Summary:

- Netflix stock has fallen 15% from its recent high, presenting a buying opportunity for long-term investors.

- The crackdown on password sharing has not resulted in customer retaliation, and the company may see an increase in subscribers.

- The idea of an ad-supported tier has been successful, with 5 million users and potential for high advertising revenue.

Mario Tama

Netflix, Inc. (NASDAQ:NFLX) stock is up 41% YTD but has lost about 15% from its recent high of $485. The market seems to be having an on-off, love-hate relationship with “risk on” stocks like Netflix over the last couple of months and I believe that presents an opportunity for patient, long-term investors to accumulate the stock in a phased approach.

After the 15% fall, I believe Netflix is a reasonable growth-at-reasonable-price [GARP] stock and present five reasons for the same. Let us get into the details.

NFLX Chart (Seekingalpha.com)

Password Sharing Crackdown

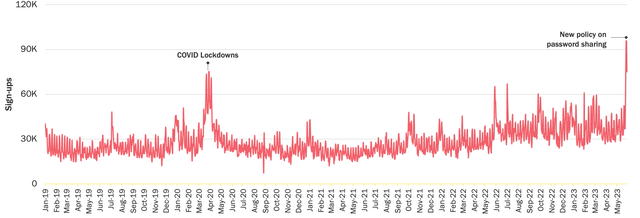

When Netflix initially announced it was going to crackdown on password sharing, there were fears of customer retaliation. However, this has not been the case so far:

- What started out as targeted crackdown is now basically global. This, obviously, means the company is comfortable enough with the results from the initial go-around.

- US Sign-ups have jumped since the crackdown.

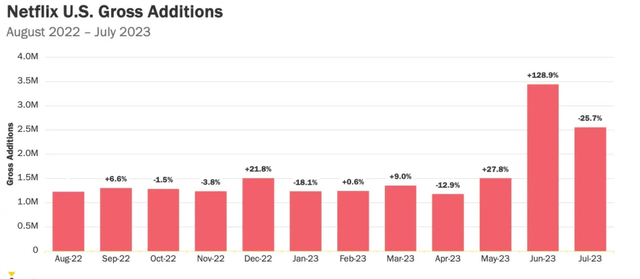

- The good news so far is that this jump, while sharp as shown in the first chart below, is also showing continuing strength (second chart below) with Netflix reporting strong additions on either side of the big jump in June 2023. Don’t be fooled by the negative number in July 2023, that’s mainly due to the monumental jump in June 2023 and by and of itself is still the 2nd biggest gain in the time period shown below.

NFLX Spike (antenna.live)

NFLX Additions (antenna.live)

As this article debates, it is rather possible that the market and analysts have underestimated the number of shared accounts in operation. In Netflix’s own words, 43% of the company’s global user base are sharing passwords. Does that mean the company can almost double its numbers simply by this crackdown? Not so easy. Some will drop out inevitably, but it appears like the company will come out with a larger subscriber base after the crackdown is over. I’d bet that anyone coming out of the shared password scenario is going to be interested in the company’s next likely growth avenue covered below. To help matters, it’s not like the competition (for comparable content) is any cheaper either and are mostly planning price increases as well.

Ad-Supported Tier

Similar to the doubts around password sharing crackdown, Netflix was also met with doubts when it floated the idea of an Ad-Supported tier. However, here too, the company is proving to be right so far:

- Netflix already has 5 million users in its ad tier.

- Netflix has scrapped its cheapest plan in favor of its ad-supported tier. This is classic Reed Hastings, who has a history of cannibalizing his own products and revenue in the short-term for longer-term survival and prosperity.

It maybe a little early to quantify the business impact here. But let’s attempt a back-of-the-envelope calculation with some assumptions.

- New Standard with ads: $6.99/month

- Previous basic plan: $9.99/month

- So, that’s a difference of $3/month.

- In the recent Q1, Netflix reported that its per-member revenue from the “Standard with ads” tier was higher than the per-member revenue from the “Standard” tier, which is priced at $15.49. That mean, each member is bringing in at least $8.51 additional value (through advertisers) on top of the $6.99 paid by the member. This more than offsets the $3/month that the company lost per member when it replaced the $9.99 plan with $6.99.

Given the company’s reach, I am willing bet that advertisers will be willing to pay top dollar. You may recall that it wasn’t long ago that Amazon.com (AMZN) was just getting into the advertising business and this unit recently brought in $10 billion in the most recent quarter. I am not saying Netflix will have the same level of success but Netflix has some commonalities with Amazon:

- Global brand with millions of faithful customers

- Enviable content and network (meaning delivery and reach)

- Profitable through other avenues

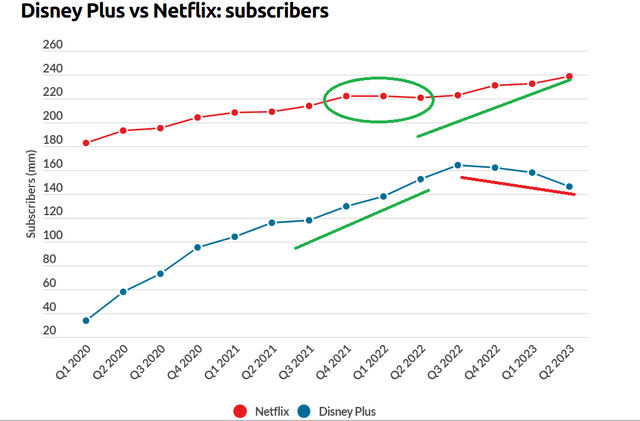

The Disney+ Factor

The Walt Disney Company (DIS) has been dealing with a bunch of internal and political issues to the extent that the stock recently made 9-year lows. For a while, just as Netflix’s subscriber count was flattening, Disney+ was gaining constant steam as shown below. This trend has reversed over the last few quarters due to Disney’s woes and Netflix has been one of the beneficiaries as it has suddenly started its own ascendancy as shown below. I expect the company to continue this momentum despite password-sharing crackdown as indicated by the two sections above, where Netflix is both gaining monthly subscribers while bringing in meaningful additional revenue per member through ads.

NFLX vs. Disney+ (businessofapps.com)

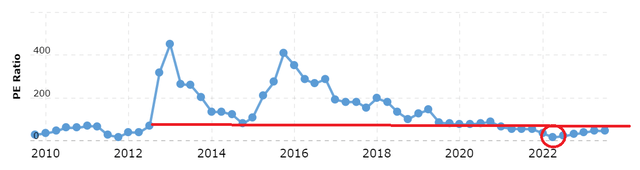

Valuation

- Netflix has always been a pricey stock in terms of valuation. As shown in the chart below, besides the 2022 lows, Netflix’s stock has not traded at the current level with a multiple of 30 to 40 in the last 10+years. The effects of multiple-compression cannot be ruled out but Netflix appears cheap enough on other metrics too.

- Based on 2022’s revenue of about $32 billion, Netflix is trading at a P/S multiple of 6. As a comparison, Apple, Inc. (AAPL) is trading at 7 times 2022 revenue and Microsoft Corporation (MSFT) is trading at 12 times 2022 revenue. Obviously, those two companies are more integrated with our lives than Netflix is but Netflix is an undeniably important part of people losing their sleep.

- Given the expected 5-year earnings growth rate of 24%/yr, Netflix’s stock is trading at a price-earnings/growth [PEG] of just 1.45, which is extremely reasonable in present market conditions for a fast grower.

NFLX PE (Macrotrends.net)

Technical Reasons

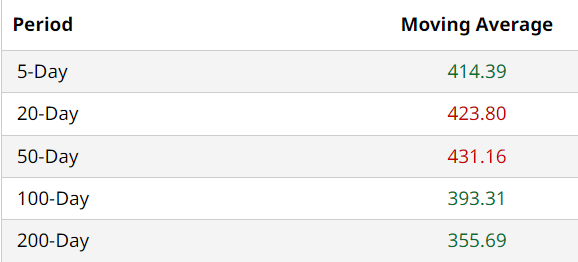

Netflix’s stock is forming a base in the early $400s but has much stronger support in the mid-to-late $300s. I like the fact that unlike some recent strong-movers like Palantir Technologies, Inc. (PLTR) and NVIDIA Corporation (NVDA), Netflix’s current price and its 200-Day moving averages are not Worlds apart, with the difference being just about 14%.

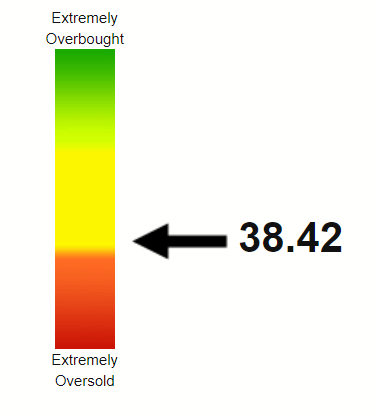

The stock is also battling to stay above the oversold levels based on Relative Strength Index [RSI] of about 40.

NFLX Moving Avg (barchart.com)

NFLX RSI (Stockrsi.com)

Conclusion

The stock may appear pricey based on its PE alone but there is still enough growth left in this company, both in terms of new territories (ad-supported, for example) as well as operating better within existing terrain (password sharing crackdown, for example). I remain a long-term believer in Netflix, the company and stock, and recommend buying on meaningful dips. The 15% fall from high looks like a good start to me to initiate a small position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, AMZN, DIS, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.