Summary:

- Meta Platforms has seen its shares rally over 137% this year, recovering most of their losses from 2022.

- The company’s “Year of Efficiency” has certainly helped control costs, but expenses are expected to rise a bit further in 2024.

- Analysts expect revenue growth of 12% in 2024, with earnings per share expected to grow at a much higher rate.

georgeclerk/E+ via Getty Images

One of the biggest winners so far this year has been Meta Platforms (NASDAQ:META). The social media giant has seen its shares rally more than 137%, recovering a substantial part of their losses from 2022. The strong gains have been a result of the company’s “Year Of Efficiency”, where management has worked to get its overall cost base in check. While the future here still looks to be very bright, investors might want to hit the brakes a little as 2023 comes to a close.

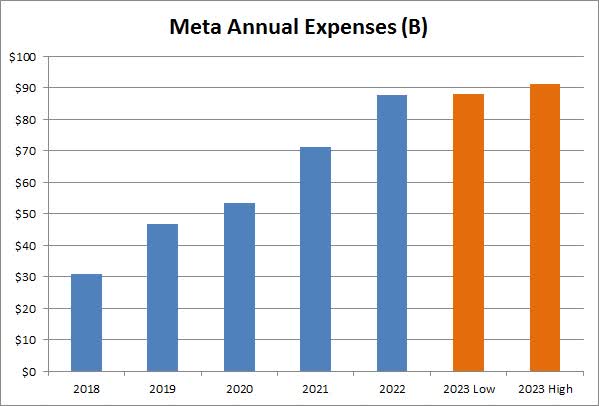

As the company grew its revenue base quite significantly over the years, total costs also rose at a tremendous rate. As the chart below shows, total expenses (including restructuring efforts and other items) nearly tripled from 2018 to 2022. That’s a nearly 30% compound rate over 4 years, and a main reason why when revenue growth slowed last year, diluted earnings per share dropped by roughly 38%. As the orange bars show, the guidance range for this year implies total expenses will rise by less than 4% over 2022 levels.

Meta Annual Expenses (Company Earnings Reports)

The current forecast for total expenses is well down from Meta’s original range of $96 billion to $101 billion, although it’s up slightly from earlier this year. Thus, despite analysts only looking for revenues to grow by about 13.5% in 2023, earnings per share are expected to soar by 55%. The company has beaten street earnings estimates in both quarters it has reported results for this year, after missing on the bottom line in four of the previous five periods.

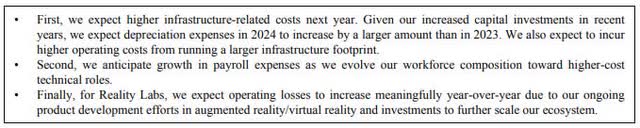

We are now more than two-thirds through 2023, however, so it really is time to start thinking about 2024. In the company’s Q2 earnings report, it did provide some commentary on what to expect for next year, seen below, although we didn’t get any concrete numbers just yet. Overall, expenses are expected to grow, and it wouldn’t surprise me if we saw them approach or even eclipse the $100 billion level.

2024 Expense Guidance (Q2 2023 Earnings Report)

Analysts are looking for another 12% plus revenue growth in 2024 at the moment, but they are also looking for earnings per share to grow at a percentage that is nearly double that. That seems to imply that we’ll see more operating margin expansion, although some other items like interest income (or expense) and the tax rate could have an impact as well.

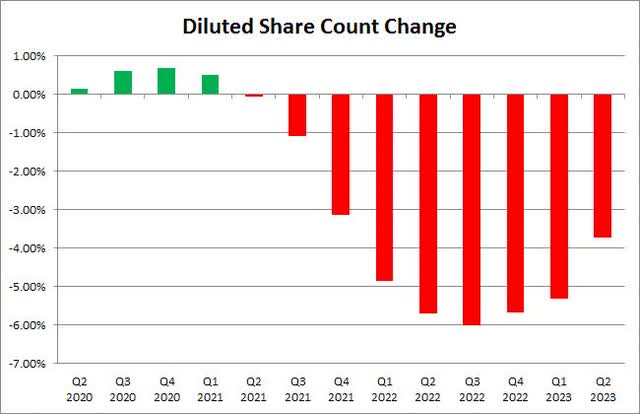

One of the reasons I’m a little more cautious on 2024 has to do with another tailwind that’s currently subsiding. Meta has a major share repurchase plan ongoing, but in the first half of this year, it only spent $10.26 billion on the buyback, down about $4.5 billion from the first half of last year. At the same time, the significant rally in the share price means the company is getting a lot less bang for its buck. As the chart below shows, the year-over-year decline in the share count used to determine EPS dropped quite a bit in Q2.

Diluted Share Count Change (Company Earnings Reports)

A couple of percent in the share count here and there doesn’t seem like much, but it adds up when you are expected to do over $16 in earnings per share a year. At the current 2024 street revenue estimate average, using $100 billion in expenses, no other income items, a 17% tax rate, and 2.5 billion diluted shares as an example, you get roughly $16.18 for earnings per share. That would be a little more than 1% below the street average. We could get the numerical expense guidance for 2024 at this year’s Q3 report, so if the range is definitely in the three digits (billions wise), there may be some concerns about profitability again.

In my previous article on the name, I was very positive on Meta shares moving forward. Since then, the stock has rallied more than 23.5%, which is more than double the return of the S&P 500. At this point, I still think the stock is relatively cheap, because at 18.1 times next year’s expected earnings, it trades at a discount to a name like Alphabet (GOOG) (GOOGL) that goes for more than 20.5 times. Other large cap techs like Microsoft (MSFT) and Apple (AAPL) go for around 28 times their expected calendar 2024 EPS. Even using below street expected earnings of $16 for 2024, a 20 multiple on Meta gives us a target of $320. That implies about 8% of upside from Friday’s close, although that percentage is only about half of my previous upside target back with my April article.

The other reason I’m not yet ready to downgrade to a hold has to do with the overall market. With US inflation data improving a bit in recent months, I think the Fed will avoid raising interest rates again at the September meeting. That likely will help equities a bit, especially on the growth side, which could send Meta back towards its 52-week high. Things could get a little trickier in Q4 when student loan repayments start again and perhaps we do get one hopefully final rate hike from the Fed, but we’re not there just yet.

2023 has been a great year so far for shareholders of social media giant Meta, but I think it is time to reign in the optimism just a little. Expense growth is likely to accelerate a bit again next year, and there likely won’t be as much earnings per share help coming from the buyback plan. My thought process here today is like the highway driver approaching a construction zone. You don’t have to stop completely, but lowering your speed a bit is definitely warranted. I think we could see some more upside in the near term, but if management really boosts its spending profile next year, the rally could fizzle out as 2023 comes to a close.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.