Summary:

- Intel Corporation is struggling to compete in the AI chip market and is behind its competitors.

- The company’s revenue is down 15% from a year ago, but it beat expectations in its recent earnings report.

- Intel’s stock has rallied about 40%, but further gains may be difficult and it is recommended to book profits.

- Margin compression and cash burn should be on all investors’ eyes.

BryanLever/E+ via Getty Images

Intel Corporation (NASDAQ:INTC) is still trying to emerge from its darkest hour. Remember earlier this year when the company reported its largest loss in history. While the company is not dead, it is fighting obliteration, as it is simply behind the curve relative to the competition.

Most specifically, with the artificial intelligence (“AI”) fueled chip rally that we witnessed over the last year, Intel largely sat out, after fighting off obliteration. Shares have quietly been clawing their way back, from where we saw shares a buy when they were in the $20’s, to now where we see shares a sell after a successful trade at $34-$35. Long term, investors are betting that the company’s longstanding brand name and power will return.

To be sure, the company is not going broke. The chip cycle has not done them any favors over the last 18 months, but the company as of right now seems to be a shadow of its former self. The long-held name by income investors saw them flee when the dividend was reduced dramatically in an effort to preserve cash. The stock is offering no earnings growth, and the value is poor due to losses, so we actually expect the stock trades sideways in an average market, and is likely to retrace if the market pressure we have seen in August picks up into September.

There is pain here. While we love buying beaten-down stocks that stand to rebound, we question what the rebound will look like here. Generally speaking, we recommend remaining net long stocks but having some hedges. Is there a place for INTC? Frankly we think it is speculative. We think INTC is a sell in favor of other stocks in the chip space. This is supported by recent performance and the forward look for the company. Let us discuss.

We want to be clear. Intel Corporation is a massive company, and one with a storied history of great success. But it is a former blue chip that has fallen onto very hard times. Look, we are not saying the company is going out of business, or going bankrupt. We understand investors sometimes grow an emotional attachment to an investment (a mistake, by the way), but we encourage level headed investing that is backed by evidence. Certainly sentiment has mildly improved in the stock, and investors are placing their bets on a sizable recovery. We simply question how long such a recovery will take, and think your money can work better for you in different trades. A buy and hold was fine with the dividend when it was at its old rate, but that cut has made the dividend far less attractive, and as such, holding the risk that comes with Intel, also less attractive.

It is hard to call the most recent earnings performance anything but encouraging, however. It was a strong rebound from its worst earnings performance in history in Q1. Intel actually surpassed many expectations in its results. In fact, there is light at the end of the tunnel for PCs. That is great news for the company to be sure, but the broader problem is that other companies are simply outcompeting them. That is a harsh reality. The market had priced in a lot of pain, so the release of earnings helped the stock rally a bit, though that rally is now fading. Still, the company is controlling its costs, and working through staving off obliteration. David Zinsner, Intel CFO, stated:

” Strong execution, including progress towards our $3 billion in cost savings in 2023, contributed to the upside in the quarter. We remain focused on operational efficiencies and our Smart Capital strategy to support sustainable growth and financial discipline as we improve our margins and cash generation.”

Pat Gelsinger, Intel CEO, added:

Results exceeded the high end of our guidance as we continue to execute on our strategic priorities, including building momentum with our foundry business and delivering on our product and process roadmaps

The company is simply controlling what it can control. It is slashing costs where it is able to through its cost savings plans, while investing to establish its internal foundry model which is going well and progressing toward IDM 2.0. With that said, the results were better than we had expected:

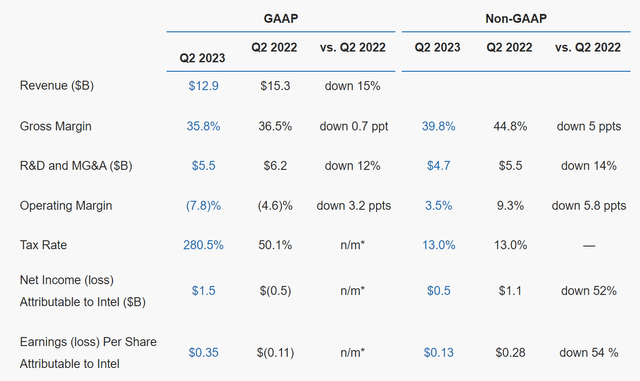

The company beat estimates on the top and bottom lines and handily did so. While better than expected, the comps with Q2 2022 are really show how the company is struggling. Yes, things were better than the sequential quarter, that is good, but even though Intel exceeded very low bar estimates, in context, these numbers are pretty horrific at a time when competition is under pressure but driving gains, largely speaking. So, as you can see, Intel’s revenue was down 15% from a year ago. Adjusted gross margins narrowed again but were above our 39% expectations, hitting 39.8%. Revenue beat by $760 million. Operating margins were down, but were positive. Net income is down 52% from last year’s earnings. The company, however, was expected to lose $0.03 adjusted, but registered a sizable beat versus the consensus with earnings of $0.13. This is down 54% from a year ago, but not losing money was very positive

What can take the stock higher?

So what can take the stock higher? Well keep in mind the rally from $25 to $35 is massive, around 40%. This has happened quietly. So further gains will not be easy. We think you book profits, but we understand investors are looking for ongoing improvement. We do see improvement in PC demand, and that is welcomed news. We also think the company will benefit from AI, it is just behind the curve. There is substantial opportunity here, but execution is another story. Pat Gelsinger did add:

“We are also well-positioned to capitalize on the significant growth across the AI continuum by championing an open ecosystem and silicon solutions that optimize performance, cost and security to democratize AI from cloud to enterprise, edge and client.”

In a world where AI is dominated by one play, Nvidia (NVDA), it is theirs to lose. Intel, and competitors, can only gain market share there. So progress on AI related innovation should be monitored, as that would be taken with bullish praise. Further, if we see no recession at all, and a confirmed turnaround for the entire chip sector, this would also bode well. We do think the chip sector is troughing but we think the economy is going into recession. The leading economic indicators have continued to suggest recession is coming. Lest ye forget, we have the return of student loan repayments in October. After three and a half years, millions of Americans will see a massive chunk of their monthly budgets devoted to repayment. This is going to cause pain in our opinion. We are already seeing some economic data slow down, but it remains hot. In fact, it is hot enough that the Fed may raise rates further, but we think the loan repayments will serve as the final nail in the coffin to push us into recession.

The valuation metrics here are not attractive because of the losses, and will not become attractive until growth returns. The market is trying to look forward here to better days ahead. Look, we think the stock is actually great for trading, but we are in a sell zone in our opinion. We like buying in the high 20s to $30, and selling in the low and mid $30s. Rinse and repeat.

For now, Intel’s business is suffering, but it is staving off obliteration. Intel has over $3 billion in cost reductions on the table, including layoffs and leaning out segment spend. As we look ahead, more Intel weakness is expected, but it looks like the worst is behind the company, welcome news to be sure, but it does not mean the stock is a buy.

Q3 2023 outlook

While we always look for performance, the outlook often matters more. Q3 numbers are expected to show stabilization. The biggest thing we have watched is the margin compression. For Q3, Intel Corporation has now guided for revenue of $12.9-$13.9 billion, on 43% adjusted margins. These margins are getting better, after horrific results the last few quarters. It is just a fact. They are targeting EPS of $0.20 adjusted, but perhaps the best news for bulls is that the company is slowing cash burn. Over the last few quarters Intel burned billions of dollars in free cash flow. That is one of the biggest negatives for the quarter. The company did burn another $2.8 billion in cash. Cash flow should be top of mind for investors over the next few quarters.

Final thoughts

Intel Corporation has staved off obliteration. The margin compression for the company has been quite horrific but we do think it is bullish that margins are starting to improve. After the biggest losses in history, the company has clawed back to being earnings positive. The PC situation is improving while there are AI opportunities. However, cash is being burned at a high rate. Shares rallied about 40%, and have started to see some pressure of late.

The chip sector as a whole is in a weird part of the curve, trying to trough. While the stock could rebound further, we see better opportunity elsewhere. We do like trading here, but would not be investors. While the company is taking steps to improve its fiscal state, we expect more of a range bound trade going forward. We think Intel Corporation stock can be traded and is a sell at these levels, with shares being a buy if we dip sub-$30, which we see as likely in this market setup.

Your voice matters

What other positives in the quarter do you see? Should Intel eliminate the dividend, or do you think they might raise it? Are you concerned with the cash flows? Is trading around a position too much work, or are you a buy and hold type market participant? Do you think the market is going much lower in the coming months?

Let the community know below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We make winners. Come make money with us

Like our thought process? Stop wasting time and join the traders at BAD BEAT Investing.

Our hedge fund analysts are available all day during market hours to answer questions, and help you learn and grow. Learn how to best position yourself to catch rapid-return trades, while finding deep value for the long-term.

- Available all day during market hours with a vibrant chat.

- Rapid-return trade ideas each week from our hedge fund analysts

- Crystal clear entries, profit taking, and stop levels

- Deep value situations identified through proprietary analysis

- Stocks, options, trades, dividends and one-on-one attention