Summary:

- Thermo Fisher has one of the best recurring revenue models in the world, through which it is exposed to the entire healthcare sector.

- It forms a duopoly alongside Danaher, and thanks to its leadership position, it will continue to dominate this market for many more years.

- TMO is going through a temporary weakness phase due to the reduced demand associated with COVID, which may provide good buying opportunities.

JHVEPhoto

Investment Thesis

Thermo Fisher Scientific (NYSE:TMO) has been one of the companies that has delivered the best stock performance over the last decade, appreciating by more than 1000% since 2012. Currently, the stock price has remained relatively flat for the past two years. However, from my perspective, this can be attributed to the company grappling with the aftermath of the Covid-19 pandemic. During the pandemic, it greatly benefited from the high demand for its products used in research, diagnostics, vaccines, and drug development.

Now that the pandemic has subsided, the extraordinary demand for these products is decreasing, which is impacting short-term sales and profits. Nevertheless, my thesis is grounded in the belief that this is merely a temporary weakness. In the long run, the core business will continue to operate much as it has in recent years, driven by its dominant position and favorable tailwinds in the healthcare sector.

Sales breakdown

Thermo Fisher markets laboratory tools, machinery, reagents, and consumables tailored for life sciences research and product development. Its mission is to equip research laboratories and universities with all the necessary tools to conduct their investigations. This business model appears to be the most robust within the life sciences sector. Companies involved in drug development often face challenges related to patents or failed research endeavors.

However, Thermo Fisher eliminates these risks by focusing on supplying essential materials to these laboratories. Regardless of whether these laboratories succeed or fail in their research or patent endeavors, Thermo Fisher ensures a steady and recurring revenue stream, as we will see later on. A suitable comparison is to view Thermo Fisher as the supplier of shovels during the gold rush, but in the field of life sciences.

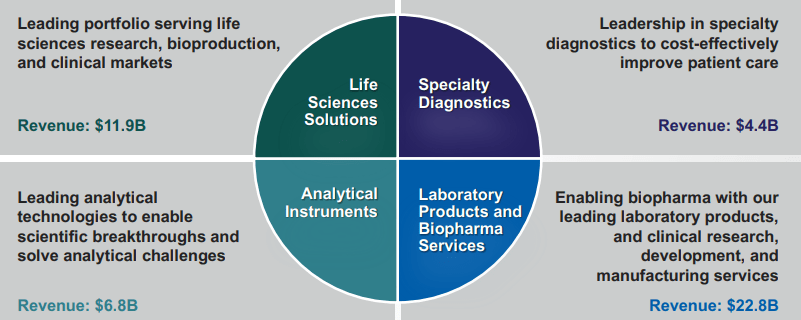

Thermo Fisher divides its sales into four segments. It doesn’t really make sense to delve deeply into each product type the company sells, as its product portfolio is vast, and most of them are highly specific to the healthcare niche. Nevertheless, let’s take a quick overview of the four segments to later identify the sector’s characteristics and tailwinds.

Sales breakdown (Investor Day 2023 (Slide 40))

-

Life Sciences Solutions: This segment focuses on providing a wide range of products and services for research in molecular biology, genomics, proteomics, and other life sciences disciplines. It offers tools and equipment for genetic analysis, DNA sequencing, gene synthesis, molecular diagnostics, and more.

-

Analytical Instruments: Thermo Fisher Scientific manufactures a variety of high-precision laboratory instruments and equipment for analytical applications. This includes spectroscopy, chromatography, mass spectrometry, electron microscopy, and other devices used in research, development, and quality control across a wide range of industries, from pharmaceuticals to food and beverages.

-

Specialty Diagnostics: This segment is centered on providing specialized diagnostic solutions and tests for clinical laboratories and hospitals. It offers a wide range of products for in vitro diagnostics (IVD), including reagents, test kits, and equipment for detecting infectious diseases, genetic disorders, chronic illnesses, and other health conditions.

-

Laboratory Products and Services: Thermo Fisher Scientific offers a wide variety of laboratory products and support services. This encompasses laboratory consumables such as pipettes and cell culture plates, as well as sample management services, biological sample storage, and instrument calibration services.

Recurring income

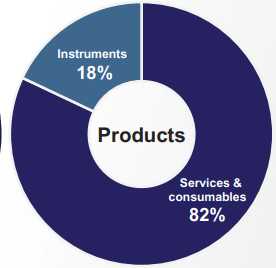

Thermo Fisher not only sells the instruments laboratories require but also offers the consumables they use. This is a key competitive advantage to understand this company. Once a laboratory purchases an instrument from Thermo Fisher, it is obliged to buy consumables regularly, as only those supplied by the company can be used.

Furthermore, something very important to understand is the drug manufacturing process. When seeking to patent a new medication, treatment, or similar products, an approval application must be submitted to the relevant authorities. In this approval application, the materials, instruments, and processes to be used must be specified, and what is even more relevant to us, the suppliers.

Once a medication has been accepted, it can only be developed with the established suppliers, and if any changes are desired, the medication undergoes the initial phase of development. Therefore, the relationships that regulation establishes between Thermo Fisher and its customers can last for decades, allowing us to predict future cash flows very accurately and significantly reducing the risk of terminal value.

Currently, 82% of Thermo Fisher’s revenues come from services and consumables, as we have seen previously, with the recurring nature they exhibit.

Recurring Income % (Investor Day 2023 (Slide 9))

Competition and M&A Possibility

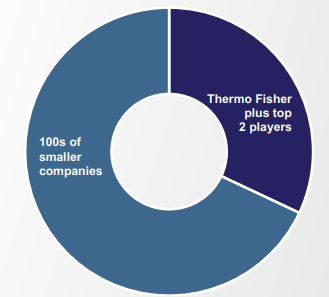

The market in which Thermo Fisher operates is highly fragmented due to its nature. Let’s consider the variety of instruments and reagents used in laboratories. Many companies focus on very specific niches within this vast market and operate as mini-monopolies in the manufacturing of those particular instruments. Therefore, being the largest player in this market provides a significant competitive advantage to Thermo Fisher, as it has the greatest financial capacity to acquire these small competitors. This is something they have been doing for many years, and it has worked exceptionally well for them. In fact, in their latest investor day, they announced their intention to invest nearly $50 billion in mergers and acquisitions over the next five years (Slide 110), so we can expect significant inorganic growth.

The other major player in this market is Danaher (DHR). Danaher is a company very similar to TMO, and after thorough research, I have not been able to determine which of the two companies has better instruments. There probably isn’t a clear overall winner as it depends on the specific niche. Danaher is another outstanding company in this sector, and together with Thermo Fisher, they practically form a duopoly, as there is no close competitor to them in terms of size and financial capacity for acquisitions.

In the following chart, we can observe the high fragmentation of this market, suggesting that the possibility of consolidation for these two giants in the coming years is very high. Truly, it’s challenging to pick a clear long-term winner between these two companies, and they are likely to deliver similar returns. Generally, duopolies tend to be solid investments, as seen with Visa (V) and Mastercard (MA) or Home Depot (HD) and Lowe’s (LOW).

Fragmented market (Investor Day 2023 (Slide 30))

Healthcare macro trend

Thermo Fisher is a leading company in the field of science and healthcare that is well positioned to benefit from the macro trend in the healthcare sector in the coming decade. Several factors support this statement.

Firstly, the aging population is a global demographic trend driving the demand for healthcare products and services. As the population ages, there is an increased need for more precise diagnostics and personalized treatments, areas in which Thermo Fisher has expertise and offers innovative solutions.

Secondly, the growing awareness of health and preventive medicine is leading to a greater emphasis on research and development of new drugs and therapies. Thermo Fisher provides essential tools and technologies for biomedical research and drug production, making it a valuable partner for the pharmaceutical and biotechnology industry.

Furthermore, the COVID-19 pandemic has highlighted the importance of biotechnology and scientific research, and Thermo Fisher played a crucial role in supplying equipment and testing kits during the crisis. This experience strengthened its position in the market and established it as a reliable company in critical times.

Post-COVID weakness

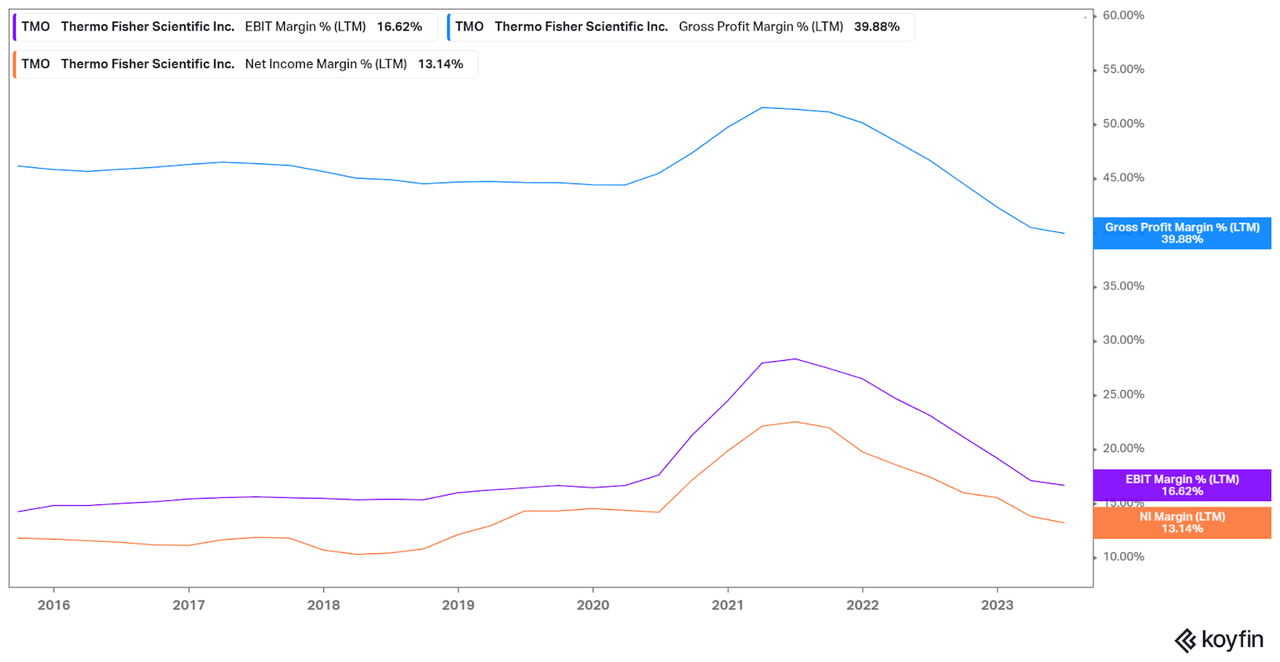

Now we must understand that the company in particular and the industry in general are experiencing the “hangover” effect of COVID-19. As expected, during the pandemic, spending on research and medical products related to COVID-19 skyrocketed. This situation greatly benefited Thermo Fisher’s sales, and as a result, profit margins also increased. Once the pandemic is over, all this spending has diminished, leading to a decline in the company’s sales and a contraction of profit margins.

However, as long-term investors, we need to take a broader view of the situation. If we look at the numbers and what executives discuss in earnings calls, the core business, which is not related to COVID-19, continues to experience healthy growth and has good long-term prospects. Therefore, from my perspective, once this negative effect of COVID-19 is overcome, we will see a return to the growth levels seen in the past, as the overall health trend remains the same as before the pandemic. I estimate that the negative impact of COVID-19 will cease to affect from the first half of 2024.

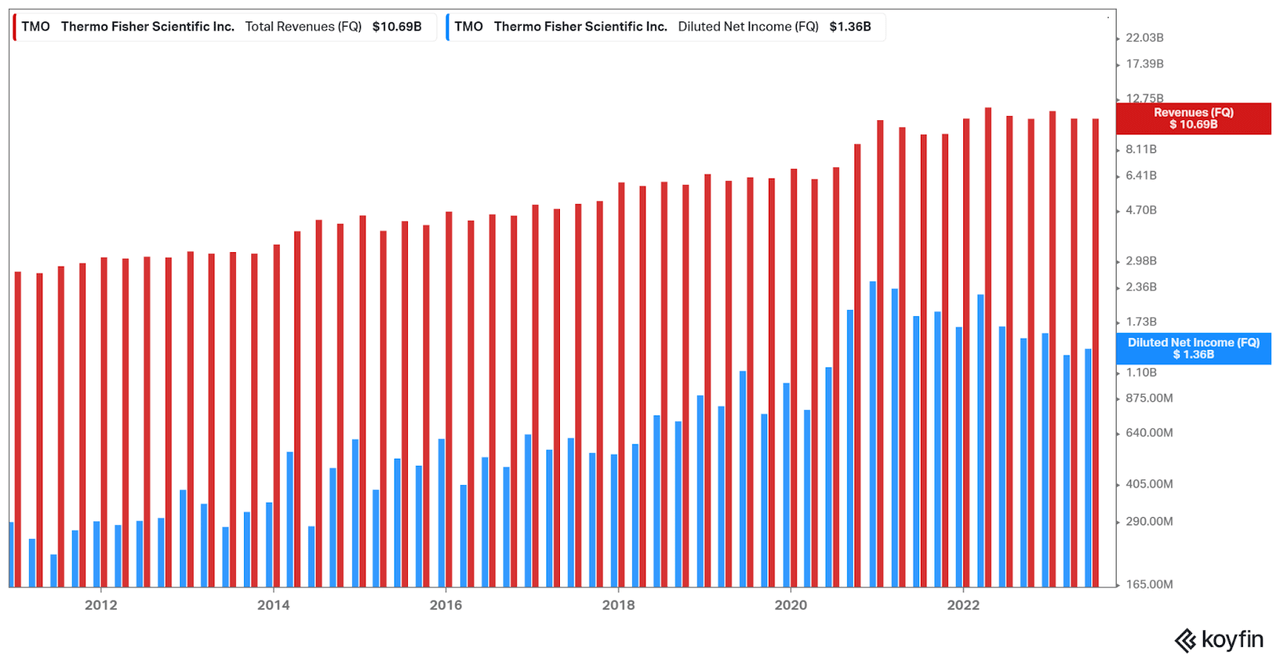

In the following chart, you can clearly observe this effect. Until early 2020, sales and profits growth remained steady, until at the beginning of the pandemic, both surged. Afterward, sales stayed flat, and profits began to decrease due to operational deleverage. However, as I mentioned earlier, I expect that starting in 2024, this headwind will disappear, and growth will return to pre-pandemic levels.

Revenue and Net Income (Koyfin)

Regarding the profit margins, we can also see in the following chart how they greatly benefited during the pandemic. However, they have already returned to the 2019 levels, and in my opinion, in the coming quarters, we will see them grow at the same pace as before, roughly 40-50 basis points each year thanks to operating leverage

Robust balance sheet enabling inorganic growth

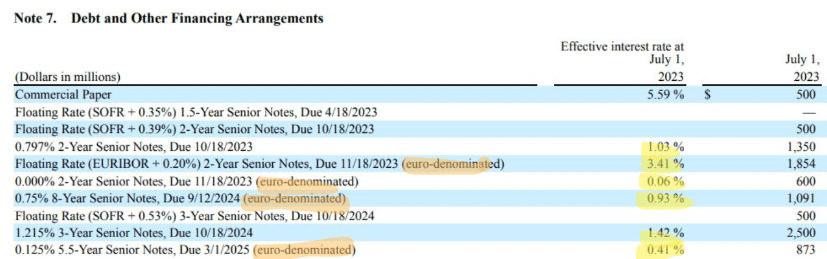

When analyzing the financial statement, we must consider that one of the company’s top priorities is inorganic growth through the acquisition of smaller competitors, as we have mentioned. Therefore, it’s logical for the company to operate with debt. However, this is not necessarily a negative aspect. Both TMO and DHR have followed this growth strategy for decades, generating significant value for shareholders. If they can achieve a return on investment greater than the cost of debt financing, this will result in value creation.

Given that the company generates highly recurrent and predictable cash flows, they can make precise calculations about when and how much to leverage without it posing a problem. However, it’s important to note that this should be monitored in the long term, as poorly executed expansion can destroy value instead of creating it.

Nevertheless, the levels of leverage remain healthy and are not a cause for concern. The Net Debt / EBITDA ratio stands at 2.59 times, below the commonly accepted threshold of 3 times. The quick ratio is 1.02, and the current ratio is 1.42 times. Therefore, we can see that even though inorganic growth is a priority for the company, they are not neglecting their financial solvency.

Another important aspect to consider is that with rising interest rates, the company’s financing capacity may decrease. However, in the following excerpt taken from their latest 10Q report, we can see that the company has been able to secure debt at remarkably low rates, around 2-3%, with some even below 1%. Hence, while the interest rate hike may have an impact, they are likely to continue accessing debt under favorable market conditions. This also speaks highly of the company.

Finally, something that caught my attention is that part of the debt has been issued in Japanese yen and euros, taking advantage of the historically low interest rates these currencies have had over the last decade. I find this to be a smart move by the CFO.

Debt Arrangements (10Q 2Q 2023 (Page 14))

Risks

For a company with the dominant position that Thermo Fisher holds, such predictable cash flows, and the tailwind of the healthcare sector’s macro trend, external risks are indeed scarce. In my opinion, the greatest risk for this company lies in the possibility of management making poor acquisitions or overleveraging the company. Although I believe this is a limited risk due to their track record of successful execution over many years, it’s something we must closely monitor each quarter, as I mentioned earlier, as the greatest threat to this company could be making the wrong decisions.

Valuation

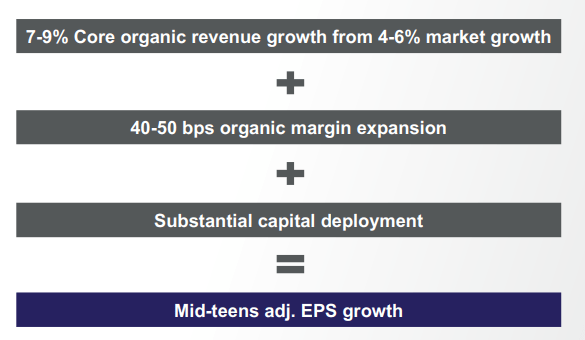

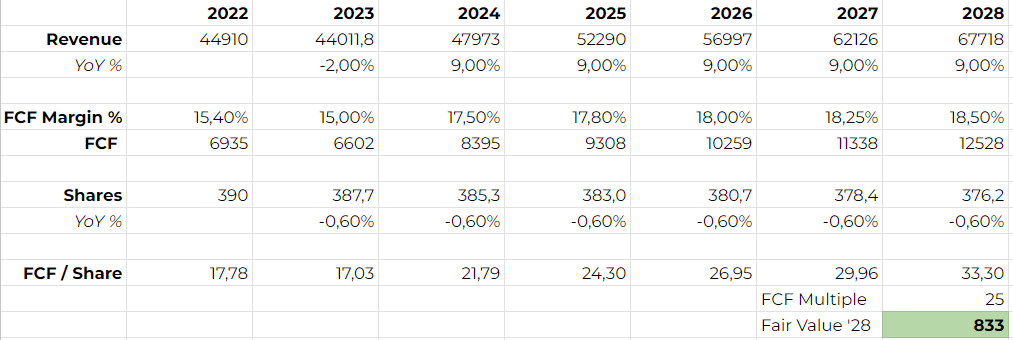

For the valuation, we will take into account the impact of COVID-19 for the year 2023 and estimate a slight decrease in sales and margins, as we have already mentioned. From there, we will estimate that revenues will grow at an annual rate of 9%. The company expects organic growth of 7-9%, to which we will add potential acquisitions, and we will lean towards the upper end of this range, although it could actually be higher if significant acquisitions are completed.

Regarding margins, we estimate that in 2024, the free cash flow margin will return to 17.5%, slightly below analyst expectations, and from there, we anticipate modest expansions as the company itself predicts, due to operational leverage. Finally, considering the quality of the business and, above all, our ability to forecast future cash flows, I believe that the terminal value of this company is very high, so I consider it appropriate to use a multiple of 25x FCF to reflect this.

Expectations of the company itself (Investor Day 2023 (Slide 109))

Applying these assumptions, we arrive at a target price for 2028 of $833, which would represent a 9.25% compounded annual growth from the current $530 as of the time of writing this article. At these levels, the expected return is not excessively high, and in my opinion, it would be best to await potential future corrections to purchase Thermo Fisher with a bit more margin of safety. Therefore, despite being a great company, I assign it a “Hold” rating.

Valuation (Author’s estimates using data from Seeking Alpha)

Conclusion

In conclusion, I believe Thermo Fisher is one of the best companies in the world. Its business model ensures a level of cash flow recurrence that few companies achieve, especially in the healthcare sector. Furthermore, it forms a duopoly alongside Danaher, and in terms of size, they are the only ones capable of deploying capital so efficiently, which is why they will likely continue to dominate the market for many more years. In my opinion, Thermo Fisher is the best way to invest in the healthcare sector since it is fully insulated from the cyclicality caused by patents, and regulations actually benefit its business. At current prices, it could be bought if we were more optimistic about the company’s future. However, I prefer to maintain some margin of safety and assign it a “Hold” rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TMO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.