Summary:

- Disney’s brand has been damaged, with declining quality and poor reception of recent releases in Star Wars, Marvel, and animated movies.

- Q3 results showed disappointing revenue growth and a decline in Disney+ subscribers, indicating potential trouble for the company.

- The reliance on the Parks segment for income may not be sustainable, especially with competition and potential economic downturn in China.

Hu Chengwei/Getty Images News

Disney (NYSE:DIS) has been in a lot of controversy recently. However, it’s only now that its stock has seen an increase in bearish bets. I believe that Disney’s troubles have only just begun. In this article, I present a bearish case for the House of Mouse.

Disney’s Brand Has been Damaged

I like to go beyond simply looking at financial metrics when analyzing stocks. I like to analyze the company’s business model and see how it services its customers.

Disney’s business model is quite simple and almost a license to print money. You have a company that holds some of the most valuable IP in the world in Star Wars, Marvel, Disney Classics, Pixar, and Others. The company can then use those brands to make endless sequels, remakes, and shows. The passionate fans of those brands will then go to the Disney parks, take their kids to the parks, and buy all the merchandise.

This does have one very important assumption though that the fans of these brands remain passionate and loyal. If the fans are treated well and given what they want, they will dress up as your characters and spend gobbles amounts of cash on your stuff. I want to make the argument that Disney’s several missteps and poor quality have eroded the fans’ loyalty to its IP.

Star Wars: Once a cultural icon of theaters and must-see entertainment has been reduced to a failing series on streaming. It’s sad to see how this once mighty franchise has fallen. The first of the sequels, Force Awakens grossed $2 billion worldwide in theaters. Now the latest series, Ahsoka, only had streaming viewership of 1.2 million households. This figure was 29% less than the Mandalorian Season 3 which was the lowest rated season.

Marvel: While doing much better than Star Wars, Marvel is stumbling as well. The franchise’s latest show Secret Invasion starring fan-favorite character “Nick Fury” had all the potential in the world to become a big hit. However, the rushed story left audiences unimpressed. The show is among the worst-reviewed and least-watched on Disney+. This is really disappointing for Disney as it costs a reported $212 million to make. Needless to say, Disney can’t continue having flops like this. Combine these quality issues with overall Superhero fatigue and it’s clear to me that Marvel is facing an uphill battle to retain its once massive audience.

Animation: The company is also losing in the animated movies department to Universal and Netflix (NFLX). The last few releases of Pixar namely Lightyear, Strange Worlds, and Elemental have become box office bombs. Not only did these movies fail to generate enough revenue to cover its cost, but they have been poorly reviewed by critics as well. On the remake front, Disney is running out of classics to turn to live-action.

Disney Value Creation (Q3 Presentation)

Q3 Results a Canary

I believe that the various Disney brands examined are in decline. Once these brands reach a certain level of apathy with the consumer it is only a matter of time before the effects of this are seen in parks and merchandize results. There are bits and pieces of evidence that this is beginning to happen.

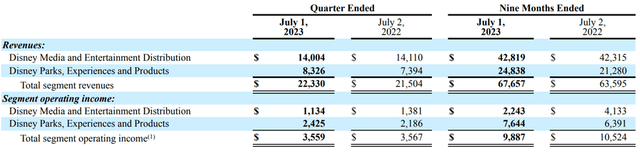

DIS stock fell by 2% after posting disappointing Q3 2023 results, although I believe it should have dropped further. Revenues grew only 4% for the quarter at $22.3 billion. This is short of analyst’s expectations of $22.5 billion. While this headline number doesn’t seem so bad looking under the hood shows a more dire picture.

As has been the case recently, the company’s Parks unit carried the results and was up 13% YoY at $8.33 billion compared to $7.39 billion the year prior. The company’s Media and Entertainment Distribution had $14 billion in Revenue down 1% from the previous year.

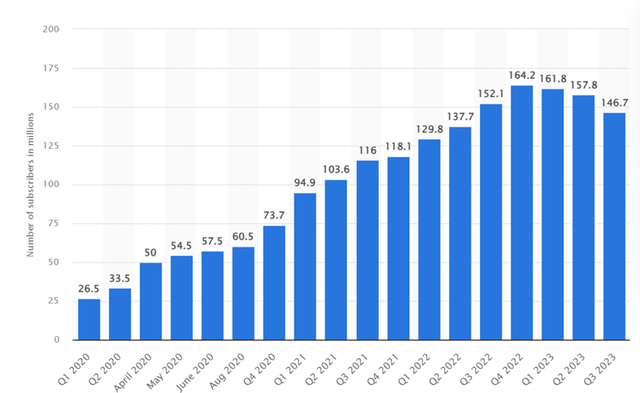

The number of Disney+ subscribers has disappointed yet again. The company reported 146.1 million subscribers globally short of the 154.8 million expected and a far cry from Q1 2023 subscriber count of 161.8 million. You can clearly see the downward trajectory in this graph from Statista ;

Number of D+ Subscribers (Statista)

What’s even worse is that Domestic subscribers (US and Canada) haven’t grown at all. In October 2022 the company reported 46.4 million domestic Disney+ subscribers. As of last quarter, this has remained flat at 46 million.

Disney CEO Bob Iger has initiated a cost-cutting plan to save $5.5 billion. The bulk of these savings are expected to come from content particularly less projects from Marvel and Star Wars. How will he accomplish this though when Disney+ as a streaming service requires a constant refresh of content?

Without new content, the platform will slowly bleed subscribers. Given the state of Disney’s most recent content, I believe the company should invest more in content and not less. Hire better writers and pay the VFX artists more.

Trouble in Disney Land

Despite making less revenue than the Media division, Disney’s Parks are actually the company’s cash cow. Segment operating income rose by 11% to $2.4 billion in Q3 2023. Disney’s Parks made up 68% of the company’s operating income.

Segment Breakdown (Disney 10-Q)

This is why the trouble in Disney’s Media department has not yet reached the bottom line and why the company can still stay afloat. However, this trouble is slowly creeping in. For example, Disney had recently closed its “Star Wars: Galactic Starcruiser” hotel. Foot traffic in its parks is slowing down as well based on line-waiting time data. New competition from the Super Mario World may further dampen results from this segment.

Compounding the issue for Disney is that this quarter’s growth in the Parks business has been primarily driven by results from China. The Shanghai Disney Resort was open all of Q3 compared to 3 days in the prior year while Hong Kong Disneyland was open for 72 days compared to 54 in the last quarter. However, China is under threat of entering a recession triggered by its real estate crisis. This will put a damper on International Park results.

Conclusion

In the latest quarter, Disney reported an EPS loss of $0.25 compared to $0.77 the prior year. Year to date the company’s EPS decreased from $1.66 to $1.14. Analysts are forecasting the company to earn about $3.69 in 2023 which would give it a P/E of 22.14x. In 2024, analysts expect an EPS of $4.96 giving it a P/E of 16.4x.

The company’s stock is actually trading at a reasonable valuation taking into account analysts’ forecast of 2024 earnings. However, I see a large risk to that forecast in declining Disney+ subscribers, box office receipts, and eventually Park attendance. I believe that long-term earnings have the potential to decline and that this quarter is a sign of things to come. I am Bearish on DIS stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in DIS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.