Summary:

- PayPal reported Q2 results that beat guidance, but shares are down 34% over the past year.

- Venmo’s payment volume growth slowed down significantly in 2022, indicating a challenge to PayPal’s business.

- The launch of its own stablecoin and crypto wallet is a strategic move by PayPal to reaccelerate its user base growth.

FangXiaNuo/E+ via Getty Images

Q2 Results

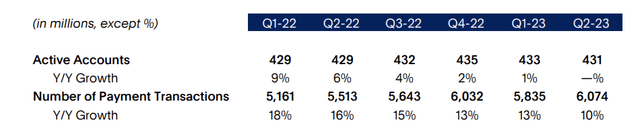

PayPal (NASDAQ:PYPL) reported Q2 results that beat guidance, with 8% revenue growth, 24% non-GAAP EPS increase, 11% payment volume growth, 10% transaction growth, and 12% growth in transactions per active account. However, the market responded negatively, with shares down 34% over the past year.

Many investors are probably wondering whether this is a value trap or an opportunity as its valuations now appear attractive relative to history. PayPal’s stock trades at a P/E of just 13x, well below its 5-year average of 39x. The PEG ratio sits at 0.75x.

What Happened to PayPal?

In the following section, we will first explain PayPal’s business model and show how competitive threats to its customer acquisition channels have impacted its ability to generate revenue. We will demonstrate how the slowdown in user growth from its peer-to-peer tools has reduced monetization potential across PayPal’s payment services.

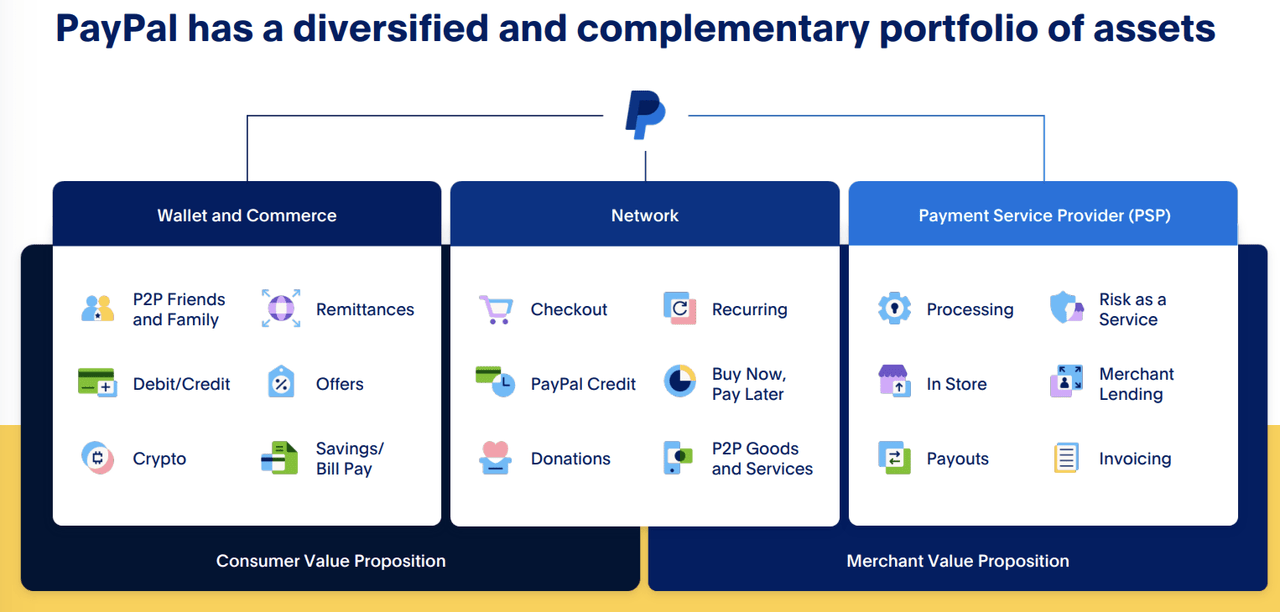

PayPal’s business model

PayPal uses its peer-to-peer (P2P) payment services like PayPal, Xoom, and Venmo to acquire new retail customers. By building a large user base of over 400 million consumers through these P2P tools, PayPal can then leverage its scale to negotiate with merchants to adopt PayPal as a checkout option. This allows PayPal to generate revenue by charging fees to both merchants (processing fees, currency conversion fees) and consumers (instant transfer fees) on transactions made through its platform. Due to the aforementioned partnership, PayPal was able to offer financing and other value-added services to merchants and consumers.

The customer acquisition channel is challenged

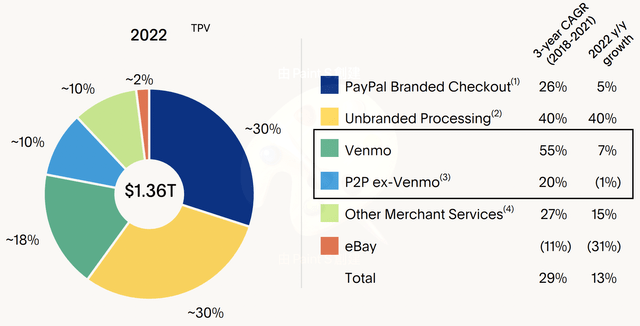

PayPal uses P2P transfers to attract users. Its P2P payment volume accounts for 25% of its total TPV.

PayPal’s business model has faced recent challenges from banks launching competing peer-to-peer payment services. In 2017, banks introduced Zelle, which has grown aggressively to approach Venmo’s user base size. Zelle is owned by several large banks. According to Oberlo, Zelle reached 67.7 million users in 2022, a 10% increase, while Venmo had 85 million users, growing 9.5%. Venmo, Xoom, and PayPal have been critical customer acquisition tools for PayPal.

However, PayPal and Xoom saw payment volume growth decline by 1% in 2022 as they faced headwinds. Meanwhile, Venmo’s payment volume growth slowed significantly to 7% in 2022, down from a 55% 3-year CAGR during 2018-2021. The pattern in Q2 2023 was that its P2P payment volume climbed by only 2%, compared to 8% growth in Venmo payment volume.

The rise of Zelle and the slowdown in Venmo growth poses a threat to PayPal’s business model which relies heavily on peer-to-peer payment services to acquire new retail customers and drive transaction volume. Its customer base growth stalled in Q2 2023.

Venmo Losing Competitive Edge

Venmo has been an effective customer acquisition tool for PayPal because it utilizes PayPal’s internal network to instantly transfer funds between users free of charge, which is much faster than bank ACH transfers. However, banks now have the potential to match PayPal’s speed with the new FedNow instant payment system. FedNow has significantly lower costs than wire transfers that banks previously relied on for fast peer-to-peer payments. With FedNow, banks only pay a $25 monthly fee per routing number receiving transfers, a $0.045 fee per transfer paid by the sender, and a $0.01 fee for requests for payment messages. This means banks can likely offer instant P2P payment services at very low or no cost to consumers. As a result, PayPal’s previous speed advantage for P2P transfers is disappearing as banks adopt FedNow, threatening Venmo’s status as an effective, low-cost customer acquisition tool for PayPal.

Credit Card Rivals have scale advantages

PayPal’s branded checkout (the blue pie in the above chart), accounting for 30% of its total payment volume, is a major revenue driver. Branded checkout refers to having the PayPal logo as a payment option on the checkout page. As such, branded checkout’s main competitors are credit card payment processors as they aim to be the chosen payment method during online or in-store transactions.

According to Shift, there are 2.8 billion credit cards in use worldwide and 70% of people have at least one. In terms of number of cards in circulation and cardholder base, PayPal does not compare. For example, Visa (NYSE:V) alone has 1.1 billion credit cards globally according to Credicards.com. Credit card payment processors leverage their deep relationships with banks to attract users through attractive sign-up bonuses. This partnership also allows them to operate with scale and dominate the payment landscape.

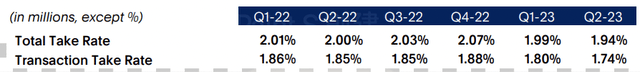

PayPal’s branded checkout business slowed in 2022, with growth decelerating to 5% compared to 26% annually during 2018-2021. Branded checkout earns higher take rates by charging merchants a premium, capitalizing on customer preference for the PayPal logo at checkout. However, branded checkout’s transaction take rate fell to a new low in Q2 2023, signaling rising competitive pressure on PayPal’s most prominent payment service that leverages its brand visibility. This indicates competitive pressures facing PayPal’s most visible payment service when its logo is displayed at checkout.

PayPal remains competitive in back-end payment space

PayPal’s unbranded checkout (the yellow pie in the above chart) makes up 30% of its 2022 payment volume. This refers to merchants using PayPal as the processor but not displaying the PayPal logo at checkout. Unbranded checkout has a lower take rate for PayPal than branded checkout since the PayPal brand is not visible to the consumer.

PayPal’s unbranded checkout business grew an impressive 40%, outpacing competitors like Toast (TOST)(+38%), Stripe (+26%), and Adyen (+23%). This superior growth demonstrates PayPal’s strength in providing back-end payment processing services even when its brand is not front-and-center.

Slowing User Growth Weighs on Valuation

Even while PayPal’s financial measures, such as revenue and EPS growth, are still solid, the company’s future is not promising if it cannot expand its customer base.

Without expanding its user numbers, PayPal’s payment processing business growth will likely slow. This explains why PayPal’s stock has dropped over the past year, now trading at a P/E of just 13x, well below its 5-year average P/E of 39x. PayPal is no longer viewed as a high-growth stock, at least for the time being.

PayPal Still Has Value

However, as PayPal still has a 400 million customer base and a profitable business model, it can likely maintain flat growth on the top line and growth on the bottom line through operating cost optimization and share buybacks. So in our opinion, investors should not short PayPal stock.

Crypto opportunity

PayPal is tapping crypto with its own stablecoin offering and crypto wallet. This strategy is aimed at reaccelerating its userbase growth by attracting new crypto users.

Crypto Wallet

PayPal’s eminent competitor in the consumer space is Coinbase (COIN). Despite Coinbase having $124 billion in crypto assets in custody and first mover advantage, PayPal has a larger user base of 400 million compared to Coinbase’s 100 million. The user base advantage could help PayPal win the battle of the cryptocurrency wallets.

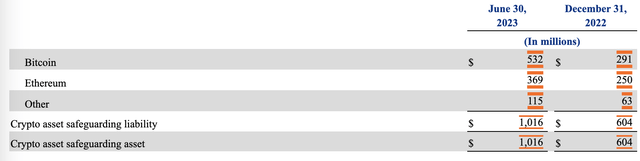

PayPal grew its crypto asset safeguarding liability quickly from $600 million to $1 billion as of Q2 2023 since the end of 2022, outpacing Square’s (SQ) $760 million.

Stablecoin

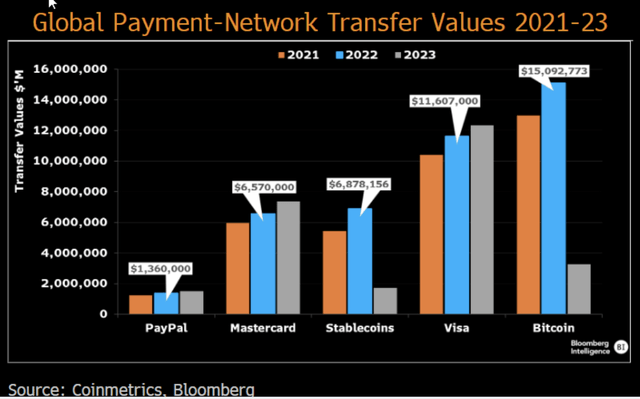

According to Bloomberg, stablecoins became very popular in 2022. The total number of stablecoin transactions was higher than PayPal’s and Mastercard’s transactions. Last year, over $11 trillion worth of stablecoin transactions happened. Specifically, over $6.87 trillion of these transactions used stablecoins on Layer-1 blockchain networks. Because stablecoins are being used more and more for payments, they could completely change the financial system.

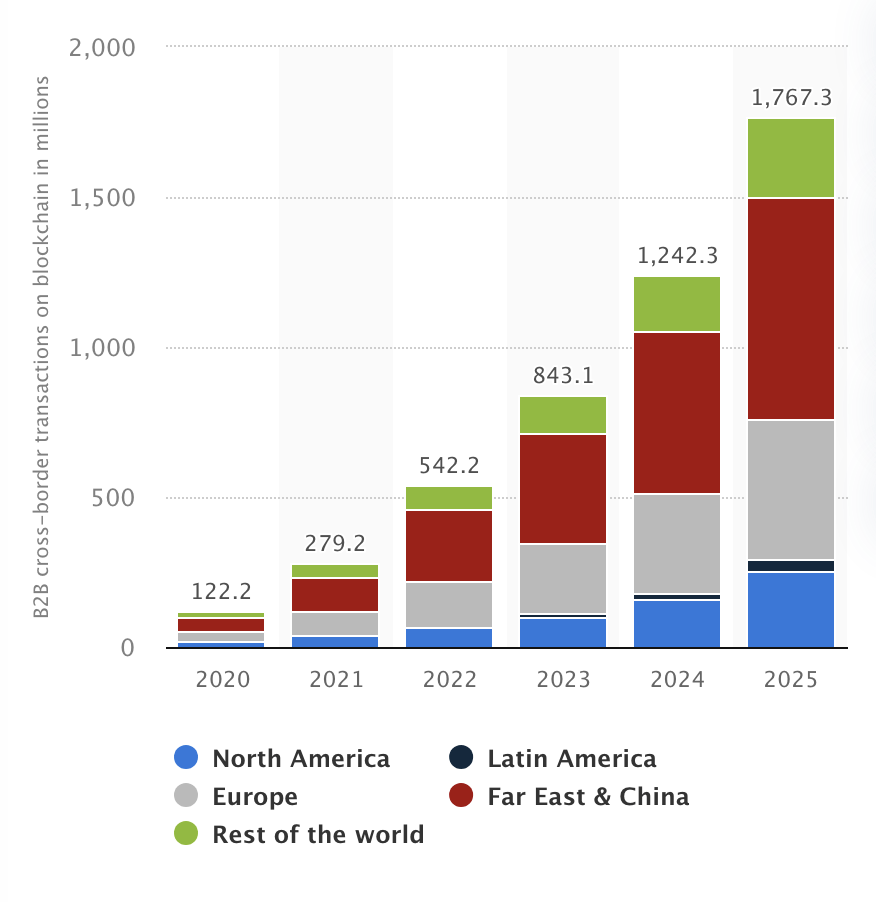

One particularly common application for stablecoins is cross-border transactions. Right now, most US businesses use SWIFT to send money internationally. But SWIFT is slow and costly. Stablecoins can make sending money abroad faster, cheaper, and less volatile compared to other cryptocurrencies.

The data below shows that using crypto to send money globally is becoming more popular. Cross-border business payments with blockchain grew 94% in 2022. Experts think these payments will keep increasing by 55% in 2023, even with new rules. Stablecoins have big potential to change how money moves around the world.

B2B Blockchain cross border transaction volume (Statista)

Competitors of PayPal are also exploring this market. Visa is actively developing cryptocurrency products, like crypto link Visa cards, while Mastercard (MA) concentrates its cryptocurrency efforts on CBDCs.

PayPal’s initiative to launch its own stablecoin is to differentiate its product offering in the cross-border payment space from Visa and Mastercard.

There are concerns that PayPal’s stablecoin could face regulatory challenges like Meta’s (META) Libra, which faced strong opposition. PayPal took a firm stance that its reserves would only be backed by US dollars, which seemed to differentiate it from Libra. While some may argue this could also face opposition from other governments, we think PayPal’s aggressive move may work since the US still dominates most cross-border regulations. PayPal’s stablecoin may have an advantage as it stands to benefit the US financial system.

Conclusion

PayPal faced challenges as its P2P payment tool faced competitive pressure from banks. In terms of scale and size, PayPal lacks the competitive advantage of leading payment networks like Visa and Mastercard in our view. However, the 400 million users of PayPal and its profitable business model should discourage short sellers from engaging below this price point. We believe the current valuation appropriately reflects PayPal’s strengths instead of undervaluing it.

The growing crypto space could drive growth for PayPal, which has demonstrated impressive growth in crypto assets and users. The launch of a PayPal stablecoin is a differentiated strategy to compete with Visa and Mastercard, though it is too early to judge the results.

Overall, we rate the stock neutral given PayPal’s strengths and competitive threats.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.