Summary:

- Nvidia Corporation reported a stunning 429% increase in Q2 earnings and a 101% increase in sales, surpassing analyst expectations.

- The company expects third-quarter sales to be well above analyst expectations and approved $25B in share buybacks.

- Despite a minimal stock increase, Nvidia remains a top AI stock with strong performance and valuation potential.

Yoshiyoshi Hirokawa

I have witnessed a lot of earnings reports during my 24 years as a professional money manager. The vast majority of them have come within a few cents one way or another when compared to the analyst’s consensus expectations. Every quarter, there are always the major whiffs and the proverbial “knock the ball out of the park” earnings results.

On October 3, 1951, a third baseman for the New York Giants named Bobby Thompson hit the famous “shot heard around the world” homerun to defeat the Brooklyn Dodgers at the Polo Grounds in New York City.

The New York Giants have since moved to the Bay Area where another team resides. It is a team that is managed by Jensen Huang, and they delivered the “earnings report heard around the world” this past week. The company makes expensive graphic chips made for video gamers but is now also the leader in the superfast and even more expensive chips that run “AI” applications.

Just how unbelievable was this past week’s Nvidia Corporation (NASDAQ:NVDA) quarterly earnings report? A consensus of analysts were expecting the company to earn $2.09 per share on $11.09B in revenue. Instead, the company reported $2.70 in earnings per share. This is a stunning 429% year-over-year increase in earnings!

In addition to this, the company reported $13.57B in sales vs. the expected $11.09B, which is a remarkable 101% increase over the same comparable quarter last year!

But wait, the story does not end there. Looking ahead, Nvidia Corporation said it expects third-quarter sales at $16B, plus or minus 2%, well above the $12.5B that analysts were expecting. In addition to this, the Jensen Huang-led company approved $25B in share buybacks and said it would continue to buy back stock this fiscal year.

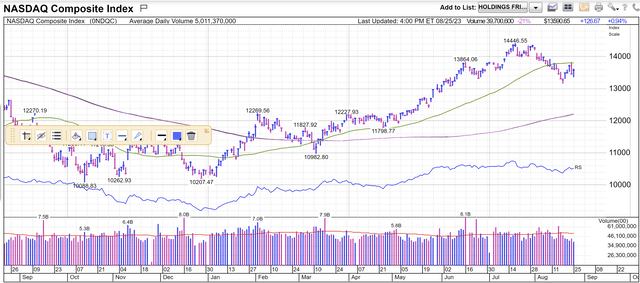

The stock was only up 0.10% on Thursday after their report and the Nasdaq was down 257 points. What gives? It would seem that the market was more afraid of what Jerome Powell would say at Jackson Hole the next day instead of reveling in Nvidia’s astonishing report.

Fed Chairman Powell did deliver hawkish remarks on Friday, but the market eventually shook them off and the Nasdaq ended up 127 points to finish the week. It now looks like the four-week correction in the market is now over (barring unknown events) and the index is finding support in the 13,250 area.

Nvidia continues to be our largest overall holding at Gunderson Capital Mgt. The question now becomes: Has the stock and A.I. fervor peaked or is there more gas left in the tank? To answer that question, let’s focus on NVIDIA, the current #1 “A.I.” stock with Microsoft (MSFT) as #2 with their ChatGPT.

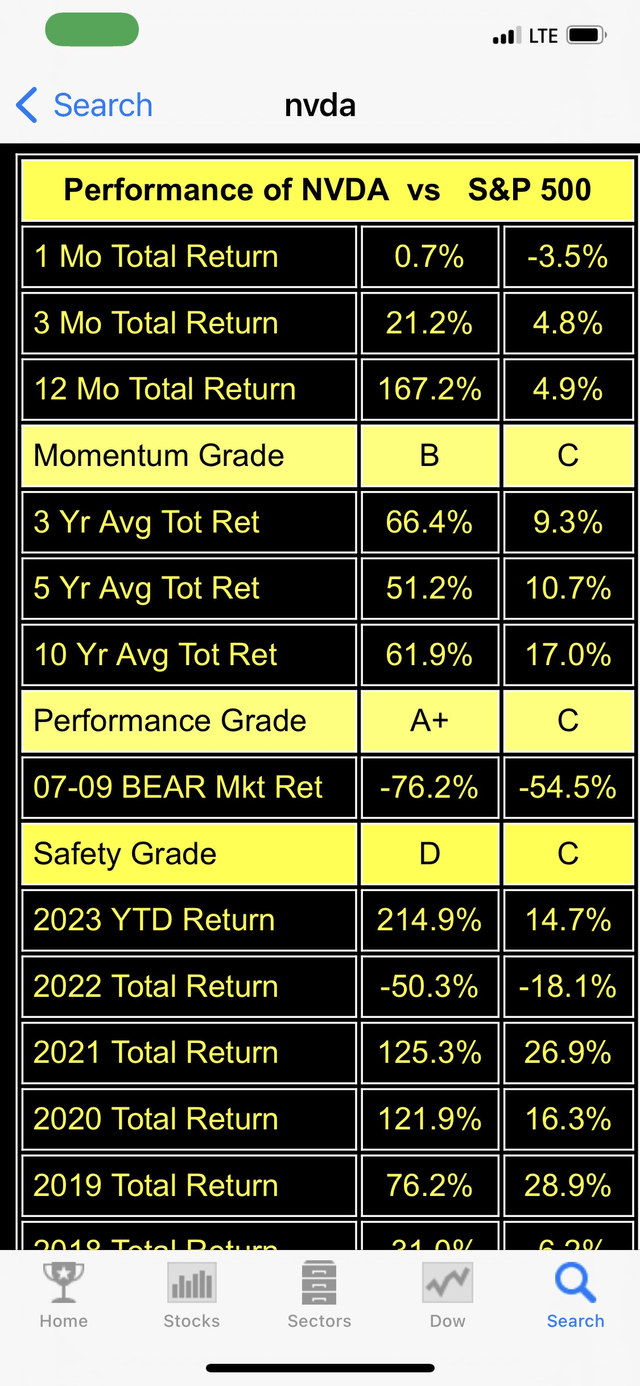

We will begin by comparing the performance of Nvidia Corporation against the S&P 500 (SP500). As you can see from the screenshots from my Best Stocks Now App above, the stock is up just over 214% year-to-date. This comes after a 50% drop in 2022. We did not own the stock in 2022 because of the rising interest rate environment that is detrimental to high PE growth stocks.

We bought (got back into) Nvidia in our Ultra Growth Portfolio and our Growth & Income Portfolio on January 18th of this year when it became apparent to us that the market was starting to look beyond the Fed Rate Hike cycle. This would be good for higher P/E growth stocks. We then added it to our Premier Growth Portfolio on March 23 of this year. We bought an overall 5% position in these portfolios.

We recently trimmed back (rebalanced) our position a bit, as it became a very outsized position for us. Risk management is also a very important element in managing portfolios. We are now back to about a 6%-7% overall position. We still like the stock at this level. We will get to that when we examine our current valuation and 5-year target price. But let’s first finish our examination of the performance of the stock, however.

The stock has clobbered the performance of the S&P 500 over the last one, three, five, and ten years. Its compound annual return to investors over the last ten years has been a sizzling 61.9% per year. There is only one stock in my database of 5,888 that has a better return. You would never guess what stock that is!

www.BestStocksNowApp.com www.BestStocksNowApp.com

The stock – Nvidia – passes my performance requirement with flying colors. But performance (momentum) is only one-half of my equation in sizing up stocks. The other half is valuation. I need to be able to justify a total upside potential of 70%-80% over the next 3-5 years.

To those relatively new to our screening process, when placing a five-year price target on a company’s common shares, the BSN app puts a high emphasis on “visible sustainable growth.” Extended growth forecasts come with their own set of limitations. Statistically speaking, the further out we forecast, the lower our confidence interval becomes around modeled expectations. To combat confidence interval slippage, we look for signs of earnings growth visibility. As the degree of earnings visibility increases, so do the chances that our growth assumptions will be observed.

Early in my career, I wrote several research reports as an analyst, and at the core of that research were price targets. I have settled in on 5-year price targets as opposed to shorter, more unpredictable ones. As you can see from the screenshot above, I currently calculate almost 90% upside potential for NVDA over the next 3-5 years.

Therefore, the stock now passes both my performance and valuation tests. When these two vital factors are weighed together, the stock comes in with an overall rank of 76 out of 5,888 possibilities. It also still maintains a BUY rating.

What could go wrong with this story? A lot. This continues to be a high-risk stock in a high-flying sector. A better chip for AI could come along from a competitor like AMD. Rising interest rates would take a toll on NVDA’s share if that were to happen. An economic and earnings recession would also be very dangerous for the stock. As of now, there is not one in site, but after 14 years of growth, we are overdue for one.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Best Stocks Now Premium gives you access to Bill Gunderson, professional money manager & analyst with 23 years of experience.

You get Bill’s daily “live” buys and sells in his four portfolios: Emerging Growth, Ultra-Growth, Premier Growth, and Dividend & Growth.

JOIN NOW to get daily “live” buys and sells, weekly in-depth market-timing newsletter, access to Bill’s proprietary database with daily rankings on over 6,000 securities, and a daily live radio show!