Summary:

- AT&T’s shares may be forming a bottom.

- It announced the nationwide launch of AT&T Internet Air, which opens up new growth opportunities for the company.

- This may be an opportune time for long-term investors to accumulate its shares.

Justin Sullivan

AT&T’s (NYSE:T) shares have slid nearly 30% from its 52-week highs as investors have grown wary about its growth prospects, the stability of its cash flows and its ability to sustain dividend payouts. While the concerns are justified, there’s one major development that has happened last week that changes things. The telecom giant announced the aggressive launch of its fixed wireless access internet, dubbed AT&T Internet Air, which opens a new growth avenue for the company and dissuades bearish narratives surrounding the name. Let’s take a closer look and understand why it’s a big deal for AT&T and its shareholders.

The Announcement

Let me start by breaking down what fixed wireless access basically is. Telecom operators essentially install a device outside a home or the office premises that connects with their wireless network, and subsequently beams internet inside the building via Wi-Fi. Different network operators have different takes on it. For instance, some cater only to residential customers while others serve businesses. Similarly, some use 4G LTE backbone while others use 5G to power their service. Moreover, some networks use mmWave, others use C-band and some deploy a hybrid. This is just to give you an idea that the technology is mature and mobile operators have different deployments.

Now AT&T isn’t a stranger to this technology. It had rolled out fixed wireless access service as part of its soft-launch to understand customer pain points but it’s launching a nationwide 5g fixed wireless access service now. Per the company’s spokesperson, AT&T is deploying C-band spectrum but not mmWave spectrum.

The setup is self-service and pretty straightforward which, the company claims, can be done in as little as 15 minutes. The Internet Air service is priced at $35 per month, which works out to be $420 per year. It doesn’t have any overages, equipment costs or pricey installations that can involve digging up yards for the laying down of fiber. Also, there aren’t any annual contracts and prices are locked for at least a year.

Considering the network connectivity will be wireless, I feel it’s a very attractive value proposition for the customer and the company also (as we’ll see in the next section of this article shortly).

It’s a Big Deal

Now, don’t mistake AT&T as a pioneer in the field. There are already Verizon (VZ) and T-Mobile (TMUS) doing this exact same thing and AT&T is joining the bandwagon. Some argue that Charter (CHTR) and Comcast (CMCSA) might join the bandwagon too. So, overall, this might seem like an underwhelming development for AT&T, but it actually isn’t.

See, Charter and Comcast are virtually supplementing their wireless networks with wholesale network capacity purchases from Verizon, T-Mobile and AT&T to roll-out their versions of wireless networks. This means it’s feasible for these Mobile Virtual Network Operators (or MVNOs) to roll out services in dense areas, to get the most bang for their buck, but not nationwide fixed wireless access internet (let’s call it as FWA going forward)

But AT&T is rolling out nationwide FWA, using its own network, giving it several advantages.

For starters, AT&T can scale its network much faster than other MVNOs, even in sparsely populated areas. This would give it visibility about spectrum requirements in the future and allow its management to preserve cash accordingly.

Secondly, think of copper broadband customers. These lines require regular maintenance, they serve slow internet speeds and are often struggling to compete with fiber broadband offerings. AT&T can quickly upgrade these customers to fiber-like speeds and reduce its churn along the way.

Third, replacing copper broadband with fiber broadband is very expensive. It involves setting up network nodes and subsequently digging up roads/yards to unearth copper lines and/or lay down fiber. But that capital expenditure requirement of going the traditional fiber-route is minimized with the FWA offering, as FWA equipment is wireless. This would allow AT&T to quickly expand its broadband footprint in under-served and underpenetrated areas.

The low cost of deployment and better speeds also means that FWA offerings from Verizon, AT&T and T-Mobile can potentially win market share from cable broadband. In fact, Charter’s CFO already acknowledged last year that this may be happening.

Besides, AT&T, Verizon and T-Mobile strike wholesale deals with MVNO’s such as Charter, Comcast and DISH to monetize their excess network capacities. With this development, AT&T can now use that excess network capacity to serve its traditional wireless traffic, lease it out to MVNOs or prioritize its own FWA traffic. This essentially opens a third avenue for AT&T management to further optimize their network utilization and monetization.

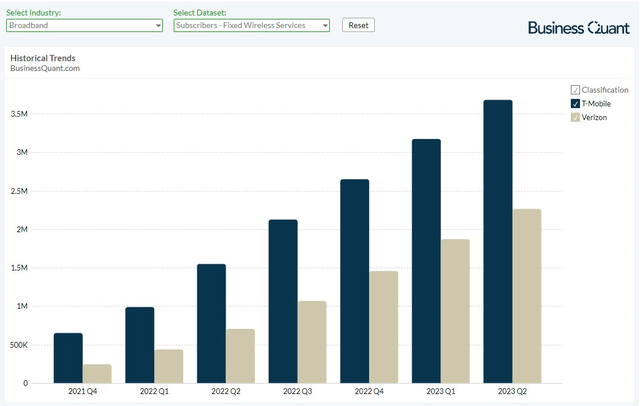

More to the point, the market for FWA is well-developed and thriving already. The chart below highlights how Verizon and T-Mobile are registering rapid FWA subscriber growth. AT&T’s aggressive entry into the space will allow it to tap this industry tailwind and grow its top line along the way.

To put things in perspective, assuming AT&T is able to add 4 million FWA subscribers in the next 12 months at a price point of $35/per month, it can potentially generate as much as $1.6 billion from this subscriber base alone. It’ll add about 1.3% to the company’s top line, which is meaningful considering that AT&T’s revenue has stagnated of late.

Lastly, although AT&T had acquired the C-band spectrum, there was no clarity if it will be rolling out nationwide FWA anytime soon. As a result, many investors grew skeptical about AT&T management’s ability to execute on their plans. But this development should now dissuade any such bearish concerns and encourage investors to initiate long positions in the company instead.

Although, I must point one risk factor. If AT&T Internet Air’s service quality is poor, which could be due to fluctuating speeds, spotty coverage or frequent downtimes, then the entire FWA foray might struggle to take off.

Final Thoughts

As a reminder, I had published a prior article on AT&T in July highlighting why the stock makes for a good buy, in light of its improving subscriber metrics, lowering churn and improving free cash flow trends. This article builds on that and discusses AT&T’s foray into the FWA space, and why it makes the company an even better buy, than previously cited.

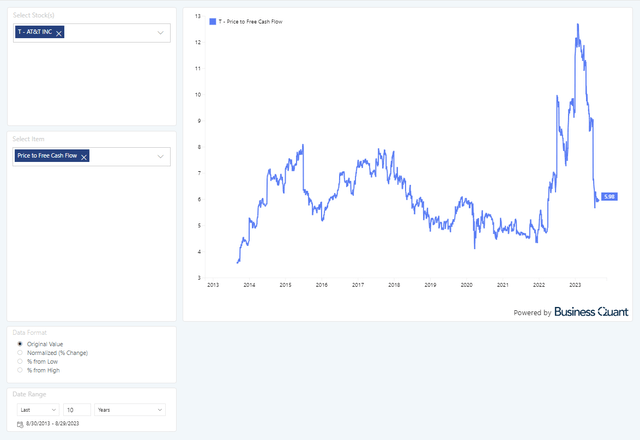

But having said that, AT&T’s shares are trading at just 6-times its trailing twelve-month free cash flow. This figure is quite low on a standalone basis as well as on a historic basis. Note in the chart below how AT&T’s Price-to-Free Cash Flow multiple is well below the levels seen in recent years and it’s approaching pre-pandemic levels. So, I’m of the opinion the stock is fairly and even undervalued at current levels.

The aggressive launch of AT&T’s FWA service only stands to improve its growth prospects and tilts the risk-reward ratio in the favor of its shareholders. Therefore, I believe this is an opportune time for investors with a long-term time horizon, to accumulate AT&T’s shares on potential price corrections before they eventually rally. Good Luck!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.