Summary:

- As a former Nvidia Corporation investor, I recently sold my position due to concerns about valuation and supply chain risks, which are often overlooked amidst market trends. This reinforces a core principle of my investment philosophy.

- My in-depth Discounted Cash Flow analysis sheds light on the current conundrum surrounding Nvidia’s stock. Even under optimistic assumptions, the current valuation leaves little room for substantial upside.

- In my article, I explore supply-chain integration and geopolitical challenges for Nvidia, and I also discuss the rationale behind valuation discounts for companies in the chip realm and why it also warrants caution for those who depend on it.

jetcityimage

Bullet Points:

Introduction

Nvidia Corporation (NASDAQ:NVDA) has emerged as a standout performer on the S&P 500 (SP500) this year, with its shares surging by an astonishing 250%, amounting a staggering total market capitalization of about $1.2 trillion as of today. This impressive run was further propelled by the company’s robust Q2 results, announced on August 28, which propelled the stock even higher to 485$.

I’ve been a passionate Nvidia investor since early 2021 until I recently sold my Nvidia position, achieving an average selling price of $460 per share after holding it since the beginning of 2021.

In the following article, I will delve into the core reasons behind my decision to divest. I’ll explore the company’s valuation and highlight one specific risk that may be flying under the radar for many investors exclusively intrigued by the soaring stock price.

When I first bought Nvidia in 2021, artificial intelligence wasn’t at the forefront of my investment considerations. What truly caught my attention was Nvidia’s consistent record of execution. This company always seems to find itself in the right market at the right time, whether it was crypto, gaming, or the burgeoning field of AI today.

My view was, that Nvidia is a great company that possesses an uncanny knack for seizing opportunities.

However, as a prudent investor, I don’t merely seek great companies. My philosophy revolves around making great investments, which translates to acquiring great companies at a fair price that offer significant upside potential. In the end, it’s a matter devoid of emotion; the price is the sole arbiter of our investment decisions.

If you happen to be a momentum investor, which is totally legitimate, you might not like this article; however, if you’re looking for an interesting perspective that you might be able to add to your very own investment case for Nvidia. Stay tuned!

Recent Results and Forward Outlook

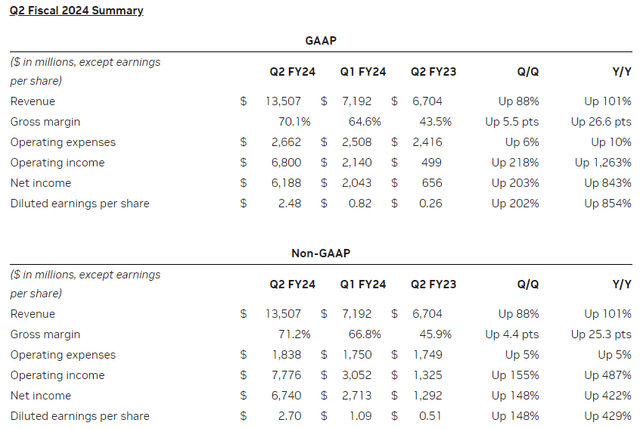

Nvidia has recently made headlines with its remarkable earnings report, surpassing analysts’ already high expectations for the second quarter and also offering a glimpse into its future.

In Q2/F24, NVIDIA achieved revenues of $13.5 billion, marking an impressive 102% year-over-year increase and surpassing analyst estimates by a substantial $2.4 billion. The company also outperformed in terms of earnings per share (EPS), delivering $2.48 compared to the projected $1.73.

Nvidia’s guidance for the upcoming third quarter includes expected revenues of $16 billion, a substantial leap from last year’s Q3 figure of $6,704,000.

Also, both GAAP and non-GAAP gross margins are anticipated to be strong at 71.5% and 72.5%, respectively, with a minor margin of plus or minus 50 basis points.

While Nvidia’s recent results and outlook are undeniably impressive, it’s essential to remember that even if something is great, it doesn’t necessarily make it a great investment. In the valuation section, we will explore whether the current stock price aligns with the company’s value and potential for future growth.

Nvidia: Powering the Online Revolution

Nvidia is an industry giant poised to play an indispensable role in shaping our world’s future. Chips have become integral components of virtually everything, and dominant companies in this sector may eventually be viewed as infrastructure providers.

Investment Approach

Nonetheless, with such compelling narratives, markets can sometimes veer toward excessive optimism, propelling these companies to valuations that aren’t enticing to prudent investors. My primary investment principle is straightforward: “Don’t lose money,” and my secondary principle is “don’t forget the first.” Therefore, I diligently assess whether there exists a spread between the stock’s price and its intrinsic value.

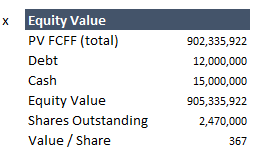

Determining price is relatively straightforward, while ascertaining value can be more contentious. I evaluate value based on two key factors: the present value of the company’s current assets, primarily cash and equivalents, and, more crucially, I attempt to forecast the company’s future trajectory and translate it into Free Cash Flows. Collectively, this process enables me to derive an Equity Value or fair value per share, which I believe is reasonable to pay.

In summary, conducting a fundamental valuation, for me, is akin to having a life vest.

Valuation

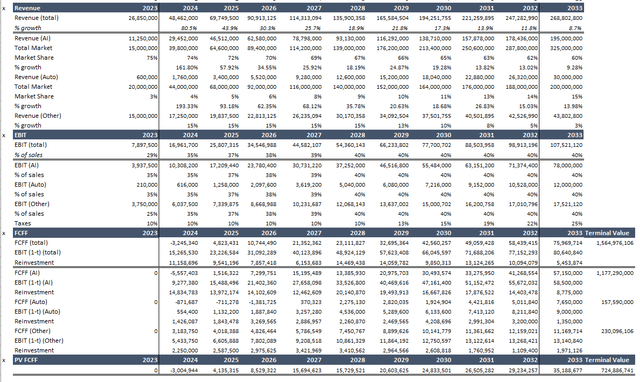

In essence, my fundamental valuation of Nvidia, which I present as a Discounted Cash Flow (DCF) analysis, hinges on three fundamental inputs:

Revenue growth, indicative of its growth potential; a target operating margin, a proxy for profitability; and a reinvestment scalar (in this case, I use sales to invested capital) to gauge the efficiency with which it achieves growth.

While Nvidia engages in diverse businesses, such as AI, Auto, and Gaming (grouped under “Others”), they share common features in terms of gross and operating margins, as well as a need for ongoing R&D innovation. However, these businesses diverge in terms of revenue growth potential, with AI being the standout driver of Nvidia’s trajectory.

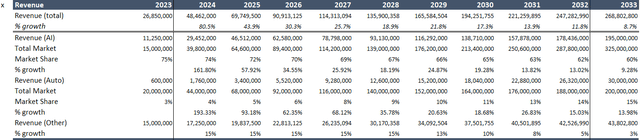

Revenue Growth: I anticipate that Nvidia will continue to be a high-growth company for two primary reasons. Firstly, despite substantial growth over the past decade, its market share in the semiconductor industry remains modest compared to giants like Intel or Taiwan Semiconductor Manufacturing Company Limited (TSM) aka TSMC. Secondly, Nvidia is strategically positioned in AI and Auto, two sectors poised for rapid expansion in the future. In my analysis, I assume that these markets will deliver on their growth potential. I estimate that Nvidia will maintain a dominant position in the AI chip market of 60% by 2033 while capturing a significant share (15%) of the Auto chip market.

I project the AI chip market to reach a size of approximately $365 billion by 2033, reflecting a CAGR of about 35%. It’s worth noting that various sources provide estimates ranging from $250 billion to over $300 billion, and my estimates lean toward optimism.

NVIDIA – DCF – Revenue (Author)

Certainly, there is room for differing opinions regarding the total market size and Nvidia’s market share in the AI and Auto sectors. However, I stand by my optimistic projections. Additionally, I assume a healthy 15% annual growth rate for gaming and other businesses, taking into account contributions from areas like the “omniverse” which the company has reiterated in its communicating about other future markets it views as a potential.

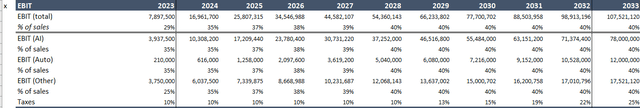

Profitability: While the semiconductor industry’s cost structure allows limited flexibility, I focus on an R&D-adjusted margin in my Nvidia analysis. I anticipate that Nvidia will swiftly rebound from its 2022 margin setback, surpassing its peer group in terms of profitability. My target R&D-adjusted margin of 40% may appear ambitious, but it’s worth noting that the company achieved margins of 42.5% in 2020 and 38.4% in 2021.

However, given Nvidia’s reliance on TSMC for chip production, margin increases will likely come from price hikes rather than cost efficiencies.

NVIDIA – DCF – Profitability (Author )

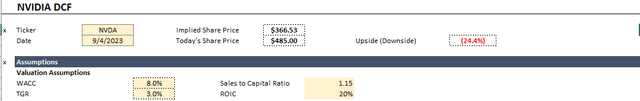

Investment Efficiency: Nvidia has made substantial investments in the last decade. These investments have proven productive, driving growth and generating excess returns. I believe that, with the company’s increased scale, the payoff from past investments will augment revenues, bringing sales to invested capital closer to the global industry median, which stands at $1.15 in revenues for every dollar of capital invested (capital to sales ratio). I also assume an average return on invested capital (ROIC) of 20% after 2033.

NVIDIA – DCF – Investment Efficiency (Author)

Furthermore, I employ an 8% discount rate to calculate Free Cash Flows to the Firm (FCFF) and a 3% terminal growth rate.

NVIDIA – DCF Assumptions (Author)

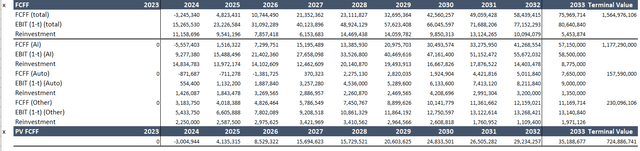

My FCFF calculation involves moving from assumed revenues to operating profits, factoring in my assumptions about operating margins (adjusted for R&D, which I treat as an investment expense, as part of my total reinvested capital calculation, along with other capital expenditures). I then adjust for taxes, employing effective tax rates derived from the company’s historical data. I anticipate that these rates will gradually approach the statutory level of 25% on average in the long run. With operating profits after taxes, I subtract total cash-effective reinvestments expected from the company.

NVIDIA – DCF – Equity Value (Author )

Ultimately, my valuation yields an Equity Value of $366 per share, indicating a 24% downside potential relative to the current stock price of $485.

NVIDIA – DCF – Everything at a glance (Author )

I am aware that In essence, my valuation hinges on predicting the future. Unfortunately, unlike the magicians on Wall Street, I don’t possess a crystal ball. Therefore, I readily acknowledge that my assumptions about the future will almost certainly prove to be incorrect. However, here’s where the nuance comes in. My assumptions reflect my own perspective, grounded in plausibility. Furthermore, when it comes to the ultimate decision of whether to invest in a stock or not, what matters is not whether I’m right or wrong but rather to what degree reality deviates from the assumptions embedded in my valuation. If, even with conservative or modest assumptions regarding growth, margins, investment efficiency, and business risk, my valuation indicates significant upside potential even in the worst-case scenario, I consider it a buy. Conversely, if the most optimistic assumptions suggest that the current share price already accounts for such optimism, and there is limited upside or potentially even downside if reality falls short, I hesitate to invest. I tend to favor the latter scenario, as pessimistic projections often have a tendency to be surpassed.

Unfortunately, I believe that the opposite unfavorable scenario seem to be true for Nvidia relative to its current valuation.

Supply Chain Risk – Geography and TSMC Reliance

In this section, we’ll delve into a critical aspect that is sometimes overlooked when assessing Nvidia’s future prospects—its supply chain, particularly its heavy reliance on the Taiwanese semiconductor giant, TSMC. This supply chain vulnerability presents a notable risk that merits consideration.

Nvidia’s remarkable success is often attributed to its cutting-edge technologies and innovative products. However, beneath this innovation lies a critical aspect that deserves scrutiny— Nvidia’s intricate supply chain. At the heart of this supply chain lies an inherent vulnerability, where Nvidia places a substantial reliance on a single entity, the Taiwanese semiconductor powerhouse, TSMC (Taiwan Semiconductor Manufacturing Company).

Understanding the Supply Chain Dynamics

To appreciate the intricacies of this issue, let’s take a closer look at how the supply chain operates and how it all connects:

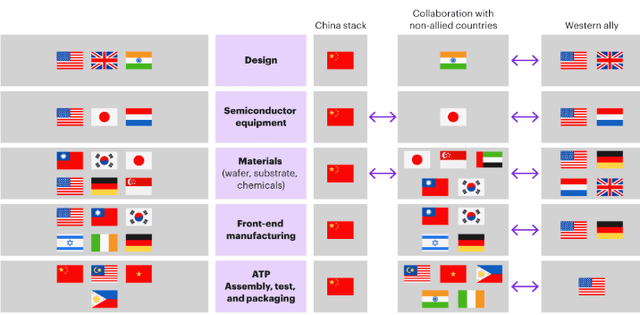

NVIDIA – Global Chip Supply-Chain (Kearney Analysis )

The supply chain begins with companies like Nvidia and Advanced Micro Devices, Inc. (AMD), which are responsible for designing advanced semiconductor chips. In this phase, the United States, with companies like Nvidia and AMD, holds a dominant position.

However, when it comes to the actual fabrication of these chips, only three major players operate on a global scale—TSMC, Samsung (OTCPK:SSNLF), and Intel (INTC). It’s worth noting that TSMC currently accounts for over 90% of the advanced processing chips required for technologies that are vital for Nvidia’s operations. This is a crucial point, as Nvidia currently relies solely on TSMC as its sole supplier.

Interestingly, TSMC, in turn, heavily relies on Netherlands-based ASML (ASML) for the specialized equipment and machinery essential for chip manufacturing.

This situation paints a picture of fragility within the supply chain. Almost the entire ecosystem hinges on a small number of irreplaceable companies. This is because, in many cases, only one company possesses the specialized knowledge and capability to perform certain cutting-edge tasks.

The Critical Role of TSMC

TSMC occupies a particularly critical position in this ecosystem. While the company’s market dominance is enviable, its geographical location presents an increasingly acknowledged risk. The rising political tensions involving China, which pose a threat to Taiwan’s political stability, add a layer of uncertainty.

Investors in TSMC have begun to raise questions about these geopolitical risks, and this is evident in TSMC’s stock price. It currently trades significantly below its 2021 highs and at a fairly modest valuation.

However, if these geopolitical risks are genuinely factored into TSMC’s price, it logically follows that they should also be reflected in the valuation of every company heavily dependent on TSMC. Strangely, this is not the case at present, and this discrepancy raises questions about market logic.

The chip supply chain is deeply integrated, with TSMC being a linchpin. Consequently, if TSMC or any other crucial player in this chain encounters trouble, the repercussions reverberate throughout the ecosystem.

TSMC’s Initiatives to Diversify

Acknowledging this vulnerability, TSMC has recently demonstrated its initiative to diversify its production capacity. For instance, the company has unveiled plans to establish a factory in Germany, expected to produce a maximum of 40,000 chips monthly. However, this output pales in comparison to TSMC’s overall capacity, which exceeds 15 million chips annually in 2022.

However, if diversification efforts are pursued on a significant scale, it will likely take many years to come to fruition. Therefore, while of course it’s simplified, given the current factual degree of intertwining between these companies and the heavy integration of the supply chain, I wonder a bit. More specifically, I think it is logical that if markets price in a risk discount in TSMC, they have to do so as well for all who rely on TSMC at the moment and in the foreseeable future.

Warren Buffett’s Stance

Furthermore, even Warren Buffett, known as the “Oracle of Omaha,” made significant moves in response to these concerns. In May 2023, he sold his entire stake in TSMC, after previously divesting over 80% of it in February. During Berkshire Hathaway’s recent annual meeting, Buffett expressed his admiration for TSMC’s business model but voiced concerns about geopolitical risks and TSMC’s overwhelming concentration in Taiwan.

He emphasized, “I feel better about the capital that we’ve got deployed in Japan than in Taiwan. I wish it weren’t sold, but I think that’s a reality.” Buffett also stated, “There’s no one in the chip industry that’s in their league, at least in my view.” Nevertheless, his actions underscore the significant risk associated with geopolitical tensions in the region.

Reflecting on Geopolitical Risks

Considering the deep interdependencies between geographies and companies in the supply chain, we must cautiously evaluate the likelihood of these geographical risks materializing. While I would have considered them highly unlikely or even impossible three years ago, my perspective has shifted to deem them as unlikely today which is an upgrade or rather a downgrade, unfortunately. Given that current market valuations appear to be built on exceedingly optimistic assumptions, it becomes even more imperative to emphasize the potential risks, particularly the most substantial ones such as the supply-chain that I’ve identified.

Conclusion

In conclusion, it’s essential for investors to continuously evaluate their perspectives and avoid falling into the traps of tunnel vision, factophobia, or even suffering from a case of Stockholm syndrome, where one starts to identify too closely with a company’s management. Especially when you have a stake in the game, maintaining sanity and considering scenarios where the bright future may not shine as brightly is crucial.

Emotional attachment to a stock should be avoided at all costs. While a business might be exceptional, its greatness ultimately depends on the price paid to enter. In the case of Nvidia, for me, the current price appears to be excessively high, and the risk-reward ratio is less favorable. Certainly, although continued momentum may temporarily drive the stock price even higher, it is highly unlikely to be supported by fundamentals. As a fundamental investor, I do not consider Nvidia’s stock a buy at its current valuation, which led me to sell my position recently.

In my investment approach, the foremost rule is to avoid losing money. Nvidia Corporation remains a remarkable company, and if the momentum cools off in the future, I may consider re-entering the company. However, if not, that’s also acceptable. In the world of investing, flexibility and rationality are the keys to long-term success.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer: Equity Analysis Articles The information provided in this equity analysis article is for informational purposes only and should not be construed as financial or investment advice. The author of this article (hereinafter referred to as "the Author") is not a licensed financial advisor or registered investment advisor. The Author has prepared this article based on publicly available information, financial data, and their own research. While the Author strives to provide accurate and up-to-date information, they make no representations or warranties of any kind, express or implied, regarding the accuracy, completeness, or reliability of the information presented in this article. The Author disclaims any liability for any investment decisions made based on the information provided in this article. Conflict of Interest Disclosure: The Author has no conflict of interest in writing this equity analysis article. At the time of writing, the Author does not own any shares, derivatives, or any other financial interest in the equity of the company under analysis. Additionally, the Author has not received any compensation from any individual or entity for writing this article, other than Seeking Alpha. Forward-Looking Statements: This article may contain forward-looking statements and projections based on the Author's assumptions and beliefs. Such statements involve risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements. The Author is not responsible for any reliance placed on such statements.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.