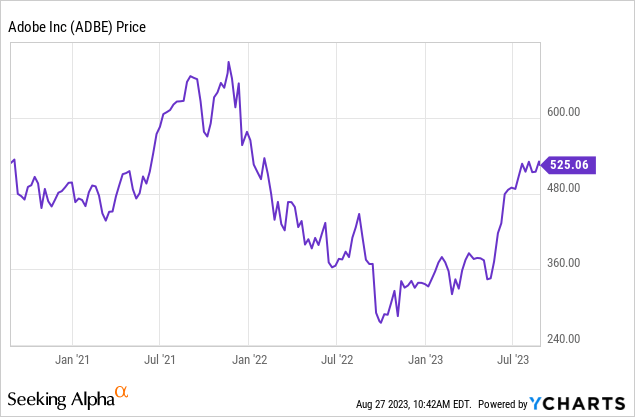

ADBE Stock Price

ADBE has been able to capitalize on the rise of generative AI to recover much of its losses. There was a time where I made the argument that the stock was not adequately valuing the quality of the earnings power, but this rally is overdone.

I last covered ADBE in June where I explained why I was downgrading the stock from buy to hold. There, I discussed expectations for generative AI to lead to near term benefits but tail-end risk. We are in the early stages of this and I caution investors to not be hypnotized by the strong near term results.

ADBE Stock Key Metrics

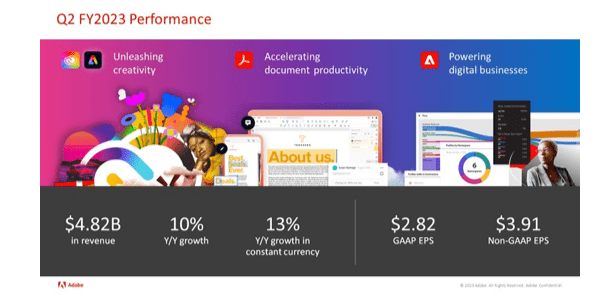

In its most recent quarter, ADBE delivered 10% YOY revenue growth to $4.82 billion, surpassing guidance of $4.78 billion, and non-GAAP EPS of $3.91, surpassing guidance of $3.80 and representing growth of 16.7% YOY.

FY23 Q2 Presentation

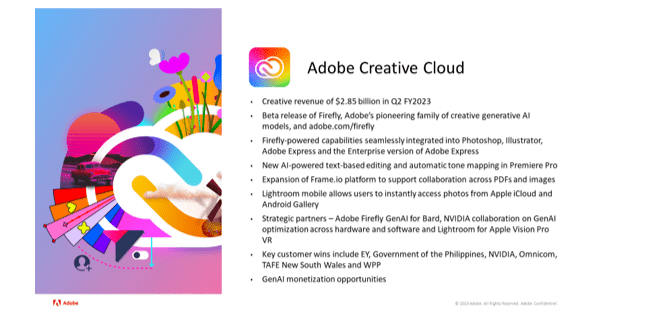

ADBE delivered strong 14% YOY growth at its creative cloud division.

FY23 Q2 Presentation

On the conference call, management noted that their generative AI offering Firefly is boosting their Photoshop product, with it generating a “viral response.” Management called Firefly and Generative Fill co-pilot as being two of our most successful beta releases in company history.”

The company is quickly moving to integrate generative AI in its other products, including a new product in Generative Recolor which would be housed in Illustrator. At the very least, ADBE has real claims to being considered a generative AI play.

ADBE sustained strong 14% growth at its document cloud division, which generated $659 million in revenue in the quarter. It is worth noting that ADBE is seeing faster growth rates here than DocuSign (DOCU) in spite of similar revenue bases.

FY23 Q2 Presentation

I note that the one soft spot in the quarter was in remaining performance obligations (‘RPOs’), which grew only slightly sequentially to $15.22 billion. Tech companies across the board have seen longer sales cycles and smaller deal bands.

ADBE ended the quarter with $6.6 billion of cash versus $3.6 billion of debt, though I can see the company eventually taking on net leverage.

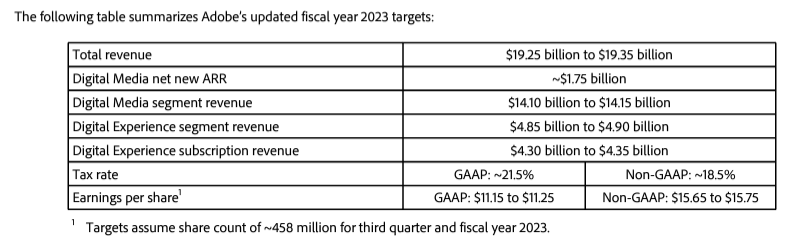

Looking ahead, management has guided for the company to generate 9.9% YOY revenue growth in the third quarter and raised full-year non-GAAP earnings guidance to $15.75 per share, up from $15.60.

FY23 Q2 Presentation

On the call, management stated their belief that generative AI would “drive both further accessibility and adoption of our products.” The idea is that it may help increase the customer base among those who had previously thought it was too hard to be a content creator, as generative AI can help quickly make efficient drafts and further edits with linguistic commands.

Will generative AI hurt or help profit margins over the long term? Management reminded investors that they have “a long history of driving strong profitable growth,” and followed by stating that they see generative AI “playing out in a similar fashion.” I have no doubt that ADBE will focus on profitable growth given that their roughly 33% GAAP operating margin ranks among the highest in the sector.

Is ADBE Stock A Buy, Sell, or Hold?

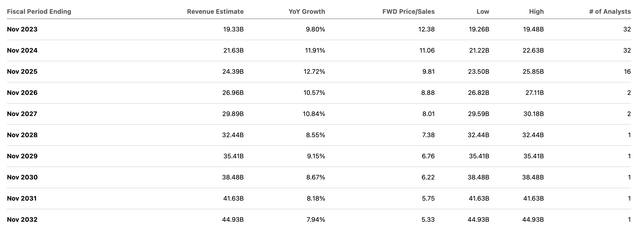

After joining the furious tech rally, ADBE no longer trades as a steal as it did for much of last year. That assessment may come to a surprise to some readers. ADBE recently traded hands at 33x earnings, representing a discount to the historical 36x multiple. But one must also remember that ADBE growth rates have decelerated meaningfully post-pandemic.

It is stunning to find a stock trading at 12x sales with low double-digit growth projected moving forward.

Obviously ADBE is able to command such a high multiple due to the high profit margins. If we assume that the stock trades at a roughly 2x price to earnings growth ratio (‘PEG ratio’) in a decade, then ADBE might trade at 18.2x earnings or $742 per share in 2032. That represents around 3.7% potential annual returns over the next 9.5 years. Throw in a 3% earnings yield and perhaps this can average around 6.7% annually for a decade. That valuation might not sound unreasonable as it might be able to keep up with the market index, but I argue that it is a stretched valuation given the tail-end risk. ADBE stock is benefitting from the company being a best-in-class operator as defined by high profit margins. That ironically may be the source of the tail-end risk here, however, as I expect generative AI to level the playing field and reduce the purchase friction for ADBE’s historically less advanced competitors. Think about the customer who is no expert in Photoshop but purchases the software anyways because it is easier to use than competitors. But with generative AI, competitive products may eventually be able to create strong rough drafts with minimal editing required. Yes, I understand that ADBE is likely to see some solid growth in the near term due to generative AI and yes, I understand that it will take time for this negative thesis to play out. But it seems almost inevitable for it to occur and 8% potential forward annual returns is not compensating for such a clear risk. Just as many names have benefitted from a generative AI valuation premium, I expect many names to eventually suffer from a generative AI valuation discount – not too dissimilar with what has happened at the energy sector or for mall and office REITs. This means that the potential downside may be quite significant from a multiple perspective, not to mention growth rates may disappoint consensus if competition heats up. I do not expect the stock to correct imminently by any means, as ADBE’s current software superiority is likely to give it some head start over competitors. But with the valuation quite rich and the outlook anything but clear, I see enough of a conflict to warrant a neutral (avoid) rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!