Summary:

- Tesla, Inc.’s Q2 2023 results showed strong revenue growth, despite a dip in operating income and average selling prices.

- The company’s diversification into the Energy and Services sectors contributes to its robust performance.

- Tesla stock has displayed bullish patterns, and the recent pullback is seen as a good entry point for long-term investors.

Spencer Platt

The recent Tesla, Inc. (NASDAQ:TSLA) quarterly results offer an optimistic view of the company’s financial health and prospects. Despite some challenges, such as a slight dip in operating income and a decrease in average selling prices for its vehicles, Tesla has shown strong revenue growth. Rising vehicle deliveries and successful diversification into the Energy and Services sectors buoy this robust performance. The company remains financially stable, with increased cash and investments at the quarter’s end.

This article delves into a technical analysis of Tesla’s stock price to ascertain its future direction and identify potential investment opportunities. Notably, the stock has displayed solid bullish patterns, and a recent pullback from resistance levels is viewed as an advantageous entry point for long-term investors.

A look into Market Performance and Future Prospects

Tesla’s Q2 2023 results present a multifaceted yet overwhelmingly encouraging financial landscape. The company has exhibited strong revenue growth of 47% YoY, totaling $24.9 billion, led by a surge in vehicle deliveries and expansion in other business areas. While adverse foreign exchange effects cost the firm $0.6 billion and the average selling price showed a YoY decline, Tesla’s overall top line performance reaffirms its market stronghold and growing consumer interest in its electric vehicles and related offerings. Notably, this growth isn’t confined to Tesla’s automotive sector but extends to its Energy and Services divisions, underlining its successful diversification efforts.

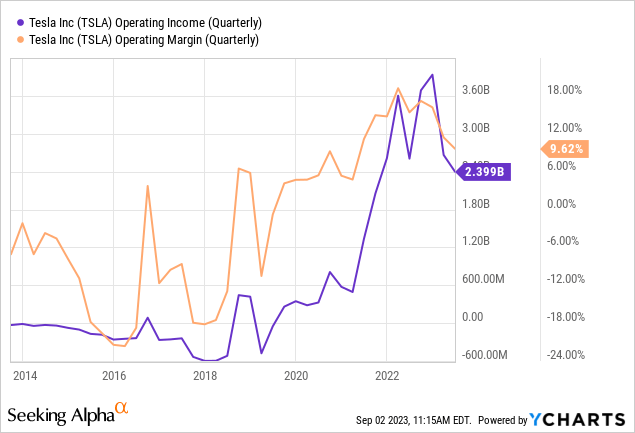

However, operating income for the quarter recorded a marginal decline, coming in at $2.399 billion, translating to a 9.62% operating margin, as shown in the chart below. This dip is attributable to several factors, such as reduced average selling price due to product mix and strategic pricing, higher operational expenses tied to emerging initiatives like Cybertruck and AI, and the costs incurred in scaling new 4680 cells. Nevertheless, Tesla’s financial position remains sturdy, evidenced by an incremental $0.7 billion increase in quarter-end cash and investments, driven primarily by a free cash flow of $1 billion. This financial stability enables Tesla to persist in its aggressive R&D and capital projects, a crucial factor in staying competitive.

Tesla’s remarkable vehicle production records for Q2 also highlight the company’s manufacturing strength and technological innovation. The flourishing new and existing factories, notably in Shanghai and Fremont, have enabled Tesla to meet the escalating demand effectively. The company’s efforts in streamlining quarterly deliveries and reducing the tendency towards end-of-quarter delivery surges further indicate optimized resource allocation. Tesla’s inventory strategy suggests efficient inventory management, reflected in most days of supply being accounted for by in-transit, test-drive, and display vehicles.

The company’s technological advancements are equally noteworthy. Tesla has commenced the production of its Dojo training computer, aiming to transform neural network training, a critical prerequisite for achieving scalable vehicle autonomy. Additionally, Tesla has focused on enhancing customer onboarding experiences through its “Get To Know Your Tesla” program and has introduced a more interactive user interface. With the Cybertruck under global testing for final certifications, Tesla continues to break new ground, targeting the creation of the first sub-19 ft. truck with a 6+ ft. bed and four doors.

With its strong Q2 2023 performance as a backdrop, Tesla appears bullish about its future. The company aims to surpass its early 2021 projection of a 50% CAGR in vehicle production, targeting approximately 1.8 million vehicles for 2023. Boasting a healthy financial position, Tesla is well-equipped to fund its extensive product roadmap and long-term capacity expansion. Moreover, Tesla’s strategic focus is not confined to hardware profits but extends to AI, software, and fleet-based income streams, signaling an integrated approach to long-term profitability. With Cybertruck on course for its initial production run at the Gigafactory in Texas and steady progress on Tesla’s next-generation platform, the company looks poised for rapid growth and sustained market leadership.

A Deep Dive Into Tesla’s Extreme Volatility

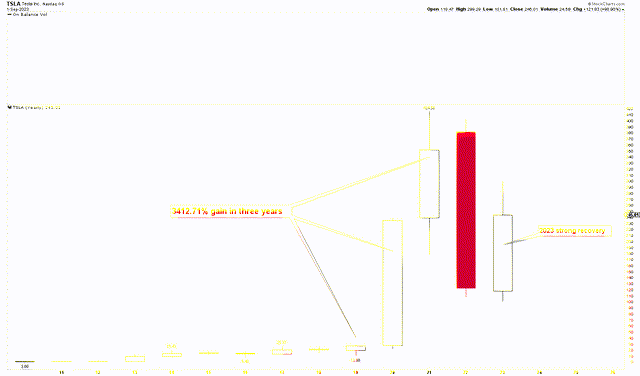

Since Tesla’s fundamentals indicate a bullish trend, the technical analysis of its stock is similarly optimistic. A closer look at Tesla’s long-term trends, as visible in the yearly chart below, reveals that the most significant gains transpired in 2019, 2020, and 2021. Tesla used 2019 as a foundational year, setting the groundwork while experiencing a notable volatility increase in 2020 and 2021. The cumulative impact was a breathtaking surge in Tesla’s stock value, increasing 3412.71% from its 2019 low of $11.80 to an all-time high of $414.50 in 2021.

This exponential growth is traced to a synergistic mix of investor optimism, consumer engagement, and impressive financials. During this time frame, Tesla not only posted profitable quarters but also exceeded skeptics’ forecasts, establishing itself as a powerhouse in the electric vehicle industry. The company successfully scaled up production of its affordable Model 3 and Model Y vehicles while expanding its global footprint into new territories, notably with the inauguration of its Shanghai Gigafactory in China. Technological advancements in battery capabilities also bode well for the long-term sustainability of the electric vehicle sector.

The allure of CEO Elon Musk further stoked the flames, captivating both the media and public interest with his knack for generating excitement around Tesla’s upcoming projects. These included innovations in self-driving technology and potential expansions into sectors like energy storage and insurance. His influence was transformative for the company. At the same time, a societal pivot towards sustainability and eco-friendly living made Tesla a compelling investment, appealing to those interested in supporting companies that aim for a more sustainable future.

Tesla Yearly Chart (stockcharts.com)

However, the monumental gain of 3412.71% over three years highlights volatility that often precedes substantial market corrections. From a technical standpoint, the stock price tumbled dramatically by 75.44%, hitting a low of $101.81, only to recover robustly in a subsequent rally in 2023. This strong rebound suggests an optimistic trajectory for Tesla’s stock in the upcoming quarters.

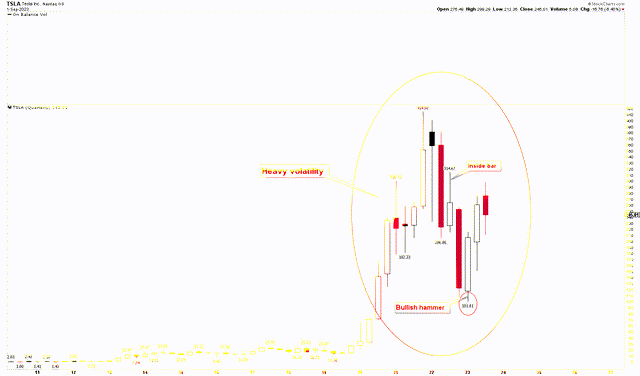

Examining a quarterly chart is enlightening to gain a deeper understanding of the fluctuating patterns in 2020 and 2021. This shows price swings within a broad range of $400 to $100. Notably, an inside bar emerged in the third quarter of 2022, signaling a substantial dip in the following quarter. However, the first quarter of 2023 brought a vigorous recovery, symbolized by a bullish hammer candle with a low of $101.81, and the second quarter maintained this upward momentum, setting the stage for a promising third quarter.

Navigating the current quarter reveals that the observed pullback is increasingly seen as an excellent buying opportunity for long-term investors. Tesla’s stock price has already reverted to the levels where the 2022 inside bar manifested, indicating that the market has internalized previous weaknesses and appears poised for an upward surge. Therefore, current conditions suggest that the downturn has likely ended, paving the way for significant upward trends in Tesla’s stock.

Tesla Quarterly Chart (stockcharts.com)

Crucial Levels and Strategic Moves for Investors

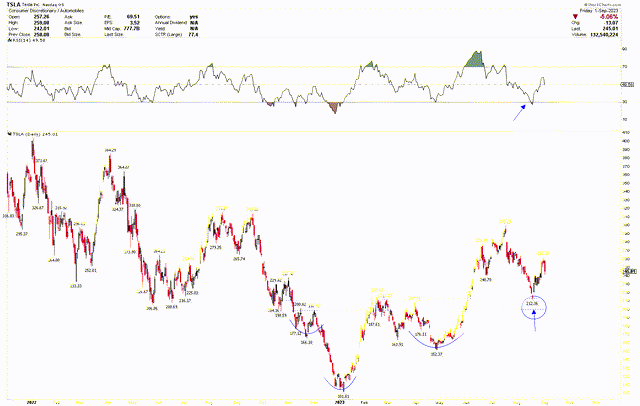

To better understand Tesla’s robust upward momentum, the weekly chart showcases a falling wedge pattern, ranging from a peak of $414.50 to a low of $101.81. This formation is a solid bullish indicator, further validated by the rapid recovery from the $101.81 low. This rebound encountered resistance at $229.29, aligning perfectly with the resistance line of the falling wedge pattern. Additionally, the low of $101.81 coincided with the RSI landing in the oversold territory, suggesting that the market has likely bottomed out and is poised for upward movement.

This pattern on the weekly chart reveals robust bullish price action, symbolized by blue arcs that shattered the $215 resistance line. Intriguingly, after encountering the falling wedge resistance line, the stock price has been retracing toward this $215 level, which is strong support. This pullback is generally viewed as an excellent entry point for investors.

Tesla Weekly Chart (stockcharts.com)

The daily chart below emphasizes the blue arc in the weekly chart for additional insight into the bullish situation. Notably, the swift recovery from the $101.81 low manifests as an inverted head and shoulders pattern, with the head at $101.81 and the shoulders at $166.18 and $152.36. This recovery originated from oversold conditions, as depicted on the daily chart’s RSI. Additionally, the RSI has surged past the mid-level of 50 and is currently retracing to this level, suggesting it is a robust support area. The breaking of this pattern’s neckline further corroborates the bullish outlook, and a price correction back to the neckline is considered an optimal buying opportunity for investors.

Tesla Daily Chart (stockcharts.com)

Based on the observed price patterns, it seems prudent for investors to think about initiating positions at the present stock prices. Additional opportunities to expand holdings could arise if the stock experiences more short-term dips. A combination of elements-the falling wedge on the weekly chart, the inverted head and shoulders on the daily chart, or the RSI trends-strongly suggests a favorable upward trajectory for Tesla’s stock value soon. A close above $300 for the month would probably disrupt the falling wedge pattern, aiming for all-time highs.

Market Risk

Although Tesla’s stock has demonstrated a stunning 3412.71% increase from its 2019 lows to an all-time high in 2021, it has also exhibited significant volatility, including a sharp drop in value. This erratic behavior may deter risk-averse investors and signal the company’s susceptibility to market fluctuations. Despite this volatility, Tesla’s Q2 2023 financials show a slight dip in operating income, even amidst a revenue surge. This can be attributed to multiple factors like a reduced average selling price, increased operational expenses for new ventures like Cybertruck and AI, and the cost implications of developing new 4680 battery cells, which collectively exert pressure on the company’s profit margins.

Further, Tesla’s bold strides into AI and autonomous vehicles are still nascent and have regulatory and technological risks. Adding to this, the landscape of the electric vehicle market is becoming more competitive as traditional automakers ramp up their EV initiatives.

Lastly, Tesla’s foray into diverse sectors, such as energy storage and insurance, brings additional operational complexities and risks. These include potential regulatory challenges and stiff competition from incumbents in these new sectors. Taken together, these various factors form a complex tapestry of risks that potential investors should carefully consider.

Final Thoughts

Tesla’s Q2 2023 financial performance paints a largely optimistic picture, bolstered by a 47% YoY revenue growth and robust vehicle production capabilities. The growth extends beyond the automotive sector to Tesla’s Energy and Services divisions. Despite challenges such as a declining average selling price and increased operational costs linked to new initiatives like the Cybertruck and AI technologies, Tesla’s financial standing remains solid. The company’s forward-looking initiatives, like the Dojo training computer and an enhanced user interface, indicate a strong focus on technological innovation.

Additionally, the technical analysis of Tesla’s stock shows remarkable resilience and indicates a bullish outlook. Even though the stock price has faced substantial volatility in the past, current patterns suggest that it’s poised for an upward surge, making it a promising investment for the long-term. The company’s broad diversification, technological innovation, and strong financials position it well for future growth. Whether it’s the manufacturing strength or advancements in sustainable technologies, Tesla seems set for sustained market leadership and growth. As the price is currently rebounding from a long-term support level at around $101.81, the short-term support near $215 suggests an optimal buying zone for investors. Traders can establish long positions at these levels and consider adding more if the stock returns to the $101.81 mark. A surge past $300 would likely trigger the next upward momentum in Tesla’s stock value.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.