Summary:

- Q2 earnings were in line with our expectations: after the release, we have only slightly adjusted mobility subscribers numbers estimates.

- Free cash flow turned out to be better than expected: AT&T will likely to get to their guidance of $16 BN.

- The recent news sentiment was terrible, although nothing critical has happened in our view.

- We maintain a Buy rating on AT&T: risks that have arisen recently seem not that critical to us, while valuation remains too cheap.

Brandon Bell

Investment Thesis

AT&T (NYSE:T) has ran into terrible news sentiment once again. Despite the company showing quite good Q2 performance, investors still appear to be afraid of the possible lead cable investigation outcomes and DISH (DISH) competition. We believe that the market is overestimating what is written in the news. Currently, AT&T offers a significant upside and dividend yield hence we maintain our Buy status.

Q2 FY2023 earnings summary and our financial model adjustments

The 2Q 2023 report is in line with our expectations, as AT&T’s business remains stable and the company maintains its leading position in the US mobile market.

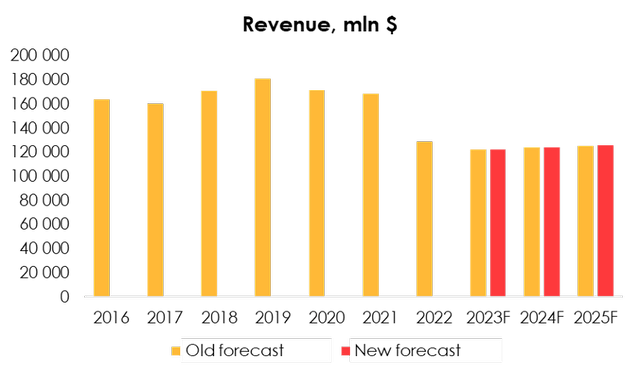

– Revenues totaled $29,917 million (+0.9% y-o-y), in line with our forecast of $29,929 million.

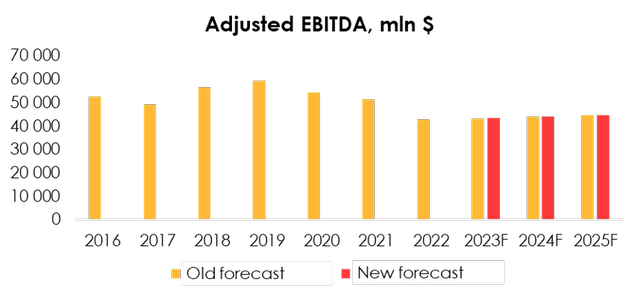

– The company’s adjusted EBITDA totaled $11,081 million (+7.3% y/y), also in line with our guidance of $10,913 million.

– Adjusted FCF totaled $4,209 million (+204% y/y), exceeding our guidance of $1,733 million due to the company’s use of the deferred tax option and lower working capital investments.

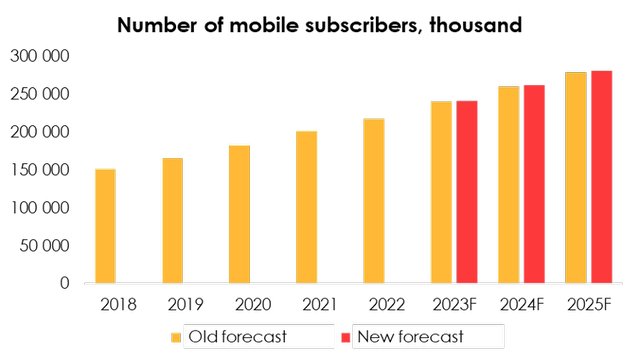

The most significant change we have made to the financial model has been to the user base estimate.

In the second quarter, AT&T’s subscriber growth slowed significantly. While the churn rate remained stable and in line with historical levels, the number of wireless subscribers (excluding vendor sales) increased by 425,000 accounts (+0.5% q/q), missing the forecast of 889,000.

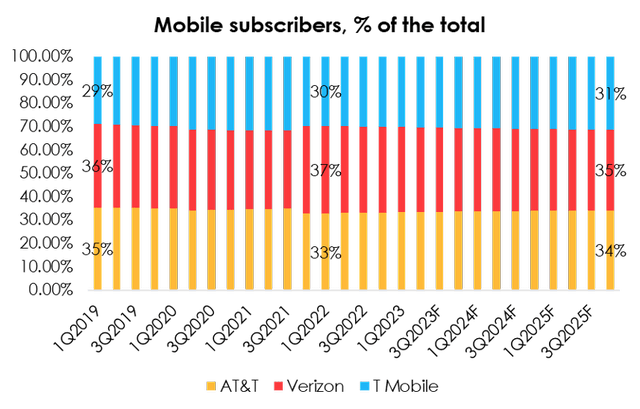

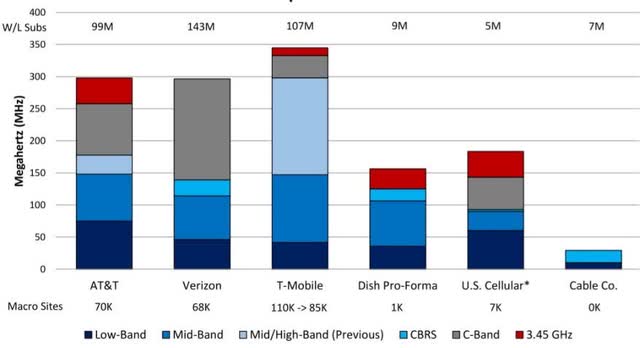

With churn rates remaining low, the significant slowdown wasn’t due to increased competition in our view, but rather because the telecom industry has reached saturation. Currently, the three largest operators (AT&T, Verizon (VZ) and T-Mobile (TMUS)) account for nearly 312 million lines, or 94% of the US population, according to internal company data and World Bank statistics. These numbers were 92.3% and 83.4% at the end of 2020 and 2021, respectively.

Verizon has the highest churn rate and market share loss, while T-Mobile and AT&T continue to grow. We have revised our subscriber forecast, with the model now incorporating expected US population growth and changes in the structure of the telecoms market (including Verizon’s market share loss of 0.22% per quarter, which is in line with the average rate over the past four years, and the growing market shares of T-Mobile and AT&T, with T-Mobile outpacing AT&T by a factor of 1.5).

However, we see that the growth of subscribers in the segment of IoT devices is outpacing expectations, with the number of subscribers reaching 117.2 mln (+21.9% y/y) in 2Q, compared with the forecast of 114 mln. Given that the growth rate of the segment beat expectations, we are raising the forecast for the number of subscribers from 240.2 mln (+10.5% y/y) to 241.8 mln (11.2% y/y) for 2023, and from 260.4 mln (+8.4% y/y) to 262.5 mln (+8.6% y/y) for 2024.

The ARPU trend was in line with our expectations: Mobility average revenue per user was $22.7 (-6.7% y-o-y), compared to the forecast of $22.7. However, we see the impact of pricing initiatives in the high speed segment being more pronounced than we had anticipated: ARPU in this segment reached $184.3 (+8.6% y/y) compared to the forecast of $183.4, leading us to slightly raise the forecast for this metric in 2023 and 2024.

As a result of the upward revisions to the subscriber and high-speed ARPU forecasts, we are raising our 2023 net revenue forecast for AT&T from $122,132m (-5.4% y/y) to $122,257m (-5.3% y/y) and our 2024 net revenue forecast from $123,990m (+1.5% y/y) to $124,241m (+1.6% y/y).

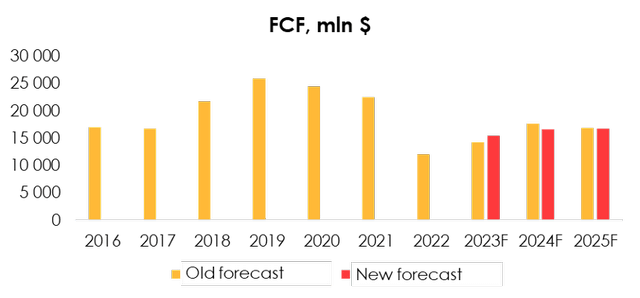

Free cash flow in Q2 significantly exceeded our expectations, reaching $4.2 bn (+209% y/y) versus forecast of $1.7 bn. This level of cash generation was largely driven by the company’s use of the deferred tax option, making it highly likely that AT&T will achieve its guidance of $16bn FCF in 2023. For valuation purposes, we have assumed that the tax liability will be paid in equal installments throughout the year starting in Q2 2024. As a result, we raise our 2023 FCF forecast from $14,285 mn (+18.5% y/y) to $15,485 mn (+28.4% y/y) and lower our 2024 FCF forecast from $17,753 mn (+24.3% y/y) to $16,585 mn (+7.1% y/y).

Free cash flow ,significantly surpassed our expectations in 2Q, reaching $4.2 bln (+209% y/y), up from the forecast of $1.7 bln. That kind of cash generation was largely driven by the company’s use of the deferred tax option, making it highly likely that AT&T will meet its guidance for a FCF of $16 bln in 2023. For valuation purposes, we have projected that tax liabilities will be paid in equal parts throughout the year, starting from 2Q 2024. As such, we are raising the FCF forecast from $14,285 mln (+18.5% y/y) to $15,485 mln (+28.4% y/y) for 2023 and lowering it for 2024 from $17,753 mln (+24.3% y/y) to $16,585 mln (+7.1% y/y).

News sentiment: is it really that bad?

In general, there have been three reasons for AT&T to fall this year:

– The company’s Q1 free cash flow missed analysts’ expectations.

– A rumor that Amazon (AMZN) was looking for a deal with telecoms to provide cheap or free mobile connectivity as part of its Prime perks.

– A Wall Street Journal investigation claiming telecoms are poisoning the US with old lead wire.

So let’s start with free cash flow:

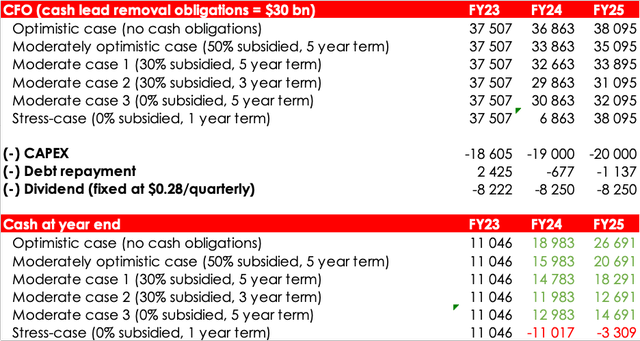

Personally, we have also been concerned about the health of the company’s dividend. In the last article on T, we carefully analyzed it and even with conservative assumptions on working capital management (which will miss T’s guidance of $16bn FCF in FY2023), the dividend of $1.12 per share turned out to be safe in our opinion.

In Q2, adjusted FCF was $4,209m (+204% y/y), beating our guidance of $1,733m due to the company’s use of the deferred tax option and lower investment in working capital. This FCF beat accounts for almost all of the difference between our initial forecast and management’s guidance of $16bn.

Going further:

In June, there was a headline that Amazon’s management discussed with providers an option to provide mobile connections in the Amazon Prime package (far below market prices or completely free). DISH is expected to be the main beneficiary of the partnership, which means that the rest of the telecommunications companies would likely lose customers.

Initially, it was clear that the format in which the partnership was presented in the news would never happen: T, VZ and TMUS together serve more than 100 million users (more than 90% of the US population). Dish Wireless (ex-Boost Mobile) serves just over 7 million people: to provide network bandwidth that can compete, the company will need tens of billions of dollars, both in equipment and in buying frequencies from spectrum auctions.

And if we look at the rumor in the context of the Antitrust Division or the Trade Commission, who would allow a company to undercut market prices? Currently, a typical connection for a mobile user costs $40-$50 per line per month and margins don’t exceed 20-25%. We don’t think such a deal would be easily allowed in the US.

The most controversial issue was the WSJ’s lead cable investigation. Companies (mainly AT&T) were accused of allegedly failing to remove old toxic lead cables. AT&T and VZ shares fell over 10% that day.

As part of our coverage, we analyzed the risks to AT&T and concluded that the market reaction was unduly strong:

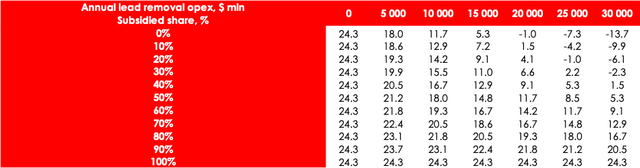

- First, analysts cited comments from an expert who estimated the potential amount of financial obligations for the removal of cables at $60 billion with subsidies covering a significant portion of the costs. As expected, a few weeks later the analysts significantly overestimated the potential: from $60 billion to $2-20 billion.

- AT&T filed a lawsuit against the newspaper. AT&T said it strongly doubted the objectivity of the study, saying the WSJ’s measurements differed significantly from its own. AT&T is proposing to leave the cables in place for now and conduct another independent study to determine whether the cables are truly dangerous and whether they need to be removed.

- According to the company, only a small proportion (<10%) of the cables are made of lead. Almost all lead cables are either buried deep underground or in pipes, and only a very small proportion are underwater (where the risk of contamination is greater).

As soon as the article was published, we analyzed how badly it could affect AT&T’s business. Initially, we assumed that the government would partially subsidize the telecoms’ plans to remove lead wire (e.g. via the BEAD program).

In the base case (with total obligations of $30), our target price was likely to fall to $18-$19/share.

Dividend cuts are also only probable under the most stressful scenario.

After recent management comments we decided to not include possible lead obligations in the valuation.

Valuation

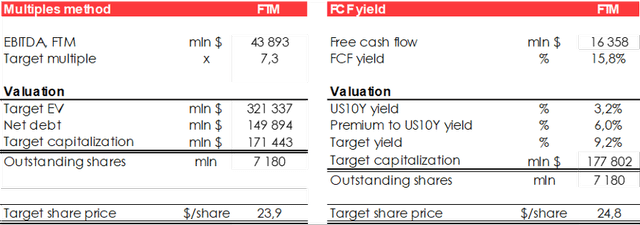

We’re evaluating AT&T prices based on FTM EV/EBITDA multiples and FCF Yield. We are raising the target price of the shares from $23.2 to $24.3 due to:

- the increased EBITDA forecasts for 2023 and 2024;

- the decrease of the number of shares from 7,474 mln to 7,180 mln;

- the shift of the FTM valuation period (we earlier included the period from 2Q 2023 through 1Q 2024 into the forward 12 months EBITDA forecast, while now the forecast period runs from 3Q 2023 to 2Q 2024).

Conclusion

After taking a close look at recent news headlines, we have decided that the upside offered by T at current prices is far greater than the risks. Although there aren’t any strong fundamental growth catalysts, the cheap valuation and the dividend yield are really attractive. What’s more, further interest rate cuts will provide strong support for dividend stocks: in general, we think now is a good time to buy.

To manage your positions we recommend to follow both AT&T and peers (Verizon, T-Mobile) earnings releases and industry research (IBM, TelecomPaper, Deloitte, Fitch).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.