Summary:

- PayPal stock dropped after the COVID-related online buying frenzy, but it has the potential for a turnaround.

- The new CEO, Alex Chriss, could bring fresh perspectives and drive new sources of revenue for PayPal.

- PayPal is likely to benefit from the long-term growth of digital payments and is investing in key areas to increase its market share.

Justin Sullivan

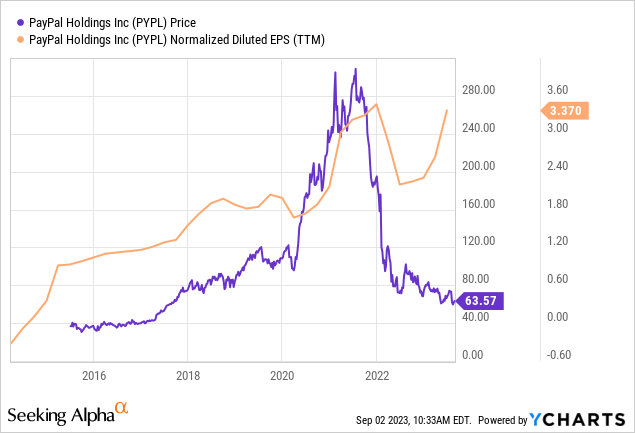

PayPal Holdings (NASDAQ:PYPL) had a significant drop since peaking around $300 in 2021. The stock had a large run-up during the COVID-related online buying frenzy that occurred in 2020 and into 2021. However, the stock took a big hit after purchasing conditions returned to normal. The stock appears to be recovering from the dip and is at the beginning of a new uptrend.

PayPal has the potential to be a strong turnaround story as the valuation is attractive and the expected growth for revenue and earnings is above-average. The stock is currently at a bullish technical turnaround level. New catalysts can keep the stock increasing with new positive momentum.

Potential Positive Catalysts

The new CEO, Alex Chriss, can be a positive catalyst that might steer PayPal on a new growth trajectory. Alex Chriss takes over as PayPal’s President and CEO on September 27, 2023. Chriss served as Executive Vice President and General Manager of Intuit’s (INTU) Small Business and Self-Employed Group since Jan. 2019. During his leadership, customers increased by 20% while revenue increased 23%. Chriss also led Intuit’s $12 billion acquisition of Mailchimp which significantly expanded business capacity and the customer base.

The new CEO could provide a fresh perspective on PayPal’s business to help drive new sources of revenue to the company. This may include expanding business to existing customers, securing new customers, and finding potential add-on acquisitions. Overall, the new CEO can be a likely positive catalyst for PayPal’s business and the stock.

PayPal is likely to benefit from the long-term growth of digital payments. The market size for digital payments is expected to increase at about 14% annually to reach $5,848.5 trillion by 2030. This growth should provide a strong tailwind for PayPal’s online payment service.

PayPal is investing in three main areas for growth: branded checkout, merchant solutions, and digital wallets. The company believes that these areas are key for PayPal to increase its market share in the e-commerce market. The company also strives to increase its margin dollar growth. If this strategy is successful, PayPal can grow revenue and earnings at a strong pace as the e-commerce market continues to grow.

Expected Growth

PayPal is expected to grow revenue and earnings at an above-average pace over at least the next two years. Revenue is expected to increase by about 8% in 2023 and 9% in 2024. Earnings are expected to increase by about 20% in 2023 and 14% in 2024. The 3 – 5 year average expected annual earnings growth is about 17%. This growth is likely to have a positive effect on the stock if expectations are met or exceeded.

Technical Perspective

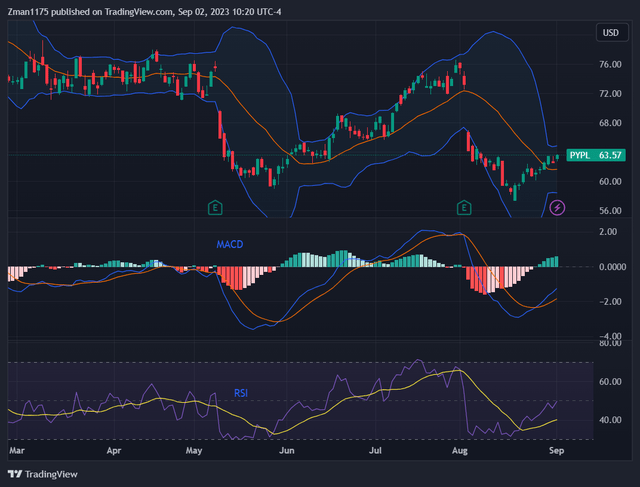

PayPal Holdings Stock Chart with MACD, RSI indicators (tradingview.com)

PayPal’s daily stock chart above shows the stock recovering from a recent significant pullback. The blue MACD line crossed above the red signal line which indicates a confirmation of a bullish reversal. The RSI has been increasing from a near oversold level. If the RSI crosses above the 50 level, it would likely lead to further gains for the stock since it would indicate strong positive momentum.

If the company continues to execute well and meets/exceeds earnings expectations for most quarters, I expect the stock to rise to the level of resistance at $76 within approximately 6 months. We can see that the stock made a similar move just a few months ago. The $76 level can be exceeded if conditions continue to go well for PayPal in 2024.

The chart above shows the current discrepancy between PayPal’s EPS and the stock price. The last time EPS was significantly above the price on the chart, the stock made a significant move higher. So, I would expect another strong run higher as the company continues its growth and as investors realize the bargain that PayPal currently presents.

Attractive Valuation

PayPal is trading with a low forward PE of just under 13x. This is below the Credit Services industry’s forward PE of 18x. Another valuation metric that I like to use is the PEG ratio which takes the 3 – 5 year earnings growth rate into account. PayPal is trading with a low PEG of 0.77. I typically like to see the PEG ratio between 1 and 2 for strong growth companies. So, PayPal is really showing a bargain valuation with its PEG below one.

With this low valuation level, the stock has plenty of room to move higher in my opinion.

Risks to the Investment Thesis

Competition remains an ongoing threat for PayPal. The company faces competition from numerous sources such as traditional bank debit cards, credit cards, Apple Pay, GoCardless, Payoneer, Skrill, etc. So, PayPal’s success hinges on consumer behavior and the company’s ability to entice them to use its services over alternatives. Significant changes in consumer payment behavior could lead to a loss of market share for PayPal.

Changes in government regulations regarding online payments could have a negative effect on PayPal. This could be in the form of stricter regulations, making it more difficult for the company to increase market share. Or, it could involve higher taxes that could negatively impact the company’s services.

PayPal’s Long-Term Outlook

PayPal’s long-term outlook is positive in my opinion. The company has an attractive valuation and is back to a bullish technical level, providing plenty of upside for the stock. Concerns about competition are probably overblown. PayPal already has first mover advantage as one of the main go-to solutions for online payments. PayPal has a market share of over 50% for online payment processing. There are over 426 million active PayPal accounts currently being used. It’s a trusted brand that has been around for years, so it is natural for many consumers to use it and for new ones to adopt it.

Analysts have a one-year price target of $86 for the stock which is 35% higher than the current price. This would bring the forward PE to 15x based on expected EPS of $5.64 for 2024. That’s still below the Credit Service industry’s forward PE of 18x. So, I see PayPal as a great buy the dip opportunity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The article is for informational purposes only (not a solicitation or recommendation to buy or sell stocks). David is not a registered investment adviser. Investors should do their own research or consult a financial adviser to determine what investments are appropriate for their individual situation. This article expresses my opinions and I cannot guarantee that the information/results will be accurate. Investing in stocks involves risk and could result in losses.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.