Summary:

- Amazon faced challenging years with heavy capital expenditure, slowing demand, and cost inflation, leading to a decline in profitability and FCF.

- Higher-margin businesses such as advertising, prime and third-party sales will strengthen Amazon’s retail ecosystem and profitability.

- The cloud business is poised to grow as the cloud transition continues and margins recover.

- There is significant room for margin improvement driven by an improving business mix, cost-cutting initiatives and easing inflation pressures.

4kodiak/iStock Unreleased via Getty Images

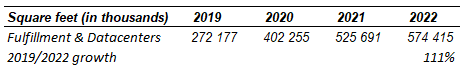

The past few years have been challenging for Amazon (NASDAQ:AMZN) due to heavy capital expenditure, slowing demand and cost inflation, leading to a deterioration in the company’s profitability and FCF generation. Following the surge in demand during the pandemic, Amazon decided to scale up its distribution network and kept investing in cloud infrastructure. Amazon built a last-mile transportation network of the size of UPS and doubled its fulfillment network footprint in just two years.

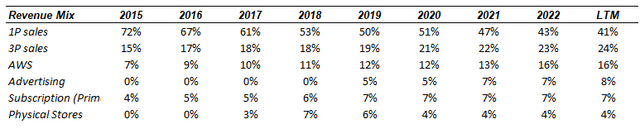

(Source: Annual reports)

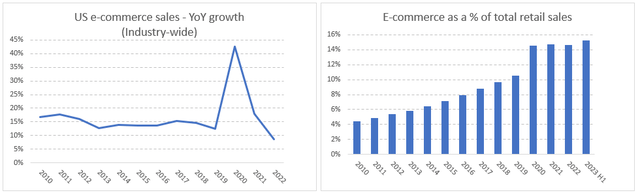

As a result, the company’s margins took a hit and capex spending soared. Not surprisingly, after surging by +43% and +18% in 2020 and 2021 due to lockdown measures, the e-commerce demand slowed while remaining in positive territory (+9% in 2022 versus +15% on average pre-Covid). AWS also faced a reduction in corporate spending because of a more challenging macroeconomic environment (war in Ukraine, inflation, higher interest rates…).

(Source: https://www.census.gov/retail/ecommerce.html)

Finally, inflation led to an increase in labour and shipping costs, further pressuring the company’s profitability. As a result, Amazon’s share price dropped by over 55% from its 2021 peak, before rebounding by roughly 60% from the end of 2022. Despite that rebound, we believe Amazon’s stock price has further to go as the company should continue to grow and margins should significantly improve.

Retail (including 1P and 3P sales, advertising, Prime subscriptions, and physical stores)

Amazon has leveraged its low-margin retail business for developing much more profitable businesses around it. Indeed, in addition to provide fast deliveries for a large selection of attractively priced items, Amazon has used its brand, scale, and distribution network for making its marketplace available to third-party vendors. The marketplace is attractive for third-party vendors because Amazon is the most widespread search engine in terms of product searches. As a result, merchants join the platform to benefit from the e-commerce transition and have access to a larger pool of potential customers. At the same time, the increasing number of merchants broadens the range of products available on the platform and attracts more customers, further strengthening the network effect. In addition, third-party sales are much more financially attractive for Amazon because they carry higher-margin and no inventory risk. 3P sales account for 60% of total units sold on Amazon and continue to account for a higher share of total volumes.

Amazon also offers prime memberships to over 65% of US households, which include many services such as one-day delivery, video streaming, Kindle library, music content… It enables Amazon to generate a recurring revenue stream while building a loyal customer base which tends to spend more on Amazon.com than non-prime customers. Finally, Amazon uses its existing logistic infrastructure by enabling merchants to ship products sold on other sites and without storing them in Amazon’s warehouses (competing head-to-head with UPS and FedEx).

The third-party business is also one of the key drivers for growing the nascent advertising business because third-party sellers will be the ones to purchase adds. Thanks to proprietary data, Amazon is well positioned to benefit from the shift to digital advertising and grow its advertising business. Moreover, it should keep gaining market share over the largest players (Meta and Google) as it can better target customers and is not at risk from third-parties for data collection (e.g.: Apple’s policy change for data sharing). The advertising business is margin accretive as it requires no additional costs.

AWS

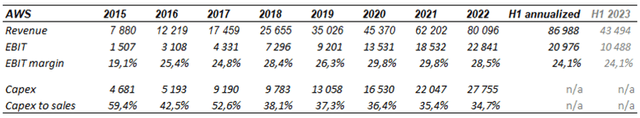

AWS, the public cloud infrastructure business, is poised to grow as the cloud transition is still in the early innings of a secular shift. Per William Blair, approximately 20 to 30% of all workloads now reside in the public cloud. Cloud solutions offer many benefits such as higher flexibility, lower security burden, lower piracy, lower upfront investments, and reduced maintenance. On top of that cloud migration, AWS will also benefit from the increasing demand for compute as the world becomes more digital and new applications (such as accelerated computing and generative AI) are developed. AWS seems well positioned to capture these growth opportunities as it already owns the costly infrastructures (AWS spent $108B in capex over the period 2015/2022) and is the largest player (33% market share versus 21% and 11% for Azure and Google Cloud, respectively). Moreover, clients are sticky as they are reluctant to switch providers given IT infrastructure is mission-critical. Finally, AWS will continue to upsell higher-value Platform-as-a-Service solutions such as analytics, databases, and developer tools to its existing customer base.

Room for margin improvement

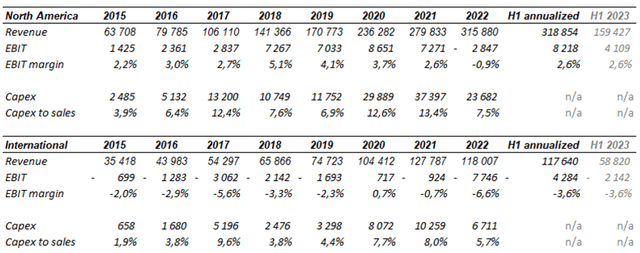

The company’s profitability seems to be at the top of Andrew Jassy’s agenda and he is very optimistic about it. He believes that the operating margin of the North America segment can exceed its 4%-5% pre-pandemic levels.

And I continue to believe what I said last quarter, Brian, which is I do believe that we will get back to margins like what we had pre COVID. And I do not think that is the end of what is possible for us there.

(Source: Q2 2023 Earnings Call Transcript)

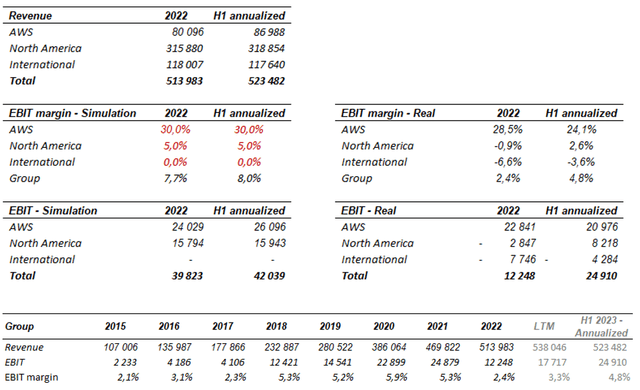

(Source: Annual reports)

The retail business is going to benefit from the rationalization of the US fulfillment network. Amazon reorganized its fulfillment network from one national network to eight regional networks, lowering the cost to serve customers through a 20% reduction in the number of touches per package and a 19% decline in miles traveled. Then, the high-margin advertising, third-party sales and prime subscription businesses are now bigger than they used to be. For instance, prime memberships reached over 200 million members (versus 100 million in 2018) and advertising accounts for 8% of revenue (while being non-existent in 2018). Finally, headcount reduction (the number of employees is 9% below the level of end-2021) and easing inflation (around fuel prices, linehaul rates, ocean and rail rates. …) should also be supportive.

Even though accounting for 16% of revenue, AWS accounts for more than 100% of operating income given that the retail business is loss-making. AWS’s margins have also been under pressure as clients decided to scale down cloud capacity in order to face more challenging macroeconomic conditions. Nevertheless, management indicated that cost optimizations are beginning to ease and customers are starting to refocus on new workload deployments. Longer-term, margin will also benefit from upselling higher-margin PAAS services.

And while customers have continued to optimize during the second quarter, we have started seeing more customers shift their focus towards driving innovation and bringing new workloads to the cloud.

(Source: Q2 2023 Earnings Call Transcript)

(Source: Annual reports)

(Source: Annual reports)

Longer-term, Amazon will also benefit from a positive business mix because the highest-margin businesses will continue to grow faster than Amazon’s lower-margin online (1P sales) and physical stores.

Assuming a margin recovery in-line with pre-Covid levels and constant revenue, EBIT could reach over $40B, which is equivalent to roughly an 8% operating margin at the group level.

(Source: Annual reports & Author)

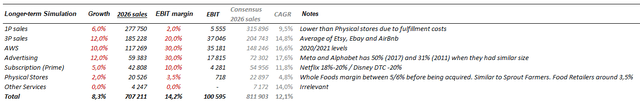

Longer-term, we expect Amazon has the potential to reach a low- to mid-teen EBIT margin and can exceed $100B operating income (if it does not reinvest heavily into its business or new initiatives).

(Source: Annual reports and Author)

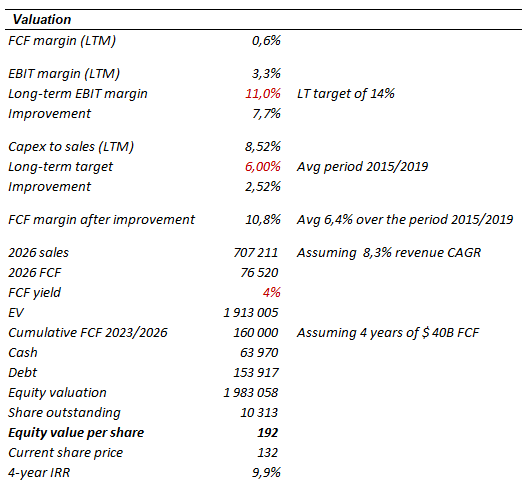

Valuation

A quick valuation yields a potential 10% CAGR over the coming years.

(Source: Author)

Conclusion

Amazon’ share price has suffered from having invested extensively into its business while facing a slowdown in demand and cost inflation headwinds. The company now seems well positioned to benefit from previous investments and efficiency initiatives (overhaul of the US fulfillment network, layoffs…). At the same time, the demand for cloud services and e-commerce should keep growing over time while margins and FCF generation should significantly improve. As a result, we believe that Amazon is a buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.