Summary:

- AbbVie’s future growth depends on improving its balance of drugs offered, in contrast to its Humira-dependent first decade.

- Skyrizi and Rinvoq should offset the decline in Humira sales, but further growth depends on oncology and neuroscience as well as international sales growth in aesthetics.

- Even with this growth, ABBV stock should deliver around 8% total return annually through the end of the decade. This is in line with market performance making AbbVie a hold.

Hailshadow

The Decline of Humira

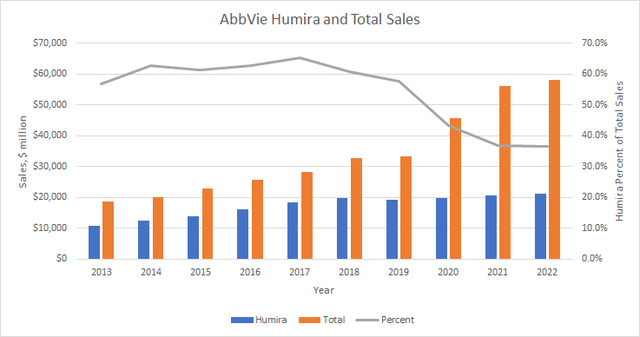

For the first seven years of AbbVie’s (NYSE:ABBV) existence as a public company, its top selling drug Humira made up over 60% of the company’s total sales on average. By some accounts, based on cumulative sales since its launch in 2003, Humira has been the top selling drug of all time.

With its patent protection, AbbVie was able to grow Humira sales each year by gaining approval for a growing list of indications in rheumatology (rheumatoid arthritis, psoriatic arthritis, ankylosing spondylitis), dermatology (psoriasis, hidradenitis suppurativa), and gastroenterology (Crohn’s disease, ulcerative colitis). Humira sales grew through 2022 despite loss of exclusivity in Europe. LOE in the US happened in 2023 with multiple biosimilars launching this year. As a result, AbbVie expects a 35% drop in Humira sales this year. That’s actually an improvement from the 37% decline expected until it was revised on the 2Q 2023 earnings call.

AbbVie saw the patent cliff coming and pursued an M&A deal to keep the revenue flowing while their pipeline developed internally. This resulted in the purchase of Allergan, which I covered in 4 articles in 2019-2020. This allowed Humira sales to drop below half of the company total. Allergan brought in the aesthetics (Botox and Juvederm), neuroscience, and eye care segments. Still, it would take much more than this to offset lost sales from Humira when it went off patent in the US.

In 2023, AbbVie is expected to see a decline in revenue with possibly just a slight improvement in 2024. AbbVie has developed replacements in the immunology segment for Humira, but these will probably just keep overall immunology sales at current levels for the rest of the decade. The company is counting on faster growth in its Oncology, Neuroscience, and Aesthetics segments to return to growth. This better balance of therapeutic areas is necessary to carry AbbVie beyond its first decade when it was heavily dependent on Humira.

Immunology

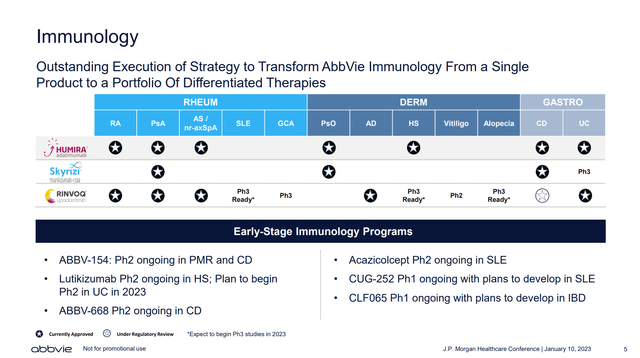

The first and biggest selling of these new drugs are in the immunology segment like Humira. Skyrizi and Rinvoq work by different mechanisms than Humira but are indicated for many of the same conditions, and the company continues to seek approval for additional indications.

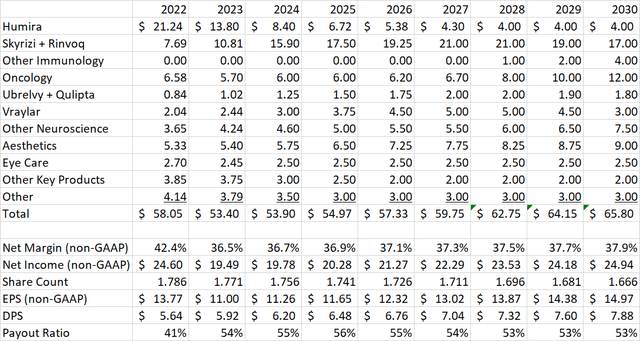

Concurrent with the trough in overall company earnings in 2023-24, Humira will be in its last years as AbbVie’s top seller. The 35% drop in 2023 will take Humira sales to $13.8 billion. The company has not provided guidance for 2024, but analysts now expect something around $8.4 billion. After that, management suggested on the 2Q earnings call that sales would have a “stable tail”. I my model, I show sales declining to $4 million by 2028 and holding there for the rest of the decade.

The new sales leaders will be Skyrizi, projected at $10 billion in 2025, and Rinvoq, at $7.5 billion. The company then expects sales of these two drugs to peak in 2027 above the $21 billion that Humira hit at its peak in 2022. Beyond 2027, I expect AbbVie to begin commercializing some of the drugs currently in early stages of development. This should keep immunology segment sales stable around $25 billion.

Risks in this segment include competitors like Pfizer’s (PFE) Xeljanz, which is a JAK inhibitor like Rinvoq. Skyrizi has several competing IL-23 inhibitor drugs including Cosentyx (NVS), Stelara and Tremfya (JNJ), and Taltz (LLY). JAK inhibitors also have the potential for serious side effects and may not be considered as a first line treatment.

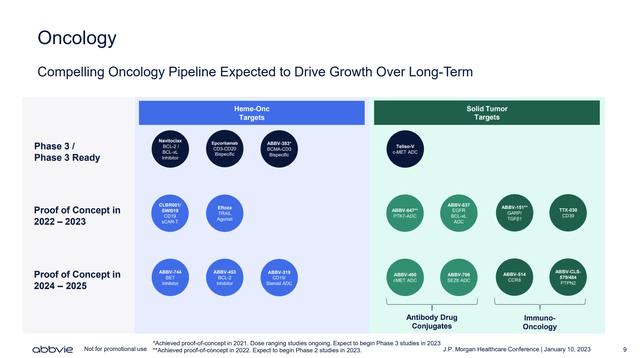

Oncology

AbbVie’s current focus in the oncology segment is blood cancers like chronic lymphocytic leukemia. Their top selling drug in this segment is Imbruvica, however sales have already peaked and are subject to competition from other BTK inhibitors like AstraZeneca’s (AZN) Calquence. AbbVie’s newer drug, Venclexta, works by a different mechanism and is still growing by double digit percentages, especially in international markets. Until additional drugs come on the market, this segment is expected to have flat sales in 2024 and 2025.

Furthest along in the pipeline is Epkinly (epcoritimab) for diffuse large B-cell lymphoma (DLBCL) with initial approval expected later this year. In 2024, the company expects to see approval for navitoclax in myelofibrosis and Taliso-V for non-small cell lung cancer, the company’s first drug in the solid tumor area. AbbVie expects to get about $6 billion in revenue from these three drugs at their peak. The pipeline is full of additional drugs in the early stages of development. I expect these to start showing up in sales by the end of the decade, potentially doubling sales from the current level to $12 billion.

Drug development is risky in this segment, as AbbVie found in 2019 when it wrote off $4 billion from its acquisition of Stemcentryx when its small cell lung cancer drug did not work out.

Neuroscience

While the Allergan acquisition was mainly intended to provide a cash cow with its Botox and eye care products, the neuroscience segment has turned into a key growth driver for the company, even bigger than the oncology segment. The top seller here has been Botox Therapeutic. This is the same Botox used in cosmetic treatments, but for therapeutic uses like migraine, overactive bladder, and others. The company’s newer migraine treatments, Ubrelvy and Qulipta, are still growing and are expected to have $1 billion in sales each at peak. The real hidden gem from the Allergan deal however, is Vraylar. The depression drug was just approaching approval at the time of the acquisition and is already over $2 billion in sales. It is expected to hit $5 billion sales at peak. The pipeline in this segment includes ABBV-951 for Parkinson’s disease with approval expected this year and peak sales around $1 billion. The company also has an Alzheimer’s disease drug in Phase 2.

Aesthetics

Botox and Juvederm are the two main products in the aesthetics segment. Sales in the segment were $5.3 billion in 2022 with just slight growth expected this year. Demand fluctuates a bit differently in this segment compared to the therapeutic drug market as it is more discretionary and not typically reimbursed by health insurance. Growth has reversed in the US this year as inflation in the general economy has forced some consumers to forgo Botox and Juvederm treatments. Internationally, growth has been much better, up 6.1% in the first half of the year as reported, or up 13.2% on a constant currency basis. Demand in China is back to pre-Covid levels. AbbVie plans to focus a lot of marketing to further grow international demand. They are targeting sales over $9 billion in 2029.

Financial Model

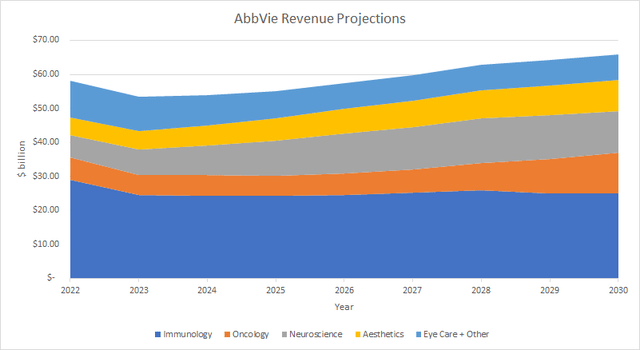

Putting it all together, AbbVie is guiding to $53.4 billion of sales this year, which I expect to be the trough level. Looking forward, as discussed above, I expect the immunology segment sales to stabilize around $25 billion. Oncology sales will roughly double by 2030, and Neuroscience and Aesthetics will add 60%-70%. Eye care and other products are expected to be flat to down. This takes overall sales to $65.8 billion in 2030, about a 3% CAGR from 2023 levels.

I am modeling a small improvement in net margin to 37.9% in 2030 from 36.5% in 2023. While the company has room to improve SG&A costs after a jump in 2023, the main driver of the net margin improvement I am counting on is a reduction in interest expense, as the company has cash available to pay down debt taken on for the Allergan deal. Another large acquisition in the future would be a risk to this assumption.

The company also should have cash available for a small net buyback of around 15 million shares per year, in line with recent levels. The overall effect of the margin improvement and share count reduction is to take EPS from $11.00 this year to $14.97 in 2030, a CAGR of 4.5%.

I am projecting a dividend increase of $0.28 each year, in line with the increase from 2022-23. This maintains the payout ratio in the mid 50’s% area. This dividend growth in the 3%-5% range is a slowdown from the 10%+ annual growth seen during the company’s first decade.

Valuation

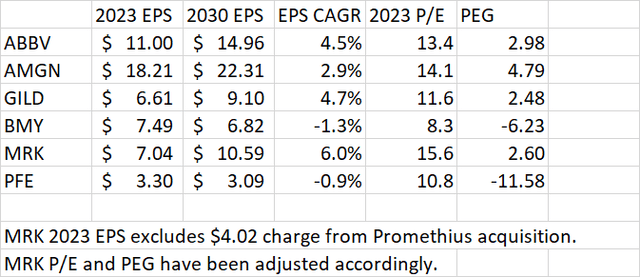

Most of the large cap biotech and pharma companies have low growth. Pfizer (PFE) and Bristol Myers (BMY) even have negative growth based on analyst consensus estimates. AbbVie is near the middle of the pack at a 4.5% EPS CAGR. AbbVie’s P/E ratio of 13.4 times 2023 earnings is also near the middle of the pack.

Using the PEG ratio to normalize P/E for expected growth rate, all the companies with positive growth have a PEG above 2, normally considered the high end of fair value. At low single digit growth rates, however, this rule of thumb tends to fall apart. With Merck (MRK), Gilead (GILD), and AbbVie all in the 2.5-3.0 PEG range, I would call all three fairly valued relative to each other.

Conclusion

AbbVie’s future depends on improving its balance of revenue sources compared to its heavy dependency on Humira during its first decade. Skyrizi and Rinvoq have come a long way toward stabilizing sales in the Immunology segment, but future growth depends on the pipeline in Oncology and Neuroscience, as well as international sales growth in Aesthetics.

While these pipelines look promising, they still produce an overall EPS growth rate in the mid-single digits like many of its large cap peers. The strong dividend growth of AbbVie’s first decade is expected to slow to 3%-5%. If the share price grows in line with earnings, AbbVie should produce a total return of 8% per year the rest of the decade, about in line with the long-term historical return of the S&P 500.

I have been a holder of AbbVie since its spinoff from Abbott Labs (ABT) and see no reason to sell here. Nevertheless, I don’t see much to distinguish it from large cap peers like Gilead and Merck, or even the overall S&P 500. AbbVie is a Hold at the current price of $148. Those looking to start a new position might want to wait until it trades down to $132.50 which is the low end of the trading range in place since the start of 2022.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.