Summary:

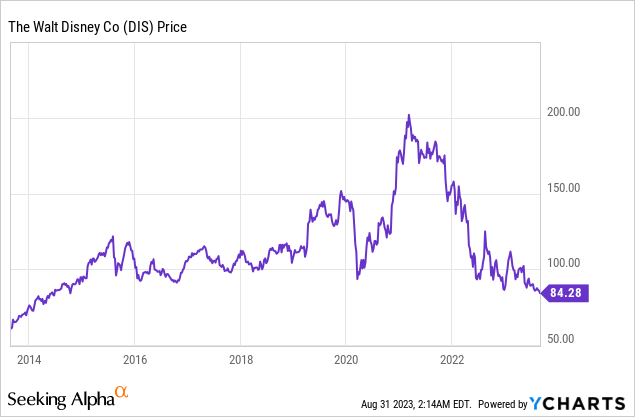

- Disney is trading at multi-year lows and has become a battleground stock.

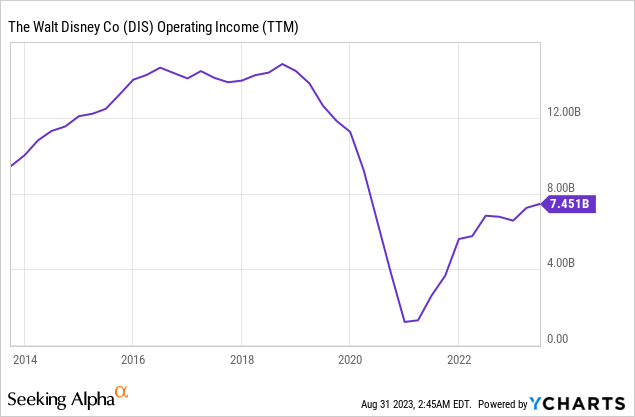

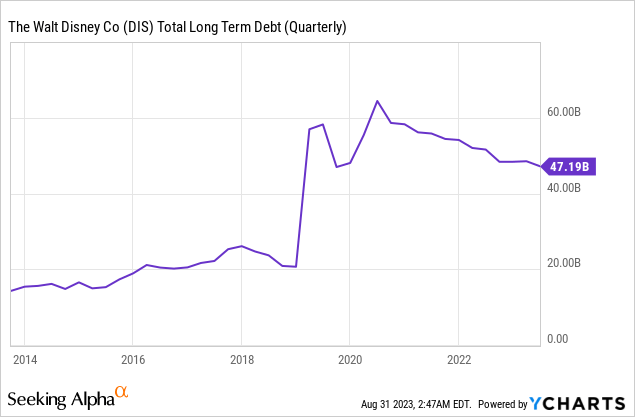

- The company has significantly more debt and lower operating income than it had pre-pandemic.

- We believe investors should wait on the sidelines until the fundamental picture materially improves and the narrative surrounding the company changes.

Razvan

Thesis

Despite trading at multi-year lows, we believe that Disney (NYSE:DIS) remains overvalued and is currently a fundamentally broken company. The discussion around Disney is often made a political one, but the story here has more to do with distractions and poor execution. Fortunately, for investors, this isn’t the first time that Disney has been in a difficult situation and we can look to the past for clues on how this might play out.

The Story of Walt Disney and EPCOT

Disney as a company is no stranger to navigating tough times. In 1941 Disney had issues with a massive workers strike. The Disney animators’ strike was a nearly 4-month work stoppage that resulted in Disney signing a contract with the Screen Cartoonist’s Guild. This was a major challenge to the company and they ultimately came out of it stronger. They would end up facing another organizational challenge nearly 25 years later.

The creation of what is now Walt Disney World in Florida was originally supposed to focus on building EPCOT. This acronym stands for Experimental Prototype Community Of Tomorrow. This project centered around constructing the city of the future and would feature many groundbreaking innovations, serving as a model for how other urban centers could develop across the country. The city was planned to house anywhere from 20,000 to 100,000 people (the number changed at different times during the planning stages). The theme park was just a small piece of the puzzle and was meant to be a way to attract tourists to the area and fund the city’s construction.

The project’s massive cost and scale as well as concerns about feasibility caused EPCOT to be viewed with skepticism by some within the organization. When Walt died the project was put on hold. EPCOT was eventually scaled down and built in park form. Some of the inventions Walt designed for the city of the future were incorporated into the various parks (such as the trash system). Others were turned into rides at the parks (such as the PeopleMover). At the end of the day what began as an ill-advised financial and operational nightmare turned out to have positive effects and no lasting negative consequences.

Financial Challenges in the DTC Segment and Disappointing Movie Profitability

In many ways, EPCOT is similar to Disney’s adventure into streaming. Disney has been spending way too much time, energy, and most importantly money on streaming and has gotten distracted from their previous focus on creating profitable content and profitable development of IP. The costs of streaming have become astronomical and content is quickly becoming a money pit. In their most recently reported quarter, the company reported an operating loss of $512 million in their Direct-to-Consumer segment. The company mentions in the report that for both Disney+ and Hulu their higher revenue numbers and decreased marketing spend were offset by an increase in programming and production costs. This shows that content spend continues to increase while streaming as a whole remains unprofitable.

In addition to streaming content spend not being profitable, some of Disney’s movies released in 2023 have also failed to generate the high level of returns that many have come to expect. Studios generally don’t disclose the financial metrics of movies but thankfully we do have some insight. Movies made in the United Kingdom benefit from something called the Film Tax Relief scheme which allows film studios to claim a cash reimbursement of up to 25% of the money they spend in the country. The important thing for investors is that they have to file financial statements in order to receive the cash. You can read a Forbes article covering these four expenditures by clicking here. For those unfamiliar with the author of that article she investigates the profitability of many films made by a variety of studios and is definitely worth following.

Ant-Man and the Wasp: Quantumania: Earned $81.9 million profit, however, this number excludes marketing and post-production so it is highly likely that this film ended up in the red.

The Little Mermaid: $70 million profit but this number excludes 1.5 months of post-production as well as marketing costs.

Indiana Jones and the Dial of Destiny: Needed to gross $477.8 million at the box office to break even but only grossed $381 million. The breakeven calculation is also before market costs are added, which makes the loss even greater.

Secret Invasion: Budget of $211.6 million. While this isn’t a movie shown in a theater, it is a show on Disney+ and was filmed partially in the UK. This can help to put some context into content spend on streaming. While it is impossible to estimate the profitability of shows on Disney+ due to the nature of the service, it seems difficult to believe that Secret Invasion resulted in incremental revenue of $211.6.

The main point is that Disney is spending more on content for streaming and despite cutting marketing costs for streaming the segment is still unable to turn profitable. This comes as subscribers dipped by 11.7 million, which could be a sign that a high level of marketing spend was fueling growth and as that marketing spend decreases there aren’t enough new users to make up for the ones who leave. Some of Disney’s movies have been unable to earn the financial returns that many have come to expect leading to a further reduction in profitability.

Both EPCOT and Disney’s adventure into streaming started as a distraction that was poorly executed and both will end up turning into a more rationalized version of themselves. Disney will eventually right the ship, the question here is one of timeframe. For now, we think investors should wait on the sidelines until there are significant improvements, as the current valuation and balance sheet leave a lot to be desired given the challenged narrative and growth prospects.

Price Action and Valuation

The price action here looks atrocious and has turned Disney into a battleground stock. On one side there are bulls who believe the selloff is unwarranted, and on the other side, there are bears who believe there is more to come. The bulls will point to a storied franchise and massive IP catalogue, and the bears will point to poor fundamentals and a potential culture problem. Each camp is correct in their own way, and thus the battleground is set. With Disney at multi-year lows, it seems that the bears are correct, at least for the time being. While we do believe that Disney will turn itself around eventually, we don’t like the risk/reward at this time and think there could be even more downside as the last investors finally throw in the towel. The fundamentals of the business are less than ideal and we think that waiting on the sidelines is a safe choice.

Disney has done well to improve their operating income off the pandemic lows but that number is still well below their pre-pandemic high. This provides a fundamental justification as to why the share price is trading at multi-decade lows. It’s probably best to view the rapid run-up in share price in 2021 as an anomaly fueled by positive market sentiment around streaming and momentum rather than a move based on fundamentals. If Disney can return their operating income to pre-pandemic levels the stock may once again trade at pre-pandemic prices.

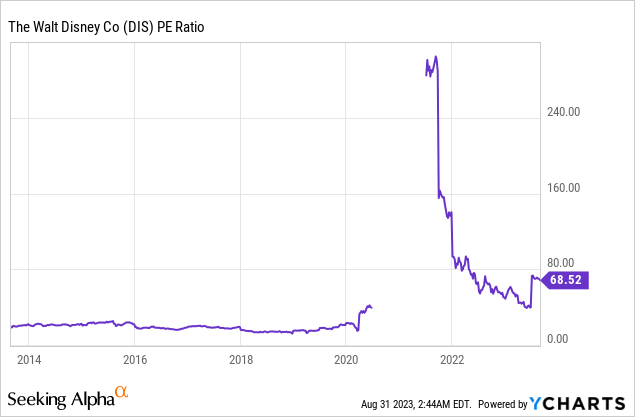

We believe the valuation of Disney is still way too high given their current operational and financial situation. A PE multiple of 68.5 seems rich, and we believe that a more fair trailing multiple would be in the 15 range. We arrive at this range of 15 because that is the average trailing PE multiple that Disney traded at between 2009 and 2019 before the pandemic skewed their business (approximated to a round number). Even then the stock may not be a buy if the company has yet to turn around their operations and shift the narrative around their business.

The debt load of Disney has ballooned over the past several years. We view this debt load as being too high, especially relative to their TTM operating income. It would take about 6.5 years for Disney to pay off their debt if they put all of their operating income towards it. Investors will rightly point out that the debt isn’t due until well into the future, but the interest and eventual principal repayments do have the effect of decreasing free cash flows to equity holders and thus decrease the firm’s intrinsic value. I think we can all agree that Disney in 2019 was financially healthier than they are now, with less than half the debt and nearly double the operating income. For this reason, even if the company can return their operations to pre-pandemic levels the stock may fail to achieve the valuation multiples previously given to them by the market.

In our opinion, there are too many good investment opportunities out there to take a position in Disney given the situation at the company and their financials. We will be watching closely to see when the financial situation meaningfully improves and the risk/reward becomes more attractive, at which point we would turn bullish on the company (if the price remains near or below these levels).

Risks

A risk to the bull case for Disney is the potential for the company to have a material culture problem and be unable to turn their operations around. Bob Iger won’t be at the company forever and somebody will eventually have to step up and fill his shoes. Another risk is that their shift to streaming permanently impairs the profitability of their business, and content for streaming becomes an endless money pit. Finally, a risk to the bull case is if Disney ends up permanently impairing their IP and damaging their brand image, which are the two biggest moats of the company.

A risk to the bear case for Disney is if the company can successfully monetize streaming and cut down on content costs. This could lead to the company gaining a valuation multiple closer to the one Netflix has. Another risk to the bear case is if the public ends up having a short memory regarding the numerous controversies that Disney has gotten themselves into, and the controversies end up having no impact on revenue and profitability over the long term.

Overall we are neutral on the company and believe there will eventually be a time to buy, just not now.

Key Takeaway

Even though they are trading at multi-year lows we don’t see a compelling reason to buy Disney’s stock at this time. The company is in a significantly worse position than they were pre-pandemic. Once the narrative around the company has changed and financial metrics begin to improve we will take another look here and may turn bullish depending on valuation. For now, investors would probably be better off waiting on the sidelines until the picture becomes clearer.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

UFD Capital, LLC manages a hedge fund and does not provide investment advice to anyone else. Nothing contained in this article is investment advice or financial advice of any kind and investors should do their own research and consult a professional before making financial decisions. Nothing contained in this article should be interpreted as a solicitation to buy or an offer to sell securities.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.