Summary:

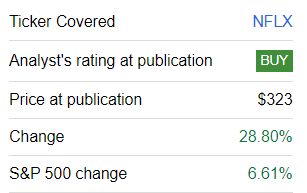

- Netflix’s stock has gained almost 29% since my first call, outperforming the broad market.

- The company’s recent earnings report showed steady revenue growth and improved profitability metrics.

- Despite competition and potential risks, Netflix is undervalued and has a strong pipeline of new products, making it a “Strong Buy”.

JasonDoiy/iStock Unreleased via Getty Images

Investment thesis

My first article about Netflix (NASDAQ:NFLX) stock aged really well, with the stock price gaining almost 29% since then. To compare, the broad market rallied less than 7% during the same period.

Seeking Alpha

Despite a challenging environment, the company continues to improve profitability with steady revenue growth. Recent developments suggest that the company is poised to continue improving its financial performance, and the stock is still massively undervalued, even after the solid rally from last year’s bottom. All in all, I upgraded Netflix’s rating to “Strong Buy”.

Recent developments

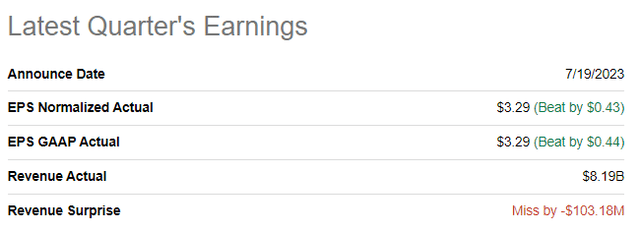

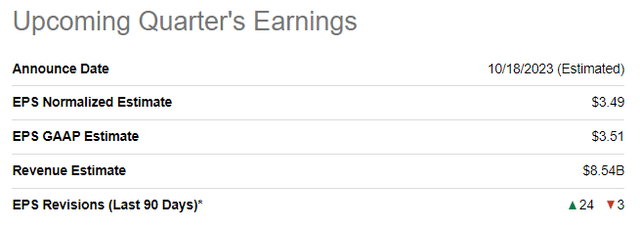

Netflix announced its latest quarterly earnings on July 19, missing consensus revenue estimates by about $100 million, which I consider insignificant. On the other hand, the adjusted EPS was well above consensus estimates. Revenue grew 2.7% YoY, and the adjusted EPS expanded from $3.20 to $3.29.

Profitability metrics have improved YoY, a solid sign amid the harsh environment. The operating margin expanded YoY from 19.80% to 22.32%. Stronger operating leverage enabled the company to generate $4,581 million of the levered free cash flow [FCF], almost a 12% growth. The company’s FCF margin is still stellar at almost 56% in Q2. Such a wide FCF margin means the business can reinvest heavily to innovate and continue producing its buzz-worthy content.

The upcoming quarter’s earnings are planned to be released on October 18. Quarterly revenue is expected to grow YoY by a solid 7.6%, and the adjusted EPS to expand from $3.10 to $3.49.

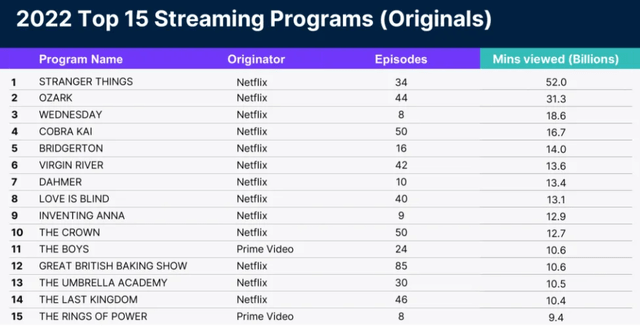

Overall, I am optimistic about the company’s future prospects. Despite the video streaming industry’s growth pace cooling down while moving toward full penetration in the developed world, I see several growth drivers for Netflix. Netflix tops the brand loyalty ranking among the most popular U.S. streaming services. The company has a massive track record of success across various genres. According to variety.com, in 2022, Netflix dominated the original video streaming with the massive presence of its shows in the top 15 most viewed shows.

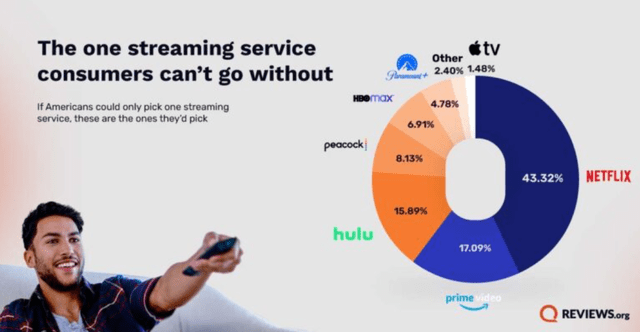

Several of these popular shows are expected to continue with new seasons in 2023 or 2024, meaning that Netflix has a strong pipeline of new products that are highly likely to maintain its high brand loyalty. That said, I believe the number of subscriptions is safe and poised to continue expanding. On the other hand, many bears might say that amid the current harsh environment, people are keen to cut their entertainment spending, which is likely to pressure revenue growth. The overall unfavorable sentiment is actually true, with recent surveys revealing that about 30% of internet households in the U.S. are cutting back on streaming spending. However, it is doubtful that households will cancel all their streaming subscriptions, and Netflix is well-positioned to be the most frequent survivor. The company now offers its lower-tier $7 per month subscription-based service, which means decent savings for households compared to the no-ads tier, and people will still have access to their favorite shows. It is also crucial to emphasize that Americans consider Netflix essential, with 43% of respondents answering that Netflix is the one streaming service consumers can’t go without.

While I consider Netflix’s revenue growth safe even amid the current challenging macro environment, it is also important to underline that the management is also focused on costs. During the latest earnings call, the commitment to be more efficient in spending was reiterated by the management. To conclude, I believe that prudent cost discipline together with bright revenue growth prospects will enable Netflix to remain on its wide FCF margin trajectory. This in turn will be reinvested back into production and build long-term value for shareholders.

Valuation update

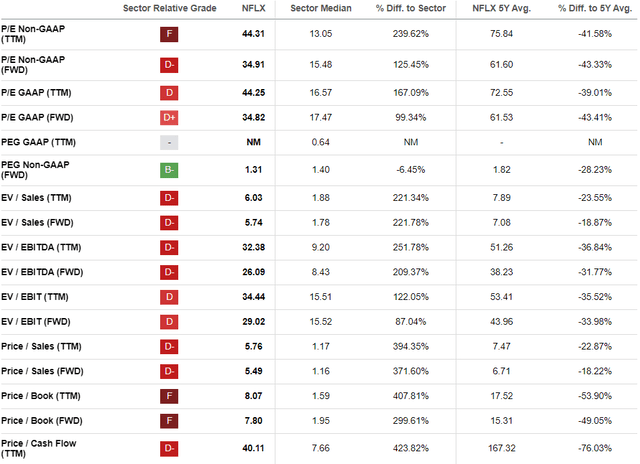

The stock significantly outperformed the broad market this year with a 41% year-to-date rally. Seeking Alpha Quant assigns the stock a deficient “D-” valuation grade due to high multiples compared to the sector median. But Netflix is a highly profitable company with a solid brand and a vast fan base. That said, I prefer to compare current multiples with historical averages, and based on this comparison NFLX looks attractively valued.

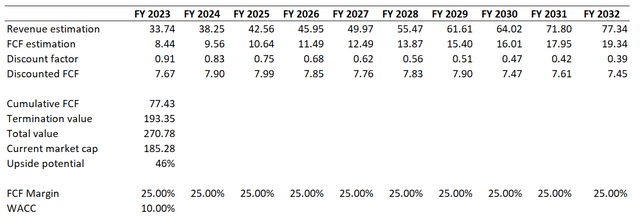

Now, let me proceed with the discounted cash flow [DCF] approach. I use a 10% WACC as a discount rate. Netflix is an FCF star generating above 50% margin, but assuming this high level to be sustainable over the next decade looks too optimistic. Therefore, I assume a long-term stable 25% FCF margin for my DCF valuation. Revenue consensus estimates forecast a 9.7% CAGR for the next ten years, and I consider it fair to use in my valuation simulation.

Based on the above assumptions, the stock still looks extremely undervalued, with a 46% upside potential. It is also essential to remember that my FCF assumptions are very conservative, meaning the valuation is very attractive.

Risks update

Netflix operates in a highly competitive environment, facing competition not only from peers like Disney+ or Amazon Prime but from social networks as well. The competition from short-form internet videos should not be underestimated as well. In recent years, we have seen how viral services like TikTok or Instagram Reels demonstrated substantial growth in the total number of views. That said, Netflix faces intense competition, and to maintain its success, the company has to continue producing its trendsetting content consistently. Failing to do so may lead to an increase in churn rate, which will ultimately undermine the financial performance.

The company’s significant strategic moves, like introducing new advertising-supported subscription tiers or password-sharing crackdowns, are at the early stages of development, and there is a very high level of uncertainty about how these initiatives will unfold in the foreseeable future. The new, lower-end subscription tier might cannibalize revenues from more expensive tiers. Password-sharing crackdowns might significantly undermine brand loyalty over the long term as well.

Bottom line

To conclude, NFLX is a “Strong Buy”. I think that the massive upside potential significantly outweighs all the potential risks and uncertainties. The company’s massive FCF suggests that the company has vast resources to attract the best people in the industry to continue generating trending content. The ability to grasp viewers’ attention is crucial in the highly competitive environment, and Netflix has been very successful in it in recent years. A strong track record of success gives me high conviction about the company’s ability to sustain its buzzworthy content pipeline.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.