Summary:

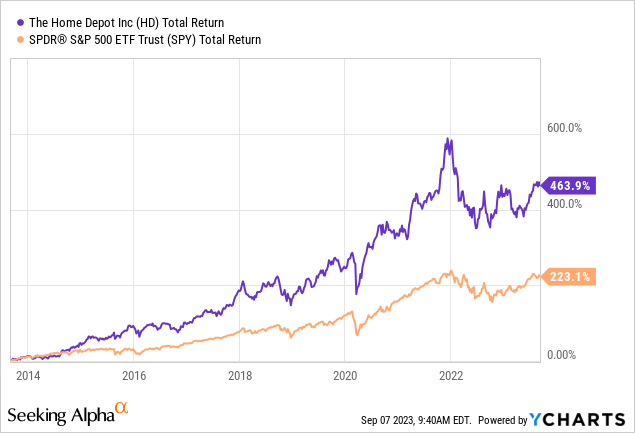

- Home Depot has been a top wealth generator, with a 460% return in the past decade, double the S&P 500, offering a 2.6% dividend yield and consistent dividend growth.

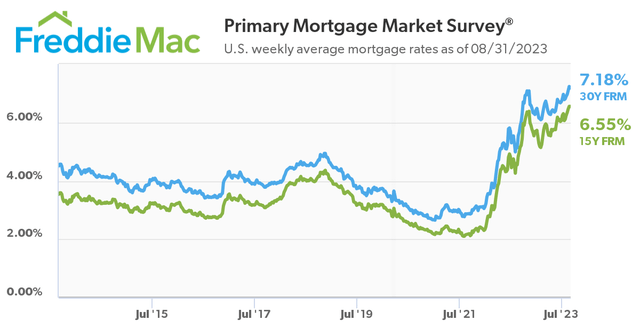

- HD is facing challenges due to declining consumer sentiment, high rates, and poor economic growth.

- The demand for DIY products has been hit, impacting the company’s stock performance.

- The Company’s valuation is relatively high, but it remains an attractive long-term dividend growth investment.

Justin Sullivan/Getty Images News

Introduction

It’s time to talk about one of my all-time favorite dividend growth investments: The Home Depot (NYSE:HD).

The last time I covered this beauty was on July 12, 2022. Back then, I wrote an article titled Home Depot: I’m Adding Aggressively To This Beauty. Since then, Home Depot shares have returned 20%, including dividends.

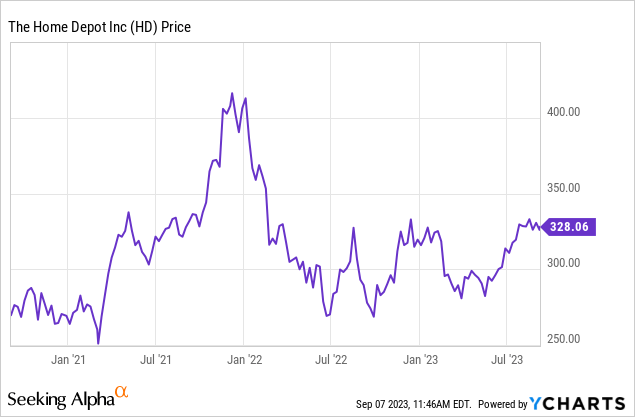

Now, the stock is running into resistance again. The $330 per share area is a tough nut to crack, mainly due to deteriorating macroeconomic conditions.

Although home builders did very well, the do-it-yourself space remains in a very tough spot.

High rates, declining consumer sentiment, and poor economic growth are too much to handle for the American consumer. The same goes for other nations. The U.S. is not alone when it comes to suffering from inflation.

In this article, we’ll discuss all of this as I explain why I’m watching Home Depot very closely. Based on its valuation and macroeconomic developments, I’m positive we might soon get another chance to add this dividend beauty at attractive prices.

So, let’s get to it!

Historical Outperformance & Dividend Growth

Home Depot is, without a doubt, one of the biggest generators of wealth of the past decades. With a market cap of almost $330 billion, this Atlanta-based corporation has helped countless people reach their financial goals.

Over the past ten years alone, HD shares have returned more than 460%, including dividends. This is more than twice the already stellar performance of the S&P 500.

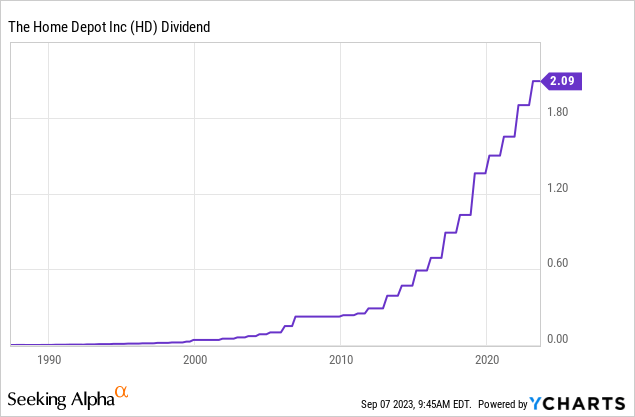

On top of that, the company has a dividend yield of 2.6%.

This dividend is protected by a 51% net income payout ratio (more on dividend safety later), and it comes with a five-year CAGR of 15.5%.

The company has hiked its dividend for 13 consecutive years after keeping its dividends unchanged during the Great Financial Crisis.

On February 21, the company announced a 10.0% hike.

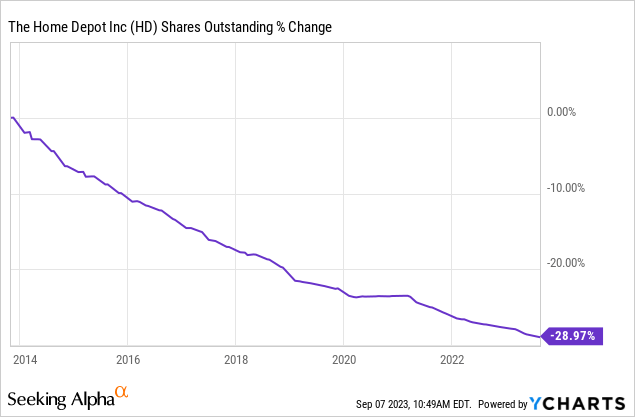

It also bought back close to 30% of its shares over the past ten years.

Purely based on these numbers, HD has its allure. The problem is that the good times are over – at least for the time being.

Macro Struggles Keep A Lid On HD’s Stock

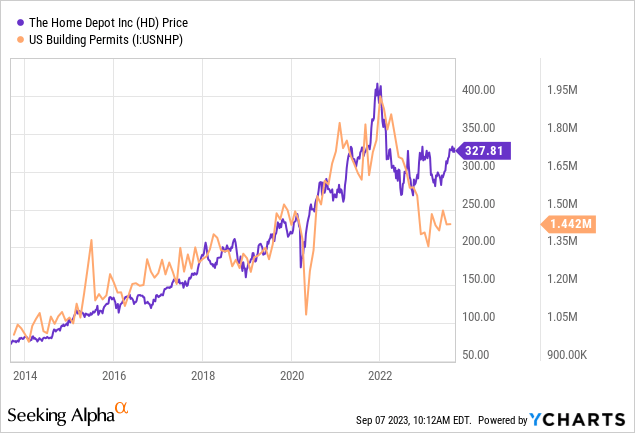

As the first chart of this article shows, HD shares haven’t gone anywhere since 2021. While many stocks have had a worse performance, we’re seeing increasing pressure on Home Depot.

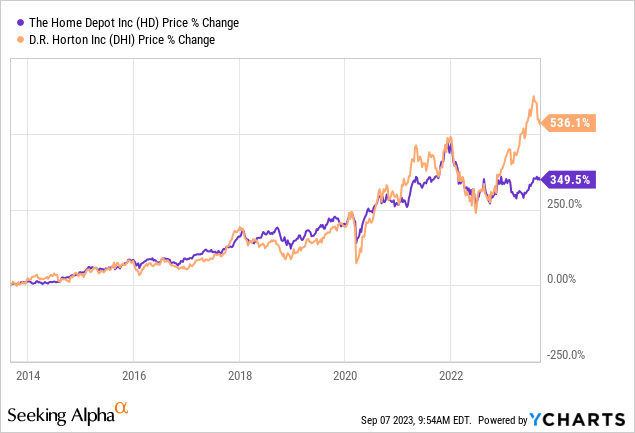

Looking at the chart below, we’re seeing a divergence between homebuilders and Home Depot. In this case, I’m using the nation’s largest homebuilder, D.R. Horton (DHI), as a benchmark.

Usually, builders and retailers trade in lockstep. That makes sense, as Home Depot benefits from higher building activity. People need to buy stuff for their homes. They require tools for smaller projects, while the increasing PRO segment benefits from stronger orders from contractors.

This time is different.

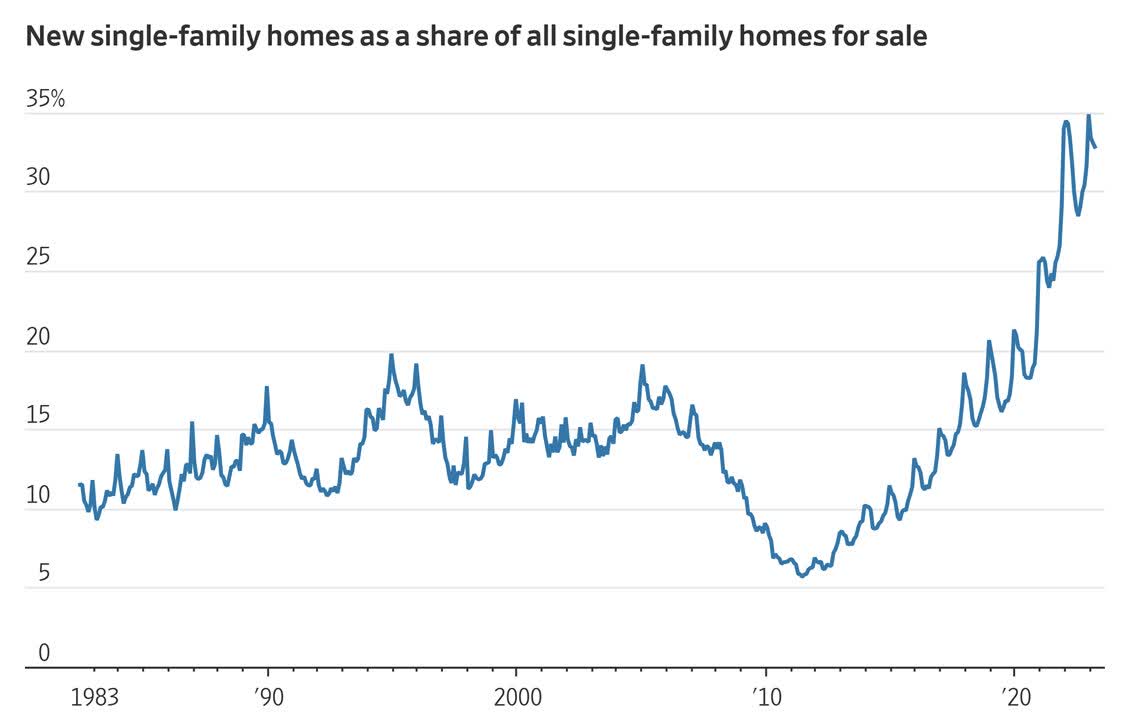

As I wrote in a recent article, the only reason why builders are doing so well in this high-rate environment is the fact that people aren’t selling their homes.

Due to high rates, people refuse to look for new homes, as this comes with the possibility of having to borrow money at >7% rates.

As a result, more than a third of all homes that are sold in the U.S. are new homes. This is good for builders. It’s bad for consumer-focused companies like Home Depot.

Wall Street Journal

When looking at one of my favorite indicators, building permits, we see that there’s a reason why HD is down: building demand is poor.

Unless something changes, it will feel like there’s a big magnet below HD’s stock price, making rallies short-lived.

We see these developments in HD’s results as well.

How’s HD Doing – Financially Speaking

Roughly three weeks ago, Home Depot reported its earnings.

As one can imagine, the company has seen better times.

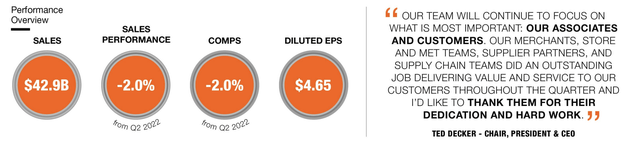

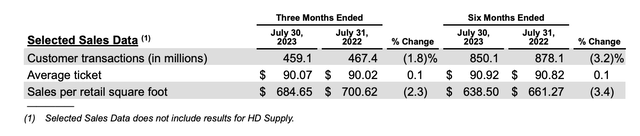

In the second quarter, total sales reached $42.9 billion, a 2% decrease from the previous year.

Total company comparable store sales were also negative 2% for the quarter, with somewhat volatile monthly numbers.

According to the company, lumber deflation impacted the comparable results, but unit productivity improved.

Diluted earnings per share in the second quarter were $4.65, down from $5.05 in the previous year.

Notably, all three U.S. divisions experienced low single-digit negative comps during the quarter.

During its earnings call, the company pointed out that geographic variability narrowed due to improved weather conditions, especially in the Western division.

Additionally, the company mentioned that certain big-ticket discretionary categories continued to face pressure, while project-related categories like building materials, hardware, and plumbing showed strength.

In light of what we discussed in the first half of this article, these developments make sense.

Speaking of bigger projects, the company acquired Redi Carpet, which is a national MRO flooring provider.

This acquisition, which closed at the beginning of the third quarter, extends HD Supply’s product offering in the multifamily customer vertical.

Redi Carpet has 34 locations throughout the U.S., which enhances HD Supply’s market position.

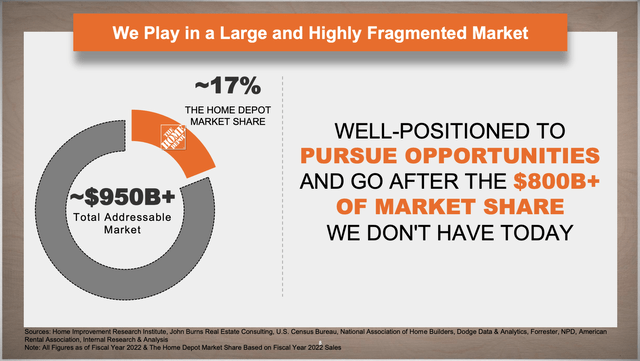

This is one of many ways the company aims to capture market share in a fragmented $950 billion-plus addressable market.

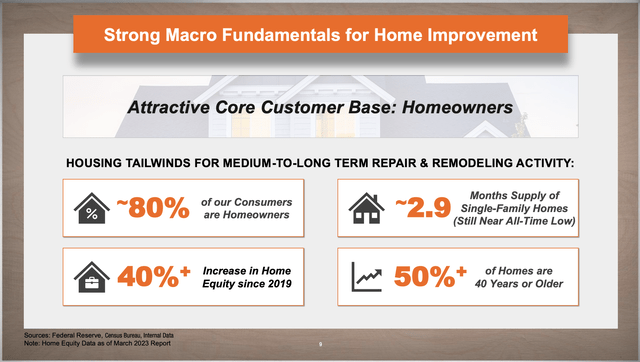

Furthermore, the expansion makes sense, as Home Depot sees strong long-term tailwinds. This includes a few key factors that support future DIY demand.

For example, 80% of the company’s customers are homeowners. More than 50% of homes are older than 40 years. When adding high homeowners’ equity and low supply, there is a strong pipeline of demand.

Right now, however, the problem is that this demand cannot be unlocked, as high rates are doing a number on affordability. The same goes for inflation, which is related to elevated rates.

The company also aims to offer a broad assortment of best-in-class products that are readily available.

During its earnings call, the company announced the introduction of the Milwaukee brand to its assortment of electrical hand tools.

This includes a line of innovative Milwaukee hand tools designed for precision and durability, targeting Pro customers.

In the kitchen and bath category, they are innovating with Glacier Bay, expanding faucet options to include touchless and spring neck designs, sinks, shower heads, and disposals.

The company is also gearing up for the Halloween season with an expanded assortment of products.

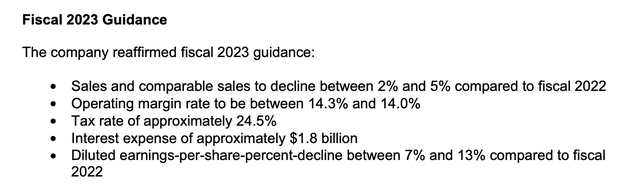

Despite economic challenges, HD reaffirmed its guidance, expecting sales and comp sales to decline between 2% and 5%.

The target operating margin is between 14.3% and 14%, with an effective tax rate of about 24.5%.

Interest expenses are estimated at approximately $1.8 billion, and diluted earnings per share are projected to decline between 7% and 13% compared to fiscal 2022.

As a result, the focus remains on driving productivity, cost savings, product authority, in-stock levels, and customer satisfaction.

So, what about the valuation?

Valuation

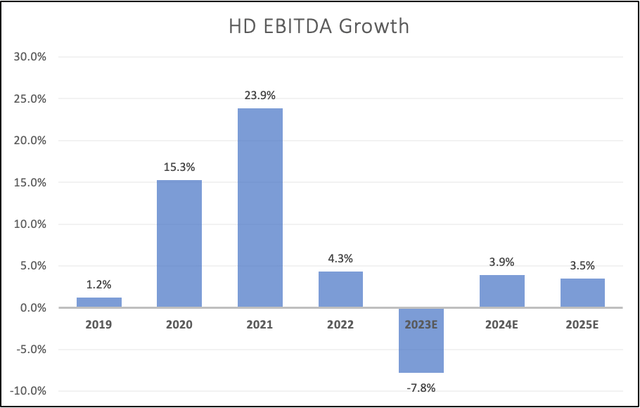

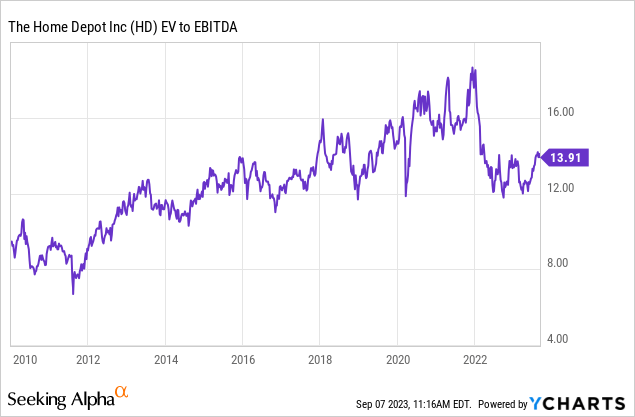

Looking at the chart below, we see a few interesting things.

- In 2020 and 2021, the company achieved mind-blowing EBITDA growth, thanks to the pandemic impact on home improvement and homebuilding demand.

- Higher inflation caused 2022 to normalize.

- 2023 is expected to see an 8% EBITDA contraction.

- 2024 and 2025 are expected to see a recovery with low-single-digit annual EBITDA growth.

Leo Nelissen (Based on analyst estimates)

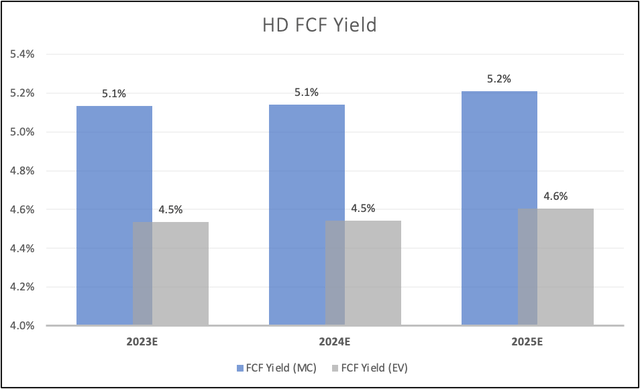

Furthermore, the company is expected to maintain close to $17 billion in annual free cash flow, which translates to a 5%ish free cash low yield.

This protects the 2.7% with an implied 52% cash dividend payout ratio.

Leo Nelissen (Based on analyst estimates)

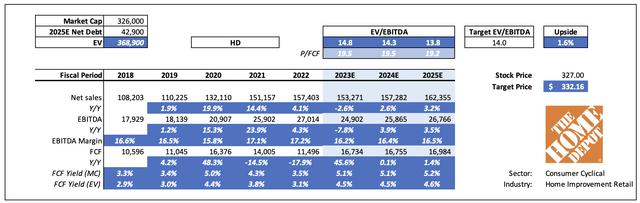

Valuation-wise, we’re dealing with a 14.8x 2023E EBITDA multiple. That number drops to 13.8x using 2025E numbers.

Leo Nelissen (Based on analyst estimates)

Before the 2012 housing recovery, HD was trading at 8-9x EBITDA, which was just ridiculously cheap. Between 2013 and the pandemic, that number slowly rose to 13x EBITDA. The valuation during the pandemic was stretched, which is why the stock has been unchanged since 2021.

When applying a 14x multiple, which is certainly not cheap, we get a fair valuation of less than 2% above the current price.

So, I am applying a Hold rating here.

Having said that, HD remains one of my favorite consumer dividend growth stocks.

I have both eyes on the stock and will buy it on 10% to 15% weakness. This includes some of the accounts that I advise.

Due to its fantastic characteristics, I have little doubt that the stock can outperform the market for many more decades to come, generating consistently rising dividends along the way.

So, be aware that the current valuation isn’t great – especially not in light of ongoing economic challenges. However, don’t be afraid of potential stock price weakness. Use it to your advantage if you’re looking for high-quality dividend growth stocks.

Takeaway

Home Depot has been a powerhouse of wealth generation, offering impressive historical returns and a solid dividend track record. Despite recent macroeconomic challenges affecting the do-it-yourself sector, HD remains a stalwart in the industry.

While the stock faces headwinds due to elevated interest rates and shifting consumer sentiment, its commitment to dividend growth and market expansion remains strong.

Meanwhile, Home Depot’s strategic acquisitions and focus on innovation demonstrate its determination to adapt and benefit from long-term tailwinds.

Regarding valuation, HD is currently trading at a fair price, but potential investors should keep an eye out for a 10% to 15% price dip as an opportunity to buy into this high-quality dividend growth stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.